Compare Lenders

Discover Popular Financial Services

More About Getting a Personal Loan in Alberta

- How to get a personal loan in Alberta?

- Where to get personal loans in Alberta?

- What are the types of personal loans you can get in Alberta?

- How much money can I get from a personal loan in Alberta?

- What can personal loans be used for in Alberta?

- What is a good interest rate on a personal loan in Alberta?

- What factors affect personal loan interest rates in Alberta?

- How do I find the best personal loan rates in Alberta?

- What factors to consider when comparing personal loan lenders in Alberta?

- How do I qualify for a personal loan in Alberta?

How to get a personal loan in Alberta?

To get a personal loan in Alberta, the first thing you need to do is find the right Albertan personal loan lender. More on this below! Once you’ve found a lender, you will need to apply using their system. This is usually possible online, but you may also have the option to do so in-person. In either instance, you need to make sure you have some documents to hand. The exact paperwork will depend on the lender, but in general you’ll have to provide:

- I.D.

- Proof of address

- Employment information

- Bank account information

Once the paperwork is received, your chosen Alberta personal loan lender will decide whether your application is approved. If it is, you will receive a loan offer with all of the terms of your loan; once you sign this, the lender will send you the full loan amount.

Where to get personal loans in Alberta?

Personal loans in Alberta are available from a variety of personal loan lenders. Loan products of all types are typically available from:

- Banks

- Credit unions

- Alternative lenders

- Online lenders

In addition, specific loans are available from your chosen:

- Mortgage brokerage

- Vehicle dealership

- Payday lender

- Private wealth financial institution

Thanks to the prevalence of online personal loan lenders, personal loan interest rates in Alberta are competitive and don’t depend on where you live. And competitive Alberta loans are available to all kinds of borrowers too. Even if you have bad credit, there are specialized bad credit lenders in Alberta able to cater to you. Given all this choice, the best thing you can do as a consumer is to shop around to find the best personal loan rates for your situation and needs.

What are the types of personal loans you can get in Alberta?

A personal loan is any loan offered to general consumers, and there are many different types of personal loan in Alberta. All fall within two main categories: secured loans and unsecured personal loans.

Secured Personal Loans in Alberta

A secured personal loan (or title loan) is “secured†by putting up an asset (like your house or car) as collateral in the event you can’t repay the money you owe. Because this is considered less risky by private personal loan lenders in Alberta, you can often borrow a larger sum of money at a lower interest rate, or get approved even when you have a poor credit score.

Unsecured Personal Loans in Alberta

Most personal loans take the form of an unsecured installment loan, with no collateral required. This means you do not need to have any assets to get one. But because this makes them a riskier proposition for private loan lenders, unsecured personal loans tend to be for smaller amounts and have higher interest rates and stricter payment schedules than secured loans.

Alberta Personal Loan Examples

All of the following are types of personal loan:

- Installment loan

- Personal line of credit

- Home equity line of credit

- Home equity loan

- Car loan

- Student loan

- Debt consolidation loan

- Payday loan

- Bad credit loans

- Home repair loan

- Guarantor loans

- Emergency loan

- Boat loan

How much money can I get from a personal loan in Alberta?

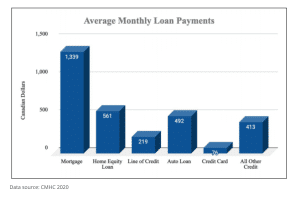

Alberta personal loans come in all sizes; some can be for as little as $100, while others are for $100,000 or more –Â although most people get personal loans of between $5,000 and $20,000. The loan type you choose and your financial circumstances will heavily influence how much money you are approved to borrow.Â

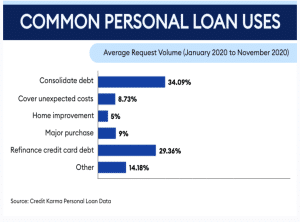

What can personal loans be used for in Alberta?

Alberta personal loans are versatile and can be used for all manner of reasons. Here are some of the most common:

- Debt consolidation

- Unexpected emergencies

- Home improvement and home repairs

- Vehicle purchase or repair

- Wedding or vacation

- To pay off student loans

- Medical bill coverage

- New venture funding

There will be terms and conditions relating to your personal loan, but these will usually be restricted to repayment schedule, fees and so on, rather than fund uses. This means that in most cases, you are free to use the funds from your Alberta personal loan as you need. This is true of installment loans, home equity loans, payday loans, personal lines of credit, home equity lines of credit, guarantor loans, emergency loans, and bad credit loans.

There are some exceptions however; a couple of different types of Alberta personal loans are use-specific, meaning they are designed and intended for a designated reason. A good example of this is an auto loan; this is a type of personal loan, but it is specifically meant to be used for a car purchase, and not for, say, home repairs. The same is true of a boat loan, which must be used for a boat. Debt consolidation loans and home repair loans are two other examples of use-specific loans. Make sure you get the right personal loan for your needs by checking your chosen Alberta personal loan lender’s conditions before you apply.

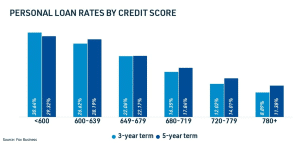

What is a good interest rate on a personal loan in Alberta?

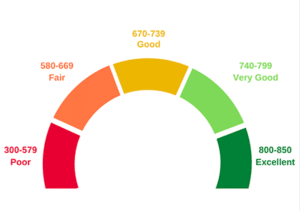

Personal loan interest rates in Alberta depend on a number of factors, and as such can vary a lot between borrowers. Some may be able to access an APR of just 5% on their Alberta personal loan, while others pay 20% or more. This is because each person has their own financial profile, including credit score, pay level, other debts, and so on. This profile, as well as the type of loan applied for, the Alberta personal loan lender in question, and the loan amount, will all determine interest rate, fees and other costs. To find the best personal loan rates in Alberta, it helps to: shop around; minimize other debts; take steps to improve your credit (including checking your credit report for errors); and minimize the number of credit applications you make.

What factors affect personal loan interest rates in Alberta?

Personal loan lenders in Alberta will consider a number of factors when setting your personal loan interest rate. Their goal is to assess how risky you are to lend to. The riskier you are perceived to be, the higher the interest rate they’ll charge you. These are the factors in question:

Credit Score

A high credit score shows previous financial trustworthiness; those with good credit get lower rates.

Income

The higher your income, the more secure an Alberta personal loan lender will feel.

Income Status

Steady income is preferable to inconsistent income from a lender’s perspective.Â

Financial Commitments & Other Debts

Your existing financial commitments will influence whether a personal loan lender in Alberta thinks you can afford new loan payments.Â

Assets

If you own an asset you can use it as collateral to lower the personal loan lender’s risk, and hence secure a lower interest rate.Â

How do I find the best personal loan rates in Alberta?

There are some attractive loan deals available, but to find the best personal loan interest rates in Alberta, you may need to shop around. Luckily, this has never been easier – almost all Alberta personal loan lenders list their products and (broad) terms online. But to properly compare products, you need to make sure you’re comparing your options fairly. Different products and lenders have different eligibility conditions and terms, so not everything you see listed online will be relevant.

As a place to start, consider what type of loan you need, how much you need to borrow, and if you have any circumstances (such as bad credit, or lack of steady employment) that may impact loan approval. Compare this to what’s available in the marketplace to get a shortlist of Alberta personal loan lenders and products. Then you can compare loan offerings to find the one with the best rate.

What factors to consider when comparing personal loan lenders in Alberta?

With so many personal loan lenders in Alberta, you need to know how to compare all of your different options. Key areas to consider include:

Loan Amount

Alberta personal loans vary in size; some are available for as little as $100, while others can be $100,000 or more. Find Alberta personal loans that can provide the amount you need.

Type of Loan

Personal loans in Alberta come in many forms, so your intended use of the funds will impact the type of loan and the private loan lenders in Alberta that can help you.

Term Length

Repayment periods typically range from 3 months to 5 years, although some loans have longer lifespans. Choose one with a term that makes sense for you.

Interest Rate

Find the best personal loan rates in Alberta for your loan type, to keep it as affordable as possible over the whole life of the loan. Remember that both fixed and variable rates are available.

Applicable Fees

All loans come with some fees, and it’s crucial to take into account the effect these fees will have on your overall loan cost when comparing Alberta personal loan lenders.

Speed of Application

Some private loan lenders in Alberta take weeks to process personal loan applications, while others take just hours. How quickly you need the money should influence the type of lender you go to. Generally speaking, online personal loan lenders are usually the fastest.

How do I qualify for a personal loan in Alberta?

The basic requirements for personal loans in Alberta are simple. All loan applicants must:

- Be 18 years or age older

- Have a valid bank account

- Be able to prove residence

If you pass these requirements, then you will be eligible for some form of Alberta personal loan – though not necessarily from every Alberta personal loan lender. Different financial institutions have different eligibility criteria for their loan products, so you will need to check with a specific personal loan lender in Alberta to see if you qualify with them. Factors such as income, credit score and so on will potentially be looked at during the application process.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice