Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

The exporter is defined as the person responsible for causing the transport of goods out of the country. Often, the exporter is confused with the transportation or distribution company, so it is important to properly identify the identity and responsibilities of each party involved in the export transaction. In Canada, the exporter has to submit a form called the export declaration to an organization called the Canada Border Services Agency (CBSA). The export declaration is submitted at the port of export and encompasses key information about the materials being exported including the nature, number and value of the goods. This information then gets used by customs to control the nation’s exports and compile information about foreign trade.

While Canada is a signatory of the USMCA free trade agreement, there are certain countries that Canada has placed export restrictions on for a variety of reasons. These are called sanctions. Some countries that Canada currently has sanctions on include the following:

It is important to recognize that just because sanctions are imposed on a country, that doesn’t necessarily mean that all exports to that country are banned. There are only restrictions on certain types of goods that can be exported to that country.

In Canada, the top 10 sectors account for 62.6% of total global shipments. As per a document released by the Government of Canada, in 2018, the top 10 exporting sectors were:

While there is no one size fits all strategy that can be followed for exporting, it is important to have a well-defined plan in place when looking at the foreign markets that you want to sell your product in. One proven method is the top-down analysis of the market in question. This starts off with high-level research into the country’s laws for business, interest rate environment, current import restrictions, GDP growth and population growth. All of these determine whether the country is suitable for long-term expansion as the foundation of every good business is a solid backdrop where it can be operated.

Once the initial step is complete, it is worth digging deeper into the microeconomics wherein you find out the appetite in that market for your product and check the number of competitors supplying substitutes of your product there already. This information ultimately serves to ensure that you are not jumping into the water with both feet in, and have a sound rationale for entering said markets.

Whether your company is small or large, the first step to global success is developing an export plan to help you reach your goals. This upcoming webinar will help you understand the steps you need to take to get export ready, how to find markets for your goods and services, and how to develop an actionable plan.

Register to attend or receive an on-demand version you can watch anytime. You’ll learn:

1. How to develop a market entry strategy

2. How to get your product known in a new market

3. What resources are out there to help you develop an export plan

4. How other companies like yours have found success

In sports, playing on home turf is always a psychological advantage as it allows athletes to play in familiar conditions with the home crowd backing them as well. In a similar parallel, operating a business on home territory comes with its own psychological advantages too. However, venturing out into foreign markets is a key step to growth once the home market is saturated. Therefore, while the entrepreneur may not have the same knowledge and expertise of conditions in the markets abroad, there is no excuse for not completing a high degree of quality due diligence to establish that knowledge before initiating operations.

This includes getting to know about the new government’s laws and regulations as well as obtaining references and checks for suppliers, distributors and customers that you will be working with in the new market. All of these help to protect your business by onboarding only trusted partners, and ensure that you are minimizing the risks involved with the export strategy.

To keep your financial situation secure, consider talking to an Export Development Canada (EDC) Trade Advisor. EDC has solutions that can protect you against the risk of not getting paid when doing business beyond our borders and help you get more cash to grow your exporting business.

The biggest beneficiary of exports besides the exporting company of course is the country that the goods and services are being exported from. They help to increase the level of economic growth, employment and balance of payments within the country. Balance of payments is defined as the difference between a country’s total exports and total imports. A positive difference means that the country has exported more than it has imported and leads to a current account surplus. Conversely, a negative difference means the country has imported more than it exported and leads to a current account deficit, which then reduces total GDP.

For this reason, governments are often willing to provide incentives and subsidies to exporters to promote greater exports and support economic development. Some goods in particular will be favoured for export incentives. If this is the case for your business, then it is worth doing research on these incentives from the government prior to exporting, as it would help to reduce the costs involved and enhance the business’s P&L at the end of the year.

Trade finance and the various products involved in it can be a highly useful tool for generating working capital and converting credit sales to cash on accelerated timelines. Some such solutions are export letters of credit, export finance and export loans. The export letter of credit ensures that you are paid on time even if your customers miss or delay payments while export finance helps you manage the risk of having a slower supply chain by providing cash for accounts receivables to revitalize working capital in the business. Finally, the export loans are a sort of bridge financing solution that helps your business finance day-to-day expenses right after shipment and before payment is received from customers.

As we will explore later, one of the main risks of exporting to a new country is the currency exposure. By purchasing raw materials in one currency and selling in another, businesses open themselves up to currency fluctuations which can erode P&Ls. This is particularly true for businesses operating in or exporting to highly volatile currencies, where the bottom-line can be impacted up to 10% or even higher just by currency movements quarter over quarter.

To prevent against this, businesses can hedge themselves using forward contracts, which can be negotiated with the appropriate counterparty. The forward contract is essentially a currency rate that is locked in for both parties for a fixed period of time. This helps the business gain visibility on bottom-line impact, while providing additional comfort from an operating cost perspective.

The most successful export businesses have successfully maintained their appeal over the multiple markets they sell in. Think about Coca-Cola for example. Its brand image across developed markets like the US is similar to its brand image in developing markets such as Brazil and India. This is no accident. Coca-Cola carefully cultivated this through diligent market research and an understanding of local customs, trends and consumer preferences to modify their marketing and advertising accordingly.

When moving to a new market, it is important to develop this understanding of the customer to make sure that they can relate to your product. At a base level, this includes changing the product packaging to the local language, but on a more granular level, this also involves revising marketing and advertising to ensure that there is no room for misunderstandings of the message you intend to purvey.

Trade shows are a great resource for potential exporters to reach their target market and/or attract certain partners that can help them gain a foothold in the markets they intend to expand to. When going to these trade shows, it is important to keep an open ear and talk to people outside of just potential clients. In some cases, there could be a distributor looking for a new client who has a knowledge of the market you will soon be entering. This could be a compelling long-term partnership opportunity for both parties.

Doing business with international counterparties brings an added element of risk that can and should be mitigated. Some of the key risks that exporting businesses today face are:

While economic and financial risks encompass a broad range of scenarios, some of the most common financial risks are customers who refuse to pay or face delinquency. Similarly, there may also be customers who refuse to honour the terms of a stipulated contract. It is much more difficult to claim payments or pursue cases against these customers when based in a foreign country than when based in the same jurisdiction. On a more macro level, currency fluctuations as described above or economic recessions faced by the country where the goods are being exported to represent another headwind for the exporter as exports become more expensive and/or demand slows.

To manage these risks, credit insurance can be purchased, which protects the business from risks including customer bankruptcies, contract cancellations, non-payments etc. Customer and market diversification is also critical to ensure that the loss of one major customer or market does not cripple the business. Finally, a good legal team can help you write stronger, more binding international trade contracts that provides additional protection in court cases.

Social risks arise from business activities that result in a weakening of local and global societies and systems. This can include receiving or offering a bribe, involvement in terrorist financing, labour and human rights malpractices, environmental damages etc. Any and all of these involve significant reputational and brand damage to the business in addition to monetary fines and penalties. In some cases, businesses may not even realize they are involved in corruptive practices until it is too late.

To protect against these risks, it is important for companies to educate their employees on major laws and regulations involved in the countries they do business with. Furthermore, they should also be proactive in teaching their employees to identify signs of corruption or terrorist financing backed by the appropriate escalation procedures when such issues are encountered.

Political risk doesn’t have to be concentrated in just emerging markets. As the U.S. trade negotiations and Brexit have shown, even developed markets can be subject to instability during certain time periods. To protect your business against these short-term instabilities, which can have serious repercussions on financial and operational success, businesses can buy political risk insurance, which helps to protect assets during times of political disruption.

As mentioned above, governments have an interest in maintaining a positive trade surplus which helps to increase their GDP and show positive economic development. To do this, governments impose a range of what are called protectionist policies. As the name implies, protectionism is intended to “protect” the country’s domestic industries from export competition. Some of the key tools used by governments in this endeavour are:

This is defined as a tax on the price of an imported good. For example, if the Canadian government was to place a 20% tariff on a Good X that originally cost $1.00, the new price would now be $1.20. This additional cost that consumers now have to pay is intended to discourage the purchase of imports and instead encourage the consumption of domestic goods, which are priced cheaper in comparison. Tariffs are also a way for governments to increase their revenues, which is then used to provide public services and infrastructure for citizens.

While this doesn’t impose a tax or surcharge on top of the value of the goods, quotas are physical restrictions on the amount of a particular good that can be brought into a country. The direct impact here is that there is a limited outflow of funds from the country as there is a cap on how much can be purchased. The indirect impact is that because of the shortage of that product in the country available from import means, the consumption of domestic goods either rises and/or the price of the imported goods rises, which discourages consumption of the exporter’s goods.

The embargo is an extreme measure which completely prohibits the import of a certain type of good into the country.

Subsidies are incentives provided to producers of a certain good, which helps them lower their costs of production. When these costs are lowered, the producers can then sell their goods for cheaper in the domestic markets, which once again discourages the consumption of foreign goods.

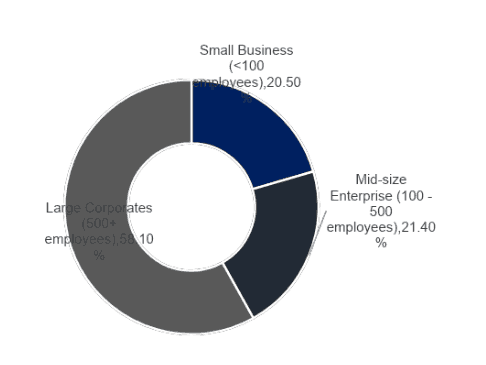

Small and mid-sized enterprises (SMEs) contribute significantly to Canada’s exports. In 2017, the government reported that small and mid-sized business with less than 500 employees were accountable for approximately 42% of total exports as evidenced by the diagram above.

In terms of export destinations, the U.S. and China are the main trading partners as of 2017. All figures are noted in billions.

This article was intended to answer the preliminary questions about how to start an export business. We have highlighted some of the key risks and pitfalls that are faced which should hopefully help you in the process of creating the best export business in Canada! However, setting up such a business is a highly nuanced process that requires tremendous perseverance, patience, and attention to detail. Good luck to all entrepreneurs out there, and feel free to use the resources available on this site!

From Corporate Communications Specialist to your favourite Storyteller, Jenna West has built up a list of published work on various global recognized websites like RE/MAX Canada, Freeman Audio Visual Canada and now carries the title of Freelance Content Manager for Smarter Loans. Jenna adds creative value and fresh perspectives on all things finance, especially pertaining to millennials, and has a natural knack for turning a page full of words into a visual reading experience that influences decisions and persuades action.

.