Top Banking Institutions in Canada

Earn 2% money-back rewards on purchases and other perks

All of Canada

1.70% everyday interest, no everyday banking fees, cheap international money transfers, unlimited transactions, no minimum balance

All of Canada

Free Account Available. Premium Account with 2% cash back is $9/month or $84 annually.

All of Canada

No Fees Savings Account, Neo Rewards provides exclusive offers and an average of 4% - 6% cashback

All of Canada

What is a Bank?

A bank is a company or institution that focuses on financial matters; it is licensed and regulated by the government, and can receive deposits and make loans, as well as engage in other financial services. On this page you can see a list of major commercial Canadian banks and some information about them. These are the institutions that most of us use every day.

How do Banks Work?

Like most other companies, commercial banks work on a for-profit basis, meaning that they seek to make money from the services they provide. They do this by accepting deposits from customers, which are put into accounts and gather a modest amount of interest, and simultaneously loaning money to people, charging them a higher interest rate. Bank offer both secured and unsecured loans. The differential in interest given and interest collected is one of the primary ways a bank makes money. They also change fees for basic services.

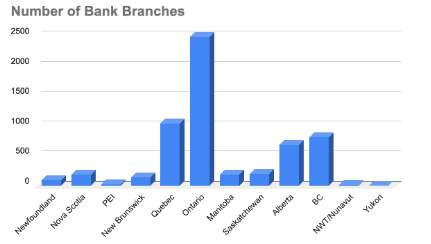

The Canadian Banking System

In Canada, there is one central bank: the Bank of Canada. This enacts the government’s monetary policy, supports commercial banks in times of financial stress, holds governments funds, and issues money. Below the Bank of Canada sits a wide range of other banks that help ordinary Canadians with their day-to-day financial needs. There are over 3,000 companies in Canada that offer both specialized and general services, although only five banks account for roughly half of the assets in the financial system.

| Bank | No. Branches | No. Customers | No. Employees |

|---|---|---|---|

| Royal Bank of Canada (RBC) | 1,300 | 16 million | 74,000 |

| Toronto Dominion (TD) | 1,100 | 22 million | 85,000 |

| Scotiabank | 1,000 | 23 million | 89,000 |

| Bank of Montreal (BMO) | 9,39 | 7 million | 47,000 |

| Canadian Imperial Commerce Bank (CIBC) | 1,100 | 11 million | 44,000 |

As well as traditional banks like the above, there are also online-only banks, which do not have physical branches but operate solely online. These often offer similar products to traditional banks, but at lower fees and with more attractive savings interest rates. They can do this because their costs to run are lower.

Products and Services Bank Provide

The most common services accessed at commercial banks are:

Chequing and Savings Accounts

A chequing account is an account that allows you to make frequent deposits and withdrawals, and is best used for everyday banking - accessing cash, depositing funds, transferring money to others, paying bills, and so on. Chequing accounts come with a debit card and often a chequebook, and there is no limit on how many transactions you can make. Some chequing accounts do however cost a monthly fee.

A savings account is a deposit account designed to hold funds over a longer term, and offers a reasonable interest rate to help you grow your money. Savings accounts are useful if you wish to ring fence money for a specific purpose, or separate it from your day-to-day banking.

Credit Cards

A credit card is a card that allows you to borrow money to purchase items, and the borrowed amount sits on the card as the accrued balance. You are charged interest on the balance, on a monthly basis, and can pay off the balance of the card at any time. Some credit cards come with an annual fee. Credit cards can be a useful cash flow tool, and help you earn rewards on your spending; but the interest on outstanding balances is high and can get out of hand quickly if not managed.

Loans & Mortgages

Banks offer a range of loans to their customers, from personal installment loans to student loans, line of credit, to car loans to mortgages. All loans require the borrower to pay back both the borrowed amount plus some interest, at a rate determined by the bank. Depending on the type of loan and your financial situation, interest rates can differ, and some loans are much more expensive than others. Other loan terms such as repayment schedule, arrangement fee, variable or fixed rate, loan term, loan use, and loan type can all also vary.

Currency Exchange

Banks also provide their customers the opportunity to purchase and sell foreign currency. This is useful if you are travelling to another country, or have just arrived from somewhere else and wish to exchange foreign money for Canadian dollars. The exchange rate your bank offers will be slightly lower than the global conversion rate, as this is how the bank makes money from these transactions.

Safe Deposit Boxes

A safe deposit box is a small locked container that you can essentially “rent†from the bank to keep valuable personal items in. The bank holds it, along with all of its other safe deposit boxes, in a safe or vault at the bank, and you as the owner of the box are the only one who can access it. They are designed to be extremely secure. The cost of a safe deposit box varies by institution.

Insurance

Insurance is often seen as a separate financial service from banking, but many banks now offer insurance products as well as their more traditional services. These products require the customer to pay a fee for insurance against specific events, though the terms and conditions of each plan can differ considerably. The types of insurance banks offer include: life insurance, travel insurance, auto insurance, home insurance, credit card insurance, mortgage insurance, and health insurance.

Business Loans

A business loan is separate from your personal finances, and usually requires that your business banks with the institution you are seeking a loan from. These loans can be used for a wide variety of business-related purposes, like equipment financing and the loan terms will heavily depend on your business’s situation. The bank will need to assess your company’s financials thoroughly before approving or rejecting a business loan.

Wealth Management Services

For those with high savings or high income, banks also offer wealth management services. These services rely on experts working with you, one-on-one, to maximize your savings and target your investments, as well as minimize your risk and stay tax efficient. As these issues can be complicated and time-consuming, having a dedicated professional on hand to help can be of benefit; it does however come with high fees.

Frequently Asked Questions About Banks

What is a bank?

A bank is a financial institution that is authorized and regulated by the federal government to provide financial services to Canadians. The main tasks of a bank are to accept deposits and provide loans, although they can also offer many other services.

How do banks work?

Banks are regulated by the federal government to ensure they keep within mandated guidelines. They are also for-profit businesses, and earn money from their customers in a variety of ways.

How do banks make money?

Banks make money in a few different ways; primarily they charge higher interest rates on the loans they give out than they offer for the savings deposits they accept. It is this difference between interest provided and interest charged that forms the basis of their income. However, they also charge fees for many of their services.

What are banks used for?

Banks are used for all manner of financial transactions: day-to-day access to cash, paying bills, transferring funds, saving, retirement planning, insurance, loans, mortgages, credit cards, currency exchange, and much more.

Are banks safe?

Canadian banks are backed by the Bank of Canada, and are considered to be among the safest in the world. A program called the Canadian Deposit Insurance Corporation (CDIC) ensures that up to $100,000 in savings (per person and per financial institution) is permanently insured, to protect your assets in the event of a bank collapsing.

How do I pick the right bank?

A good place to start when searching for a bank is by investigating interest rates, fees, and services of different institutions; be clear about what you will use the bank for, how much you are willing to spend on your banking, and what you expect in terms of rewards. In the end though, banking is a personal choice, and you need to ensure you are working with an institution that you like and trust.

What do banks offer?

Banks offer day-to-day banking services, loans, credit cards, mortgages, insurance, and other financial planning amenities.

Who regulates banks in Canada?

Banks in Canada are regulated by the federal government via the Bank of Canada, the Department of Finance, the Canadian Deposit Insurance Corporation, and the Office of the Superintendent of Financial Institutions.

How many banks are there in Canada?

There are 88 banks in Canada, and over 3,000 different financial institutions; but just five account for roughly half of all the assets held in the country. There are domestic and foreign banks, as well as over 200 credit unions.

Who owns the banks in Canada?

Major banks in Canada are owned by their shareholders; each company is publicly traded, meaning that the exact ownership of each can change over time as shares are bought and sold. The major shareholders of the biggest Canadian banks are actually each other, through their various investment vehicles.

How do I switch banks in Canada?

Switching banks in Canada is relatively simple; first you must identify what you dislike about your current bank, and pick a new one to replace it. Make a list of all your accounts, your automated payments and deposits, and then open your new account(s) at the new bank. Use the data you gathered to set up your automated payments and deposits in the new account(s); once you have successfully transferred all of your money and transactions over, you can close the account(s) at your old bank.

What is the difference between a bank and a credit union?

A bank and a credit union offer many of the same services, but they are structured and regulated differently. Many credit unions are regulated on the provincial level, rather than the federal level. They are owned by their members, rather than by shareholders, and operate on a non-profit basis, versus banks which operate for profit.

What is an online bank?

An online bank is a bank that does not have any physical branches, but operates entirely online. The number of online banks has increased greatly in the last few years as technology has allowed more customers to perform day-to-day banking from home.

Written by Smarter Loans Staff

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada's highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the "GPS of Fintech Lending" by the Toronto Star in 2019.

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice