Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

Canadian consumers can get a credit score to understand their personal credit health. But what about Canadian business owners?

Business credit is much different than personal credit, and there hasn’t been a simple way for entrepreneurs to measure their business credit health. Until now.

Thinking Capital has partnered with Equifax to create the Small Business Grade: a simple letter score that shows you what your business credit health looks like. The Small Business Grade can help Canadian business owners like you discover and improve your business credit health.

Your business credit health reflects how well you are able to meet financial obligations. With good business credit, you can establish strong relationships with the lenders and suppliers you rely on to run your business. The Small Business Grade can empower you to understand, build, and improve your business credit health.

Increase borrowing power with lenders: Building your business credit health will help you qualify for better financing from lenders.

Improve repayment terms with suppliers: Having strong business credit health can help you negotiate flexible repayment terms with your suppliers

Protect your personal credit: Using business credit for business purchases and expenses can help you avoid negative impacts to your personal credit score.

Build long-term business success: By improving your business credit health, you can build a strong reputation with your lenders and suppliers and ensure long-term success for your business

Your Small Business Grade dashboard has been built to give you the right tools, resources, and advice needed to help you build and maintain your business credit health.

Monitoring and alerts: You’ll get alerts for important changes that affect your grade and impact your business credit health

Education and insights: You’ll see the top factors that are impacting your small business Grade, along with tips on how to improve your grade and your business credit health.

Financing offers: Leverage your Small Business Grade and apply for financing to help you manage your business’s cash flow.

Enter a few details about you and your business to receive your Small Business Grade.

Access your dashboard and learn what factors are impacting your business credit health.

Stay updated on how your Small Business Grade is changing, so that you can take necessary actions.

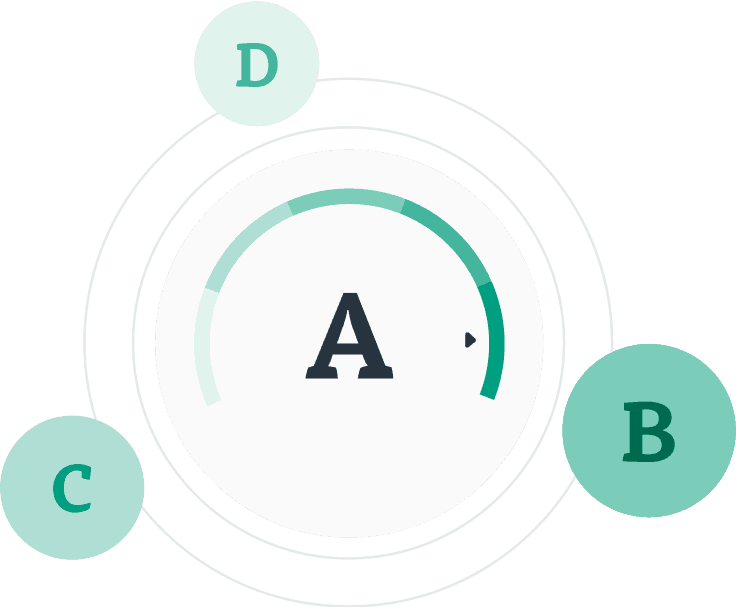

The Small Business Grade is a metric that helps you understand your business credit health. Like grades on a report card, your Small Business Grade appears as a letter score from A to E. The higher your score, the stronger your business credit health is.

Thinking Capital, a leader in the Canadian fintech industry, has reinvented the way small businesses access financing. Since 2006, more than 15,000 Canadian small businesses have turned to Thinking Capital for their business financing needs.

Equifax is a global information solutions company that uses unique data, innovative analytics, technology, and industry expertise to power organizations and individuals around the world by transforming knowledge into insights that help make more informed business and personal decisions.

Accessing your Small Business Grade does not affect your personal or business credit scores. Accessing your Small Business Grade is considered a “soft” credit inquiry, which doesn’t impact your credit scores.

Having good business credit health can help you qualify for business loans, lines of credit, and trade credit from lenders and suppliers. It can also help you secure more favourable repayment terms.

Personal credit demonstrates how reliable you are with your personal finances, and others need your permission to access your personal credit report. Your business credit indicates your business’s ability to pay bills on time, and anyone, including lenders and suppliers, can access your business credit report by paying credit bureaus a fee. Because of this, it’s important to know what your business credit health looks like and how you can improve it.

Verify some information and access your Small Business Grade today!