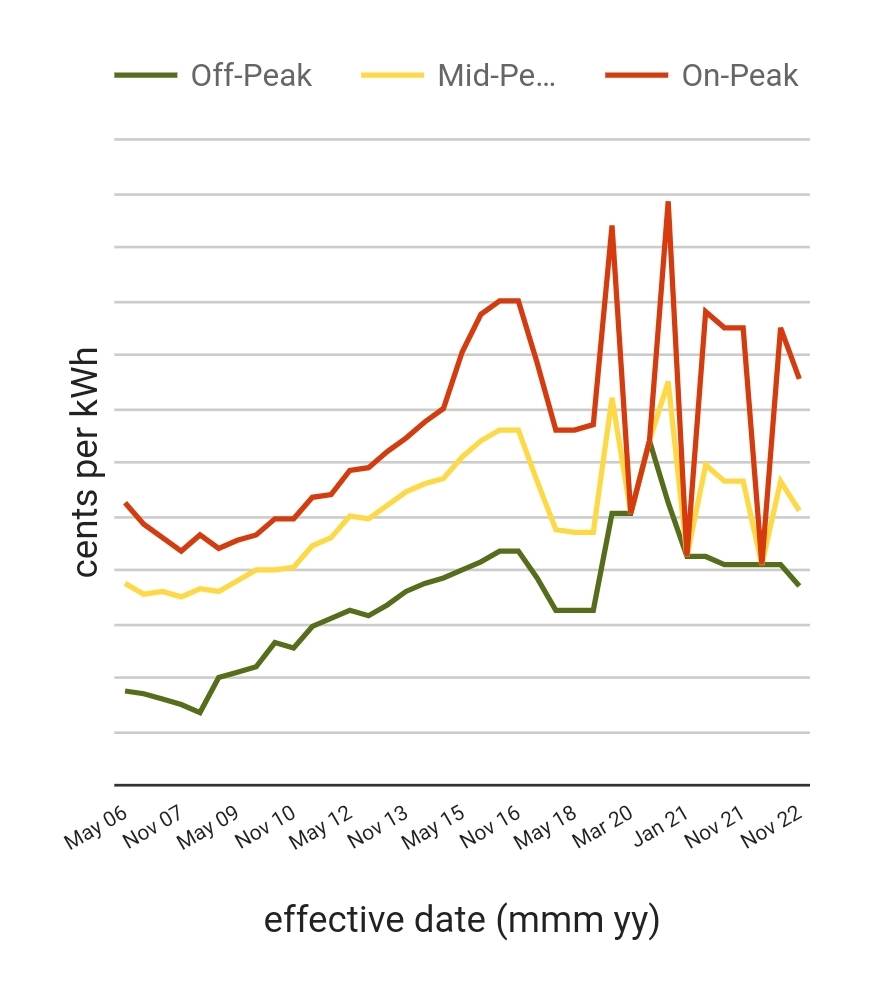

The Ontario Energy Board charts the price of residential hydro. It shows some recent temporary drops due to COVID-19 pandemic relief, but all lines are still trending up overall.

A recent report compiled by the Royal Bank of Canada suggests hydro rates in most parts of Canada could increase by another 30 per cent.

For even more energy savings, or the chance to make your home at least partially energy self-sufficient, there’s the option (available sunshine permitting) of installing a solar array on your roof.

In northern climates where temperatures stay quite low, geothermal heating is an option.

Other options include installing a battery to charge in the wee hours of the night when the time of use hydro rates are lowest and then dispursing the stored energy to power your home during the day when rates are much higher.

But all of these options will likely run well above the $50,000 or so total on offer from the three federal programs.

That’s where financing, such as a green-tailored home equity line of credit (HELOC) may help. Here are the links for BC, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, PEI, Newfoundland and Yukon to further learn about freeing up your home equity to be able to participate in the Greener Homes grants programs available in your province or territory.

Take a look at this How HELOC Loans Work page if you would like more information about Home Equity Loans. Another viable solution might be a mortgage, learn more about Mortgage vs HELOC when each one is best used to free up equity in your home.

A full energy retrofit with power storage, a solar array installation or both could run beyond $100,000 or even more.

With a HELOC for a green energy retrofit, you can repay what you owe on your terms, at a rate that is typically lower than many other forms of credit.

In Sept. 2023, major banks are offering lines of credit with interest rates in the eight per cent range.

But when considering whether to upgrade your home’s green factor, you need to also consider the long-term savings in the form of lower energy bills.

Recent studies peg the net energy cost savings of even a smaller, more basic (no solar panels, no batteries) home retrofit at anywhere between 30 and 78 per cent.

Even at the low estimate of 30 per cent, this could mean about $41 per month in savings for the average Ontario residential consumer of electricity and natural gas.