Compare Lenders

What is a low interest loan?

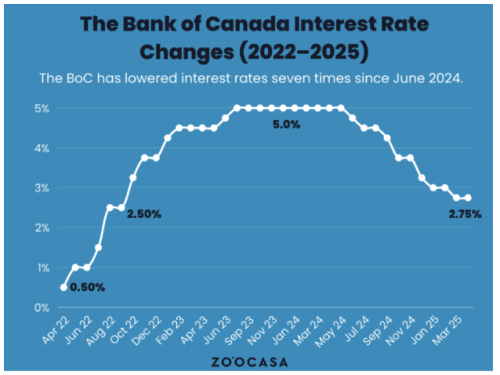

A low interest loan is any type of loan with a lower-than-market-average interest rate. The Bank of Canada reviews monetary policy and economic factors eight times a year, and reflects its views via changes to the country’s “base” or “key” interest rate. This base rate then dictates the interest rates offered by banks and other financial entities throughout the country, both for loans and savings.

As the base rate can change over time, what’s considered “low” interest can change too; so whenever you are shopping for a low interest loan, you need to check the status of the wider market to understand what’s the current prevailing average.

Why is getting a low interest rate on a personal loan so important?

There are a wide variety of loans available to consumers in Canada, and Canadians aren’t shy about using them. The total consumer debt in the country reached $2.56 trillion by the end of 2024; and while 75% of all household debt is mortgage debt (usually considered lower interest), the remainder is made up of higher interest products: 10% comes from lines of credit, and a further 5% from credit card debt. Overall, this equates to an average non-mortgage debt per Canadian of $21,931.

So it’s no exaggeration to say that the average Canadian’s budget is heavily impacted by the interest rates their borrowing is subject to; in 2024, household debt payments equaled 14.91% of disposable income. The lower the rate you are paying on your debt, the smaller this number will be, and the further your money will go.

Who can get a low interest loan in Canada?

Loans of all types and at a range of interest rates are widely available across the country; in theory, all you need to qualify for a loan is to be the age of majority in your province, with an active bank account, and proof of address. However, while these basics will grant you access to some forms of borrowing, lower interest rate products tend to have a higher eligibility threshold.

A credit check is a common requirement for many types of low interest loan; banks and credit unions often offer among the lowest rates on the market, and they require a minimum credit score of 650 to qualify. An income check is also common. But as the exact requirements for a loan (and a preferential interest rate) vary from lender to lender, the general rule to remember is this: the better a financial position you are in, the less risky you are perceived to be by lenders, and the lower the interest rate you will qualify for.

Where’s the best place to get a low interest loan in Canada?

The best place to get a low interest loan depends on two things: your financial profile, and the type of loan you want. As mentioned above, your credit, income and other financial characteristics will affect the interest rates you qualify for – but not in the same way for every lender. This is because all lenders use their own, proprietary models to calculate the rate they will charge each borrower, based on their unique attributes. So to find the lender with the lowest rate for you, you need to shop around.

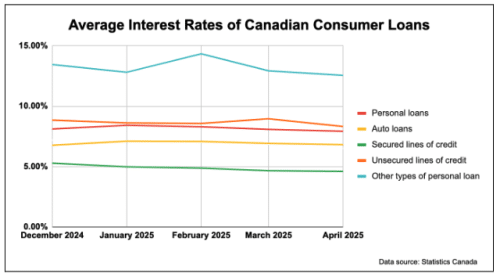

The other factor to remember is that different types of loans tend to have different levels of interest rates. Longer-term and secured loans generally have lower interest rates than short term, unsecured or easy-access loans. You pay for the convenience of quick accessible borrowing with a higher interest rate. So when looking to get a low interest loan, focus on lenders that offer the right type of products: secured loans, long-term loans, guarantor loans, and so on.

What’s the best interest rate on a personal loan in Canada right now?

The Bank of Canada base rate is currently 2.75%, but the market average for personal loans is much higher, at around 10%. This includes both secured and unsecured loans though, so you can expect a bigger spread depending on what exactly you’re shopping for. Some lenders are offering rates as low as 6%, while others may charge upwards of 34%. This is why shopping around, and using comparison tools, is so important when considering a new loan.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice