Compare Lenders

Discover Popular Financial Services

What Counts as a Home Business?

The legal definition of a home business is simple: it is any business that is run primarily from the business owner's residential property. But whilst that may sound clear, it's important to note that this is not the same thing as working from home, or the same as being self-employed. And home-based businesses can have you working outside of the home. Confused yet? Don't worry, we're here to break it down for you!

Self-Employment, Home Business and Working From Home - What's the Difference?

Self-employment

is where you work for yourself, rather than for a single employer. This can be via contracts, freelance work, gig work, or through other means, and most self-employed people are highly skilled in one particular profession - like lawyers, writers, investors, and so on. Self-employed individuals do not need to register as a business with the government, and they cannot hire anyone else. They operate entirely independently.

Working from home is often a sign you are self-employed or have a home business, but it's also possible to work from home while being employed by a permanent employer. It's just a catch-all term for anyone who performs some or all of their work duties from home, for any reason.

So that leaves home businesses; these are registered businesses that are based out of a residential home. The work can be done in or outside of the home, and the business can employ multiple people. It is just like any other business really, with the only difference being that there is no other official business property or address.

The confusion comes from the fact that many home businesses are owned and operated by a single individual, making it look a lot like self-employment - but for legal and tax purposes these forms of employment are distinct. Canada's home business market is broad and varied, and includes farm operators and truckers, as well as the multitudes operating a physical in-home office.

Financing Options for Home Businesses

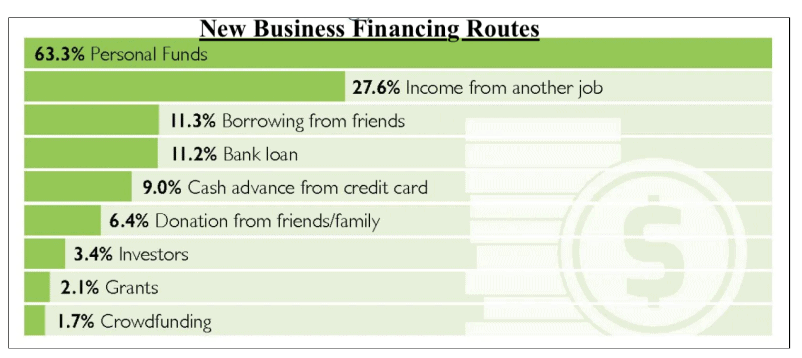

Financing a home business may seem - on the surface - much like financing any other kind of business, but the lack of a physical business property and the small nature of almost all home businesses means that qualifying for a traditional business loan is tricky. There are financing options available though, and to understand which will work for you, you need to understand your business's position and needs.

Bank or Credit Union Business Loan

This is what is generally thought of as a “traditional†loan, and as mentioned above, these are hard to get, primarily because they require so much paperwork - including full financial and legal documents for the business spanning at least two years. Any new venture will simply not meet these eligibility criteria. However, if you have an established home business and are seeking a large loan or longer term financing, a traditional loan might work for you.

Business Loan from an Alternative Financial Institution

There are other financial institutions that offer business loans, of all sizes and terms, and depending on your need one of these might suit your purposes. Most home businesses do not need to borrow much to get going - the average startup loan is between $10,000 and $50,000 - and the more secure your business, the better the interest rate you'll qualify for. Microloans are available through these alternative lenders, and as these are loans of less than $10,000, they may suffice for a home business's needs.

Business Loan from Online Lender

There are also online lenders, which work much like other financial institutions and have many of the same products, but with the added benefit of performing their operations entirely online. This means you can apply for and access your financing without having to go anywhere, and because of their low overheads, some of these online lenders offer very competitive interest rates too.

Small Business Loan

A small business is technically any business that employs less than 100 people - which is essentially all home businesses! Small business loans have more flexible requirements than other business loans, as they are geared toward the needs of entrepreneurs and fledgling businesses. The borrowing limit is usually low, around $50,000, but this is enough to meet the needs of most home businesses.

Personal Loan

If your business does not yet qualify for a business loan but you still need financing, you have the option to get a personal loan and use the funds released for your business. There are few limits on how you can use a personal loan, and they are easier to qualify for than a business loan - all of the eligibility criteria revolve around your personal financial circumstances and not the business's. However, it's important to note that with a personal loan you are liable for the loan, not the company, regardless of how well the business does.

Grants and Government Financing

Depending on the nature of your business and your personal details, you may qualify for a grant to help your home business along. These grants vary widely in size and qualifying rules, and they change all the time, so check here to see if you fit any. There are, in addition to grants from both the government and other organizations, government-sponsored business financing opportunities for certain businesses.

Angel Investors

An angel investor is a high net worth person who invests in small businesses. Unlike the other forms of financing mentioned, this requires you to give up some ownership portion of your home business, so you need to be prepared to relinquish control to get this type of funding. Given the nature of most Canadian home businesses, those who go the angel investor route do so through friends and family.

Crowdfunding

Lastly, crowdfunding is becoming an ever more viable option for people setting up merchandise or product focussed businesses. This relies on utilizing a platform - such as Kickstarter or Indiegogo - to find many small investors interested in buying your product. In exchange for their investment, they get perks, such as priority access to new items.

Other Factors To Consider When Setting Up a Home Business

There are many other factors to consider when setting up and running a home business, and as a business owner you need to be on top of all of them. They include:

Taxes

As a home business, you have to complete and file your taxes with the CRA, taking into account all income, revenues and expenses for the business. A lot of people forget about the many deductibles available when running a home-based business; these include any reasonable expense related to the operation of the business, such as:

- Rent or mortgage costs - proportional to how much space in the home is used exclusively for business purposes

- Other home costs, including cleaning supplies, utilities, home security, and so on

- Advertising

- Phone and internet

- Office supplies

- Computer equipment

- Maintenance and repairs

- Vehicle and travel expenses

Just be sure to keep all relevant receipts to back up your tax filings. As a business, you should keep these business receipts for at least 7 years.

Registering Your Business

You should also register your business with the Canadian government. This includes choosing a name for your business, setting the business type, and so on. For more info, see here. This is also a sensible time to consider whether you need to trademark your name or logo, if you need any copyright or intellectual property protection, and other legal matters of this nature.

Permits and Licensing

Some businesses will need permits or licenses to operate; this depends on the sector and type of work being done, but it's always better to check before starting any work, to ensure you don't fall foul of the law. You can check if permits or licenses are needed for your business here.

Frequently Asked Questions About Loans for Home Businesses

How is working from home different from a home business?

Working from home is different from having a home business, in that while you are working from home, you could be working for anybody - yourself, your own company, or another company entirely. It just means that you perform your work duties from home. But a home business is a registered business whose legal address is the same as your residence. This doesn't mean that you have to perform the work of the business in the home itself, just that the business is registered there.

How much does it cost to set up a home business?

The cost to set up a home business depends on the nature of the business, what tools or equipment you need, and if you need large initial investment for anything. If you are making physical products, you'll need materials; if you are performing a service from your computer, you'll need some technical infrastructure and probably office supplies. Every type of business has its own needs, but most home businesses only need $10,000 to $50,000 to get going - although many start with even less than this!

How much can I borrow with a home business loan?

The amount you can borrow with a home business loan depends on your business, how long it's been operating, your personal financial circumstances, the type of loan you use, and what lender you go to. Banks and credit unions have the ability to lend large amounts, but these loans are hard to qualify for. Microloans are easier to get, and these go up to $10,000. If you're using a personal loan or a small business loan, you may be able to get as much as $50,000.

What can I use a home business loan for?

A home business loan can be used for any business-related expense, such as inventory, equipment, repair, office supplies, connectivity, travel expenses, advertising, working capital, and so on. You can even use it to pay your own salary.

Explore more

Similar products

- bad credit business loans

- coffee shop business loans

- expansion business loans

- auto shop business loans

- food grocery store business loans

- home business loans

- invoice factoring

- medical dental practice business loans

- mid market financing

- point of sale financing

- restaurant business loans

- salon spa business loans

- business credit lines

- business loan application keep

- clothing store business loans

- business loans usa

- emergency business loans

- gym fitness club business loans

- inventory business loans

- marketing business loans

- merchant cash advance business loans

- ecommerce business loans

- renovation business loans

- retail store business loans

- working capital loans

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice