Compare Lenders

Discover Popular Financial Services

More About Invoice Factoring in Canada

- What Is Invoice Factoring?

- How Does Invoice Factoring Work?

- How To Choose An Invoice Factoring Company

- Invoice Factoring vs Invoice Financing

- How Much Does Factoring Cost?

- Are There Different Kinds of Factoring?

- What Type Of Businesses Is Invoice Factoring Right For?

- Invoice Factoring: Background

- Types of Invoice Factoring in Canada

What Is Invoice Factoring?

Invoice factoring is a debtor financing option that allows you to turn your unpaid invoices into instant cash. It is a fast and convenient option, but can be expensive. It's important to understand the cost of borrowing before you commit.

How Does Invoice Factoring Work?

Invoice factoring is you selling your invoices to an invoice factoring company at a discount. With invoice factoring, you are paid immediately. So it is a great way to get quick cash when your customers are slow to pay you. It can allow you to solve cash flow problems quickly instead of relying on your customers to pay you soon.

If you want invoice factoring services, the first thing you need to do is find an invoice factoring company. Invoice factoring companies can be found online easily. Comparing rates is also simple because invoice factoring companies can be compared through a few quick searches. You can use our table to compare them.

How To Choose An Invoice Factoring Company?

The first thing you need to look for in invoice factoring companies are their fees. All invoice factoring companies will charge a fee for their advance. The fee will vary depending on how long it takes your customer to pay you. You can get an invoice factored immediately for a fee of just a few percentage points if your customer pays you within the first month.

Unfortunately, some invoice factoring companies carry other hidden fees as well. One example would be a hidden charge for a credit pull. This hidden fee can add up if you factor many invoices with that company.

Another important figure is the amount of the invoice that the invoice factoring company can pay upfront. Most good invoice financing companies can send 90% or more of the invoice upfront.

Invoice Factoring vs Invoice Financing

Invoice financing is a type of loan that is meant to cover the cost of an unpaid invoice. It is similar to other types of installment loans.

Invoice factoring isn’t technically a type of loan. It’s just an advance with a specific repayment process. Invoice factoring doesn’t involve interest or installment repayments.

FAQs

How Much Does Factoring Cost?

This depends on the invoice factoring company you go to. Most invoice factors should only charge about 2% for the first 30 days then about 0.5% more every 10 days until the invoice is paid off.

Are There Different Kinds of Factoring?

Yes, there are a few different kinds of invoice factoring. The difference between them is how much freedom you get in choosing which invoices to factor.

Selective factoring allows you to select which invoices you want to factor.

Spot/single factoring allows you to simply factor one invoice. This is a good option when you just need to come up with the funds for one payment.

Whole turnover is a type of invoice financing that is meant for long-term arrangements. Whole turnover requires you to factor every single invoice for an agreed upon amount of time.

What Type Of Businesses Is Invoice Factoring Right For?

Invoice factoring is good for any business that has cash flow problems due to delayed invoice payments. This applies to a wide variety of businesses that make high ticket sales.

You can take advantage of invoice factoring no matter what kind of business you’re running. However, heavy reliance on a fast cash flow is the surest sign that invoice factoring is a good option for you.

Invoice Factoring: Background

Picture a business (Business ABC) that sells to multiple different customers on credit every month. Typically, Business ABC offers these credit customers 30 to 90 days to repay their outstanding amounts. This is known as the company’s accounts receivable, which is shown as an asset on the balance sheet, but critically, is not liquid cash. On the other hand, Business ABC’s own creditors require their payments to be made in cash at the end of each 30-day cycle. For simplicity’s sake, let’s assume that the debtors pay their dues in 60-day intervals while the creditors are required to be paid in 30-day intervals. This type of situation creates what is known as a funding gap, where the business does not have adequate liquidity to fund its upcoming debts due.It is in this type of scenario that a solution such as invoice factoring is a viable option.

Types of Invoice Factoring in Canada

There are two main types of invoice factoring:

TYPE 1: In Type I, the business consolidates its invoices and passes it along to the financial institution for evaluation. Based on its internal risk parameters, the financial institution will then assign a discount, and advance the remaining amount to the company. The differential between the total amount and the advance financing amount is the financial institution’s fee for conducting the transaction. For example, if there are $10,000 in outstanding invoices for the company, the bank will advance $9,750 and keep the remaining $250 as fees.

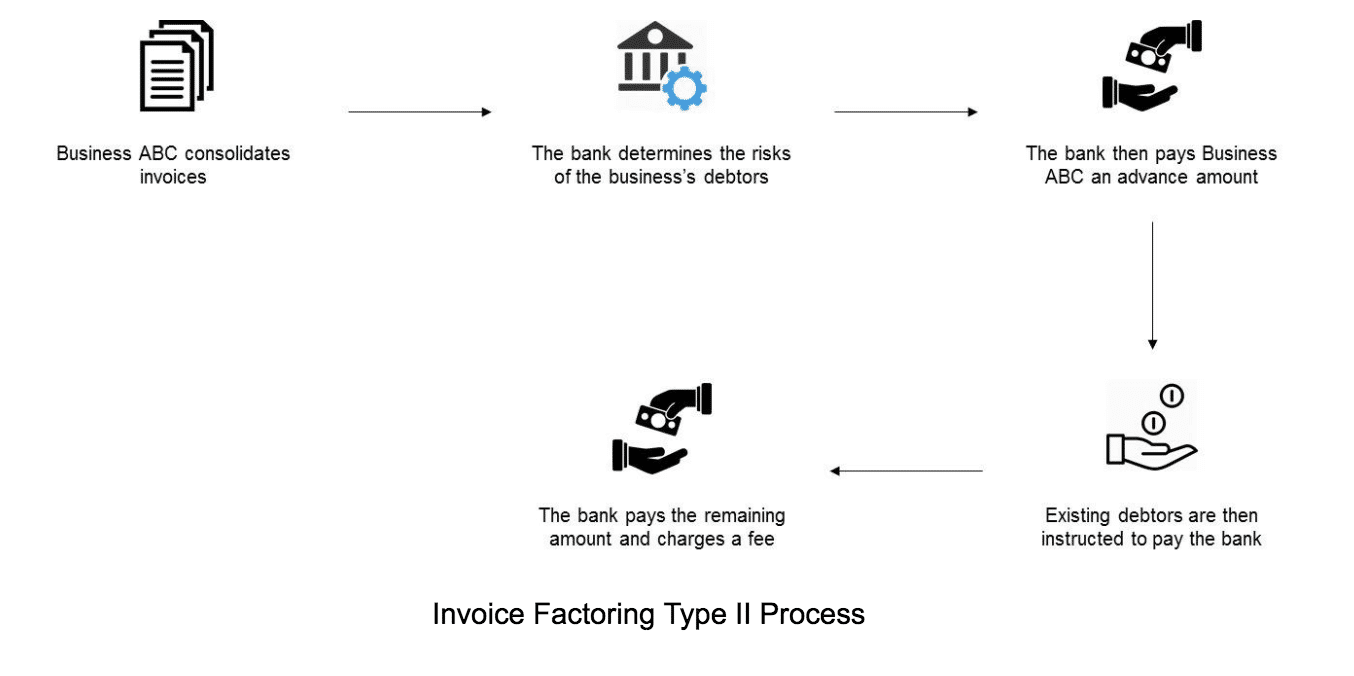

TYPE 2: In Type II, the business once again consolidates its invoices and passes it along to the financial institution for evaluation. However, in this type of structure, the institution will advance a nominal amount (typically 70% to 90%) upfront. The remaining amount (known as the reserve) will be provided to the company upon payment of the outstanding debts by the company’s debtors. For example, if there are $10,000 in outstanding invoices, the company will receive $8,000 upfront (80% of the total value). Post the repayment of the accounts receivable, they will then receive the other $2,000 less a fixed charge set by the financial institution for its services.

In both these instances, it is pertinent to note that once the invoices have been passed on to the financial institution, the company’s debtors pay the institution directly i.e. the risk and responsibility of collection lies with the institution thereafter.

Invoice Factoring Uses

As noted above, invoice factoring is helpful for businesses requiring short-term liquidity to pay out creditors on time and/or yield trade discounts. It is also used extensively by businesses that want to simplify their cash conversion cycles by reducing the administrative efforts of collection.

The Factoring Procedure Explained

The following explanation pertains to the Type II process wherein the customer receives an advance amount, and then a reserve amount once all dues have been collected. As can be seen from the diagram above, there is typically a 5-step procedure encompassed in invoice factoring.

Invoicing:

The first step is to invoice the customer buying goods or services on credit (typically for periods up to a maximum of 90 days). Once these invoices have been issued, the company then has to consolidate them and send them across to the financial institution for review.

Factoring:

Once the financial institution steps in, they will determine if the invoices meet certain eligibility criteria to receive the financing. Typically, they will also ask the business to provide information on their debtors to conduct further due diligence on their creditworthiness and credit history. Once the institution is assured of and comfortable with the risks, the two parties will sign a financing agreement stipulating the maximum amount that can be factored at any given time.

Advance:

Once the financing agreement is signed, the business will receive an advance from the financial institution that is contingent on several factors such as the size of the factoring, the industry, and other internal risk metrics that the bank gauges before issuing the funds.

Debtor Repayment:

Thereafter, the client will then pay the factor provider i.e. the financial institution directly as per the terms of the invoice. In most situations, the factor provider follows the same collection patters as the business, ensuring that any relationship repercussions with customers are mitigated.

Reserve:

Once the debts are received by the financial institution, the reserve amount is paid to the original customer and a fee is deducted for the institution’s intermediary services.

Fees

The fees of a factoring provider are contingent on several internally-defined variables. These include:

1. Overall volume of monthly receivables: The greater the volume, the lower the fees as the bank can generate economies of scale with the higher volumes.

2. Size of each invoice: “Lumpy†revenues create additional risk for the financial institution as the repayment risk is concentrated within a small group of debtors. In contrast, smaller-sized invoices are likely to be more favourable from a banking perspective.

3. The industry: Certain industries carry more inherent risk than others due to cyclicality, seasonal or other economic issues. Industries considered to be higher risk will be charged a higher fee accordingly.

4. Creditworthiness of customers: Large corporate or government customers have less risk of repayment than smaller enterprise customers who are not as established.

5. Repayment Schedules: The longer it has typically taken customers to repay in the past, the higher the fee charged to cover the risk of non-payment.

Key Merits

Invoice factoring has been a financing solution used by hundreds of businesses of all sizes across Canada to increase working capital, and unlock trapped cash flow in the business. To this end, some of the key advantages it offers include:

Better Payment Terms:

In particularly fragmented competitive landscapes, offering customers the luxury of extended payment terms can be just as powerful as reduced pricing in some industries. With invoice factoring, this can be made possible in the knowledge that the business will not have to wait until repayment is complete to be able to gain liquid cash.

Shorter Cash Conversion:

With the advance payments being received right at the completion of the financing agreement, businesses can have a larger amount of liquid cash as and when needed to fund obligations. Once this financing agreement has been signed and is in place between the financial institution and the business, the advance can be received in as little as one business day. This is in contrast to the status quo method, where the business would only be able to have that cash flow after the debtor has paid back the amounts owed (which could be up to 90 days or even longer).

Easy Applications:

The process for invoice factoring is much more simplified than other alternate financing solutions. It is much easier to qualify for invoice factoring provided that the company is established, has a stable operating history, sells to relatively stable customers and has not faced major continuity problems in the past.

Conducive to Growth:

The value received from invoice factoring is directly proportional to the value of the invoices being factored. That means that when a business is experiencing high growth in customer volumes, it can factor this larger volume and receive equivalent advances seamlessly.

Considerations

However, despite its obvious advantages in working capital improvement, invoice factoring does come with certain limitations. These include:

Costs: The invoice factoring process typically is slightly more costly than other forms of funding due to its fee-based structure. Because the burden of collection falls directly on the financial institution, these fees are proportionally higher to compensate them for the additional services rendered. This is in contrast to debt or equity financing wherein the business itself is responsible for all aspects of operational continuity even after raising the capital.

Short-term Capital: Invoice factoring is not designed to be a long-term solution for raising funds to deploy towards growth or capital expenditures. It is more of a short-term solution to generate additional liquidity in the business for obligations coming due within 30 days or less. Therefore, the amounts received are typically lower relative to debt or equity financing which are traditionally more aligned with the requirements for capital investment.

Invoice Verification: The due diligence process of financial institutions to assess the eligibility and suitability of invoice factoring includes invoice verification where customers will often be interviewed to evaluate whether they are satisfied with the product and/or whether they have the financial capabilities to pay off outstanding debts. This can be cumbersome from a customer’s perspective.

For more information on Factoring Laws and Regulations please check the government of Canada website.

Explore more

Similar products

- bad credit business loans

- coffee shop business loans

- expansion business loans

- auto shop business loans

- food grocery store business loans

- home business loans

- invoice factoring

- medical dental practice business loans

- mid market financing

- point of sale financing

- restaurant business loans

- salon spa business loans

- business credit lines

- business loan application keep

- clothing store business loans

- business loans usa

- emergency business loans

- gym fitness club business loans

- inventory business loans

- marketing business loans

- merchant cash advance business loans

- ecommerce business loans

- renovation business loans

- retail store business loans

- working capital loans

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice