Frequently Asked Questions About Loans For Immigrants and Newcomers In Canada

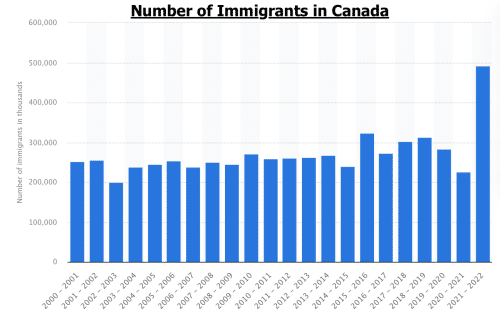

Are there affordable loans for immigrants in Canada?

Yes; as an immigrant you may be eligible for financial assistance, including loans designed specifically to cater to the needs of newcomers. Some of these programs are offered by the government; these focus on affordable loans for low income immigrants. Other products are available from other financial institutions, like the big banks, or charities like Windmill Microlending.

Where can I get a loan as an immigrant?

Depending on what you need the loan for, you can get one from the government, a charity, or a mainstream or online financial institution.

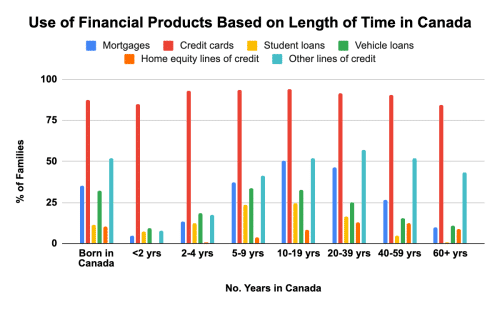

Can newcomers get a credit card in Canada?

Yes; most of the big banks have special 'newcomer' programs for new immigrants, and many of these include a credit card. Some even have limited time offers that include cash-back or no-fee cards. You usually need one or more chequing accounts with the bank in question to qualify, and it's vital you understand how you will be charged interest on every purchase made with the card. You must also remember to make your regular payments on the card, to protect your Canadian credit profile.

Are there loans for immigrants to help with career development once in Canada?

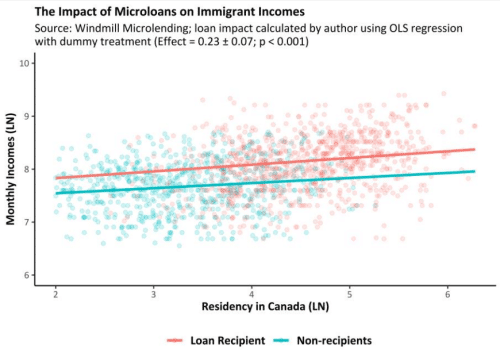

Yes; financial assistance is available from Windmill Microlending, a charity that specializes in helping skilled immigrants achieve career success in their new country. These loans charge interest and to qualify you must meet certain eligibility criteria; the intent is to fund career development and job-related needs, such as qualification assessment, education, licensing, and so on.

Can newcomers qualify for affordable loans to buy property once in Canada?

Yes; for many, buying a new home is an important step in settling into a new place. But approval for a standard mortgage requires a Canadian credit profile and a good credit score - and almost no one has the finances to cover the entire purchase price of a new home on their own.

Thankfully, mortgage options exist that can help fund your dream of home ownership, regardless of how long you've been in Canada. Take a look at the newcomer mortgage options provided by the likes of TD, Scotiabank, RBC and CIBC for more information.

Does the government provide financial assistance to skilled immigrants?

No, not specifically; the government's loan program is called the Immigration Loans Program (ILP) and focuses on affordable loans for refugees and immigrants who need cash to cover certain basics, like transport, healthcare and settling in.

However, Windmill Microlending is a charity that operates throughout Canada to help further career success by providing loans to cover schooling, qualification, coaching, and so on, to help advance the careers of newcomers to ensure they succeed.

Can I get a loan without PR in Canada?

Yes; while some loans require PR, many only require proof of residency in order to be eligible for approval. Newcomers therefore have plenty of options; and as long as you don't miss a payment, a loan will help you build your credit profile.