Compare Lenders

What is a Canadian dental loan?

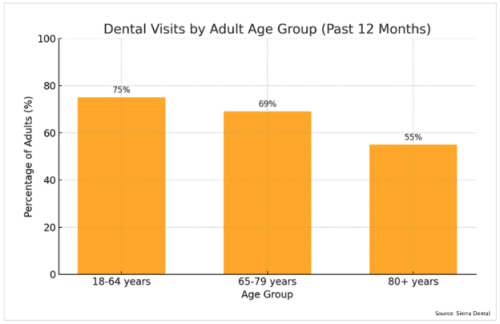

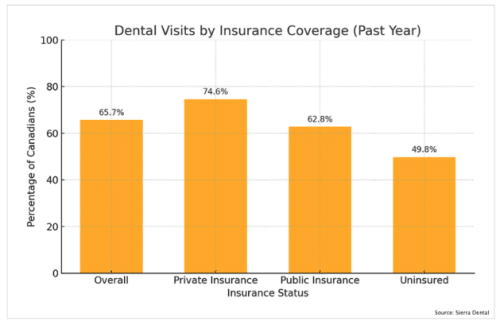

The dental industry is big business, and Canadians spent $16.4 billion on dental care in 2019 alone. This equates to an average of $461 per household per year – a significant increase over previous eras, even as the number of people with extended healthcare coverage (including dental) has increased. But with growing bills comes growing problems; research shows that a massive 24% of Canadians avoid visiting the dentist because of cost. And 32% of all Canadian households have at least one member who has foregone dental treatment because they couldn’t afford it.

Naturally, solutions have arisen to help those struggling with their dental costs, of which one popular option is a dental loan. A dental loan is just like any other form of personal loan, but intended to help borrowers cover the costs of oral healthcare. A lump sum can be secured from a lender, which is then used to cover dental care bills; the loan is then repaid over time. This helps people spread the cost of their dental work over time, rather than facing a single large bill at their dentist’s office.

Who can get a dental loan in Canada?

Eligibility for a dental loan varies by lender, but in general you need to be:

- Age of majority in your province

- With valid I.D. and proof of address

- And an active bank account

You may also need to pass a credit check and/or employment/income assessment – depending on the lender you choose and your exact situation.

What can a dental loan in Canada be used for?

A dental loan can be used for any valid dental procedure or service; there are no restrictions on use, or on which dental offices you can visit.

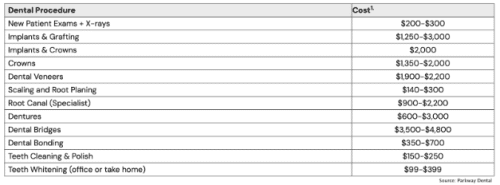

How much can I borrow with a dental loan in Canada?

Dental costs vary by provider, treatment type, and province. For example, the cost of a basic cleaning in Ontario can range from as little as $123 to as much as $495. Because of this variety, and the levels that some procedures, such as bridges and crowns, can reach, the amount available with a dental loan is flexible. As little as $300 to as much as $20,000 is available from many lenders – thus covering the costs of not just medically-necessary procedures such as root canals and dentures, but aesthetic dental procedures, like straightening, too.

Can I get a dental loan in Canada if I have dental insurance?

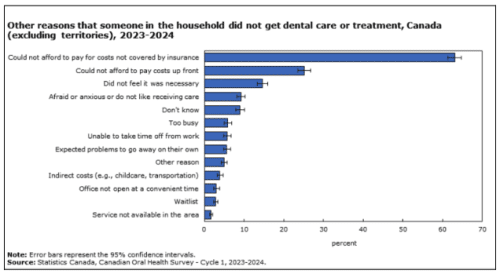

Unfortunately, having dental insurance is not a silver bullet against dental poverty; among those avoiding dental care, nearly two thirds could not afford the amount not covered by their insurance, and a further 25% could not afford to pay for their care upfront and wait for reimbursement from their insurer.

Fortunately, it is absolutely possible to get a dental loan if you have insurance. In fact, it may even make it easier – because if a lender knows that reimbursement is guaranteed by your insurer, it makes it more likely that you will repay your loan, and thus lowers their risk. But regardless of whether it’s to cover the interim until reimbursement, or to cover a non-reimbursible deductible, extended healthcare coverage that includes dental does not preclude you from obtaining a dental loan.

Does getting a dental loan in Canada affect my ability to qualify for CDCP?

The Canada Dental Care Plan (CDCP), launched in 2024, aims to help millions of Canadians with dental care costs; so far it has had over four million applicants, of whom two million have been approved to receive care. Its eligibility is fairly simple: you must be a Canadian resident, filing taxes in Canada, with a household income of less than $90,000, and no access to dental insurance of any kind. So, in theory at least, the program should assist many of those struggling most with dental affordability, and indeed 38% of those eligible for CDCP reported having previously avoided recommended dental care because of cost.

There are no requirements in CDCP that relate to the use of dental loans, so either using one in the past, or planning to use one in the future, will not in any way impact your eligibility for the program. This is good news, as even amongst those eligible for, or registered with, CDCP, there are limits to its utility. For example, only certain oral health providers can be used as part of the program – meaning that if you need to go to a non-CDCP-registered provider for any reason, you will need to pay for your care out-of-pocket. In addition, not every dental service is covered; you can find a full list of covered procedures here. And lastly, the program does not necessarily cover 100% of eligible costs – there may still be co-pay or additional charges. So even among those actively using CDCP, a dental loan can still provide vital financial assistance in times of need.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice