When the COVID-19 pandemic hit, the Bank of Canada unleashed a monetary firehose. The central bank’s overnight policy rate was slashed from 1.80% to 0.25% in short order. Most observers (including the Bank itself) expected rates to stay low for an extended period.

How times change. The Bank of Canada’s easy monetary policy of the pandemic era was largely predicated on inflation staying low. Indeed, both the Bank’s rate cuts and bond-buying program (quantitative easing) were designed to prevent a scenario of falling prices, a spectre central banks have been keen to avoid since the deflationary Great Depression.

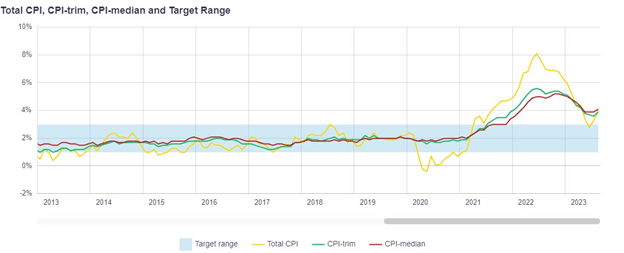

But as every consumer knows, the low-inflation days of mid-2020 are long gone. Supply-chain bottlenecks, pandemic stimulus programs, and central bank largesse combined to create a surge in inflation not seen in decades.