Installment Loans on the Rise as Payday Loan Rules Tighten

In early May, Toronto was the latest of a host of municipalities to crack down on payday lenders. They imposed bylaws to restrict business activities by limiting the number of physical locations and requiring operators to be licensed. Meanwhile, the Ontario government had already decreased the cost of a payday loan from $21 to $15 this year.

How Rifco’s New Online Brand, Splash Auto, Is Turning the Auto Financing Process Upside-down

Rather than waiting until the end of the transaction to know where their credit stands, Canadians can now secure financing online before walking into a dealership. That is because Rifco—the same company that has been offering Canadians non-prime auto financing since 2002—now has a new online brand, Splash Auto, that can answer all of their auto financing questions before leaving home.

How to Get a Business Loan for a Restaurant or Bar

Anyone who aspires to open a restaurant or bar is in good company for sure. Worldwide, there are approximately 15 million thriving restaurants that rake in hundreds of billions of dollars annually. By some investment company accounts, bars and taverns in the U.S. alone grabbed $24 billion in 2015. This article points entrepreneurs in the right direction toward their own success.

How the Canadian Lenders Association is Elevating the Industry From ‘Alternative’ to ‘Innovative’

Little over a year ago, there was no leading voice in the “alternative” lending space in Canada; no industry association to advocate on its behalf or network to help establish and spread best practices. Fortunately, those resources are now available to the industry through the Canadian Lenders Association (CLA), an industry association dedicated…

How Merchant Advance Capital is Doubling Down On Its Commitment to Canadian Businesses

As businesses grow from startups to success stories they often look to new markets where they can expand their operations. After eight years building a reputation as a reliable and friendly business lender in Canada, however, Merchant Advance Capital is instead growing the suite of products and services it offers its existing client base in the Great White North.

How Fetch Auto Brings Dealership-Level Services to Private Online Auto Sales

Private car sales often had to take place through unverified ads on online public forums; there was no financial assistance of any kind, nor any inspection of the vehicle by a licensed professional, and certainly no way to guarantee the safety and security of either buyer or seller.

Former Bank Executives Launch Lendified.com To Fill Canada’s Small Business Lending Gap

Rather than spending countless hours preparing applications and business plans only to wait weeks or even months to find out if they qualify for a bank loan, small businesses across Canada are now able to visit Lendified.com and get funded in as fast as 48 hours.

OnDeck’s Success Story in Serving Small Businesses

One of the pioneers in Canada’s fintech lending space, OnDeck fills the financing gap to small businesses such as local hairdressers, restaurants and mom and pop shops – often underserved by the major banks.

Alternative Lender Company Capital Recognizes “Stuff Happens” To Every Small Business

Unexpected stuff happens to every small businesses. It can be an unplanned opportunity or an unexpected emergency.

And for alternative lender Company Capital, those are the stories they hear regularly from potential borrowers. One of the nation’s most successful fintech lenders, providing short-term loans to small businesses, its ability to scratch below the surface of a computer algorithm to understand its customers is what sets it apart.

Making the Holidays Magical

The holiday season creates pressure to spend—but many people find themselves short of cash. Either way, the children still need their prezzies and people still want to make the holidays a special time for their families. With flexible short term loans, Magical Credit gives Canadians a better financial option to get through the spending-heavy holiday season.

Truck Loans: Comparing the Merits of Fixed Versus Variable Rates

Vehicle loans are the one of the most common forms of financing. Terms may be as short as a couple of years or last for as long as six years. One of the decisions the buyer must make has to do with the type of interest rate. While a fixed rate installment loan is more well-known, it’s possible to secure a truck loan with a variable interest rate.

What is a Home Equity Line of Credit?

Home ownership comes with a list of benefits which includes access to a home equity line of credit (also known as a HELOC).

What is an Unsecured Business Loan?

Few banks offer unsecured business loans, especially to start-up companies or those with bad credit. However, there are ways to get unsecured loans from other sources as well, eliminating the need to put personal or business property at risk.

Cashco Financial Offers Canadians a Better Alternative to Payday Loans

Cashco now offers customers installment or “flex” loans from $500 to $7,000 for a term of up to 60 months to help them make ends meet without having to turn to a payday loan provider.

How do Boat Loans Work?

Boat loans provide the funds needed to purchase a new or used boat for water activities like fishing, water skiing, sailing, and sometimes, living.

Magical Credit’s New Product Helps High Risk Borrowers Build Back Their Credit

Magical Credit, the short term lender known for helping its customers get out of the payday loan cycle through manageable low monthly payments, has added a new product to its offering for those farthest in the deep-end.

What is a Title Loan?

Title loans let individuals get cash in exchange for the lender holding title to the vehicle until it is repaid. And the cost for these loans is many times over the cost of the average installment loan.

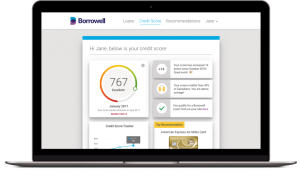

Borrowell is Commited to Helping Canadians Improve Their Credit Health

Borrowell is a fintech startup based in Toronto that uses technology to make financial services fast, fair and friendly. Along with offering Canadians access to their credit scores for free, Borrowell believes Canadians deserve more choice and more transparency when it comes to their personal finances.

Home Loans for Veterans

Veteran home loans come with distinct advantages for men and women who serve, or have served, in the military. These loans are also available for reservists, active duty service members, and National Guard members.

Peer-to-Peer Lending Has Finally Arrived in Canada

After providing small businesses with impossibly low lending rates while bringing high returns to everyday investors in places like China, the United States and the UK, peer-to-peer lending has finally made its way to Canada.

How Equipment Loans Work

Learn all you need to know about getting equipment financing in Canada. Pros and cons, how the process works and where to get fast equipment financing.

Company Capital’s Midas Touch is its Personal Touch

Easy application and turnaround time of 24 to 48 hours means Canadian small business owners can have money in their hands sooner and easier than ever

How to Get an Emergency Loan

Each day, thousands of people suddenly face a financial crisis that forces them to look for emergency loans. It is very stressful to get broadsided by a serious situation in which money is needed immediately but no ready cash is available.

Business Loans for Minorities

Finding Minority Business Loans in Canada Canada is a country known for its diverse population and multiple cultures. This has a positive impact on the country when it comes to living, entertainment, education, and business. Minority owned-businesses are widely accepted and welcomed in Canada. Because of this, the government offers several ways to assist minority…

Installment Loans Explained by Magical Credit

More and more Canadians are turning to installment loans as high-interest payday loans continue to build a bad rap in the alternative financing world. In this feature, Magical Credit explains installment loans, a better alternative to the familiar payday loan.