Compare Lenders

What is a High Ratio Mortgage and How Does it Work?

A high ratio mortgage lets you purchase a home if you have less than a 20% down payment. If your mortgage is high ratio, you must qualify for mortgage default insurance through one of the three mortgage default insurance providers – Genworth, CMHC or Canada Guaranty.

A high ratio mortgage is different from a conventional or low ratio mortgage, when you purchase a home with a down payment of 20% or greater. In this instance, you aren’t required to pay mortgage default insurance.

The minimum down payment on a low ratio mortgage is as low as 5%. The amount you’re required to put down depends on the purchase price of the property. When the purchase price is $500,000 or less, you can put 5% down. When the purchase price is above $500,000, but below $1,000,000, you can put 5% down on the first $500,000 and 10% down on the remaining portion. (If you’re buying a home with a purchase price of $1,000,000 or above, the purchase price is too high to be insured, therefore, you’re required to make a down payment of at least 20%.)

What is Mortgage Default Insurance?

Mortgage default insurance doesn’t protect you similar to other types of insurance like home insurance, it protect your lender. Your lender is protected in case you fail to repay your mortgage according to its terms and conditions. For that reason, lenders tend to be able to offer more attractive interest rates on high ratio mortgages compared to conventional mortgages.

When it comes to mortgage default insurance, you have two choices. You can choose to pay it as a lump sum when your mortgage funds or you can have it added to your mortgage loan amount and paid over the life of your mortgage. Most homebuyers choose the latter, as most simply don’t have the funds to pay for the mortgage default insurance upon closing.

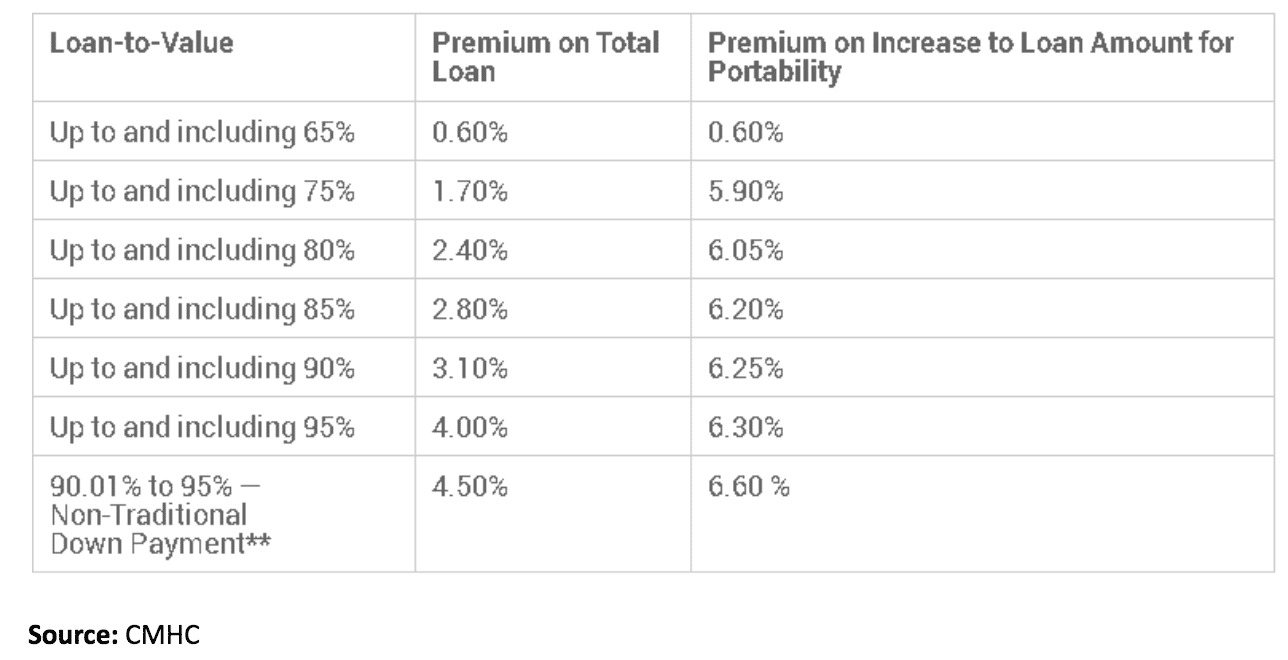

The amount of mortgage default insurance premiums you’re required to pay depends on the size of your down payment. The closer your mortgage payment is to 20%, the less costly your mortgage default insurance premiums will be.

Mortgage default insurance premiums in Manitoba, Quebec, Ontario and Saskatchewan are subject to PST. You’ll be required to pay the PST amount upon closing. The PST can’t be added to your mortgage loan amount, so it’s important to set money aside to pay them as part of your closing costs.

Why You Might Choose a High Ratio Mortgage

The main benefit of choosing a high ratio mortgage is that you can buy a property now instead of waiting until you’ve saved up a 20% down payment. This can be especially advantageous in hot real estate markets like Toronto and Vancouver where home prices tend to go up faster than you can save.

Low ratio mortgages tend to come with lower mortgage rates than conventional mortgages. That’s because mortgage default insurance providers protect lenders in the event that the borrower defaults, meaning less risk for the lender.

By The Numbers

Between 2015 and 2018, 53% of first-time homebuyers made a down payment of less than 20%.

Source: Mortgage Professionals Canada

More Articles About Mortgages

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice