Compare Lenders

What is an Open Mortgage and How Does it Work?

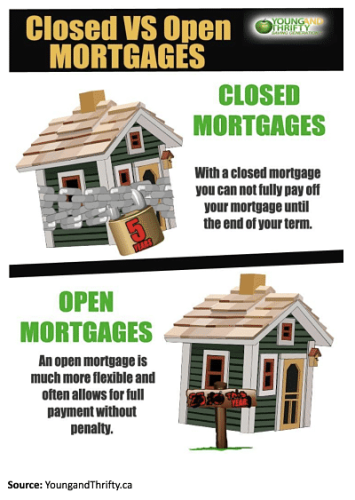

While most Canadians are aware of the difference between a fixed and variable rate mortgage, not as many of us are aware of the differences between an open and closed mortgage.

If you’re a homeowner with a mortgage, chances are pretty good that it’s a closed mortgage. Open mortgages just aren’t that popular in Canada. When you go to the bank to inquire about mortgage options, the bank probably will only present you with closed mortgages, but that doesn’t mean open mortgages aren’t worth considering.

Are you expecting a lot of money in the near future? If you are, an open mortgage may make sense. With an open mortgage, you can pay your mortgage in full if you so choose during your mortgage term without paying a penalty. But that freedom comes at a cost. You’ll typically pay a higher mortgage rate on an open mortgage versus a closed mortgage.

Why You Might Choose an Open Mortgage

If your mortgage is closed and you break it, you’ll pay a penalty. Not so with an open mortgage. For that reason, if you think there’s a good chance you could sell your home in the next year or two, you might consider signing up for an open mortgage. Although you’ll likely pay a higher mortgage rate right now, you won’t have to pay a mortgage penalty if you break your mortgage. This means you might come out ahead if you do end up selling your home.

Another time you might choose an open mortgage is when you’ve decided you’d like to switch lenders when your mortgage comes up for renewal. Many homeowners aren’t aware that it typically takes about a month to move a mortgage from one lender to another. (It usually takes about a couple weeks for the commitment package to be issued and all the lender conditions to be satisfied. It then can take another couple weeks for your mortgage to be transferred over to your new lender.)

If you have less than a month until your renewal date, but you’d still like to move lenders, you might consider signing up for an open mortgage with your current lender once your closed mortgage comes up for renewal. Although you’ll most likely have to pay a higher mortgage rate for the time being, the cost will likely be negligible if you switch to a lender a week or two later that’s offering you a mortgage at a lower mortgage rate.

You may be wondering why you’d sign up with an open mortgage in this instance. You’d do that because there isn’t a cost to breaking the mortgage. Even if you went with a one-year fixed rate closed mortgage at a lower rate, you’d have to pay a penalty to break it. This could negate any interest you were hoping to save at the new lender.

If the timing is tight on your mortgage renewal, you should contact your current lender and let them know that you’d like to renew with a mortgage with an open term. It’s a lot better than being stuck with a lender that you don’t like just because you don’t have enough time to switch lenders. (Keep in mind that not all lenders offer open term mortgages, so be sure to ask to find out if your lender does.)

More Articles About Various Mortgage Types

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice