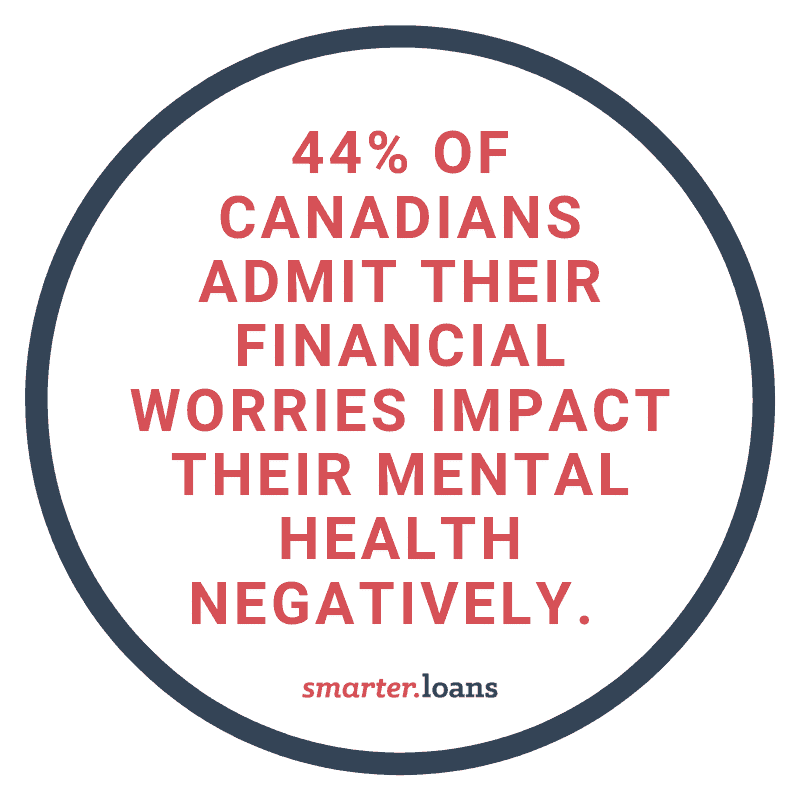

When it comes to debt, you can always hear different opinions. Some financial experts are strong supporters of the zero-debt life, Dave Ramsey or Mark Cuban, whereas others suggest taking a hybrid approach, i.e. pay off debt while investing. If you have debt, it is quite likely that you have somewhat similar thoughts, and it could be daunting to choose between them. Here’s a short exercise that can help you choose the most suitable option.