Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

Banking shouldn’t be stressful. At EQ Bank, you can save more of your money. EQ Bank provides Canadians with a digital banking experience. Earn up to 30 times more interest than with a traditional bank.

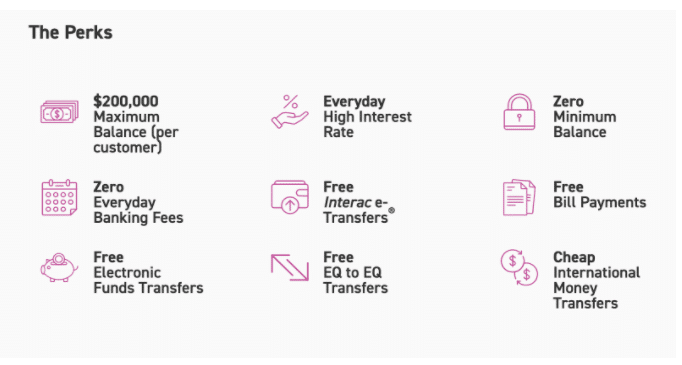

With this high-interest savings account, you can earn up to 1.25%* interest on every dollar. You pay no monthly or everyday banking fees and can hold a balance of up to $200,000. Other perks include free Interac e-Transfers®, free bill payments, and cheap international money transfers.

A TFSA is a registered investment or savings account that lets you earn money tax-free. Whether you are planning for retirement or just putting money aside for emergency use, a tax-free savings account can help you get closer to your life goals. Earn up to 1.25% on your money and keep it all, while paying no penalties or taxes for accessing your deposits. EQ Bank offers the ability to pair your TFSA with your Savings Plus Account or any other external bank account for a simple way to set up one time or recurring deposits. To open a TFSA with EQ Bank, you first need to open a Savings Plus Account. After you have successfully opened a Savings Plus Account, there are easy to follow instructions on their website to open your TFSA.

It’s important to save for your future, and an EQ Bank Retirement Savings Plan may be able to help you reach your goals, faster. The RSP accounts are a no-fee, low-tax option that can grow your retirement funds with as much as a 1.25% interest rate. With an RSP you never pay tax on the interest you earn, and whatever amount you invest is deductible from your yearly taxable income. At tax time, EQ Bank will notify you when your tax slips are ready, and you can then download them as a PDF.

A GIC is designed to help you grow your money faster. With some of the highest rates in the industry, EQ Bank gives you guaranteed high rates, and flexible options for purchasing. Whether you choose to invest in a short-term or long-term GIC, you can be sure you are getting the most out of your money.

At EQ Bank, there are no monthly fees and none of the everyday banking fees associated with most bank accounts. In fact, it’s easier to talk about what EQ Bank does not charge for. Here is a list of some of the things you can do for free with your EQ Savings Plus Account:

Opening a bank account with EQ Bank is simple. Just visit the website at www.eqbank.ca and click on the ‘set up account’ button.

Yes, your money is absolutely safe. EQ Bank is a federally regulated Schedule I bank. They are a member of the CDIC, which protects your deposits into chequing and savings accounts as well as GICs.

In order to facilitate a quick sign-up process, for identity verification purposes, EQ Bank does something called a “soft credit check”. This credit check does not affect your credit score in any way and it is never visible to other third parties who may view your credit report.

EQ Bank has the same great products and interest rates available for everyone. The basic requirements that must be met to open an account with EQ Bank are as follows:

Traditional banks have high overhead costs associated with their operations. As a bank with no branches, EQ Bank is able to save all of those operating costs. They then pass on those savings to their customers in the form of some of the highest interest rates available in Canada.