Compare Lenders

Discover Popular Financial Services

More About Payday Loans in Alberta

- Why Do People Turn to Payday Loans in Alberta?

- Payday Loan in Alberta: The Basics

- How Much Do Payday Loans in Alberta Cost?

- Payday Loan Regulation in Alberta

- What About Online Payday Loans?

- Online Payday Loans vs. Other Instant Online Financial Solutions

- Short Term Loans and Long-Term Financial Planning

- A Word on the Legitimacy of Online Lenders

- Frequently Asked Questions About Payday Loans Alberta

Why Do People Turn to Payday Loans in Alberta?

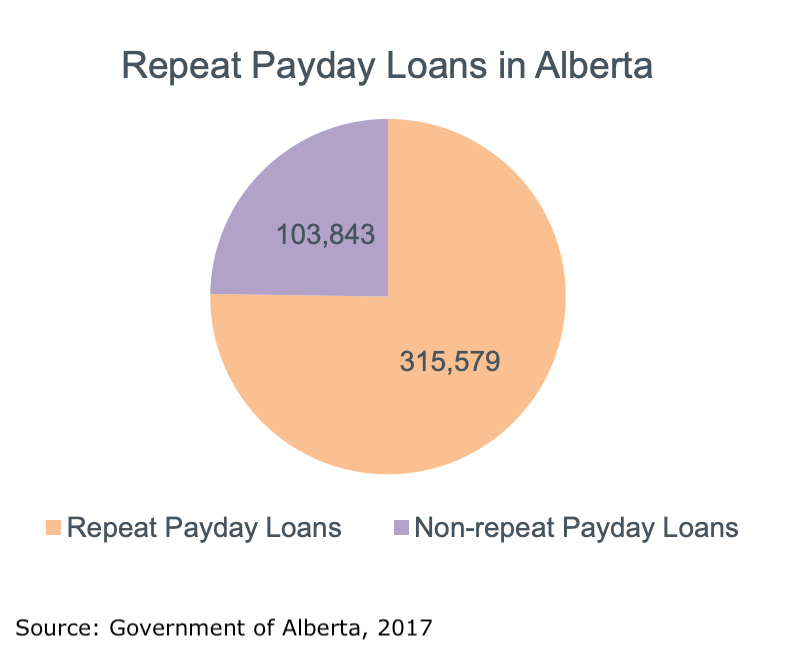

Payday loans in Alberta serve as a pivotal financial bridge forp individuals needing relief until their next payday. These loans are designed to provide extra cash for urgent needs, and have become a popular financial solution across the province.

Online payday loans in Alberta simplify the process, offering a convenient, swift solution through the ability to apply online and receive cash via e-transfer. Companies across Canada offer these loans with the promise of instant approval, catering to a wide range of borrowers, including those with a bad credit history.

The attraction of payday loans lies in their accessibility; they provide a quick cash solution without the extensive paperwork, difficult loan applications or long approval times associated with traditional loans. However, every borrower must understand a loan’s terms, including loan amount, interest rate, repayment schedule, and associated fees, in order to ensure they align with their needs.

Payday Loan in Alberta: The Basics

How Do Payday Loans in Alberta Work?

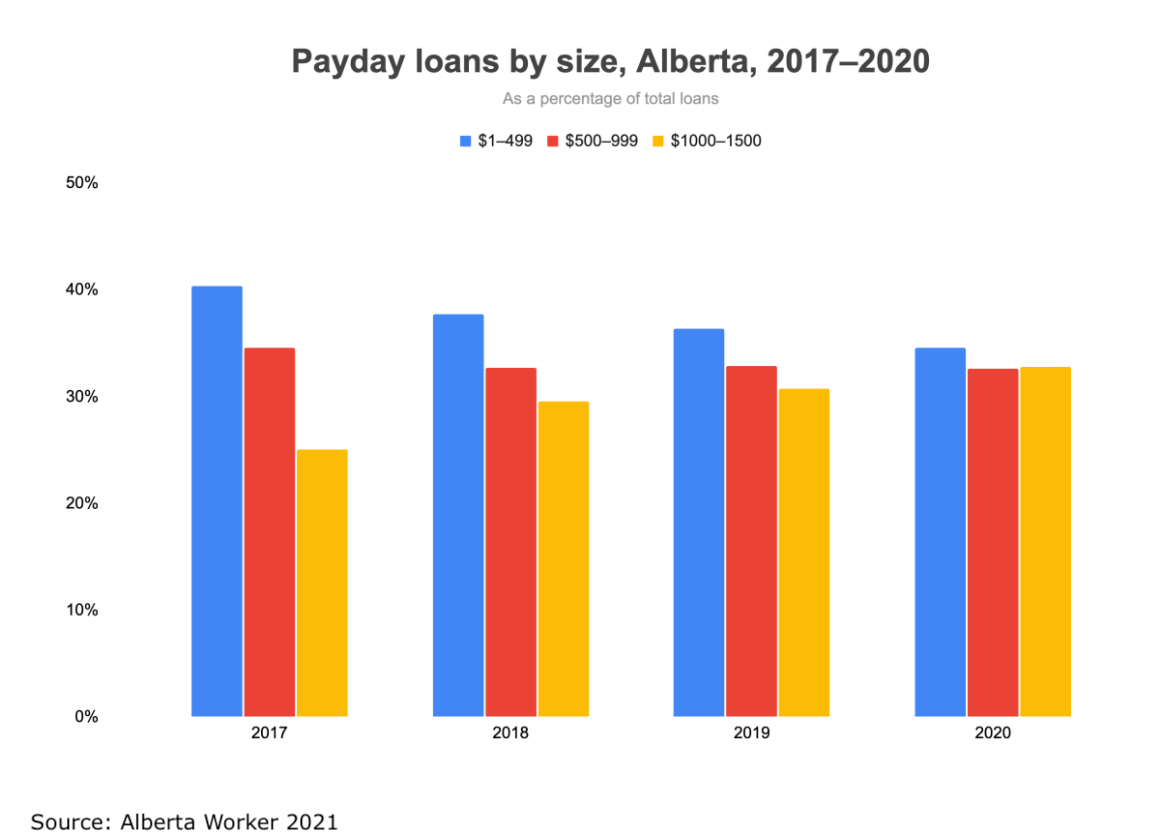

A payday loan is an unsecured loan available to retail consumers, and it works just like other cash loans. You complete an application process (either an online form or an in-person loan application), and if approved, you receive a sum of money – typically between a few hundred and $1500. You may use this money as you wish.

You then have to repay the loan, plus interest and fees, according to the repayment plan in the loan agreement. Most of these loans must be repaid when the borrower receives his/her next paycheque.

Who Can Get a Payday Loan in Alberta?

Getting an instant payday loan is simple, as the basic requirements are lenient. Applicants must:

- Be at least 18 years old

- Have a chequing account

- Have some form of steady income

And that’s it! Loans with no credit check is required; neither is any form of collateral. You also do not need to be a Canadian citizen. As long as you can show the above, you are likely to receive approval.

Their minimal eligibility requirements and instant approval process are a big part of why these loans are so popular for dealing with unexpected expenses and emergencies.

What Income Is Needed for a Payday Loan in Alberta?

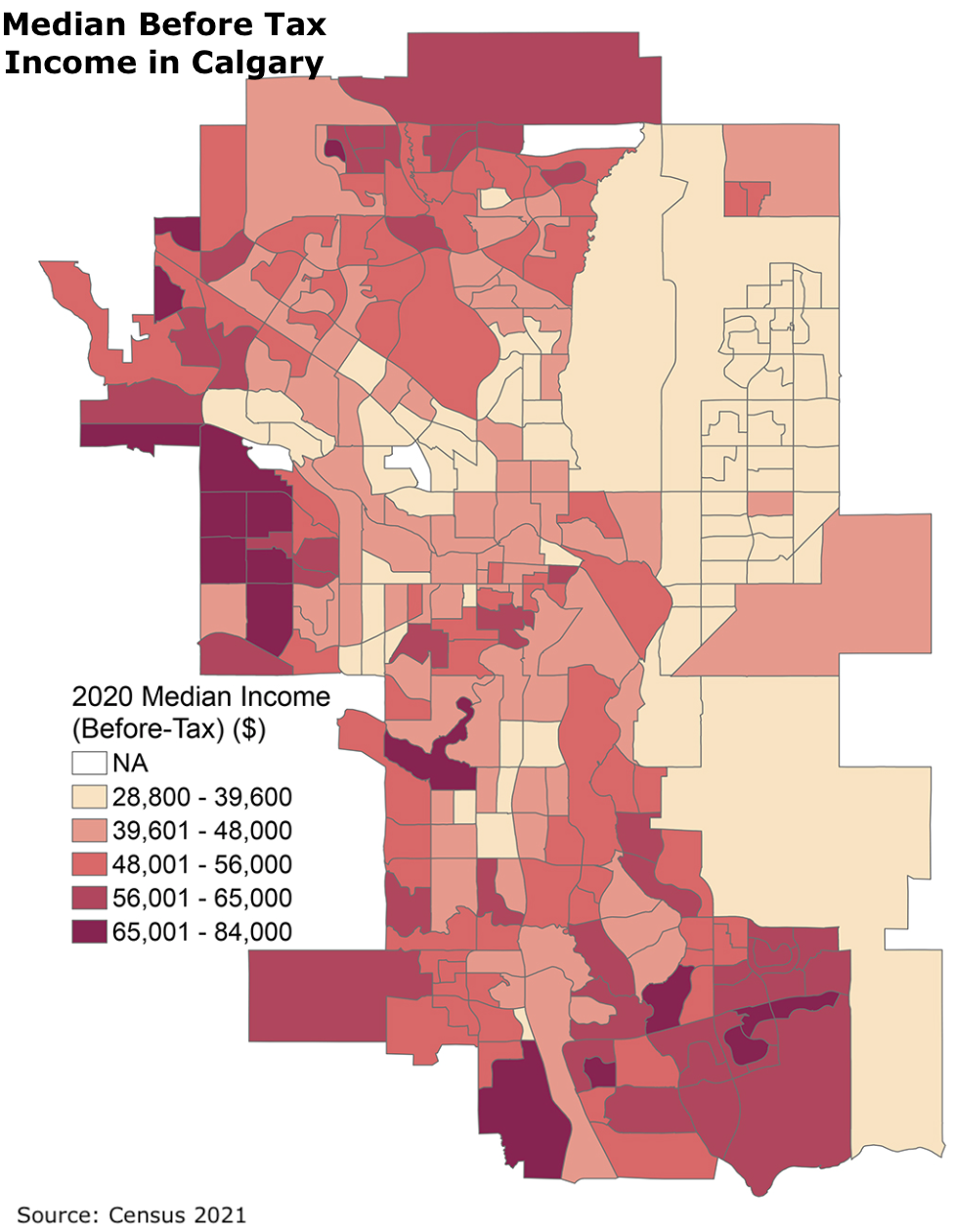

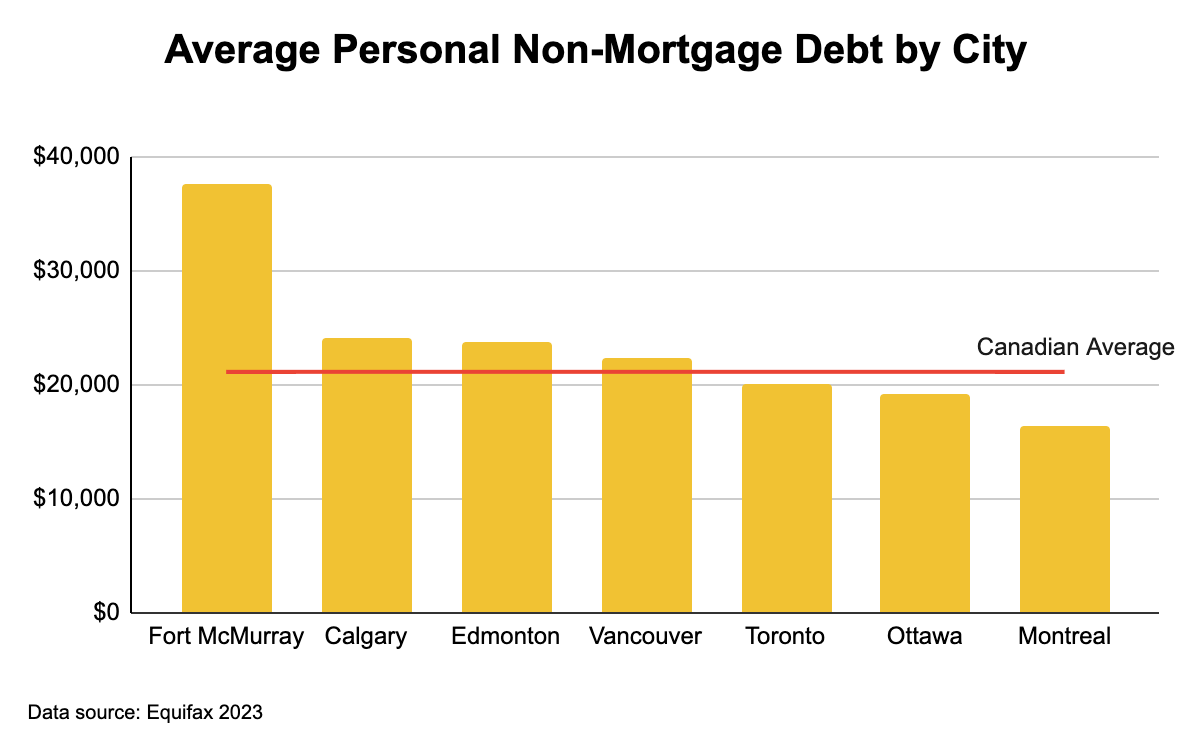

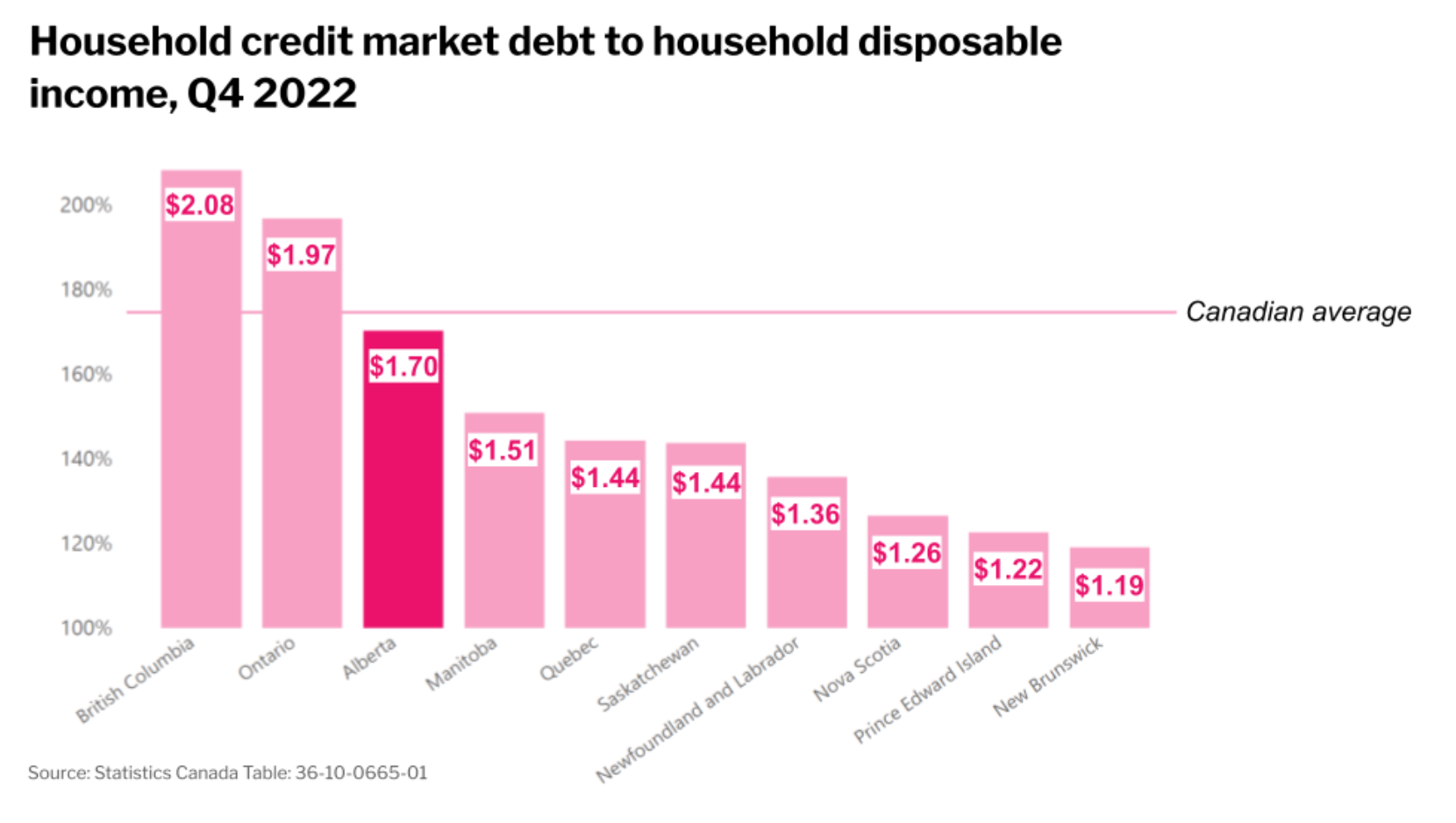

All payday loans in Alberta require proof of steady income, but this can come in many forms, including: employment income; child tax credit income or child tax benefit; private pension workers compensation; private pension income; private disability income or other non-government disability benefits; predictable investment income; employment insurance income; workplace insurance income; and other forms of repeatable, predictable income. The average weekly salary in Alberta is $1292, the highest in Canada. Remember, it’s your net income that matters, not the gross amount.

Does My Credit Score Matter?

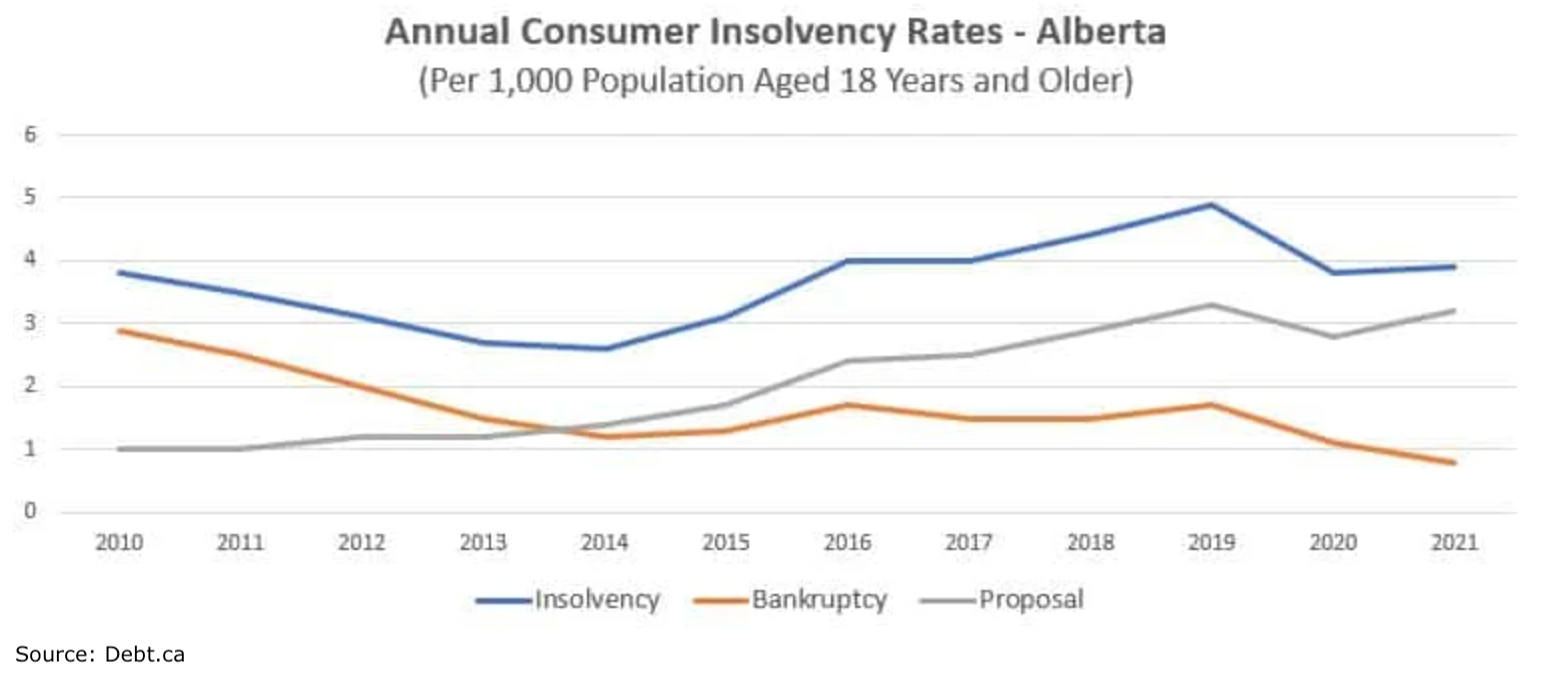

Unlike with bank loans and some other types of cash loans, credit checks are not necessary when you apply for payday loans; the only really important factor is income. This means payday loans are a great option for those with bad credit, or who wish to avoid a credit check for any reason. Even Alberta residents with a difficult financial history, such as past bankruptcies, can access these cash loans. A good score is anything over 670; the average score in Alberta is 650 – a little higher in Calgary at 667, and a little lower in Edmonton at 649.

It’s important to realize that payday loans are not suitable as a means to rebuild your credit. This is because a payday lender does not report payments to credit bureaus, so positive payment will not be taken into account in your credit history.

How Can I Use a Payday Loan?

Due to their structure, cash loans offering fast approval are best suited to provide funds for financial support in times of emergency. Their size and interest rate makes them less suitable for long-term borrowing or large amounts of money.

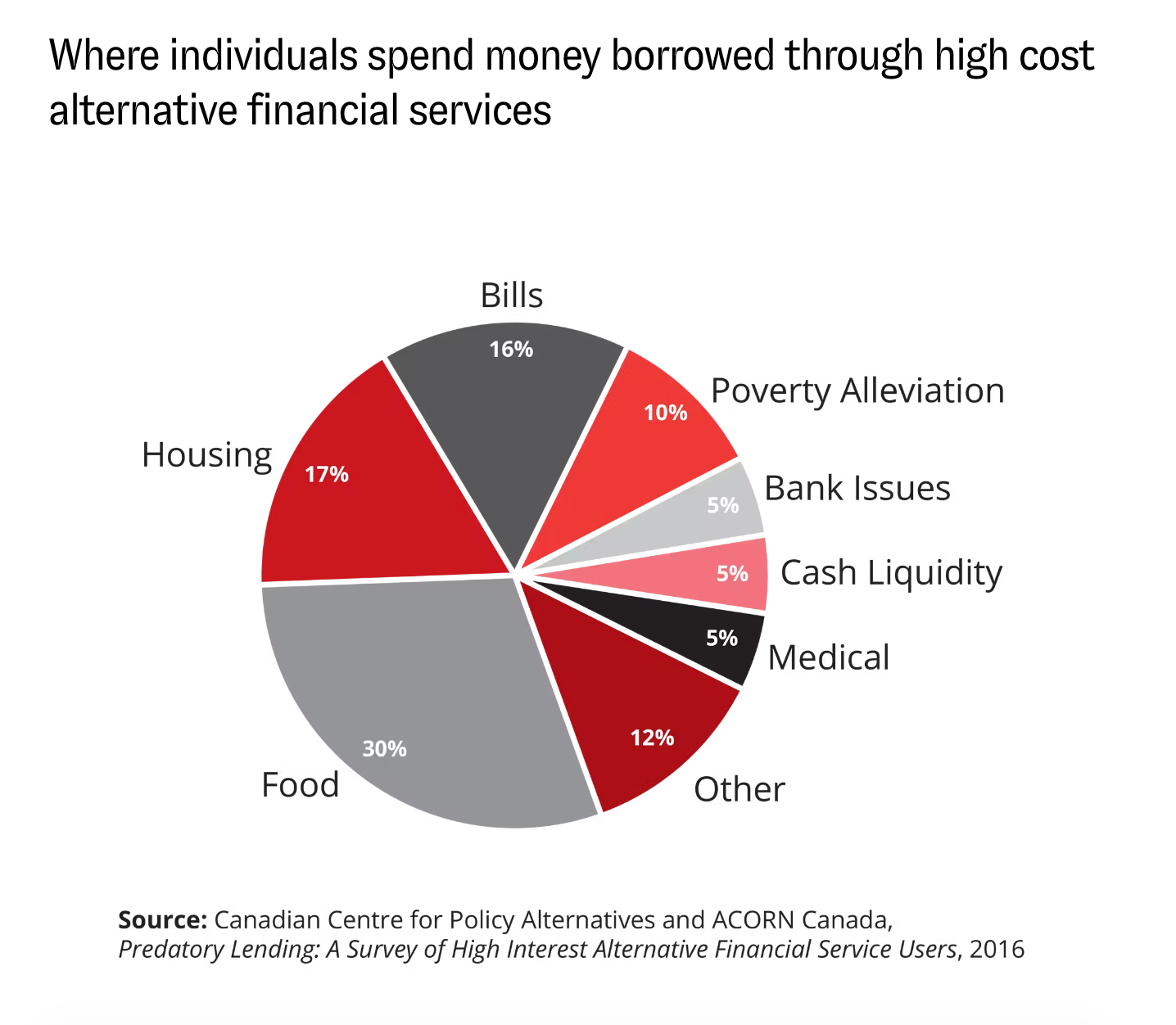

This doesn’t mean those accessing them are restricted in how they can use their funds; on the contrary, payday loans in Alberta can be used for any purpose, including:

- Financial assistance for ongoing expenses, such as food or utility bills

- Unexpected expenses, such as a car repairs

- Unexpected bills, such as medical bills

- Discretionary purchases

How Much Do Payday Loans in Alberta Cost?

Alberta residents enjoy some of Canada’s lowest loan rates. This is because the maximum allowable cost is controlled by the provincial government.

This maximum cost is set to $15 per $100 borrowed. The cost is expressed in this way rather than as an interest rate because most payday loans are intended to be repaid in one lump sum from your next paycheck, so their cost is advertised as a ‘flat fee’. There should be no hidden fees of any kind.

However, you should know that this is the cost only if you pay back the cash on time, and does not account for other fees or interest that will increase if you fail to repay.

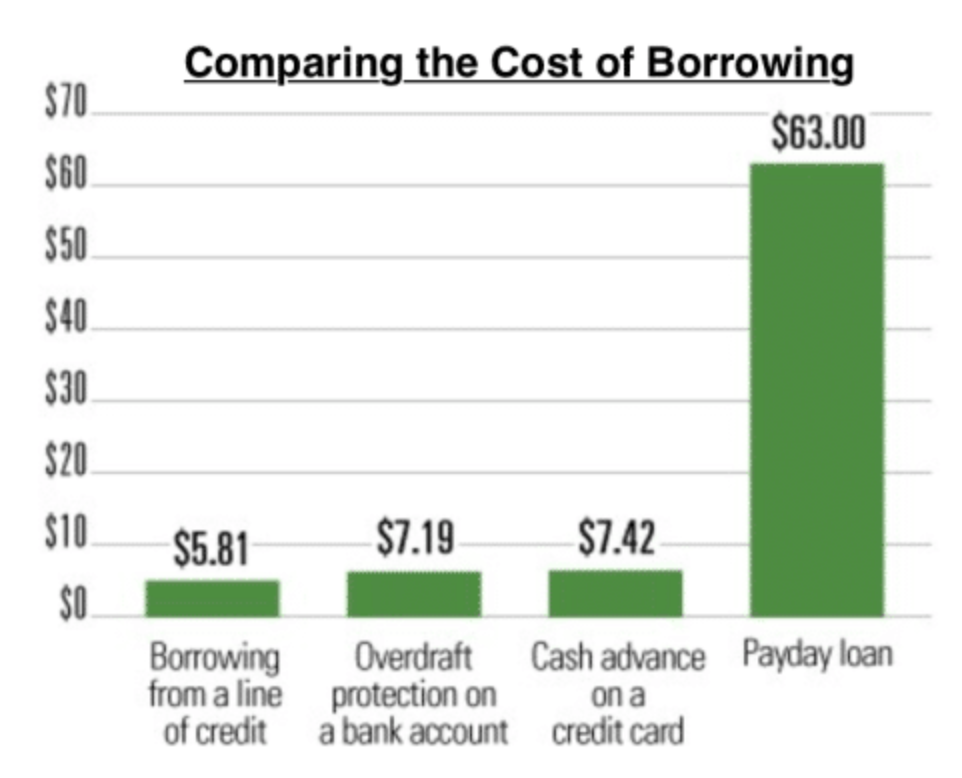

It’s also worth noting that even with this cost cap, payday loans in Alberta are still significantly more expensive than other online loans and personal loans. Even if you have a poor credit score, there is financial support available that can provide quick access to urgent funds at a lower cost.

Payday Loan Regulation in Alberta

As mentioned above, payday loans in Alberta are regulated via provincial legislation designed to protect consumers by capping the maximum allowable cost of borrowing, and ensuring transparent lending practices. This approach means Albertans can access urgent financial help, to manage financial emergencies or bridge gaps until their next paycheque, while being safeguarded from potentially predatory practices.

The Legal Framework of Payday Lending in Alberta

The province’s regulations require payday loans in Alberta to have clear and comprehensible agreements, highlighting all terms, including interest rates and repayment obligations, to protect borrowers’ financial well-being.

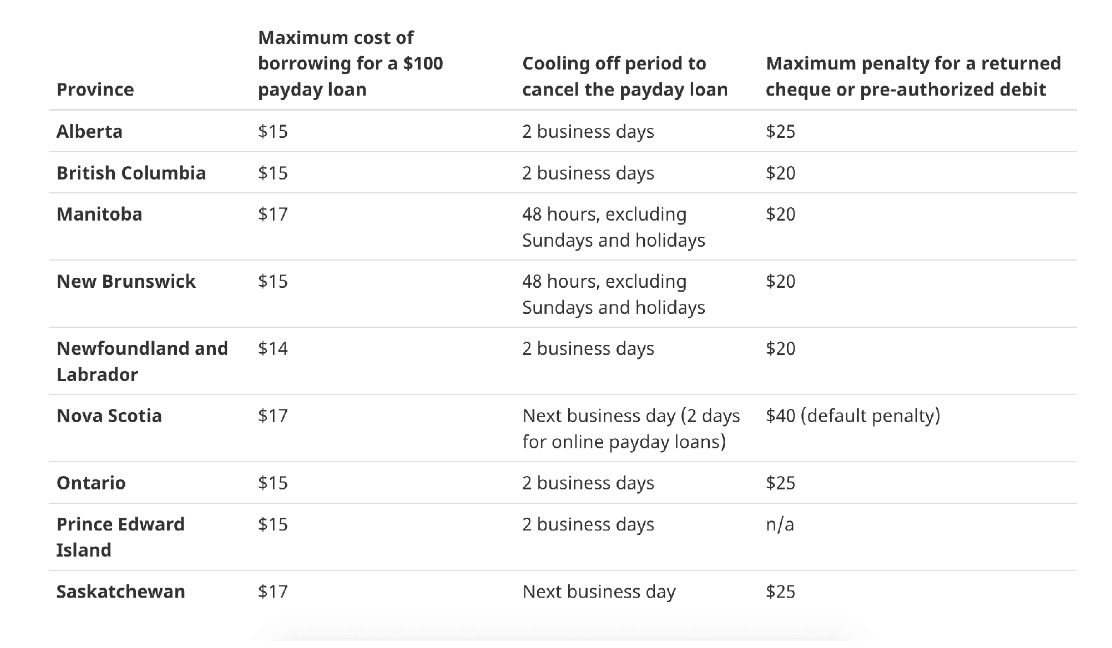

This regulatory framework is mimicked across the country, but Alberta has some of the lowest costs associated with payday loans, mirroring the rates paid by Ontario residents; Albertans and Ontarians pay $15 per $100 borrowed, versus $17 paid by Manitoba residents and those in Nova Scotia.

With these protections and limits in place, residents of Alberta’s capital city and beyond can access secure, regulated financial solutions designed to meet their urgent needs, safe in the knowledge that the companies who offer loans of this kind are held to a strict standard.

What About Online Payday Loans?

Online payday loans in Alberta are essentially the same instruments as those obtained at a payday loan store, and regulated in the same way. And because so many people want convenience, the majority of lenders are now offering online payday loans; once you submit your online payday loan application, you can receive an almost instant loan decision, and if approved have funds deposited directly into your bank account or sent via e-transfer on the same business day.

So online payday loans are extremely accessible; but physical locations for most instant cash lenders are present throughout Alberta as well, with most open outside of regular business hours for convenience.

Online Payday Loans vs. Other Instant Online Financial Solutions

Online payday loans provide immediate financial solutions for those needing to secure funds for urgent needs. Through online loan applications and quick e-transfer of funds, these loans cater to unexpected expenses, offering instant approval and same-day access to cash. The convenience of applying from anywhere via a simplified loan application makes online payday loans a go-to option for those in need of quick financial assistance.

Navigating Different Instant Loans for Urgent Financial Needs

Instant loans in Canada are attractive because they offer an easy solution in times of financial crises, but the key to navigating them successfully lies in understanding their terms.

The benefit of easy access and rapidity comes at a cost, and this means that not every financial situation will be best served by an instant loan; other types of personal loan may prove more cost-effective over the long term, and many are accessible via an online application, and many without credit checks.

To better understand how other forms of online borrowing can compete effectively with payday loans, let’s take a look at some key benefits of an online payday loan:

1. The Role of E-Transfer in Fast Cash Solutions

E-transfer plays a crucial role in modern fast cash solutions, offering an efficient and secure method to receive funds from payday loans and other lenders almost instantly. This technology enables lenders to deposit funds directly into borrowers’ bank accounts, facilitating immediate access to cash.

The convenience and speed of e-transfer enhances the appeal of online loans, but it is by no means restricted to payday options; many online and alternative financing companies offer e-transfer or direct deposit cash. If this is your primary criteria when choosing a loan, you still have a lot of options!

2. Qualifying for Loans with Bad Credit

Your credit score can have a big effect on what loans you qualify for, and how much you pay for them.

Many people with bad credit turn to payday loans as they do not require any reference to past financial behaviour or credit score. However, they are not the only option for those with less-than-perfect credit histories. Many lenders specialize in financial solutions that are based on factors beyond credit score – such as current income, and the ability to repay the loan. This approach allows individuals with bad credit to access the financial assistance they need, without having to turn to high cost payday loans.

3. Technology and Apps for Instant Borrowing

Technology and apps have revolutionized instant borrowing and the transfer of money. Digital platforms provide user-friendly interfaces that allow for quick loan applications and instant approvals, facilitating immediate financial relief. With features like real-time updates and e-transfer capabilities, borrowers can manage their loans effectively, ensuring timely access to the money they need.

Payday lenders do not have exclusive domain over user-friendly apps and systems, but you will find that different companies have different platforms, with some being more sophisticated than others. If ease of application and loan management is a critical issue for you, take a look at customer reviews to find the company with the best technology.

Short Term Loans and Long-Term Financial Planning

Short term loans, such as payday loans and cash loans, can serve as immediate financial solutions, but must be carefully balanced with long-term financial planning.

While these loans offer quick access to funds, addressing urgent needs or covering unexpected expenses, their higher interest rates compared to other financial solutions necessitate prudent management to avoid exacerbating financial strain.

Long-term financial planning focuses on stability and growth, involving savings, investments, and low-cost borrowing options. Integrating a short term loan into your broader financial strategy is crucial if you are to understand its role and impact, and to ensure any form of borrowing is used judiciously within the context of overall financial health and goals.

Strategies for Responsible Borrowing and Repayment

Adopting strategies for responsible borrowing and repayment is essential for individuals utilizing payday loans or any form of instant money solutions. This includes thoroughly assessing one’s finances and personal details to borrow only what loan amount can be comfortably repaid, understanding all payday loan terms, and prioritizing loans with the lowest interest rates and fees. Setting up automatic deductions for repayments can help ensure timely payments, safeguarding credit scores.

A Word on the Legitimacy of Online Lenders

Financial institutions like banks and credit unions often stand in contrast to payday lenders in terms of the services and products they offer. While banks and credit unions provide a range of solutions from personal loans to credit check loans, emphasizing long-term financial health and lower interest rates, payday loan providers cater to immediate, short-term needs, offering fast cash and easy approval for borrowers, including those with bad credit histories.

The choice between these lending sources depends on the borrower’s specific situation, urgency of financial need, and the potential impact on their finances. Payday loans serve as a viable option for obtaining quick cash, but borrowers should weigh these higher cost loans against more traditional financial products that might better support their long-term financial planning.

But while all this must be taken into account, it’s important not to conflate cost with legitimacy. The legitimacy of online loans is foundational to the whole industry, and there are many reputable online lenders and payday lenders outside of traditional financial institutions.

You can determine if a lender is trustworthy by looking at their reviews, conditions, and contracts. Reputable online lenders maintain transparency in their lending practices, offering clear terms and conditions, and adhere to all regulatory standards.

Frequently Asked Questions About Payday Loans Alberta

Does Alberta have payday loans?

Yes, Alberta has both storefront and online payday loan products. Bear in mind that sometimes these products are known by another name – including cash advance loan, and child tax loan.

Can I borrow money until my next payday?

Opting for an online payday loan in Alberta offers a quick solution to urgent money needs. These accessible solutions, available through online applications and e-transfer services, provide same-day funds to cover emergencies or unforeseen expenses until your next paycheque. Many online providers and payday lenders specialize in short-term loan products, ensuring a quick cash infusion without the lengthy approval processes typical of traditional financial institutions.

What are the fees for a payday loan in Alberta?

Alberta payday loans are regulated by the government; this means that a payday lender must adhere to certain rules throughout the lending process, including rules regarding costs and fees. There can be no hidden fees when you get a payday loan; the total cost must be transparent from the start. This cost is usually expressed as a flat fee for the entire loan amount.

Can you get a loan with bad credit in Alberta?

In Alberta, obtaining an online loan with bad credit is possible. Online and alternative lenders provide loans designed for individuals with a bad credit history or other specialized needs. They can do this by focussing on current financial stability and the ability to make repayments, instead of credit score.

Where can I borrow $100 instantly in Alberta?

In Alberta, individuals can borrow $100 instantly through payday providers or online loan services that offer instant cash loans. These services cater to Canadian citizens with online solutions that promise fast cash, often with the convenience of online forms and instant approval processes that facilitate swift access to funds.

Are payday loans the same across Canada?

No. Different provinces have slightly different regulations regarding short term, high interest loans. These differences can relate to cost, as well as how the lender must behave. For example, in British Columbia, the basic cost of borrowing is the same as in Alberta, but the penalty fees for late payment differ. It’s important you understand the rules where you are; see here for Alberta’s specifics.

Is Speedy Cash legit?

Speedy Cash, as a provider of quick cash and emergency loans, is considered a legitimate option for those in need of financial assistance quickly. It operates within the legal and regulatory standards set for financial institutions, offering transparent terms and conditions to borrowers. As with any trusted lender or financial institution, verifying their credentials can provide added assurance to the borrower.

What is the safest place to get an online loan in Alberta?

The safest place to get a loan in Alberta is a reputable financial institution, such as a bank, credit union, or alternative lender with a good reputation. These institutions offer a range of loans, many letting you apply online.

Explore more

Similar products

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice