Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

The Bank of Montreal (BMO) is the eighth largest bank in North America, and the fourth largest in Canada – and it didn’t get to that size by accident. BMO has a long history of innovative products and services, tailored to meet the needs of its 12 million customers, and the BMO Eclipse Visa Infinite Card* is just the newest in the bank’s storied history. Let’s take a look at this new card, what it has to offer, and how it stacks up against its competitors.

BMO has traditionally only issued Mastercard cards, but with the Eclipse Visa Infinite Card the bank is expanding its scope. This new Visa card has been designed to meet the needs of BMO’s customers via access to a convenient, flexible credit card that seamlessly integrates with everyday life. This is a rewards-based credit card, and it has a generous and convenient points collection and spending system that means users can make every penny go further than ever before.

If you like earning points or cash back on the money you spend, the BMO Eclipse Visa Infinite Card is a great credit card option for you. The card offers 5X BMO Rewards points on basic day-to-day expenses (such as groceries, dining out, gas and transit) and 1X points on absolutely everything else. These points can then be spent on cash back, travel, merchandise, or used to pay for items on your credit card bill – the choice is yours.

The key is that the points collect automatically, via everyday use of your card, so no matter how busy you are, you’ll be gathering points. Popping to the grocery store or buying gas comes with a bonus that will quickly accumulate, meaning you can live your day-to-day normally, and then use your points to treat yourself as you wish.

The BMO Eclipse Visa Infinite Card offers many perks, including:

As with any credit card, it’s important to be aware of the cost associated with its use. The important details you need to know about the BMO Eclipse Visa Infinite Card are:

As you spend on your credit card, your Rewards points accumulate in your Collector Account. These points can then be used in three ways:

As it is a card geared towards busy professionals, the BMO Eclipse Visa Infinite Card has some income requirements. The primary cardholder must have a minimum annual income of $60,000, or a household annual income of at least $100,000.

The card’s generous rewards program gets a lot better when you qualify for the Welcome Offer, which kick starts your points balance. To be eligible for this, you must apply for the BMO Eclipse Visa Infinite Card between October 19th 2020 and October 31 2021, and you must spend a minimum of $3000 within the first three months of the account being open. That’s it! 25,000 points will be credited to your Collector Account. And if you keep your account in good standing, you’ll get another 15,000 points on the first anniversary of the account.

There are plenty of rewards-based credit cards available in Canada, so let’s see how the BMO card stacks up:

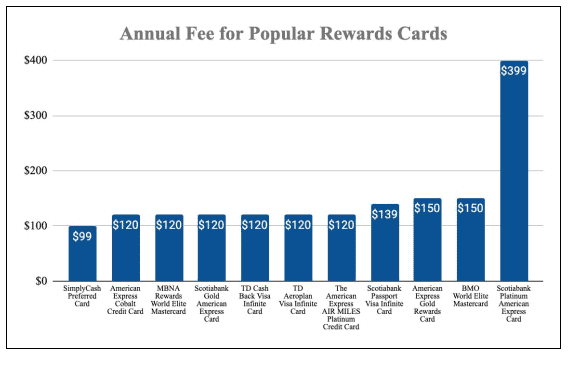

BMO’s annual fee is $120 (waived in the first year). This is about average for this type of card; some basic credit cards have lower fees (as low as $20) but do not offer rewards benefits, and some premium cards have much higher fees – for example, the American Express Platinum Card.

The BMO Eclipse Visa Infinite Card has an interest rate of 20.99% on purchases, and 23.99% on cash advances. The average interest rate on rewards cards is around 19.99%, though some go as high as 30% or require that consumers pay off the balance every month.

Every credit card has a slightly different rewards structure, with some offering compounding rewards for specific types of purchases, and others offering a flat rewards structure. The BMO Eclipse Visa Infinite Card offers a mix – holders earn 5X BMO Rewards on gas, transit, grocery and dining costs, and 1X on everything else. To see how this compares with other cards, see the table below:

| Card | Rewards Tier 1 | Rewards Tier 2 | Rewards Tier 3 |

|---|---|---|---|

| BMO Eclipse Visa Infinite Card | 5X on groceries, gas, transit and dining | 1X on everything else | |

| SimplyCash Preferred Card | 2% cash back on everything | ||

| American Express Cobalt Credit Card | 5X on food and drink | 2X on travel and transit | 1X on everything else |

| MBNA Rewards World Elite Mastercard | 2X on eligible purchases | ||

| Scotiabank Gold American Express Card | 5X on eligible groceries, entertainment and dining | 3X on gas, transit and streaming services | 1X on everything else |

| TD Aeroplan Visa Infinite Card | 1.5X on grocery, gas, drugstore purchases | 1X on everything else | |

| Scotiabank Passport Visa Infinite Card | 2X on dining, groceries, transit and entertainment | 1X on everything else | |

| BMO World Elite Mastercard | 3X on travel, dining and entertainment | 2X on everything else | |

| Scotiabank Platinum American Express Card | 4X on gas, groceries, dining and entertainment | 1X on everything else | |

| TD Cash Back Visa Infinite Card | 3% cash back on groceries and gas | 1% cash back on everything else | |

| The American Express AIR MILES Platinum Credit Card | 0.2X on food, drinks, gas and transit | 0.1X on everything else | |

| American Express Gold Rewards Card | 2X on food, travel, gas and drugstore purchases | 1X on everything else |

The BMO Eclipse Visa Infinite Card has an annual fee of $120, and an interest rate of 20.99% on purchases. This puts it squarely in the middle in terms of the cost of popular rewards-based credit cards.

To be eligible for the BMO Eclipse Visa Infinite Card, you must earn more than $60,000 a year, or have a household income of more than $100,000 a year. If you fall into this category, then you qualify for the card. Those who can truly benefit from this card are those seeking high rewards returns on their credit card purchases, and flexibility in how those rewards can be spent.

Rewards points collected via your BMO Eclipse Visa Infinite Card can be used in several ways: as cash back, for travel or merchandise, or to pay for items sitting on your credit card bill.

The BMO Eclipse Visa Infinite Card offers 5X rewards on the first $50,000 per year spent groceries, transit, dining and gas. After this initial $50,000, rewards on these purchases falls to 1X. There is no limit on the number of points that can be collected.

Yes! If you qualify for the BMO Eclipse Visa Infinite Card Welcome Offer, you are eligible to receive up to 40,000 bonus points, as well as a rebate of the first year’s annual fee ($120). As well as this, all cardholders have a $50 a year annual credit, mobile device insurance up to $1000, and generous ongoing rewards.

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada’s highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the “GPS of Fintech Lending” by the Toronto Star.

BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information.