Compare Lenders

Discover Popular Financial Services

What is a Small Loan?

In the realm of personal loans, a small loan is typically defined as a loan of less than $5000. It's specifically designed to assist individuals in managing unexpected personal expenses or financial challenges that may suddenly arise. These small loans are a boon for many, especially in times when access to quick funds is imperative.

Unlike secured personal loans, which require collateral (like property or valuable items) to back the loan, most small loans are either unsecured loans or personal loans. This means they don't necessitate any form of collateral. Instead, the approval largely depends on the borrower's credit score. While a good credit score is advantageous when securing these unsecured loan loans, there are options for bad credit loans as well, ensuring that a wider range of individuals can access funds when they need them.

Many financial institutions provide the option to apply for a small personal loan online. It's a convenient approach that allows potential borrowers to submit their applications and possibly even receive loan amounts directly into their bank account without the need to visit a physical branch.

The interest rate for these loans can vary widely, often based on the applicant's creditworthiness and the lender's policies. The annual percentage rate (APR) is a comprehensive way to understand the cost of borrowing money, as it encapsulates not only the interest rate for personal loan payments but also any additional fees that might be involved.

While small personal loans are a favourable option for many, it's crucial to be wary of certain pitfalls. For example, payday lenders often provide loans with exorbitantly high interest rates, targeting individuals who need quick cash. These might seem tempting in dire situations but can lead to a cycle of debt if not managed prudently.

Another vital aspect to consider is the terms. Longer terms might mean smaller monthly payments, but they can also equate to more interest over time. Conversely, shorter terms might have higher monthly payments but often come with a lower overall cost.

Some individuals also utilize these loans for debt consolidation, allowing them to combine various debts into one manageable monthly payment plan, often at a lower interest rate.

Whether you're looking to cover an unexpected expense, consolidate debt, or need a minimum loan to tide you over, online loans, especially a small loan online lender, can be an ideal solution. However, always ensure that you understand the terms, your minimum credit score requirements, and the potential impact on high credit score and your financial health before securing a loan.

How Does a Small Loan Work?

Small personal loans operate much like other loan types, allowing individuals to access quick financial assistance for various needs. The process is relatively straightforward: you borrow a predetermined amount from a lender, and in return, you agree to pay a reputable lender back the principal amount along with interest over a specified period. However, the specific terms of your small personal loan can vary based on the loan agreement with the lender and your unique financial situation.

One essential aspect to note is that small personal loans are typically designed to provide relatively modest sums of money. While some lenders may set minimum borrowing amounts, often around $1,000, there's usually a cap on the maximum amount you can borrow through such loans. The upper limit for a small personal loan commonly hovers around $5,000, which ensures that these loans remain accessible for various financial needs without becoming overly burdensome.

In terms of the loan duration, a small personal loan is characterized by its short repayment timelines and fixed interest rate. This short-term nature reflects their utility in addressing immediate or emergency financial requirements. Typically, borrowers can expect loan terms ranging from three months to a year. The relatively brief repayment period helps individuals quickly resolve financial challenges while keeping interest costs manageable.

Speaking of interest rates, it's important to understand that small personal loans often come with relatively higher interest rates compared to longer-term or secured loans. The Annual Percentage Rates (APRs) for these loans can vary widely, spanning from 6% to 35%, depending on several factors. Your credit score, for instance, plays a pivotal role in determining the interest rate you'll be offered. Those with excellent credit scores may secure loans with lower interest rates, while individuals with lower credit scores might face higher rates due to perceived higher risk.

When applying for a small personal loan, you'll need to submit a loan application, which includes essential information about your financial history, income, and the purpose of the loan. Many online lenders have simplified this process, making it convenient for borrowers to apply from the comfort of their homes. These online lenders often offer competitive terms and rates, providing a wider range of options for borrowers.

It's important to be aware that some private lenders may impose prepayment penalties, which means you could incur additional fees if you decide to pay off your loan early. Therefore, it's crucial to review the loan terms and conditions carefully before committing to a small personal loan.

Small personal loans are a valuable financial tool that can assist individuals in addressing various immediate financial needs. They offer a relatively quick and accessible source of funds, but it's essential to carefully consider the interest rates, loan terms, and potential prepayment penalties when choosing a small personal loan to ensure it aligns with your financial goals and circumstances. Your credit score will also play a significant role in determining the secured personal loan amount's interest rate, making it vital to manage and maintain a good credit score to access more favourable borrowing terms.

What Can I Use a Small Loan For?

There are 101 uses for a small loan, but they are most commonly needed for:

- Medical expenses

- Funeral expenses

- Veterinary bills

- Emergency home repairs

- Day-to-day bills

Given the short-term nature of small loans and their cost, it is not advisable to use them for discretionary or optional expenses.

Where Can I Get a Small Loan?

There are a few different types of lenders that offer small loans:

When you're in need of a small personal loan, you have several options to explore, depending on your financial circumstances, credit history, and preferences. The availability of these loans and the terms associated with them may vary, so it's essential to assess your specific needs and choose the most suitable lender accordingly.

Traditional Banks and Credit Unions:

Traditional financial institutions, such as banks including the bank of Nova Scotia and credit unions, are often a reliable source for personal loans. They typically offer both an unsecured personal loan and secured personal loans. An unsecured personal loan doesn't require collateral, making it accessible to borrowers with a good credit score and a solid credit history. These loans usually come with competitive interest rates, especially if you have a high credit score. On the other hand, secured personal loans are backed by collateral, such as a savings account or a vehicle. These loans can be an option if you have a low credit score or need a larger sum of money, but they come with the risk of losing your collateral if you default on the loan.

Online Lenders and Peer-to-Peer Platforms

In recent years, the rise of online lending platforms and peer-to-peer lending has revolutionized the personal loan landscape. These platforms connect borrowers with multiple lenders, increasing your chances of finding a suitable loan, even if you have a low credit score. Online lenders often provide unsecured personal loans with varying interest rates, depending on your creditworthiness. They also offer the convenience of applying for a loan from the comfort of your home. However, it's crucial to compare offers from multiple lenders to secure the best terms for your small personal loan.

Specialized Personal Loan Providers

If you're specifically looking for small loans in Canada, various specialized personal loan providers cater to the Canadian market. These lenders understand how personal loans work within the Canadian financial system and offer options tailored to the country's regulations and consumer needs. Whether you have a high credit score or are dealing with a low credit score, you can explore these specialized providers to find a small personal loan that suits your circumstances.

Obtaining a small personal loan is achievable through a range of lenders, each offering different terms and conditions based on your credit score, credit history, and preferences. Thoroughly research and compare offers from many lenders to secure the most favourable interest rate and repayment terms for your small personal loan. Consider your individual financial situation and whether an unsecured or secured personal loan is the best fit for your needs and risk tolerance.

For information on Personal Loans in Canada, visit the Government of Canada website.

Benefits of a Small Loan

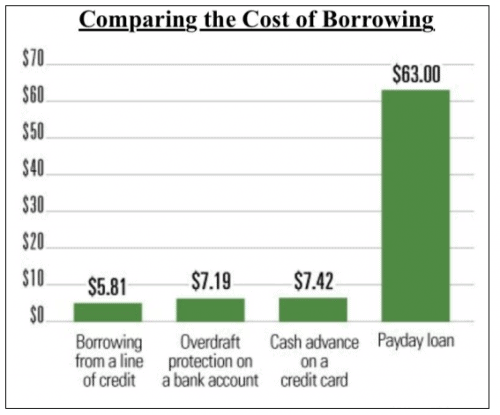

Many people might automatically think of paying for the type of expenses listed above on their credit card, or even by getting a payday loan. The advantage of a dedicated small loan is that it will typically have lower interest rates than either of these other options. Credit card APRs are usually 20%+, and payday loans are intended to be so short-term (two weeks or so) that if renewed more than a few times, the very high interest rates end up costing you a lot (many other payday loans, borrowers end up paying more in interest than the amount originally borrowed).

A small loan has the benefit of known, predictable monthly payment and payments that won't escalate if you stick to them – making them a safer option overall. This is particularly true if you have good credit and qualify for lower interest rates on your small loan.

Qualifying for a Small Loan

As with any loan, each lender has their own eligibility criteria that you must meet.

You will need to show proof that you have:

- A permanent Canadian address

- Photo ID

- Regular income

- A bank account

There may also be eligibility criteria related to existing debt payments, income level, and credit score. A common minimum required credit score is 600, although options are available for borrowers with a lower score than this credit limit.

Choosing the Right Small Loan

When comparing your small loan options, remember to take into account:

- The interest rate (and whether it is fixed or variable)

- The loan term

- All associated fees

As a general guideline, small loans should meet the following criteria:

- Fixed monthly payments

- No balloon payments or punitive fees or penalties

- Short loan term

- Monthly payments that do not exceed 5% of your monthly income

A small personal loan is not necessarily the best (or only) option for you. If you have a lot of existing debt, adding to your monthly debt payments may not be the best idea, and if you have a poor credit history or minimal or no income, then you will not qualify for bank or credit union loans and will instead be forced to use more expensive lenders with punitive interest rates. If this is the case, always make sure you research all of your options thoroughly before agreeing to take on more debt. Other options may include:

- Asking for help from family and friends

- Using a chequing account overdraft

- Seeking an advance from your employer

Frequently Asked Questions About Small Loans

What is a small loan?

A small loan is a loan of less than $5000. These loans are usually unsecured loans and short term in nature,

Can I get a small loan with no income?

It is possible to get a small loan with no proof of income, but as this is a riskier loan for the lender, they will charge you higher than average variable interest rate and rates to offset their risk. This makes getting a loan more expensive.

Can I get a small loan with poor credit?

Yes, it is possible to get a small loan even if you have bad credit.

Lenders typically require a credit score of 600 or more, but some will accept lower scores under certain conditions, and others even cater specifically to bad credit borrowers. This means that they are more familiar with the challenges facing a bad credit borrower, although they may charge higher interest rates to offset a low credit score and the higher associated risk.

How much can I borrow with a small loan?

Small loans are usually capped at $5000.

For loans greater than this, other types of personal or secured loans and credit unions are advisable. You do not have to borrow $5000 though – many small loan providers will lend you a secured loan for as little as $1000.

What can I use a small loan for?

Small loans can be used for almost any expense.

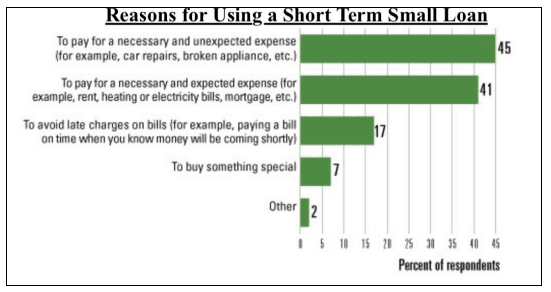

They are most commonly used for unexpected costs (such as vehicle repairs, other emergency expenses, home repairs, and medical bills) or to help with short-term cash flow problems (i.e. to pay monthly bills).

Where can I get a small loan from?

Small loans can be found at some banks, credit unions, and online lenders.

Online lenders are the most popular choice, as they are easy to access and have fast turnaround times.

Why should I use a small loan instead of a payday loan?

Small loans generally have lower interest rates than payday loans, so you pay less overall for the money you're borrowing.

They are also slightly longer term than installment loans. A payday loan is intended to last a few weeks, while a small loan can last from months to a year.

What do I need to qualify for a small loan?

Qualifying for a small loan starts with some basics: ID, proof of Canadian residency, age of majority, and a bank account.

Depending on the lender, you may also have to provide proof of income, information regarding existing debts, and your personal information so they can check your credit and loan payment history. It is possible to qualify for a small loan even with bad or no credit, or with no income, but you may need to seek help from a specialized lender.

Written By Smarter Loans Staff

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada's highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the "GPS of Fintech Lending" by the Toronto Star in 2019.

Explore more

Similar products

Near me

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice