Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

Insights for Auto Financing and Equipment Lenders

Alternative financing is steadily gaining popularity in Canada, but those offering auto or truck and trailer financing solutions still need to catch up with other online providers, according to the State of Alternative Lending in Canada 2018 study published by Smarter Loans.

While auto loan and truck and trailer financing seekers have traditionally begun their searches in the dealership, today’s customers are beginning their searches online, often choosing to pursue financing and pre-approvals before shopping for a vehicle.

The survey of 1,160 users found that more Canadians are turning to online providers as a viable alternative to traditional financial institutions each year, with one-third of auto loan customers and half of truck and trailer finance seekers submitting their first online applications in just the last two years.

Those seeking auto or truck and trailer loans were also more likely to seek a loan with a traditional financial institution than other loan types. The study found that roughly 40% of auto loan seekers had consulted with a bank, as well as 44% of truck and trailer finance seekers, compared with an industry average of 28%.

The most popular age bracket for both loan types was 45 to 54, which represented 30% of all auto loan seekers and half of all truck and trailer financing seekers. The second most popular age bracket for both product types was the one directly below it, 35 to 44 year olds, followed by the one directly above it, 55 to 64 year olds. In fact, 72% of auto loan seekers and 93% of truck and trailer financing seekers were between the ages of 35 and 65.

How Canadians discover and evaluate auto and truck and trailer lenders

According to the study, the first step of the customer journey is an online search, where 64% of auto loan and 56% of truck and trailer financing seekers discovered the provider they ultimately applied with.

Another 11% of those searching for auto loans and 6% of those seeking truck and trailer financing found their vendor on social media. Roughly 10% of those seeking auto loans found a provider through a personal recommendation, as well as 12.5% of those seeking truck and trailer financing. Less than 5% of auto loan seekers and only about 6% of truck and trailer financing seekers found their provider in traditional media, like TV, radio and newspapers. In fact, more respondents said they found the truck or auto-financing provider they ultimately applied with on Smarter Loans than in all traditional media combined.

Nearly half of auto and truck and trailer finance seekers focused their research on three to five providers, with about 23% of auto loan seekers and 12.5% of truck and trailer financing seekers only exploring one or two options. The remainder—roughly 30% of auto loan seekers and 37% of truck and trailer financing seekers—considered more than six providers.

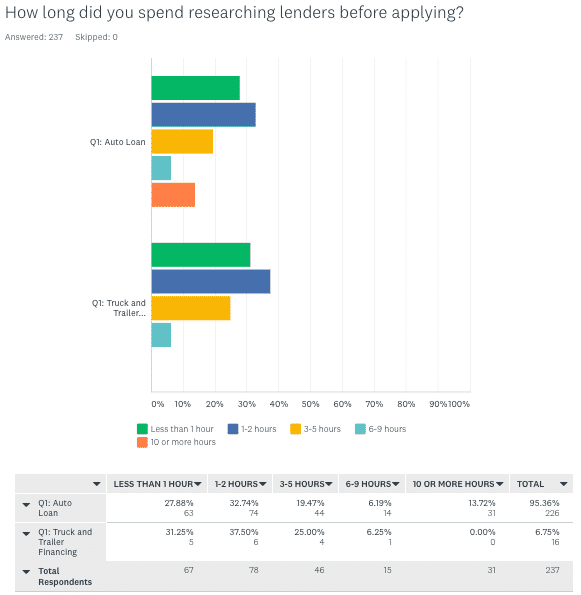

Less than one-third of auto and equipment financing seekers spent under an hour conducting that research, nearly one third spend between one and two hours conducting research, and more than one-third dedicated three hours or more. Nearly 14% of all auto loan seekers dedicated 10 or more hours to researching providers.

Those hours were largely spent looking through the provider’s website, which was explored by two-thirds of auto loan seekers and half of truck and trailer financing seekers. More than half of all auto loan seekers and a quarter of truck and trailer financing applicants also read online reviews about the provider, and 29% of those looking for an auto loan also read articles and reports about the prospective vendor.

While conducting their research the most important factor for consumers seeking truck and trailer financing was interest rates and terms of the loan. They were also more interested in learning about the ease of the application process than other loan seekers. Auto loan seekers were also most concerned with interest rates and terms, though they were almost equally as interested in the speed of receiving the loan.

Before submitting an application, only 65% of auto loan seekers and half of all truck and trailer financing seekers felt comfortable with the amount of information they had about the provider’s services, interest rates, products and reputation, compared with an industry average of 70% across all loan types.

Evaluating the application process

Those seeking auto loans and truck and trailer financing were more likely to apply with multiple providers than other loan seekers. In fact, 60% of those applying for an auto loan and 75% of those applying for truck and trailer financing submitted multiple applications, compared with 55% across all loan types.

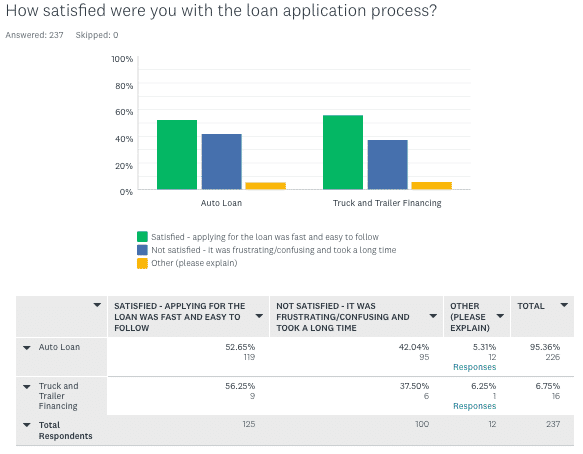

Overall, just over half of auto and truck and trailer financing seekers were satisfied with the application process, compared with an industry average of 62%. Their frustration had little to do with the speed or complexity of the application process, however, as 67% of auto loan seekers and 60% of truck and trailer financing seekers “agreed” or “strongly agreed” that the process was fast and easy to completely. Instead, respondents commented that they wanted to see more transparency in the application process, urged providers to take a deeper look at their entire financial history and encouraged them to lower their interest rates.

Approvals, denials and speed of delivery

Roughly one quarter of all applicants of auto and truck and trailer financing had their applications denied, which is consistent with other loan products, according to the survey findings. Nearly 20% of both applicant types, however, said they had to apply with multiple vendors in order to get approved, compared with 14% of the general population. Furthermore, only 25% of auto loan seekers and 19% of truck and trailer financing seekers felt the process for getting approved was fast, smooth and easy, compared with 33% of all survey respondents.

Two thirds of truck and trailer financing seekers and 75% of auto loan seekers were approved within three days. While 36% of truck and trailer finance seekers and 28% of auto loan seekers received approval the same day they applied, however, nearly the same proportion was left waiting for a week or more. In fact, more than 9% of those seeking truck and trailer financing and 6% of those seeking an auto loan waited for over a month for a response after submitting their application.

Perceptions of auto financing and equipment lenders in Canada

A majority of respondents (55%) who applied for an auto loan or truck and trailer financing in the past year said they were “satisfied” with the service they received, though they weren’t overly enthusiastic. Only 24% of auto loan seekers and 18% of truck and trailer financing seekers were “very satisfied” with their loan provider, compared with an industry average of 35%. The remainder—21% of auto loan seekers and 27% of truck and trailer financing seekers—expressed dissatisfaction, saying they would not work with or recommend the provider in the future, compared with only 14% of respondents across all loan types.

Perhaps most concerning is that when asked whether they felt “borrowing money from online lenders in Canada feels safe and scam-free,” a full quarter of both groups “strongly disagreed”, and another quarter of truck and trailer finance seekers as well as one-third of auto loan seekers “disagreed.”

Just over half of both groups agreed or strongly agreed with the statement “online loan providers are transparent about their fees, interest rates, terms and conditions.”

Furthermore, when participants were asked if they were likely to return to a traditional financial institution after their experience with an alternative lender, 43% of all survey participants said yes, compared with 56% of auto loan seekers and 57% of truck and trailer finance seekers. Despite receiving an average score of 3.2 out of five stars for overall experience with alternative lending from all loan types combined, those seeking an auto loan only gave the industry 3 stars, and those that pursued truck and trailer financing only rated it 2.6 stars.

While the industry is increasing in popularity amongst auto and truck and trailer finance seekers it still has some work to do in order to win over Canadian consumers.

Related Research by Smarter Loans: