Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

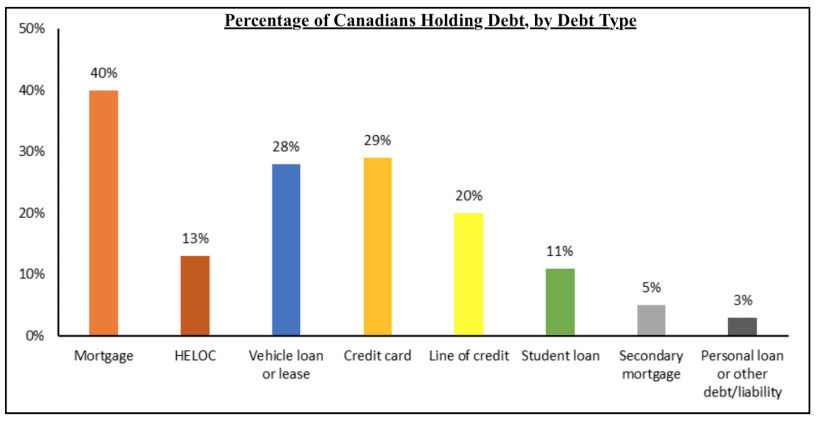

Nearly two thirds of Canadians hold some form of debt, and these financial burdens can quickly become overwhelming unless you make your money work harder – and smarter. Given the prevalence of debt across the country, one way to achieve this is by choosing smarter loans. Smarter loans are loans that work with you, not against you, to help you achieve your financial and life goals without drowning you in debt.

But choosing the smartest loans for you means understanding your options, the debt landscape in Canada, and how the different factors at play can influence your choices. So let’s do that!

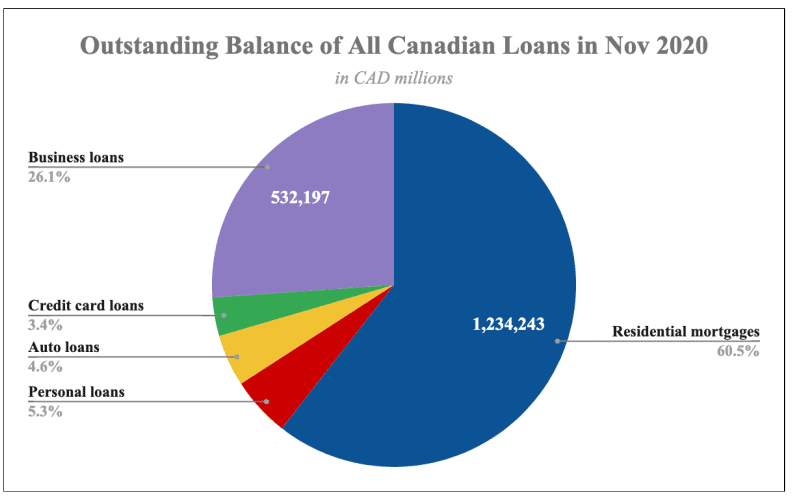

A further 26% of Canadians expect to take out a new loan in 2021.

And all of that debt equals interest, mounting debt payments and a never-ending struggle to get above water.

So now you know just how widespread the debt crisis is in Canada – but what can you do to protect yourself while still getting the financial help you need?

The primary way to protect yourself against bad debt is to choose your loans wisely – a.k.a. get a smarter loan. That may sound trite, but it’s a little more complicated than simply opting for the lowest interest rate you can find.

Your circumstances will inherently affect both your loan choices and what your priorities should be, and only by considering both your needs and the full context of what’s available will you be able to make a smarter loan choice, get yourself out of debt quicker, and bridge the gap towards a brighter financial future.

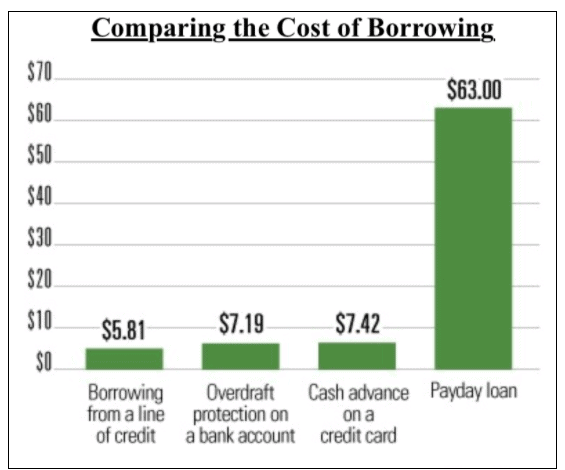

Over 15% of all new personal loans taken out by Canadians are for debt consolidation purposes – meaning people are taking on a new form of debt to pay off older debts with unmanageable terms. This is both inefficient and expensive, and can be avoided if loans are chosen widely from the beginning. But how much difference does choosing the right loan really make? A lot!

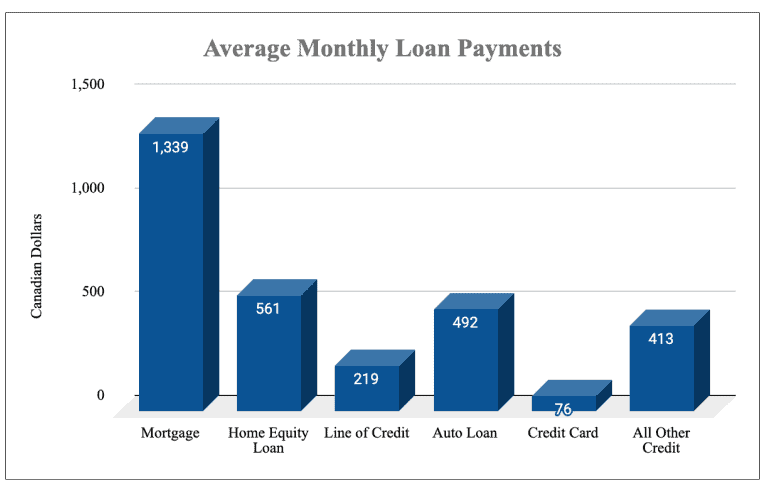

Just consider the difference loan type alone can make to your out-of-pocket expenses.

The chart beside compares the cost of borrowing just $300 over a two week period – not exactly a lot, or for very long. But the difference between getting this money from a line of credit, your overdraft, your credit card and a payday loan is a massive $57.19 – and that’s just on a small amount for a very short period of time!

You’ll never be able to properly compare your options and choose a smarter loan if you don’t understand the way loan companies talk about their products. You should be familiar with all of the following:

There are literally dozens of different types of loan available to Canadians, and because they’re all meant for different purposes, you need to pick the right one for your needs. These loan types include:

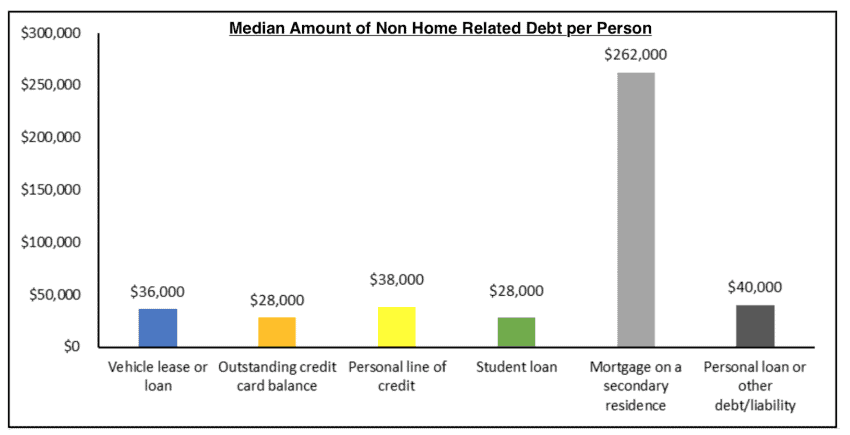

Personal, general loans are loans that are for personal use, but that can be utilized for almost any reason: one off expenses, emergency funds, to pay monthly bills, to aid with cash flow, as a money management mechanism, or to aid with a purchase. There are few restrictions on how these loans can be spent, and they can be either secured or unsecured. The majority of non home-related debt held by everyday Canadians comes in the form of personal loans like this. Popular types of personal loans include:

There also exist loans for personal use, but that are geared towards a specific need – either a purchase or a problem. Two of the most common loans in Canada (mortgages and auto loans) fall into this category. Purpose-specific loans include:

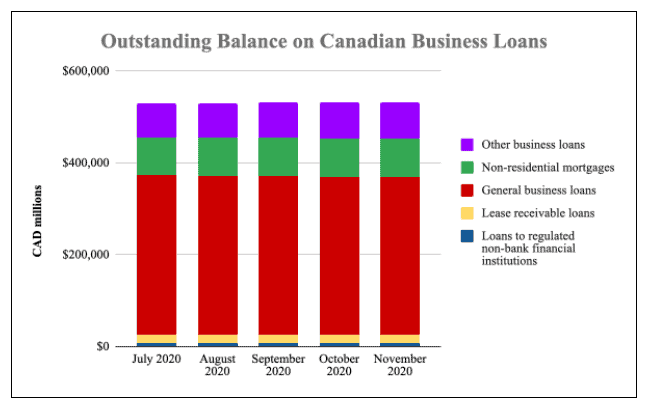

And let’s not forget business debt – which is especially important for small business owners, who may be securing their business through personal means. Business loans have different eligibility requirements than personal loans, but can be used for just as varied reasons. Common types of business loans include:

Next, and again before you even start searching for a smarter loan, you must understand your financial position. This has a big impact on what loan you’ll be able to get. So get a good handle on:

And finally, and perhaps most important when understanding your financial position: what can you afford? Start from your bottom line. Calculate exactly how much you can afford to pay monthly for a loan, including all fees, interest and associated costs, and use this as your benchmark for considering whether or not any individual loan product is appropriate for you.

Now you know how loans work, how to talk to a loan company and understand their terms, what you need from a loan and what you can afford. This means you’re ready to consider your options by comparing lenders and their products. Start by ruling out anyone who won’t lend to you (because of credit or other reasons). Next, rule out any lender that doesn’t offer the type of loan you want. Then finally, compare the lenders that are left for your smartest loan choice.

Tips for Comparing Loans

We’ve talked above about understanding which loan companies will work with you, and which you may want to work with. Let’s dive into that a little deeper:

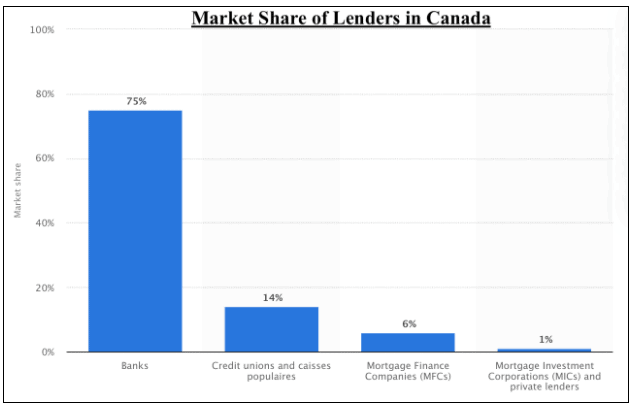

Loan providers come in many shapes and sizes, each with their own benefits, drawbacks and rules, and which all affect whether they will cater to you and whether their loans are right for you. Broadly speaking, they fall into a few major categories:

Banks and credit unions are perhaps the most obvious source of financing, and they cater to the majority of Canadians seeking a loan – especially when the loans are large and long term, as with mortgages. However banks and credit unions have stricter eligibility requirements than other types of lender. They require a minimum credit score of 600, and they have fairly long processing times – sometimes weeks. So they don’t work for those seeking bad credit loans for a quick loan.

Lastly, there exist a fairly new category of lenders: online-only. These are companies who offer, service and manage all of their loan offerings via an online platform, with no brick-and-mortar locations at all. These companies have the advantage of lower overheads, and so can sometimes offer better rates or more flexible terms than more traditional lenders. However there are predatory lenders in this category, so it’s important to always check a company’s reputability before borrowing from them.

There are literally hundreds of financial companies in Canada apart from banks and credit unions, of all sizes and in every conceivable specialty. These include general loan companies, payday lenders, credit card companies, equipment or vehicle specialists (or even dealers, who sometimes offer their own financing), merchants, and financial service providers of all kinds. They can have quite diverse loan terms, depending on the specialty (if any) and the type of borrower they cater to. Comparing these providers can be tough as they vary so much, so remember to check their loan terms, including the possibility of any hidden fees.

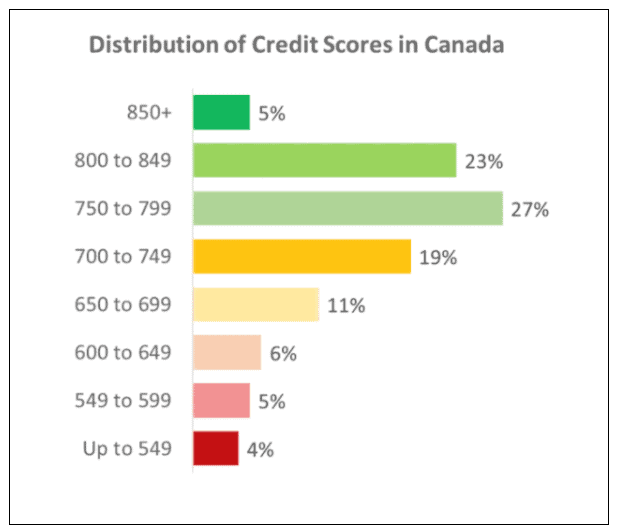

Credit scores are an important part of your financial identity, and help lenders, creditors, businesses and banks assess their willingness to do business with you.

Do you have a good record of paying your debts on time? Have you ever been bankrupt? Have you got a lot of other debts already? Do you have few debts and a solid financial record?

The lower your score, the higher a financial risk you are perceived to be. If you have a score of below 600, you may be considered a credit risk. This means it’s harder to get a loan, and that it becomes more expensive to borrow. This is true even if you have a low score but good income. Conversely, the higher your score, the easier you will find accessing financial products. The average credit score in Canada is 650.

Choosing a smarter loan is just one aspect of ensuring your financial health, but it’s a big one. Debt payments equate to an average of nearly 10% of Canadian household income; so while shaving a few percentage points off of your monthly debt payments may not sound like much, over the course of a year it could save you thousands, as well as allow you to get out of debt faster. Always consider, before taking out any loan: is there a better way to meet this financial need? A smarter loan, or another option entirely? Don’t underestimate the importance of thinking ahead when making your next big financial decision!

Practising good financial habits across your life is important – not just in reaching your life goals, but in securing your financial health, improving your credit score and meeting future obligations. As well as choosing smarter loans, you can:

There are a few steps to improving your credit score:

It takes time to improve your credit, but if you’re diligent it can be done!

Canadians with a credit score below 600 may struggle to get a traditional loan, but there are many companies that cater to medium or bad credit borrowers. Research these companies online to find your best options; just bear in mind that you’ll almost always need to be able to prove your employment income to get a bad credit loan, and you’ll probably have to pay higher interest.

Yes, payday loans are legal everywhere in Canada, though the regulations concerning them and how they work do vary by province. See here for more information.

Absolutely! Smarter Loans is your home for smarter loans! We work with many trusted lenders across Canada and are able to help with a variety of loan types and circumstances. And by pre-applying with us we can help you find the best loan for you.

To get an accurate loan quote you will need to provide personal data such as name, date of birth and address, as well as income information. The loan company will perform a credit check themselves. When applying, you’ll need to provide some supporting documentation.

Yes, absolutely; many lenders – both traditional and online-only – have web-based portals that allow you to submit all of your information and apply for a loan entirely online.

How can Smarter Loans choose the best loan for me?

The experts at Smarter Loans have experience working with people from all walks of life, and with all types of financial need, and by pre-applying for a loan with us we can take your information, assess your circumstances and needs, and use our knowledge to recommend the loan that works best for you specific position.

Yes, although you may find it difficult, and it’ll be almost impossible to get a loan through your bank or credit union. Some bad credit lenders do cater to those with a past bankruptcy or consumer proposal, but you’ll have to be able to prove your income and will likely have to pay high interest.

That depends on the loan provider you go to. Some providers have same-day turnaround, while others (like banks) can take days or even weeks to process a loan application and release funds. Your urgency should be a factor in deciding which loan company is best for you.

Loan companies charge a range of fees; although not every company charges every fee, you should be aware of them all and ask about them. They include: