Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

It is finally happening. Peugeot S.A. (Groupe PSA) and Fiat Chrysler Automobiles N.V. (FCA) are moving forward to merge their business operations.

A statement on PSA’s website revealed that shareholders of respective companies held separate meetings on Monday and resolved to create a new company called Stellantis. The statement further divulged that over 99% of the investors supported the transaction.

The new company’s Articles of Association show that the transaction is a 50/50 merger. Carlos Tavares, the current Groupe PSA Chief Executive, will assume the same role at Stellantis. At the same time, FCA’s reigning CEO Mike Manley will be the top-ranking Stellantis official in North America.

According to initial reports, the two companies wanted to close the merger on February 2, 2021. However, disruptions in the auto industry wrought by the Covid-19 pandemic and the onslaught of electric vehicles forced the companies to push the timeline up to January 16, 2021.

Auto sales in 2019 sputtered in many regions, piling pressure on struggling automakers. For example, U.S. auto sales fell by 10.9% to 4.7 million units compared to 2018’s 5.3 million units. Vehicle sales in Canada also fell, although not as bad as the U.S. Overall, Canadian vehicle sales came in at 1,914,357 units for full-year 2019, a 3.6% decline.

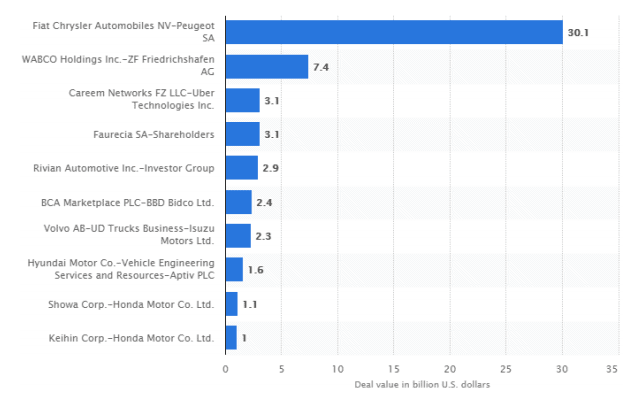

Interestingly, this is the same year that FCA and PSA first made public their intention to merge. The deal was anticipated to be worth $30.1 billion (C$38.18 billion), putting it in contention for the deal of the century. For 2019, the FCA-PSA merger topped the list of auto industry M&A deals by value. Others were WABCO Holdings Inc. – Z.F. Friedrichshafen AG, Careem Networks FZ LLC – Uber Technologies Inc., and Faurecia S.A. – Shareholders.

Size of M&A deals in global auto industry in 2019 (in billion U.S. dollars)

After the merger deal closes on January 16, Stellantis will take the fourth position on the list of the world’s largest automakers. To put the merger’s size in perspective, just two deals in the global auto industry M&A history come ahead of the FCA-PSA deal. They are DaimlerChrysler and Schaeffler-Continental.

The largest auto industry deals in history

Before announcing the merger, both FCA and PSA’s stocks were tail-spinning towards the bottom. The Covid-19 crisis was not kind on the stocks, with PSA (which trades on Borsa Italiana, BIT) sinking to €10.09 (C$15.70), an all-time low, while FCA (which trades on the NYSE) bottomed out at $6.71 (C$8.51), a three-year low.

From this perspective, the merger was necessary. To a large extent, the companies will complement each other well. Fiat Chrysler has a wider presence in Europe and North America, while Europe is PSA’s primary market. While FCA has little venturing into the electric vehicle sector, PSA is among the leading E.V. automakers in Europe.

With EVs expected to go mainstream in 2030, PSA sounds like the perfect insurance policy for Stellantis. Meanwhile, FCA has a substantial presence in the US SUV market. Considering the growing popularity of this vehicle category, especially in the U.S., where FCA is the fourth-largest automaker, Stellantis will not miss out on the boom. In short, the crystal ball predicts success for Stellantis.