Top Life Insurance Companies & Brokers in Canada

Pricing varies by coverage needs

ON, BC, AB, MB, NB, NS

Pricing varies by coverage needs

Ontario, Alberta and Manitoba

What is Life Insurance?

Let’s start with the basics: life insurance, in its simplest form, is insurance against the possibility you lose your life. In exchange for a small regular premium, the insurance company pays out money (the death benefit) to your beneficiaries when you die. This payout can come in the form of a lump sum or in ongoing installment payments, and you may nominate whoever you like to be your beneficiaries - the recipients of this money. This money can then be used however the recipients wish.

The most common uses for life insurance benefits include:

- Funeral expenses

- End of life care bills and medical bills

- Mortgage payments

- Living expenses, such as utility bills

- Cosigned debts

- Other ongoing expenses that the deceased person’s salary helped to pay for

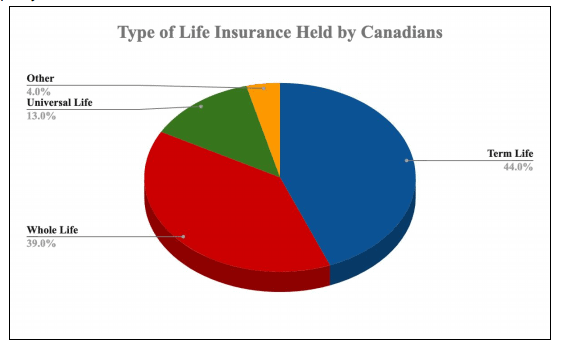

Different Types of Life Insurance

As you might expect, there are different types of life insurance, as not everyone will need or qualify for the same type of coverage. There are four main categories:

1. No Medical Life Insurance

Many people have pre-existing conditions that may make other types of life insurance expensive or impossible; some people simply do not wish to share their in-depth medical data. In either case, no medical life insurance policies are exactly what they sound like - policies that do not require you to provide a detailed medical background. They are one of the simplest types of life insurance to apply for, but are generally more expensive and come with fewer options for coverage than more traditional forms.

There are three subtypes of no medical life insurance:

- Simplified issue life insurance (requires a medical questionnaire, with some exclusions)

- Guaranteed issue life insurance (where coverage is guaranteed to everyone)

- Final expense life insurance (commonly referred to as burial insurance)

2. Group Life Insurance

Group life insurance is life insurance offered by your work, as an employee benefit. 49% of Canadians have group coverage. These plans are cost-effective (as an individual you don’t pay any premiums, and as a company you receive discounts for group policies), but they tend to be short-lived in nature. Few people stay in one job their whole career, and there is no continuity across workplace insurance plans. These policies also tend to fall on the lower end of the coverage spectrum. So it is incumbent on you to check your employer’s life insurance policy and supplement it if you can, to ensure continuing, adequate coverage regardless of your employment status.

3. Term Life Insurance

Term life insurance is the most popular form of life insurance in Canada, as it is the cheapest; it provides life insurance for a set amount of time (usually 10 or 20 years), or until a set age (for example, 65). If the term expires before you die, the policy expires and there is no payout. You may have options to renew (usually for higher premiums), or find a new policy. While the lower premiums on these policies make them attractive for consumers, it is important to keep an eye on the term so that you don’t end up without coverage during your elderly years.

4. Permanent Life Insurance

Permanent or whole life insurance is life insurance that never expires - it stays with you as long as you live, regardless of where you work, your age or how long you’ve had the policy - as long as you pay the premiums. Premiums are higher than for term life insurance, but they are set at one level and never change. What’s interesting about this type of insurance is that the payout amount correlates to how much you’ve paid in premiums. So the longer you have the policy, the bigger the payout will be in the event of your death.

In many ways this makes permanent life insurance a sort of investment; there is a cash value in the policy that can be used as collateral for a loan, or that can be claimed back if you cancel the policy. You can even choose how you want the money in the policy to be invested - some policies offer set returns (known as whole life insurance), others track a stock index (known as universal life insurance), and some allow you to choose the exact mix of the portfolio your money is invested in (known as variable life insurance).

Riders

Many life insurance policies also offer riders, or add-ons, to supplement generic policies with specific coverage for areas you are concerned about. Common riders include:

- Accelerated death benefit rider (for the terminally ill)

- Long term care rider (in case you need long term care)

- Premium return rider (to reclaim the premiums in the event of policy cancellation)

- Waiver of premium rider (so the premiums continue to be paid if you become disabled and are unable to pay them)

- Guaranteed purchase option rider (which allows the insured to increase their level of coverage at a later date, without a medical exam)

- Term conversion rider (lets you convert a term policy into a permanent policy)

There are dozens of different riders available, all with varying costs, so be sure to mention to your insurance company if you are worried about a specific eventuality and want it included in your policy.

How Much Does Life Insurance Cost?

The cost of life insurance depends on lots of variables. Primary among them is the type of policy you choose. Each company also has different pricing models. And personal factors play a role. Your premiums (and coverage level) can be determined by:

- Your age

- Your gender

- Your health history

- Your family’s health history

- Your current health

- Your weight

- Your lifestyle

- Your occupation

- Whether you drink, smoke or engage in other high risk behaviours

Choosing the Right Insurance For You

Step One: Choose Your Insurance Type

Compare the different types of insurance to understand what’s most important to you: the cost of your premiums, the investment angle, guaranteed coverage, coverage that never expires - identify your priorities and choose the type that best fits your needs. Note that some policies have restrictions, so be aware of them and rule out any you don’t qualify for.

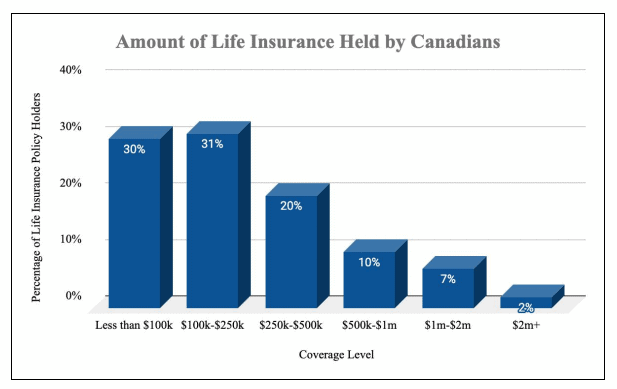

Step Two: Consider How Much Coverage You Need

Another important factor that can determine the cost of your premiums is how much coverage you choose to have. While more is obviously better, there has to be a balance between the amount of coverage and its cost. So a good rule of thumb that many people use is aiming for coverage equalling five to ten times your annual income. It is also helpful to sum up your debts, to make sure any payout will cover them.

Step Three: Choose Your Beneficiaries

This step is easy - who do you want to receive the payout in the event of your death? This is normally a spouse, child, or other loved one. Many families have life insurance policies for the primary wage earner in the family, to ensure financial security in the event their salary disappears.

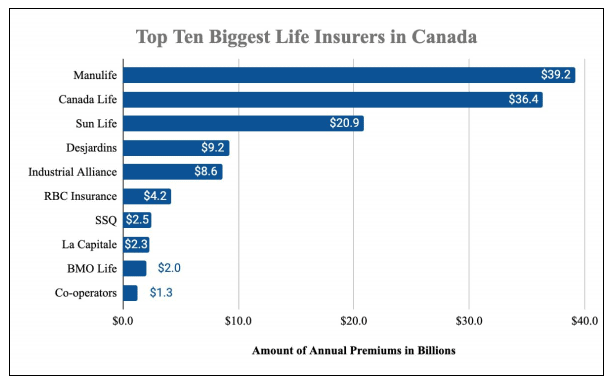

Step Four: Choose an Insurer

Now you must pick the specific company you want a policy from. Compare premiums, coverage options, term flexibility, and past customer reviews to find an affordable option that works for you, from a trustworthy source.

Frequently Asked Questions About Life Insurance

Can I name my children as my beneficiaries?

Most Canadian provinces have a stipulation that says anyone under the age of 18 cannot be the direct recipient of the death benefit from a life insurance policy. This means that if you wish to leave your insurance money to your kids, you will need to name a trustee to look after the money until they turn 18.

Is life insurance invalid if the covered person commits suicide?

Most policies have exclusions that state the payout will not occur in the event of death by suicide. Some policies provide exceptions to this rule, but even among these there will be a clause that states that in the first two years of the policy, suicide still invalidates the claim.

Does life insurance cover critical illness?

Life insurance does not include critical illness coverage; this is usually purchased as a separate form of insurance coverage, or can sometimes be added as a rider.

Do my beneficiaries have to pay tax on the life insurance payout?

No, death benefits are not considered taxable income. However, if you hold a permanent insurance policy that has generated interest over time, then your estate may be liable to income tax. This would be deducted before the death benefit was paid out.

Can I access my life insurance policy money before I die?

There are two ways to access the money you’ve spent on your life insurance policy while still alive: 1) cash in a permanent policy; 2) access it via a pre-set living benefit rider. If this is something you’re interested in, you must consider it when setting up the policy.

Can I change beneficiaries?

Yes, you can update your named beneficiaries at any time. You may even name multiple beneficiaries and state exactly what portion of the death benefit goes to each.

Can I cancel my life insurance policy?

Yes, you can cancel any life insurance policy at any time, but bear in mind that you’ll only receive money back for the premiums you’ve paid in if: 1) you instituted a premium rider when setting up your coverage; 2) you cancel during the free “cooling off†period after purchasing the policy (standard is ten days); 3) you have a permanent policy.

Can I get life insurance if I smoke?

Yes, though this may affect your premiums and your coverage. If you have smoked regularly or casually within the last 12 months, you need to disclose this, and the insurer will classify you as a smoker.

What happens if I miss a premium payment?

Missing a premium payment can affect your coverage, so it’s important to notify your insurance company if you’re having trouble making your payments. They might be able to offer a freeze period over which you don’t need to make payments. But if you miss multiple payments, this will invalidate your policy.

Written By Smarter Loans Staff

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada's highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the "GPS of Fintech Lending" by the Toronto Star.

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice