Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

As one of Canada’s largest and oldest banks, BMO is a trusted partner in over 12 million customer’s lives – helping with everything from basic day-to-day financial needs to more customized wealth management solutions. And as nearly 10% of the population has an income of over $100,000 a year, the demand for reputable high-end products and services has never been greater.

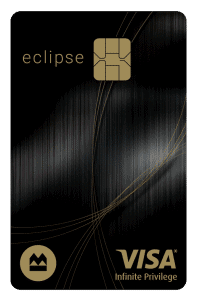

To better serve this portion of the country, BMO is launching a new premium credit card aimed at those seeking to make the most of their hard-earned income. The BMO Eclipse Infinite Privilege Card* is a new and exciting departure from other BMO products, so let’s take a closer look at it.

The BMO Eclipse Infinite Privilege Card is a Visa credit card; this in itself is noteworthy, as BMO has historically been a Mastercard issuer only. But with this new card, the bank is offering a premium Visa to its customers who are hoping to cash in on generous rewards and bonuses.

Holders of the BMO Eclipse Infinite Privilege Card therefore not only have a useful, versatile credit card for day-to-day use, but gain access to privileges not available elsewhere – and all while earning BMO Rewards points on every dollar spent.

As the BMO Eclipse Infinite Privilege Card is a premium card specifically designed for high net worth individuals, there are some qualification criteria. To be eligible for the card, applicants must have an individual annual income of at least $150,000, or a household annual income of at least $200,000. This narrows down the applicant pool to the top 2% of the population’s earners – which is how BMO is able to offer such exclusive benefits to its cardholders.

As mentioned above, there are a range of generous rewards that come as standard with the BMO Eclipse Infinite Privilege Card. This includes:

Cardholders earn 5X points on all dining, gas, travel, drugstore and grocery purchases, and 1X rewards on everything else. These points compound by 25% if you add another authorized user to the card. These points can then be spent however you wish: on travel experiences, on merchandise, to receive cash back, or to pay for items on your credit card bill. Because the points collect automatically, and the most basic day-to-day expenses earn the most points, cardholders find their rewards balance quickly escalating, with no effort at all!

Ownership of the BMO Eclipse Infinite Privilege Card grants access to the Visa Infinite Privilege Concierge, a personal assistant service that can help you with anything from getting groceries to celebrating special occasions in style. This is an invaluable bonus for busy professionals, as it is a 24/7 service that you can rely on for both the most mundane or the most bespoke requests.

Holders of the BMO Eclipse Infinite Privilege Card also gain access to Visa’s other Infinite programs, including their Dining Series and Wine Country plan. This means that you can get multi-course meals with appropriate wine pairings delivered straight to your home. You can also attend events at some of the best restaurants and wineries in the country, and experience complimentary wine tastings at select vineyards across North America.

Priority Pass membership is a must for those who travel frequently – whether for business or pleasure – and it comes as standard with the BMO Eclipse Infinite Privilege Card. This membership includes six visits per year for you or your guests to any participating airport lounge, as well as access to over 1300 airport experiences worldwide. Travel never felt so luxurious!

As well as the features highlighted above, the BMO Eclipse Infinite Privilege Card also has:

The BMO Eclipse Infinite Privilege Card has an annual fee of $499 – about average for premium cards of this nature. Some “platinum” cards have lower fees than this, but offer far fewer rewards, and some have higher annual fees and are much harder to get. For example, the Amex Centurion Card costs $2500 a year (as well as a sign on fee of $7500)!

As with most truly premium cards, the BMO Eclipse Infinite Privilege Card has a minimum income requirement for its applicants; this threshold sits at $150,000 annually, so narrows down the field of potential cardholders to just the top 2% of earners in the country. This places the BMO Eclipse Infinite Privilege Card as the most exclusive non-invitation credit card in Canada (as the Amex Centurion Card requires an invitation).

The BMO Eclipse Infinite Privilege Card has an interest rate of 20.99% on purchases, and 23.99% on cash advances. The average for this sort of card is around 19.99% for purchases, though the Amex Centurion Card boasts a much higher rate of 30%.

The BMO Eclipse Infinite Privilege Card has an annual fee of $499, and interest rates of 20.99% on purchases, and 23.99% on cash advances.

If you earn more than $150,000 a year, or have a household income of over $200,000 a year, you are eligible to apply for the BMO Eclipse Infinite Privilege Card.

The card’s generous rewards program will get a shot in the arm if you apply for the BMO Eclipse Infinite Privilege Card between October 19th 2020 and October 31 2021. Doing so qualifies you for the Welcome Offer of 35,000 BMO Rewards points, and then all you have to do is spend a minimum of $5000 within the first three months of the account being open. And if you keep your account in good standing, you’ll get another 15,000 points on the first anniversary of the account.

The BMO Eclipse Infinite Privilege Card offers 5X rewards on the first $100,000 per year spent on groceries, transit, travel, drugstore purchases, dining and gas. After this initial $100,000, rewards on these purchases falls to 1X. There is no limit on the number of points that can be collected.

“Pay with Points” is a system that allows you to log onto your BMO account online, browse recent transactions, and choose an eligible transaction to redeem your rewards points against. In this way it is like cash back, but immediate! You can redeem against purchases as small as $1 – so you can use your points to pay for your morning coffee – or against large costs, such as airfare.

Holders of the BMO Eclipse Infinite Privilege Card have access to exclusive travel privileges, including: Priority Pass membership, six airport lounge visits per year for you or your guests, Priority Security Lane, airport parking, and valet service discounts at select Canadian airports, 5X rewards points on travel purchases, and access to Visa’s Infinite programs, which include access to exclusive resorts, events and discounts.

The Visa Infinite Privilege Concierge is a form of 24/7 personal assistant service that comes with your BMO Eclipse Infinite Privilege Card. This service lets you have direct and immediate access to a customer service specialist who can help you with everything from making dinner reservations to assisting with travel difficulties.

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada’s highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the “GPS of Fintech Lending” by the Toronto Star.

BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information.