Compare Lenders

Discover Popular Financial Services

More About Installment Loans in Canada

- What are Installment Loans?

- How Do Installment Loans Work?

- What are Installment Loans Used for?

- What You Need to Apply for an Installment Loan?

- Installment Loan Decision Factors

- Key Benefits of Installment Loans in Canada

- Drawbacks

- How to Choose the Best Installment Loan Provider in Canada

- Alternatives to Installment Loans Canada

- Debunking Common Myths about Installment Loans

- Installment Loans Frequently Asked Questions

What are Installment Loans?

Installment loans are a form of online loans that are provided to the borrower in a lump sum at the beginning of the transaction and then paid back over time at monthly or biweekly intervals. Installment loans are typically between $500 and $10,000 but can go up to $25,000 or more.

The terms of an installment loan can range from short-term to medium-term durations, but most fall within the range of 6 months to under 5 years. These loans are unsecured which means they do not require any collateral from the borrower.

How Do Installment Loans Work?

Taking out an installment loan means that you are borrowing a specific sum of money, usually somewhere between $2,000 and $10,000, which must be repaid over a set period of time (such as a few months or a few years) and at a set frequency (for example, weekly, or monthly).

Check out our video on Personal Loans to understand the different types of loans available, including installment loans, and how to pick the right solution for your situation. Different loans serve different purposes and come with different terms, so it is very important to compare your options.

What are Installment Loans Used for?

These loans can be used for a variety of purposes, most common being automotive or home repairs, renovations, catching up on overdue bills, medical or emergency expenses, consolidating debt, travel or making a purchase.

Automotive or home repairs

Installment loans can be issued to cover the costs of car repairs that are typically paid out in a lump sum either prior to or directly after completion of the repairs depending on the vendor.

Medical Expenses

Unforeseen medical expenses that arrive unexpectedly often cannot be met by income and savings. If this is the case for a borrower, then the installment loan can be a lifeline that provides lump sum payment at the outset.

Utility bills

In cases where the borrower finds themselves unable to pay off an impending hydro, cellphone, or other type of basic utility bill, the installment loan can be used to keep the lights on – literally and figuratively.

What You Need to Apply for an Installment Loan?

When searching for an online installment loan, most lenders will typically ask for the same basic requirements for you qualify for a loan. This includes proof of income and employment, a valid bank account, proof of age and residency. Most lenders will conduct some sort of a credit check to ensure you are not currently in collections, or undischarged bankruptcy or consumer proposal.

Proof of Income:

This can be a tax slip, employer verification letter or other such document. However, a full-time job is not a criteria for the proof of income requirement. Part-time jobs, disability income, pension income, and social welfare benefits count too.

Bank Account:

In most cases, online installment loan providers ask for a valid and active bank account to deposit the funds into. However, it is also possible to obtain cash loans from a physical branch location in some cases, albeit rare.

Age Verification:

In most provinces and territories, the minimum age for receiving an installment loan is 18. For this reason, installment loan providers will ask for government-issued ID.

Canadian Citizenship or Permanent Residency:

Installment loans are typically extended only to Canadian citizens or permanent residents.

Installment Loan Decision Factors

When choosing between online installment loans, there are a multitude of providers. However, it is important for the borrower to screen each provider’s offerings to achieve the best alignment with their needs and financial capabilities to repay. Some of the factors that should weigh into this selection decision are:

Interest Rates

Evaluating the interest rate upfront is an important consideration as it determines the borrower’s cost of borrowing. Higher rates mean higher indebtedness when it comes to repayment time.

Term

Longer loan terms mean lower monthly payments, but higher interest charges in total by the end of the term, It is therefore important to evaluate which of the two to prioritize when selecting the loan term.

Principal Amount

While it is tempting to take out a large amount that covers the entirety of the expense, the high rate makes this an unfeasible idea. Borrowers should therefore look to budget conservatively, and obtain a personal loan only for the amount they cannot cover through savings and income.

Additional Fees

Some installment loan providers may charge fees upfront such as administrative fees. Other fees can also encompass fees for late payments, all of which should be considered when making the final decision.

Speed

While some borrowers can wait for a few days, other situations call for an immediate need for cash. An important caveat though is that faster loans could also be more expensive.

Key Benefits of Installment Loans in Canada

There are multiple benefits to obtaining an installment loan despite the higher interest payments that have to be made compared to personal loans. As compared to a similar substitute, the payday loan, the installment loan has a slightly lower interest rate attached to it and allows for longer terms of repayment. Some other benefits include:

Efficiency, efficiency, efficiency

These loans are much faster to obtain than other forms of loans, which typically involve meeting with a banking institution’s representatives before approval for the loan is received. Comparatively, the online nature of these loans means that approval can be finished within an hour and funds can be received as soon as the next business day.

Flexible Repayment

Unlike a payday loan which have to be paid back the next time the borrower gets paid, these loans are structured more like personal loans in that regard. They allow the borrower to select the loan term and in some cases, even the repayment frequency (monthly, biweekly etc.)

Acceptance of Poor Credit

These types of loans are available to all types of customers including those with bad credit scores as long as they demonstrate a reasonable ability to repay the principal and interest amounts. On the other hand, conventional loans come with strict lending criteria to target higher credit scores.

Drawbacks

Potential downsides to installment loans include:

Higher Repayments

Because these loans can offer higher principal amounts than a payday loan, the cost of repayment from a purely principal perspective is higher as well, all other things equal.

Fees

Some providers may charge additional administration, origination or other affiliated fees, which could add up to total costs for the borrower.

Interest Rates

With the simplified processes required to obtain the loan, and relatively fewer requirements in terms of credit strength, lenders have to be compensated for the additional risk they take in lending to borrowers with an instalment loan structure. This results in higher interest rates.

How to Choose the Best Installment Loan Provider in Canada

In today's financial landscape, installment loans have become an increasingly popular option for those seeking to borrow money. Whether you need to cover unexpected expenses or consolidate debts, installment loans can offer a flexible and convenient solution. But with so many installment loans Canada providers out there, how do you choose the best one for your needs? Next, we will help you navigate the world of installment loans, a payday loan, and bad credit solutions, ensuring that you make an informed decision and find the best installment loan provider in Canada.

Understand the Basics of Installment Loans:

Installment loans are a type of unsecured loans that allow borrowers to repay the loan over time through regular installment payments. These loans are often an attractive alternative to a payday loan, which typically require a lump-sum repayment on the following payday. Installment loans can also be a viable option for those with a bad credit score, as some online lenders specialize in providing installment loans for bad credit.

Assess Your Financial Situation and Needs:

Before applying for an installment loan online, it's crucial to evaluate your financial situation and determine whether this type of loan is right for you. Consider your income, expenses, and any existing debts to ensure that you can afford the monthly installment payments. Keep in mind that a responsible lender will also assess your ability to repay the loan before approving your application.

Check Eligibility Requirements:

Each installment loan in Canada provider has its own set of eligibility criteria, which typically includes having a valid Canadian bank account, proof of income, and meeting a minimum age requirement. For those with bad credit, some lenders may require additional documentation or a co-signer to approve the loan application.

Compare Different Installment Loan Providers:

When searching for the best installment loan online provider in Canada, it's essential to compare various financial companies and online lenders. Consider factors like interest rates, repayment terms, and hidden charges to find the most suitable option for your needs.

Review the Loan Agreement Carefully:

Before signing any loan agreement, make sure to read the terms and conditions thoroughly. Pay close attention to the repayment terms, interest rates, and any potential penalties or hidden fees. If you have any questions or concerns, don't hesitate to ask the lender for clarification. Remember, choosing a responsible lender means ensuring that you fully understand and agree with the loan terms.

Alternatives to Installment Loans Canada

While installment loans can provide a flexible financial solution, they may not always be the best option for everyone. If you have a bad credit score, need quick cash, or simply want to explore other options before getting an installment loan, there are several alternatives available. Here, we will delve into various alternatives to installment loans online, helping you make an informed decision when facing financial challenges.

Personal Line of Credit:

A personal line of credit is a revolving credit account offered by financial providers, allowing you to access funds as needed up to a pre-approved limit. This option may be more suitable for those with a bad credit score, as some lenders may approve lines of credit with a lower credit score check threshold than installment loans. With a personal line of credit, you only pay interest on the amount you use, which can save you money compared to a fixed installment loan.

Payday Loans:

A payday loan is a type of short-term loan that provides borrowers with quick access to cash, typically repaid the next time they receive a paycheck. These loans can be a viable option for those who need money fast and are confident in their ability to repay the loan early. However, keep in mind that a payday loan often come with high interest rates and fees, which can lead to a cycle of debt if not managed responsibly.

Credit Cards:

Credit cards can be a convenient alternative to installment loans online, especially for smaller expenses or emergencies. Some credit cards offer promotional interest rates or rewards programs, making them an attractive option for those who need money quickly. However, be aware of the potential for high interest rates and fees if you don't pay off your balance in full each month.

Peer-to-Peer (P2P) Lending:

Peer-to-peer lending is an online platform that connects borrowers directly with individual investors, bypassing traditional financial providers. This alternative allows you to request a loan from multiple lenders, increasing your chances of approval and potentially securing a more favorable interest rate.

Borrowing from Friends or Family:

In some cases, reaching out to friends or family for financial assistance may be the most suitable option. This alternative can help you avoid high interest rates and fees associated with traditional loans. However, borrowing money from loved ones can also strain relationships if not managed responsibly, so be sure to establish clear repayment terms and communicate openly.

Secured Loans:

If you own valuable assets, such as a home or vehicle, you may consider applying for a secured loan. By using your assets as collateral, lenders may be more willing to approve your loan application even if you have bad credit. Keep in mind that if you fail to repay the loan, you risk losing your collateral.

Facing financial complications can be daunting, but understanding the alternatives to installment loans can help you make the best decision for your unique situation. Whether you need money quickly, have a poor credit score, or are simply exploring your options, consider payday loans, personal lines of credit, credit cards, peer-to-peer lending, borrowing from friends or family, and secured loans as potential solutions.

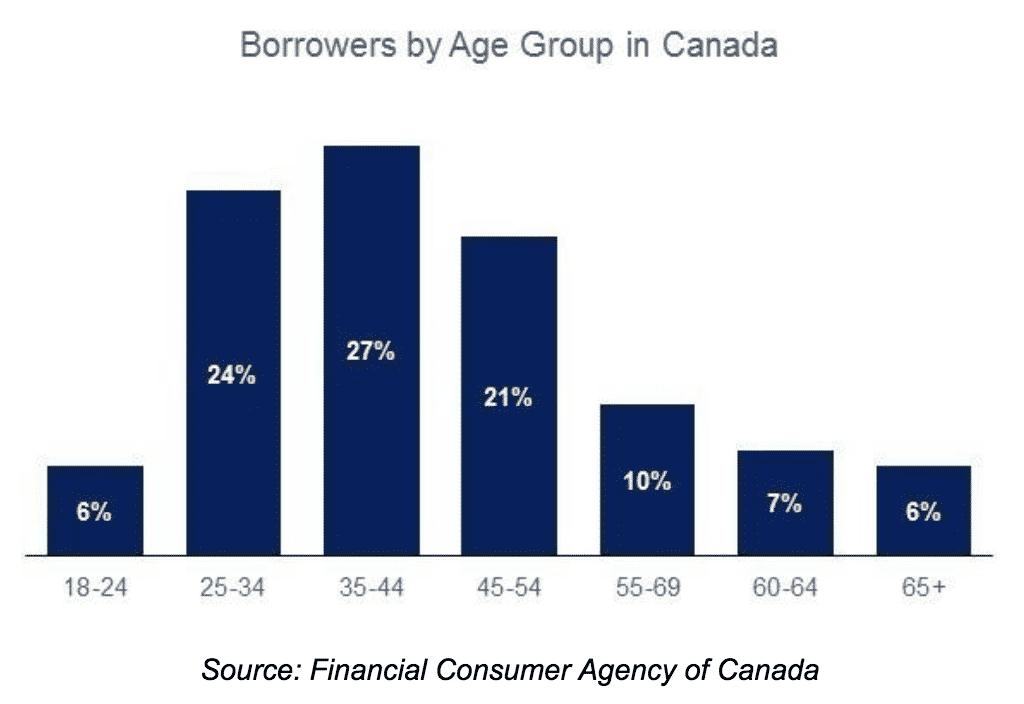

What the Numbers Say

Millennials tend to be the greatest users of “quick-cash†loans such as a payday loan or installment loan. A survey conducted by PwC found that 42% of about 5500 millennial respondents surveyed had taken out one or both of these products at some point in their lives.

The most common purpose that these loans were used for was to pay off student debt. 2 out of 3 respondents had at least one source of outstanding debt while 30% had more than one. Delving deeper into the college educated respondents, the number of people with atleast one source of long-term debt is 81%.

While data for installment loans is not publicly available due to lower regulations in the industry, the following graph shows the breakdown by age of payday loan users. This serves as a reasonable proxy for the installment loan, owing to the similarity in their loan profiles and target market.

Debunking Common Myths about Installment Loans

Installment loans have become a popular financial solution for many individuals seeking funds to cover unexpected expenses or consolidate debts. However, there are several myths and misconceptions surrounding installment loans that can deter potential borrowers from considering this option. Let’s debunk some common myths about installment loans, helping you make an informed decision when seeking financial assistance.

Myth 1: Installment loans are the same as payday loans.

Fact: While both installment loans and payday loans provide borrowers with quick access to funds, they differ in terms of repayment structure. Payday loans typically require a lump-sum repayment on the borrower's next payday, whereas installment loans allow for more flexible repayment terms, with the loan amount divided into smaller, regular payments over a set period.

Myth 2: You need perfect credit to get an installment loan.

Fact: It is a common misconception that installment loans are only available to individuals with an excellent credit score. In reality, many financial institutions and online lenders offer installment loans for bad credit score or even loans for individuals with no credit history. These lenders often consider factors beyond your credit score when assessing your application, such as your income and employment status.

Myth 3: Installment loans require collateral.

Fact: While some installment loans may require borrowers to offer collateral, this is not always the case. Many installment loans are unsecured, meaning you don't need to provide any collateral to secure the loan. This makes installment loans a more accessible option for individuals who don't own valuable assets or are unwilling to risk losing them.

Myth 4: The application process for installment loans is complicated and time-consuming.

Fact: The process for applying for installment loans, particularly online, can be quite simple and efficient. Many lenders offer user-friendly platforms that allow you to complete the application process in just a few minutes. Additionally, online lenders often provide instant or same-day decisions, meaning you can have the money deposited into your bank accounts shortly after approval.

Myth 5: Installment loans come with hidden charges and high interest rates.

Fact: While some installment loans may have higher interest rates than traditional loans, it's important to shop around and compare offers from different financial institutions. Many reputable lenders are transparent about their fees and interest rates, so it's crucial to read the loan agreement carefully before signing. Also, installment loans may still be a more affordable option compared to other short-term installment loans like payday loans, which often come with significantly higher fees and interest rates.

Myth 6: Taking out an installment loan will hurt your credit score.

Fact: When managed responsibly, installment loans can actually help improve your credit score. By making regular, on-time payments, you demonstrate responsible financial behavior, which can positively impact your credit score over time. However, it's important to keep in mind that failing to make timely payments or defaulting on your loan can have the opposite effect and damage your credit score.

Installment Loans Frequently Asked Questions

What is considered an installment loan?

Any type of loan that involves a lump sum of money that you must repay over a set term is an installment loan. Direct lenders are all examples of installment loan providers. Examples include:

What is the difference between a payday loan and installment loan?

Payday loans are fast, short-term loans where repayment is typically expected on the borrower’s next pay period. Installment loans are more diverse and involve timely repayments over a longer term. An installment loan can involve monthly repayments over a term that can take years. Payday terms are usually between 2 and 4 weeks and will seldom go over one month in Canada.

Can I get an installment loan with bad credit?

Yes, there are plenty of loans for bad credit in Canada. You can even find bad credit long term installment loans on the internet.

When it comes to bad credit installment loans, you will have fewer options for lenders and you will also have to pay higher interest rates than a good credit borrower would. You can also perform a credit check in advance to find out your credit status and see if it will be possible to easily get an installment loan.

Can I get an installment loan in Canada with no credit check?

Yes, it is possible to get no credit check installment loans. For example, someone who is new in the country may not have a credit history yet, and it doesn’t mean they cannot get an installment loan. The terms on the many no credit check installment loans vary widely in Canada. You should take your time to compare these lenders to find the best rate available.

What interest rates should I expect on an installment loan?

Installment loans come with as wide a range of rates as any other kind of loan. The rates you get will depend on your credit score and the type of lender you go to.

Installment loans are harder to get from a financial institution like a bank or at credit bureaus, but they may offer rates of under 4% to the most qualified borrowers. Bank installment loan rates typically range from 4%-7%.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice