Compare Lenders

What types of personal loans are available in Moose Jaw?

There are a lot of types of personal loan out there, and pretty much all of them are available in Moose Jaw. This includes installment loans, lines of credit, online loans, payday loans, bad credit loans, student loans, and car loans. The average Saskatchewan resident has $23,167 in consumer (i.e. non-mortgage) debt, which is the second highest level in all of Canada. And the data shows us that most of these locals have this debt spread across loan types; the average figures are $1,179 in credit card debt, $885 in student debt, $7,859 in other types of consumer debt, plus $24,741 in mortgage debt. So no matter your financial need, there is a personal loan product that'll suit your purpose, and chances are some of your neighbours already hold similar loans!

How can I use a personal loan in Moose Jaw?

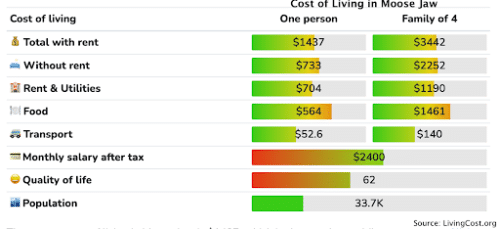

One of the reasons personal loans are so popular is their versatility; they can be used for almost anything. Car repairs, vacations, tuition, living costs, medical expenses, one-off purchases, debt consolidation. As long as you adhere to the basic repayment terms of your loan, you can use loan funds however you need. This is welcome news for Moose Jaw residents looking for that little extra help in a few places; although the cost of living locally is low compared to elsewhere in Canada, and about average in world rankings (for example, the average rent is just $945 per month and the average home price is $244,432), the rising cost of living and high interest rates are still squeezing budgets, for everyone.

What do I need to get a personal loan in Moose Jaw?

Everyone needs some basic paperwork in order to apply for any type of personal loan:

- I.D.

- Proof of address

- Bank account details

Once you have these in hand, you need to check with each lender to understand what extra items, if any, you may need for the loan you want to apply for. Some types of personal loan need minimal paperwork, while others require extensive financial documentation. For example, it's fairly common for lenders to request:

- Bank statements for the last 3-6 months

- Proof of income

- A credit check

And in some cases, lenders will ask to see even more, such as:

- Tax records for the past 2 years

- Employment details

- Proof of assets

- Details regarding existing debts

To make sure that you have the right paperwork for your loan application, check the lender's requirements before you start.

What credit score do I need to get a personal loan in Moose Jaw?

The average credit score in Moose Jaw is 642 - below the typical 650 threshold that banks and credit unions require of their personal loan applicants. Thankfully, many other types of lenders, including online lenders, have more flexible credit requirements. And some types of personal loan (such as payday loans) do not require a credit check at all. So if you have average or poor credit, you still have plenty of options.

Do I need to have employment income to get a personal loan in Moose Jaw?

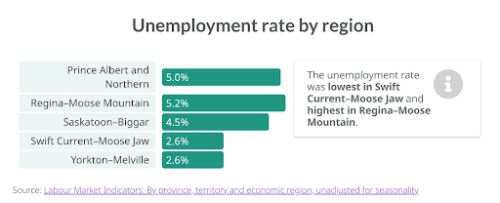

Some personal loans require proof of employment, and proof of a certain level of employment income. And as the average annual salary in Moose Jaw is $51,500, with the average household bringing in $90,800, the average employed borrower will easily pass most income requirements. However, employment stipulations are by no means the norm for every personal loan or every lender. Many will accept any form of income, as long as it is provable and regular - great news for the 21% of Moose Jaw residents who are seniors, and the 5.7% of Saskatchewan's working age population who receive some form of financial social assistance. And although the unemployment rate in Moose Jaw is extremely low at 2.6% - a significant drop year on year, and much lower than the national average - even those on unemployment benefits can qualify for certain small personal loans. The key, if you have any form of non-employment income, is to check lenders' small print, to find which companies will work with you.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice