Top Debt Relief and Credit Solution Companies

10% of monthly DMP payment, capped at $59/month

All of Canada

Free Account Available. Premium Account with 2% cash back is $9/month or $84 annually.

All of Canada

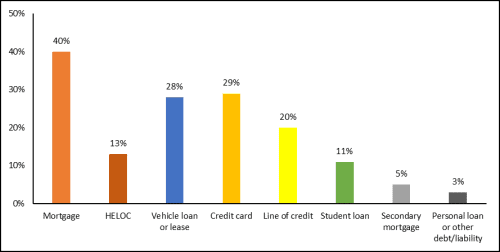

Types of Debt

Firstly, it’s important to understand what kinds of debt you have. Debt can come in many forms, such as:

- Mortgages

- Credit cards

- Personal loans

- Home equity loans

- Unpaid bills

- Income tax debt

- Medical debts

- Student loans

- Auto loans

- Payday loans

- Other secured or unsecured loans

It’s also important to understand how escalating interest can affect your debt load. 14.9% of the average Canadian household income goes towards debt payments, and nearly half of those payments are for interest.

Source: https://www.canada.ca/en/financial-consumer-agency/programs/research/canadian-financial-capability-survey-2019.html

Comparing Debt and Credit Solutions

Before we dive into each individual debt relief option, let's take a loot at the different solutions at a glance, and what they mean:

Debt Consolidation

This typically means that a new loan is taken out in order to pay off other, higher interest loans. As a result, there is a single monthly payment to be made, and the total interest is lower.

Debt Settlement

Debt Settlement typically involves negotiations with creditors in order to reduce the total outstanding debt or interest rates.

Credit Score Repair

This is not a debt relief solution, but a way to improve the credit score of an individual, which gives more access to credit of all kinds.

Debt Management Program

These programs are offered by credit counsellors that are able to work with creditors in order to reduce total outstanding debt, interest rates, review budgets and speed up overall debt recovery.

Savings Loans

These solutions do not relief of debt but if used correctly can improve credit score for someone who has poor credit history and cannot get approved for credit requests. Savings Loans involve taking out a loan that is invested into a savings vehicle, such as a GIC, instead of given in cash. As the loan is repaid, savings grow and credit improves because the repayments are reported to the credit bureaus.

Secured Credit Cards

This is again a way to improve credit rather than relief debt. It involves using personal assets to obtain a credit card. Using and repaying the balance on the credit card will be reported to the credit bureaus which can improve an individual's credit rating.

Consumer Proposal

This solution involves an Insolvency Trustee and will protect from creditors and collection calls and stops interest from accruing. It does not have as harsh of an impact on credit history as a bankruptcy, and is often a more suitable solution for someone who is considering a bankruptcy.

Bankruptcy

Bankruptcy is used as a last resort to get out of overwhelming debt when all other options have been exhausted. It has a longer impact on the financial record of an individual and requires a Licensed Insolvency Trustee to be filed, similar to a consumer proposal.

Whatever your form or level of debt, there is a solution that can help you clear your books and get a fresh start. Let’s take a look at the major options:

Debt Consolidation

You’ve probably heard of debt consolidation - there are frequently ads for private companies offering this option on TV. Debt consolidation is where you take out a new loan to pay off multiple, smaller loans. This helps to organize and streamline your debt into one payment, and it is often more affordable than paying each small loan separately. Loan terms can be more generous, with longer payment schedules and lower interest rates.

This is an especially good option if you’re paying high interest rates on multiple smaller loans. However, it does not eliminate your debt, just restructures it, and you have to apply for and qualify for a debt consolidation loan.

Debt Settlement

A debt settlement is an informal agreement between you and your creditors that states how you will pay back as much of your debt as you can. It is not legally enforceable (versus a consumer proposal, which is), and relies on you paying a fee to a debt settlement company to act as your intermediary. This is usually an option if you have a lump sum payment you can make to your creditors. Creditors are by no means obliged to accept a debt settlement arrangement though.

When successful, it can mean paying back less overall than you would otherwise, but these are considered somewhat risky arrangements. They are not enforceable, and many of the companies acting as intermediaries charge high fees with little regard to your financial situation. These fees apply regardless of whether the creditors in question accept the agreement.

Credit Score Repair

Repairing your credit score is a great, preventative measure to help you out of debt and to keep your financial situation as healthy as possible. A low credit score can affect all aspects of your financial life - from loan eligibility, to available interest rates. If you have a low score (anything below 650 is considered below average), then you will pay more for your debt than someone with a high credit score.

Low credit can happen for a number of reasons, but repairing it always looks the same. It includes:

- Paying your bills on time

- Paying off debt

- Keeping balances on credit cards low

- Only using credit cards that you actually need

- Keeping unused credit cards open, as long as they don’t cost you money, as the unused credit on them will shore up your credit score

- Only applying for one new loan or line of credit at a time

- Keeping an eye on your credit report, and disputing any inaccuracies or discrepancies quickly

Credit score repair will not help remove existing debt, but it will help you get out of debt more quickly and stay out of debt in the future.

Debt Management Programs

A debt management program is a plan offered by a private non-profit company that helps you pay off credit card debts and other unsecured debts, by consolidating all of your payments into a single monthly sum. This is not the same as a debt consolidation loan, as there is technically no loan involved - you are not borrowing new money to pay off old creditors. You still have to pay off your creditors, each month, but your payment size and the payment schedule is arranged with your creditors by the debt management provider. You make your payments to them, and they disperse the funds to your creditors.

This route, whereby your provider works out new rates and payment schedules with your creditors, can often lead to better terms and a lower overall cost of debt. It also means you have a professional helping you to understand your debt and discuss it with your creditors for you. Eligibility is not affected by your credit score, but you do need a steady income, and to apply with and have financial counselling sessions with the debt management provider. You are also required to close all but one of your credit card accounts.

Savings Loans

A savings loan (also known as a credit repair loan) is a loan of cash from a private company that you can use to help repair your credit score, among other things. The loan is secured against itself - so you pay back the loan, and then receive it, almost like a backwards loan. Sound confusing? It is, and this is a common criticism of this type of loan. Make sure to carefully read the terms and conditions of this type of loan and have a clear plan on how you will use it to help your financial situation.

Technically, by taking out a loan and paying it back perfectly, this should help improve your credit score. It also means that once you’ve completed payments, you’ll have a lump sum of cash to use for whatever you need - whether it’s to increase savings or to cover other debts. However, most experts warn that it is rarely this simple; these loans cost money that simply saving does not, and the amount you’re paying for it each month could be used to pay off your other debts.

Secured Credit Cards

A secured credit card is exactly what it seems - a credit card backed by a cash deposit from the consumer. These are common among people with poor (or no) credit history, and can provide valuable access to a credit card if you would otherwise not qualify for one. It also helps you to rebuild (or start building) your credit history, through prompt payments on the balance.

How much a secured credit card will cost depends on your financial situation; the provider will assess this based on your credit score and other information. The good news is that the security used against the card - the deposit you pay upfront - is only used if you default on the card. So when you close the card (or pass the provider’s assigned timeframe), you get the collateral back.

Consumer Proposal

A consumer proposal is a legally binding agreement between you and your creditors, arranged by a Licensed Insolvency Trustee, that arranges how you will pay back as much of your debt as you can. It relies on the premise that you are insolvent, but that your creditors would be better off through this route than if you declared bankruptcy.

A consumer proposal is not always possible, but it is a protected legal process regulated by the government. So if you qualify (typically requires you to have unsecured debts between $1000 and $250,000, and a steady income), you will immediately be protected from debt collectors, lawsuits and wage garnishment.

The agreement must be made through a Trustee (also regulated by the government) and your creditors must agree to the terms, which they are not required to do. However, when agreement is reached, it means you’ll pay off some amount of your debt, but usually not all, interest is halted, and once complete you’ll be clear of your unsecured debts. This is a serious financial position to be in, though, and filing a consumer proposal will reset your credit score to the lowest possible level.

Bankruptcy

Most people have heard of bankruptcy; it is a protected status, regulated by the government, that an individual or business declares when they are completely insolvent and unable to pay off their debts. In a bankruptcy, assets you own will be seized and used to help pay your creditors. As with a consumer proposal, a Licensed Insolvency Trustee is required to assess your finances and file the relevant paperwork, but once filed you will be protected from debt collectors, lawsuits and wage garnishment.

Bankruptcy is a serious matter, and once you have declared bankruptcy you will have a long road back to financial health. However, it is one of the only routes to completely clearing you of debt (with just a very few exceptions, like child support debt), without relying on you being able to pay back some monthly sum. Once clear of bankruptcy, you are clear of debt and have a completely fresh financial start. This is the most consequential form of debt management though, and can only be used if literally no other options exist.

Whatever your financial situation, a realistic assessment of your debts can always help inform your decision about the best path forward. It is possible to become debt-free, so don’t be afraid to ask for help or guidance when making critical financial decisions.

Frequently Asked Questions

What’s a debt solution?

A debt solution is any method that helps you get out of debt. This can be a legally protected, structured process such as a consumer proposal, an informal agreement with creditors, a consolidation loan, or even something as simple as good financial practices and repairing your credit. Any practice, tool or agreement that helps you clear your debts can be considered a debt solution.

What’s the best way out of debt?

The best way out of debt will depend on your particular circumstances, as your income level, assets, type and level of debts, monthly expenses, and so on will all impact your available choices and the best route for you. To understand how you can clear your debts, start by performing a thorough analysis of your finances. You can get help in doing this from financial institutions, Licensed Insolvency Trustees, private companies and even the government.

What’s a normal amount of debt?

The average debt in Canada is around $71,300. However, everyone’s personal circumstances, from their income to their credit score, will influence the amount (and types) of debt they can realistically afford to hold. So while it is quite common for Canadian consumers to have mortgages, credit card debts, auto loans and more, always make sure you are following the best practice for your own circumstances.

When should I get help with my debt?

It can be hard to know exactly when to get help with your debt, and many people wait until they are suffering calls from debt collectors, or seeing their wages garnished. It’s better, if possible, to try and deal with debt early, before these issues escalate. If you are in any way concerned about the amount of debt you hold, if your monthly debt payments are becoming burdensome or are a significant fraction of your monthly expenses, then it might be time to get some help. It’s never too late though, so if you are worried by debt collectors, lawsuits or wage garnishments, then you can still find help and relief.

What is insolvency?

Insolvency is the technical term for when you are no longer able to pay your bills. Insolvency is a legally protected status, and can be determined with the help of a Licensed Insolvency Trustee. Once you are declared insolvent, you have certain debt solutions option to you - such as consumer proposals and bankruptcy.

What’s the difference between secured and unsecured debt?

Simply put, secured debt is secured against some collateral, like a house, and unsecured debt is not secured against anything. Common types of secured debt include mortgages, auto loans, secured credit cards; unsecured debts include payday loans, personal lines of credit, and credit cards. When you are unable to pay your secured debts, your creditors have the option of seizing the securing asset (such as the house or car) to pay off the loan.

How do I know if I’m in financial trouble?

An excellent guide to your financial health is the level of your monthly debt payments. The government advises that no more than 10% of your monthly income should be spent on debt payments; if you’re significantly above this level then it might be time to restructure or address your debt. Similarly, if you habitually rely on payday loans, bridging loans, or frequently miss debt payments, then it’s probably time to get some help.

What’s the best place to get advice on managing debt?

There are plenty of companies and agencies in Canada that offer advice and products that seemingly help consumers out of debt, but it’s good to be wary before paying anyone for their advice or help. Some of these companies are for-profit businesses that care less about your debt than they do about collecting high fees from you. If you’re struggling with debt and think you might be insolvent, speak to a Licensed Insolvency Trustee. These professionals are federally regulated and unbiased. There are also non-profit agencies and organizations that can provide counselling and advice, with nominal or no fees.

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice