Compare Lenders

Discover Popular Financial Services

Quick Links

- What Is a Home Equity Loan?

- How Does a Home Equity Loan Work?

- How Much Can You Borrow with a Home Equity Loan?

- Why Take Out a Home Equity Loan?

- Home Equity Loan Terms and Costs

- Find the Right Loan for Your Needs

- Home Equity Loans vs HELOCs

- Home Equity Loan Pros and Cons

- How Home Equity Borrowing Works with Smarter Loans

- Home Equity Loan Frequently Asked Questions

What Is a Home Equity Loan?

A home equity loan is a form of secured loan; the security in question is the equity in your home, which you may have because of an increase in the market value of your home over your original purchase price, from paying down your original mortgage, or from investing in your home.

A home equity loan allows you to borrow money via a lump sum, which must be repaid via home equity loan payments that occur regularly - usually monthly. These monthly payments include both repayment of the original loan amount, and the interest charged on your loan. The loan is closed out once you have made all of your repayments.

Some home equity loans have a fixed interest rate, and some have variable rates; it's important you choose a loan with a structure that allows you to make each monthly payment successfully.

The benefit of a home equity loan over a personal loan or other unsecured loans is that via this type of loan you can access a lower interest rate, and potentially a larger loan amount, than you would otherwise be able to.

How Does a Home Equity Loan Work?

A home equity loan works much like a second mortgage, in that it is a loan secured against your home which must be repaid over time. In the event you default on the loan, the property used as collateral can be seized.

And much like many other types of loan, it consists of several basic steps:

- Compare home equity loan providers and apply to your preferred lender

- The lender assesses your loan application and either approves or declines it

- In the case of approval, you receive a lump sum to use as you wish

- You make regular payments until the loan is totally paid off

How Much Can You Borrow with a Home Equity Loan?

Home equity financing is a secured debt against your home, so the amount you can borrow depends almost entirely on the amount of equity in your home.

Calculating your home equity is easy. Just subtract the amount you owe on your existing mortgage or on other debts secured against your home from your home's appraised value.

Current Property Value - Outstanding Mortgage Balance = Home Equity

If, for example, your home is worth $500,000 and you still owe $350,000 on your original mortgage, your home equity is $150,000.

Since the value of your house is critical to home equity lenders, it's worth getting a professional appraisal that shows your property's current market value. Some lenders have this appraisal as part of their loan process.

Why Take Out a Home Equity Loan?

There are many reasons for homeowners to take out a home equity loan, over and above their existing mortgage. The most common include:

To Consolidate Debt

Juggling a large amount of consumer debt? With credit card rates at 19% and higher, it can cost you a lot in interest to carry a credit card balance - not to mention it takes a long time to pay it off. The same is true of a personal loan with high interest, or really any kind of debt that is leaving you in a tricky financial situation.

But by consolidating debt - especially high interest debt - via a home equity loan, you can save substantially on the interest rate you pay, and pay off your debts much sooner (with good credit, many lenders will offer these loans at prime + 0.5% or 1%).

Homeowners over 55 enjoy a special option to consolidate debt and boost their income in retirement. A reverse mortgage is a popular solution that allows you to eliminate your monthly mortgage payment altogether, without leaving your home.

To Pay for Home Renovations

Thinking about making some improvements to your home? Instead of carrying those costs on your credit card, you could borrow money against your property instead.

If you're planning to spend a sizeable sum, and you won't be able to pay it off any time soon, a home equity loan could be the ideal solution. Not only do home equity funds come with low interest rates compared to most credit cards, you can also borrow more money, and pay back what you owe at your own pace.

To Fund Large Purchases or Investments

Did you know you can use your home equity to buy a second property in Canada? This can be a low-cost and convenient financing option. Because you'll be using your first home as collateral, you'll have access to much better interest rates than the ones offered by other types of loans.

You could also consider tapping into your home equity when you need to pay for your child's education, fund a family wedding, or cover large expenses like medical bills.

To Enjoy Flexible Repayment Terms

If you're concerned about cash flow, a home equity loan could be the right choice for you. Unlike most fixed and variable rate mortgages (where you're required to make payments comprised of both principal and interest amounts), home equity loans do allow interest-only payments if you so choose.

This can make repayments less of a burden, and reduce the strain on your cash flow during tough financial times, such as during job loss.

Home Equity Loan Terms and Costs

As with all loans, a home equity loan has certain terms and costs which it is important for you to understand. These are:

Loan Amount

This is the amount you can borrow, which as discussed above depends on how much home equity you have. The maximum amount that most financial institutions will allow you to borrow against any property is 80% of the equity in your home.

Bear in mind this is a total figure, which must include your original mortgage. So you must take into account your existing debt when calculating the maximum amount you are likely eligible for.

Loan Term

The loan term is the lifetime of the loan - how long it remains open before it must be settled.

Payment Frequency

Payment frequency for most home equity loans is monthly, though some lenders may offer other options, such as bi-weekly. Make sure your payment frequency, together with your loan term and interest rate, all equal repayments that you can make.

Interest Rate

Lenders will usually charge different interest rates based on several factors, including your credit score and the home equity loan available credit limit. The better your score, the better the rate you should be able to qualify for.

Likewise, the higher your home equity loan credit limit, the better your interest rate will tend to be. A home equity loan interest rate of prime + 0.5% or 1% is considered decent, although some lenders may offer home equity loans at the prime rate.

Set-Up Cost and Fees

It's important to recognize that there may be costs involved in setting up your home equity loan. These typically include legal fees, appraisal costs, and title search fees.

Your lender might cover these for you, but oftentimes you'll be responsible for paying them yourself. In some cases, this could add as much as $1,000 or more to the cost of your loan.

Switching Costs

Lastly, you need to be aware of the effect of a home equity loan when your mortgage comes up for renewal. Having a home equity loan could make it tougher to shop around, because your existing mortgage will be registered with a collateral charge.

Only certain lenders will be able to accept properties with second mortgages, and you may be quoted higher mortgage rates. Besides higher interest, there could also be switching costs, including higher legal fees than you'd otherwise pay when switching lender for your first mortgage.

Find the Right Loan for Your Needs

Not all lenders offer home equity financing. That's why Smarter Loans has made it easy to find the loan option that best meets your needs and gives you the most flexibility.

Although home equity loans must be approved (like most financing), they're less risky for lenders. That means you'll usually find it easier to get approved, while also snagging an interest rate that's lower than many other loans. Current rates, for example, start at about 4.45%.

Here are a few of the most common types of home equity loan available in Canada:

Second Mortgage

Borrow up to 80% of your home's appraised value (less your remaining mortgage balance)

If you already have a first (primary) mortgage on your house, you could opt to take out a home equity loan as a second mortgage. This will mean continuing to pay off your first mortgage at the same time you pay off the second.

Since your home equity installment loan would be paid out after your primary mortgage in the event of a foreclosure, second mortgage lenders assume more risk and their interest rates are typically higher.

Reverse Mortgage

Borrow up to 55% of your home's appraised value (less your remaining mortgage balance)

A reverse mortgage is a special type of home equity loan that's available to Canadian homeowners aged 55 and older. Like the name implies, a reverse mortgage lender will make monthly payments (or a single, lump-sum payment) to you, instead of the other way around.

In exchange, they'll receive equity in your home. One of the primary benefits of a reverse mortgage is that you can access a sizeable loan amount without having to make monthly payments on it.

Apply for a reverse mortgage here!

Home Equity Line of Credit (HELOC)

Borrow up to 65% of your home's appraised value

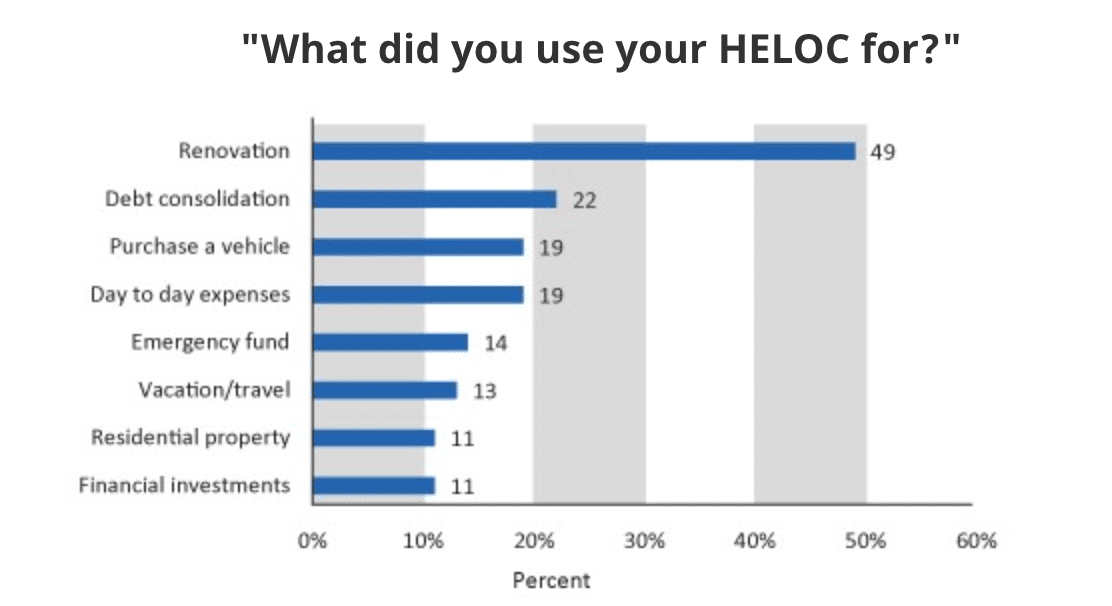

HELOCs are incredibly popular across Canada, and although they are secured against your home's equity, they work a little differently than a standard home equity loan. That's because they work like a line of credit, rather than a lump sum loan.

Essentially what happens is that you are given access to a pool of funds, with a fixed credit limit. You do not receive one lump sum at any time. Instead you can take cash from your home equity line of credit as and when you need it, and pay interest only on the money you use.

You can also pay back (and re-borrow) the amounts you owe at any time, without a prepayment penalty. There is not necessarily a monthly payment plan with an equity line of credit; you pay back as you can. Online banking makes repayment of your balance very easy.

HELOCS usually have a variable interest rate, and like other lines of credit, they work as revolving credit - meaning that you can reuse the credit after you've paid off outstanding balances, time and again. So they work sort of like a credit card, but with credit secured against your home. This credit combined with your other forms of credit can provide enormous flexibility for uncertain financial situations.

Home Equity Loans vs HELOCs

Whether you opt for a one-time payment directly into your bank account, or a revolving line of credit, both home equity loans and home equity lines of credit are a convenient, flexible way to borrow money from your home.

But they are different in nature, so to help you choose between them, here are some of the key differences between a home equity loan and a home equity line of credit:

Home Equity Loans

- May have either a variable interest rate or fixed interest rate

- Monthly payments typically include a combination of principal and interest amounts

- You must immediately begin making regular repayments on the lump sum of funds you receive

Home equity loans carry fewer restrictions and credit requirements than HELOC loans, which can make them a good option if you have a low credit score or can't prove consistent income.

HELOCs

- Come with a variable rate of interest

- Monthly interest-only payments are typically required on amounts you've borrowed but have yet to repay

- You can choose when and how much of the available funds you use, up to the fixed credit limit

HELOCs are a less restrictive financing option than a home equity or personal loan. They can be combined with a mortgage, applied for as a stand-alone product, and even used to help purchase a home.

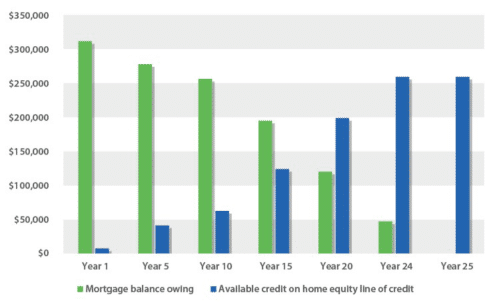

Home Equity Credit Limit and Your Mortgage

As you make regular mortgage payments, the equity in your home increases. As your home's equity increases, the amount you can borrow with a HELOC also goes up. This is one way that equity lines of credit are more flexible than a second mortgage.

Home Equity Loan Pros and Cons

Your home is probably your most valuable asset. That can make it a big plus when it comes to borrowing against your home's equity. You should be aware, however, that you could lose your home if you're unable to repay what you owe.

Understanding some of the pros and cons of home equity loans will help you better assess your financing options.

Pro: You can put home equity debt to work for you

Home equity debt can be good debt. This is especially true if you get the most out of your loan by using borrowed funds for something that's likely to improve your financial wellbeing in the future. A couple of great examples include renovating your home to increase its market value, and investing in your own or your child's education to help secure a better paying job.

Similarly, using home equity debt to improve your personal finance via debt consolidation can help you get out of debt faster and for less money than you might otherwise be able to.

Con: Interest-only payments can get out of hand

Although a flexible repayment period and terms can be an advantage in some ways, they can be a disadvantage in others. The ability to make interest only payments means that if you lack financial discipline, and you don't put your own personal repayment plan into place, you could find yourself with a larger balance than when you started.

This can make it tough to switch lenders and get the best interest rates when it's time to renew your existing mortgage, since you might not be able to pass the stress test.

Pro: Home equity can help finance a second home

You can often use your home equity to buy a second home or vacation property. Because you'll be using top-notch collateral in the form of your existing home, you'll have access to much better and lower interest rates than you would with some other loans.

While this can be a great way to invest in a second property, it does have its drawbacks. Tying up your equity funds in another asset that's difficult to liquidate could pose a problem if you're faced with a financial emergency.

Con: Equity-based personal loans have gotten tougher to qualify for

Home equity-based loans are more difficult to qualify for today than they used to be. Not only are you required to pass the mortgage stress test (2% + your loan rate), some lenders are choosing to be more conservative and qualify you based on the limit of your home equity loan instead of your current outstanding balance. If you already have a lot of debt, you may have a tougher time qualifying.

Pro: You can often still get a home equity loan with bad credit

Although it may be harder to get your home equity loan approved when you have a bad credit history (with banks for example, you'll likely be rejected if your credit score is low), many alternative lenders regularly work with homeowners who have a poor credit score.

Just be aware that you may have fewer options when your credit rating is less than ideal. The lender that provides your loan, for example, will likely offer you a higher interest rate and monthly payments than they'd offer borrowers with a good credit history.

Con: Home equity and HELOC rates can be higher than mortgage loans

Although the interest rates on home equity loans are almost always cheaper relative to other forms of unsecured debt, the fact remains that home equity rates are typically higher than mortgage rates. If you've borrowed a substantial amount of money, and you aren't planning to borrow any more, you might be better off converting your loan to a mortgage and paying a lower rate.

Likewise, the variable interest rates charged on home equity loans are typically tied to your lender's prime rate. If interest rates rise significantly over a short period of time, you could find yourself financially exposed.

How Home Equity Borrowing Works with Smarter Loans

By working with Canada's most trusted loan providers, Smarter Loans helps match you with the right lender to get the personal finance assistance you need quickly and easily.

Looking for funds to spruce up your home, cover an emergency expense, or pay off credit cards or other high interest loans? Need a secure revolving credit line?

Here are just some of the home equity financing options we can help you access when you connect with one of our partner lenders or pre-apply online:

- Second mortgages

- Mortgage refinancing

- Home equity line of credit (HELOC)

- Debt consolidation loan

- Reverse mortgage

Pre-Apply for a Home Equity Loan in 3 Easy Steps

1. Take 30 seconds to complete our application online.

Simply enter your contact information in the form provided.

2. We find you a lender. We'll find the most suitable home equity or mortgage refinancing loan provider for your needs.

3. You get your loan. Our partner lender will get in touch with you to process your application and get you the funds you need (often in just a few days).

Home Equity Loan Frequently Asked Questions

What can I expect when I apply for a home equity loan?

The first step to applying for a new loan is finding out which types of home equity lines or financing will work best for you. Once you've decided on a loan and a lender, you can expect a few additional steps.

First, the lender will want to assess you. To do so, they'll run a credit check and pull your credit score. They'll also likely require a home appraisal. This will help them determine the value of your property and your total equity.

After that, they'll consider approving you based on loan details like your income, credit history, equity, and debt-to-income ratio.

What's the average home equity loans Canada rate?

Canadian home equity loan and HELOC rates vary by lender and are constantly changing. The rates you can get from a bank or similar financial institution range from about 4.5% to 5%. Alternative lenders usually charge between 6% and 11%.

With banks, you'll likely be rejected if your credit score is low. If your credit score is excellent however, you'll have access to the widest variety of lenders who will offer you their best fixed or variable rates.

What are the eligibility requirements for borrowing against home equity?

First, you'll need a credit rating that the lender deems appropriate for home loans. Your credit score will be the loan provider's first consideration. Second, you'll need proof that you have a stable income, one that's high enough to handle repayments. Lenders will want to compare your income to the value of the loan. Third, home equity lenders will want to assess your debt-to-income ratio. If you're too bogged down by debt, they could reject your loan application. Your debt-income ratio should be below 40%.

You may also need to show:

- Proof of ownership of your home

- Mortgage details

- A recent home appraisal of the market value of your home

How can I use a HELOC to purchase a home?

You can combine a revolving home equity line of credit with a fixed term mortgage, then finance part of your home purchase with the HELOC and part with the mortgage loan. Most lenders will require a minimum down payment of 20%.

Alternatively, if you want to use a HELOC as a substitute for a mortgage, you'll need a down payment of 35%. You can still finance your home up to 80% of its purchase price this way, but the amount above 65% must be on a fixed term mortgage.

How does a reverse mortgage work?

If you're a Canadian homeowner aged 55 or older, you can use a reverse mortgage to get money from your home without selling your house. You won't have to make any regular payments (although you can typically repay the principal and interest in full any time for a fee), but the loan will need to be repaid in full when you sell or move out of your home, die, or default on your loan obligations.

Because you'll owe more interest on a reverse mortgage the longer you defer payments, you may have less equity in your home when the loan comes due.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice