Understanding Loan to Value LTV in Private Mortgages

When discussing private mortgages, one of the key terms that often arises is Loan to Value LTV. The Loan-to-Value ratio plays a pivotal role in the private mortgage sector, influencing the terms and conditions of private mortgage loans significantly.

What is Loan-to-Value (LTV)?

The Loan-to-Value (LTV) ratio is a lending risk assessment that private mortgage lenders, as well as regular mortgage lenders, use when assessing a mortgage application. Essentially, LTV represents the amount of the private mortgage compared to the appraised value of the property. The LTV ratio is crucial as it helps private mortgage lenders to quantify the risk associated with the private mortgage loan.

The Importance of LTV in Private Mortgages

A borrower's credit score and the property's LTV are two of the most critical factors that private mortgage lenders consider when deciding on private mortgage loan approval. If you have a high LTV (for example, 80% or more), it indicates that the private lender's mortgage loan covers a significant portion of the property's value. This scenario is generally riskier for the private mortgage lender, and as a consequence, the private mortgage interest rates might be higher.

On the other hand, a lower LTV ratio (for instance, less than 80%) typically means that the mortgage lender is exposed to lower risk. Therefore, private mortgage lenders may offer more favorable private mortgage terms, such as a lower interest rate, to borrowers with a low LTV.

How LTV Impacts Private Mortgage Terms

Understanding LTV is vital for both private mortgage lenders and borrowers. The LTV ratio can influence various terms of a private mortgage loan, including the private mortgage interest rate and approval decision.

For instance, a borrower with a bad credit score may still secure a private mortgage loan with the right LTV. Here, private mortgage lenders may be more inclined to take on the risk as the lower LTV offers some degree of security. Therefore, LTV plays an instrumental role in balancing the risk between the borrower's credit profile and the private lender's willingness to approve the loan.

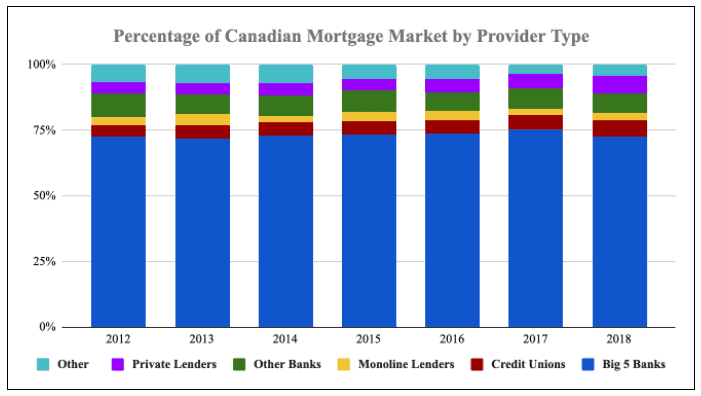

Moreover, it's crucial to remember that private mortgage lenders vs. regular mortgage lenders may assess LTV differently. While traditional lenders often adhere to strict LTV caps due to regulatory requirements, private mortgage lenders may offer more flexibility. However, these flexible terms often come with higher interest rates to compensate for the increased risk.

Navigating LTV with a Mortgage Broker

Whether you are dealing with private mortgage lenders or a regular mortgage lender, an experienced mortgage broker can be a great asset. They can help you navigate the complexities of LTV, explore various private mortgage solutions, and negotiate better terms based on your personal circumstances.

LTV is a fundamental aspect of the private mortgage sector that borrowers should thoroughly understand before applying for a loan. A proper comprehension of LTV can greatly assist in aligning your mortgage needs with the right private mortgage lender, making the private mortgage borrowing process a smoother and more beneficial journey.