Compare Lenders

Discover Popular Financial Services

When trying to borrow money for any reason - a mortgage, a medical bill, a car, debt consolidation, or something else entirely - most lenders will ask for a credit check. This is so they can assess your ability to pay the loan back. But what exactly do they look at?

What Is a Credit Report?

Your credit report contains your full Canadian credit history, which is a distillation of your financial past and present, and which helps the lender decide whether they want to work with you. It includes information about your income, your existing debts (including credit card debt and auto loans), your past debt repayment history (including any missed or late payments, as well as any positive payment history), your credit utilization ratio (otherwise known as your income to debt ratio), and so on.

All of this information is condensed into a three-digit number known as your credit score. This credit score is a quick reference tool for lenders and consumers alike, and each person's credit score (and wider credit history) is monitored and maintained by official credit agencies.

Credit Rating Agencies

In Canada, there are two credit bureaus: TransUnion and Equifax. While these are separate companies with their own algorithms, the inputs they use can broadly be distilled into the following categories:

1. Payment History

This is arguably the single most important factor affecting credit score, as lenders ideally want to see a history of prompt and full repayment. If a borrower has ever missed credit card payments or made late loan payments, their credit score is negatively impacted.

2. Outstanding debt

Most people carry some form of debt, such as mortgages, student loans, credit cards, auto loans, etc. While having outstanding debt is normal, it is the volume of debt and length of time it's held for that is gauged by reporting agencies. Borrowers with a large amount of debt month-to-month and/or who use more than 30% to 40% of their available credit limit will likely see lower scores.

3. Time

Simply put, lenders want to see a demonstrable history of credit use and timely repayment. The longer the borrower has had an open debt account and has been using it responsibly, the better the credit score.

4. Types of Debt

Borrowers who have just a credit card or a singular type of debt will likely have lower credit scores than borrowers who have multiple types of debt, such as a credit card and a personal loan (such as an installment loan). This is attributable to lenders favouring borrowers who are responsible with multiple different types of credit.

5. New Inquiries

When lenders or credit card companies complete a credit check, your credit score is (temporarily) adversely impacted. Therefore, applying for multiple different types of credit and/or loans within a short period of time is not advisable, as it signals that a borrower is either being rejected or is using too much credit.

Once all of these variables are synthesized, the output is your credit score. A credit score between 300 to 550 is generally considered to be poor, while scores of 650 or over are considered good.

How Does Bad Credit Happen?

Simply put, bad credit is a function of one or more of the following:

Missed or late credit payments

Credit cards that are regularly stretched to their maximal limits

Applying for too many loans within a short period of time

Defaulting on loans

How Is Your Credit Score Used?

At the most basic level, your credit score will be used as a litmus test to see if you pass your chosen lender's eligibility criteria. Each loan company has a minimum credit score for loan approval. However, beyond this your score is also used by the lender to determine an approved loan's terms, including interest rate, repayment schedule, whether they are comfortable issuing a secured loan or an unsecured loan, and so on. All of these factors dictate monthly payment levels.

Borrowers with higher credit scores are deemed to be more credit-worthy (i.e. less risky for lenders) and therefore enjoy privileges like easier loan approval, better interest rates, and more flexible terms.

How Does a Bad Credit Loan Work?

A bad credit personal loan is really any form of debt held by a bad credit borrower. They are typically provided in a lump sum, with terms that can vary from a few months to up to 3 to 5 years. The loan amount offered tend to be smaller than to those with good credit, and the terms (especially interest rate) tend to be harsher. This helps the loan companies offset their higher risk.

It is also important to note that the lending parameters for these types of loans are generally simpler than for other types of loan. Direct lenders who provide bad credit loans often do not require a complete credit check, instead asking for ID, financial documents, and income verification. This ensures that consumers who have a history of consumer proposals, credit counselling, restructuring, bankruptcy or other delinquencies can still be successful in obtaining a loan.

Secured Bad Credit Loans and Unsecured Bad Credit Loans

One way to obtain a bad credit personal loan is to use a secured bad credit loan. This is any type of loan where the loan amount is guaranteed or backed by a tangible asset. A mortgage is a secured loan, as it is backed by the property in question. An auto loan is secured against the car. A personal loan can similarly be secured against an asset, including a physical object such as a house or car, but also against a savings account or other financial vehicle. Bad credit lenders are more likely to provide good loan terms - including preferable interest rates - for borrowers who have some form of security, as this security lowers the loan company's risk in case of default. Unsecured bad credit loans lack this extra layer of comfort.

Open-Ended Credit Options in Canada

Another option for Canadians with bad credit seeking a personal loan is to utilize a "credit loan" or line of credit. Unlike other types of personal loan, a line of credit is open-ended. Rather than qualifying for a lump sum loan amount, payable at a set interest rate over a set period of time, in known monthly payments, a line of credit can be used sort of like a credit card. It has a maximum limit you can borrow up to, but you may utilize the available credit at any time, in whatever amount(s) you need. So if you are unsure how much you need to borrow, how long you'll need to borrow it for, or simply want an open-ended borrowing mechanism open to you, then this is a great option.

This solution works particularly well for those needing personal loans but with a chequered credit history. Many in this position are likely to benefit from the flexible nature of a line of credit, and it provides a welcome alternative to payday lenders and payday loans in times of emergency. As the interest rate only applies to the money actually borrowed, not the entire amount of credit that is available to you, it is often cheaper overall, and means you can avoid the potentially predatory lending practices of payday lenders.

Although technically lines of credit aren't personal loans at all, they are still available from many online lenders and bad credit lenders, and can offer more attractive interest rates than bad credit personal loans of a more traditional nature. This makes a line of credit one of the best bad credit loans for those unable to access secured loans, those worried about interest rates, or those looking to avoid payday loans.

How Do I Qualify For a Bad Credit Loan?

Typical qualification requirements include steady income from full time or part time employment (sometimes lenders have a minimum income requirement), being of age of majority in the province of residence, and no undischarged bankruptcy or consumer proposal on the borrower's file. Other factors may be considered, and each application is reviewed on a case by case basis.

Required Documents

When applying for both secured and unsecured loans in Canada, you will need to supply:

1. Proof of address and age

These documents serve to verify that the borrower is age of majority in their province, and a resident of Canada.

2. Existing Mortgages/Debts and Number of Dependents

This is to gain visibility into the borrower's existing obligations. In most cases, mortgages are senior to all other types of debt, meaning that if the borrower declares bankruptcy, mortgage providers get paid out first when assets are liquidated. Dependent information can either help or hinder your loan application, depending on circumstances. For example, some lenders consider child tax credit as a form of income.

3. Proof of employment

Most bad credit borrowers use unsecured loans, which means they are provided solely on the basis of the borrower's cash flows. This means that it is important to provide employment information, such as salary and length of time spent at the job.

4. Bank account information

Lastly, you will need to provide your bank account details so that the loan amount can be deposited into your account.

Once all of this information has been provided, the lender will assess the overall credit profile and come up with a maximum lending amount, rate and loan term. If this proposed loan structure is agreeable to the borrower, he/she then has to sign the documentation and the loan principal amount will be deposited into their personal bank account. Thereafter, the borrower has to repay the principal and interest at periodic intervals, as per the stipulated contract.

Advantages of a Bad Credit Loan

Accessible

While most personal loans offered by financial institutions require the borrower to come in and visit a specialist loan office, or at the very least complete a long application process, bad credit loans are usually available online and can be accessed easily by any Canadian with a Wi-Fi connection.

Easily Available

When pursuing loans for bad credit, consumers do not have to worry about their credit histories as lenders of these loans do not perform full credit checks. Bad credit loans are mainly lent out on the basis of monthly income.

Quick Approval

Conventional loans in Canada are generally slow in approvals and issuance, as their providers have to undertake a greater level of due diligence on financial and credit profiles before extending a loan. On the other hand, a bad credit loan can be approved within a few minutes and funds can be deposited within hours.

Credit Improvement

A bad credit loan can actually be used to improve credit scores. Once the loan is taken out, if borrowers show a consistent record of timely repayment, it can help boost their credit score, which then provides access to cheaper loans (via more competitive interest rate options) later down the line.

Versatile

Unlike many personal loans, which have to have a rationale provided by the borrower, a bad credit loan can be used for any type of expense the borrower deems fit.

Drawbacks of a Bad Credit Loan

There are, however, certain considerations that need to be evaluated before selecting a bad credit loan as a financing option. These include:

Endless Debt Cycle

Although bad credit loans are meant to be paid back at the end of the loan's term, their higher interest rates mean that borrowers may not be able to afford full payments and subsequently, have to get their debt rolled over into a new loan (which comes with its own fees).

Higher Rates

Bad credit loans have higher interest rates attached to them, making them a potentially expensive proposition. It's also worth noting that they may have prepayment penalties, as early payment reduces the lender's profits via interest.

Predatory Lending Practices

Although the regulatory landscape for bad credit loans has tightened in recent years, there is still potential for unsuspecting borrowers to obtain loans from predatory lenders who may not have the borrower's best interests at heart, and who charge hidden fees or exorbitant interest.

Focus on Payday Loans and Payday Lenders

It is easy to see why loans for bad credit borrowers get a bad reputation, as with fewer options, many struggling consumers turn to payday loan companies as a quick and easy way to borrow money. Payday loans tend to have much higher interest rates than other types of loans in Canada, and they are almost exclusively used by those with low credit scores. They are intended to be used as very short term solutions, and the monthly payments on these loans can quick escalate beyond what anyone can reasonably repay. This exacerbates the cycle of debt and bad credit, leaving consumers worse off overall. While each province now has rules for payday lenders, and have limits on how much they can charge in fees and interest, these loans should still only be used as short term patches e.g. for an emergency, rather than as a rolling form of personal loan.

How To Compare Lenders

The good news is that there are now many loan companies who offer solutions for those with poor credit. The options come in various forms: online lenders, private lenders, direct lenders, credit unions, and so on. Understanding which are the best bad credit loans may seem like an uphill challenge, but that's where the table above can help. Here you can analyze each lender's typical rates, loan amounts, and loan types to find what best suits your needs. This includes debt consolidation loans, credit check loans, installment loans, and much more. And to make life really easy, all have an online application form, and deposit the loan amount directly into your bank account, providing instant bank verification.

What The Numbers Say

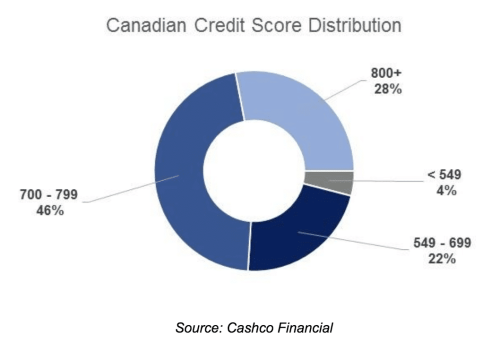

The chart below shows that nearly 50% of Canadians fall within the 700-799 credit score range. Also, over 25% of Canadians have a credit score below 699.

Bad Credit Loans Frequently Asked Questions

How Big of a Personal Loan Can I Get Approved for with Bad Credit?

Typically, bad credit loans can be anywhere between $500 and $5,000, but can go higher.

Can I Receive a Bad Credit Loan with a Previous Bankruptcy on My Record?

Yes, most bad credit loan providers offer financing even to borrowers with previous delinquencies, bankruptcies and consumer proposals. However, if the bankruptcy or consumer proposal are open (not discharged), it will make it extremely difficult to get approved for any kind of credit.

Do I Need a Downpayment for a Bad Credit Loan in Canada?

No, bad credit loan providers do not require any money to be put upfront.

What are the Consequences for Non-Repayment of Bad Credit Loans in Canada?

Most loan providers have financial penalties in place, which can add up quickly. Therefore, it is important to stay prudent with borrowing amounts and repay loans on time.

What Interest Rates Should I Expect for Bad Credit Loans?

You can expect a worse interest rate, possibly starting at about 20%, but this can rise much higher.

If you can improve your credit score, you should be able to access loans starting at about 7%. Banks will usually reject borrowers with bad credit, while alternative lenders will issue the loans, but will charge higher interest rates. If your credit score falls into the “bad†category, you can expect the APR to be somewhere between 20% and 50%. Remember to read your contract carefully, and ask the lender questions to ensure you have full understanding of the cost of your loan, and repayment terms.

Will a Bank Give Me a Loan with Bad Credit?

The biggest banks in Canada have tightened their credit-issuing requirements. If you have bad credit, it will be difficult to get a loan from the big banks.

There are still many reputable lenders that will offer bad credit loans. The unfortunate reality is that the banks are not among these lenders.

Where Does Offer Loans for Bad Credit?

There are many providers within Canada that offer loans for bad credit consumers; the list at the top of this page highlights some of the most trustworthy of these loan companies. Not every lender will work with every borrower, as each person's situation is different, and each lender may have their own set of eligibility criteria. But in general, bad credit is not a barrier to approval for the companies named above.

Can I Trust Lenders Offering Bad Credit Loans with No Credit Check and Guaranteed Approval?

Generally speaking, you should be careful with personal loans in Canada with no credit check. There are some lenders who don't check your credit and (almost) guarantee approval that are reputable.

If you want to find a lender that doesn't check your credit score, go with a trusted option. The online world may contain dangerous loan-related scams, so you should be suspicious of lenders with unverifiable reputation. Legitimate lenders will never ask you to pay upfront for a loan. They will also never ask you for personal information before you've sent an application.

If a lender doesn't ask you any of the above and is an accredited, legitimate business, you won't have any problems. With basic due diligence, finding a trustworthy lender is not difficult.

What's a Direct Lender?

A direct lender is any loan provider that provides financing to consumers, without the aid of a third party or intermediary. Just like the companies mentioned above!

How Do I Find Out If I Have Bad Credit?

Finding out your credit score is easy; anyone can request their full credit history at any time from one of Canada's official credit bureau (Equifax or TransUnion). Or consumers can use a third party credit check company. When searching for loans in Canada, knowing your credit is an important first step in understanding your chances of approval and your potential interest rate.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice