Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

If you need to transfer money quickly, MoneyGram may just be the right choice for you. As a global leader in international person-to-person and digital money transfers, MoneyGram is trusted by millions of people all over the world. Their reputable service is available in two hundred countries around the globe.

Send money anytime, from anywhere with confidence. MoneyGram lets you access money when and where you need it, through a trusted network of accounts around the world. Customers who need to send money to countries with emerging economies or where access to bank accounts may be limited should find that MoneyGram is not only right for their needs, but also a quick and secure way to transfer money.

With over seventy years of experience and a global network that makes them the second largest money transfer provider in the world, MoneyGram is well-known for their fast, reliable service. They endeavour to provide:

A MoneyGram personal account gives you the ability to do more than just reliably send money to family and friends. Whether it is on-line, in the app or in one of the in-person locations, access money when and where you need it to pay bills, purchase money orders and in some locations, cash cheques.

There are many ways that your money transfer may be paid to the recipient. Money can be received as cash at a MoneyGram agent location or into a bank account. In some countries, the options include directly onto a debit card or mobile wallet, or in some cases, even delivered to the receiver’s home.

MoneyGram is trusted by many businesses around the world to help with their banking and billing needs. By outsourcing some of your business operations, you can meet your customer needs with less effort, and that can translate into saving money. Free up your time and resources with MoneyGram’s cheque processing program, expedited payment solutions and real-time payment notifications.

Signing up for a MoneyGram account is free, as is receiving a transfer from another party.

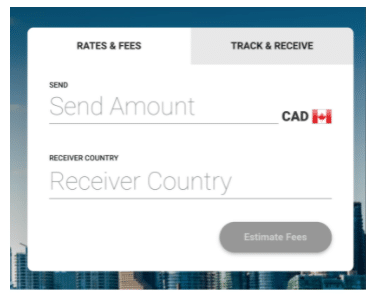

The rates and fees of sending money with MoneyGram will vary depending on many factors. These include where you are sending the money to, the type of payment, and the amount being sent. You will also incur an additional fee if the currency needs to be exchanged. MoneyGram sets a variable rate above the mid-market exchange rate. You can use the MoneyGram pricing calculator that is available on their website to estimate your fees before sending.

The fee associated with paying bills using your MoneyGram account are dependent on the company you are paying and how much the payment is for. It usually ranges from $1.99 to $12.99.

MoneyGram is a fast, convenient, reliable money transfer service. Once you have registered for an account, it is a simple process. You select a receiver, how much money you would like to send and how you would like them to receive the transfer. You can choose to have them pick up cash from a kiosk or send the money directly to their bank account or digital wallet.

MoneyGram can be used for more than just sending money transfers. Customers can make bill payments to nearly 13,000 billers, get real-time notifications, manage transactions and load pre-paid cards. Businesses can connect with customers, employees and vendors through a digital platform that lets you and your customers receive funds or make payments right through your own website.

MoneyGram strives to lead the Global Funds Transfer industry in protecting their clients against fraud. They are a well-established company that has completed millions of transactions and are committed to keeping your money safe. They are regulated and authorized in every country that they operate in. MoneyGram takes compliance very seriously. They also provide their customers with fraud-prevention education, which you can find here.

The processing time for a money transfer can vary depending on your location, the recipient’s location, and which method of transfer you choose. In-person transfers can most often be received in as little as ten minutes, which is a significantly faster processing time than can be provided by other services using bank to bank technology. Online processes are usually completed withing a few hours. Every transaction is entirely traceable on the MoneyGram app or website, so you will always know exactly where your money is.