Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

If you have taken a mortgage loan, there is a chance you have used an escrow account.

Although escrow accounts are not exclusive to real estate, they are commonly used when buying a home. Knowing what an escrow account is and how it works can simply your home acquisition process.

When using a mortgage to purchase a home, lenders may require borrowers to use an escrow account in the transaction. The account acts as a holding account for funds, and it can be used in two main ways.

An escrow account can be a holding account in a real estate transaction that is managed by a trusted third party. Funds and documents related to the home acquisition are held in the account until both parties in the transactions fulfill their part in the contract, or when the transaction is complete.

An escrow account can also be used as a savings accounts to collect a portion of monthly mortgage payments. The funds are used to meet insurance and tax bills for the year. By collecting a portion of these costs, the escrow account ensures that the homeowner does not miss out on their obligations to the insurance provider or government authority.

If you are buying a home, your lender may require you to open an escrow account as part of the homeownership process.

The two main types of escrow accounts that you may be required to open include:

When buying a home, the buyer will be required to make a deposit, typically known as earnest money, to the seller’s account. This deposit acts as a commitment by the buyer to the seller, indicating their interest in purchasing the house. The deposit is usually calculated as a percentage of the down payment agreed upon between the parties. However, sometimes it can be risky to pay the deposit directly to the seller, since they may accept higher offers for the property on sale.

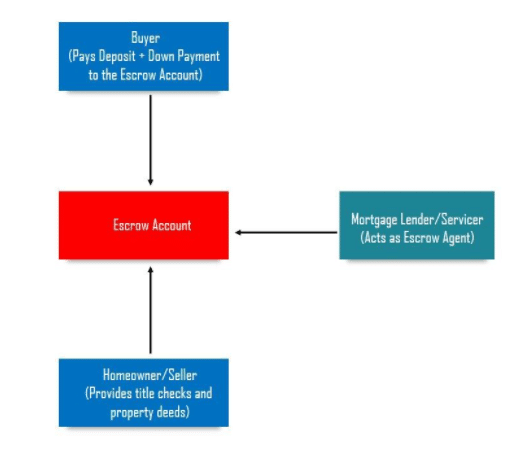

An escrow account helps protect both the buyer and seller, and holds the deposit that the buyer pays. If the transaction proceeds, the deposit paid will be included as part of the buyer’s down payment for the home. With the escrow account in place, both parties will be required to enter into a written agreement that details the conditions to be met for the contract to be completed. For example, the buyer will be required to pay the down payment to the account, while the seller will be required to provide documentation such as a home inspection certificate, property deeds, and title checks. Once all the conditions have been met, the escrow agent or neutral third party will confirm that all parties have fulfilled their part in the contract, and disburse the funds to the seller, and the homeownership documents to the buyer. Once that is completed, the escrow account is closed.

Sometimes, the escrow account may retain some funds even after the sale transaction has been completed. One of the reasons for this scenario is when the seller needs to stay in the home for a few more days before moving. It may also occur when the buyer finds a broken or missing fixture during the house tour, which requires to be fixed before the funds can be released to the seller.

After obtaining a mortgage loan from a lender, the borrower also receives an escrow account to collect property taxes and home insurance. The borrower is not required to deposit funds directly into the account. Instead, the mortgage lender will collect a portion of the monthly mortgage payments, and hold them in the escrow account. By holding the fees in an escrow account, the lender ensures that the tax and insurance bills are paid on time, to avoid late payment fees and liens against the mortgaged property. It also helps spread the tax and insurance payments for 12 months instead of waiting to pay one lump sum.

Since the insurance and tax expenses fluctuate over time, the lender will calculate the bills for the current period based on the previous year’s figures. Still, lenders require borrowers to maintain a minimum balance in their escrow accounts to cushion against any unexpected increases. Usually, most lenders require at least two months’ expenses, but the limit can be higher. If there is a shortfall in the payments due, the lender will cover the payment, and recover the difference by increasing the monthly mortgage payments for the next period. Every year, lenders send an escrow analysis showing whether the account is underfunded or overfunded, and how the monthly mortgage payments will be adjusted based on their findings. If the account is overfunded, the lender will refund the extra amount. On the other hand, if the account is underfunded, the lender may give the borrower the option of making a one-time payment, or pay increased monthly mortgage payments to bridge the difference.

The following parties may be responsible for managing an escrow account:

When buying a home, the escrow account may be managed by an escrow agent, who may also be the title company. The escrow agent acts as the middleman in the transaction, and is responsible for holding the buyer’s deposit as well as the title deed and other ownership documents from the seller. The escrow agent ensures that both parties fulfill their part of the bargain, and only disburses funds once all conditions have been met. The agent charges a service fee for managing the real estate transaction, and the cost is shared evenly between the buyer and the seller.

The mortgage lender collects monthly mortgage payments from the borrower and deposits a portion of the payment in the escrow account to pay insurance and tax bills. The lender is responsible for opening and managing the account between the closing date and when the borrower pays the mortgage in full. The lender collects the payments each month and keeps the payments until the end of the year when insurance and tax bills are due.

Once the seller and buyer reach an agreement to sell/buy a property, the buyer is required to make a deposit to the escrow account. After closing, the account holds the deposit and the down payment paid by the buyer, and the title checks and property deeds provided by the seller until a set of predefined conditions have been met.

If the buyer in a transaction backs out of a transaction due to a change of heart, the earnest money deposited into the account will not be refunded to the buyer. Instead, it is transferred to the seller.

An average escrow fee for a home purchase is 1% of the purchase value. The fee can be split between the two parties, or have one party pay the entire fee.

If the insurance and tax payments for the year have been reassessed upwards, you may be required to increase the monthly mortgage payment to meet the difference. Alternatively, the lender may require a one-time payment to settle the difference.