Compare Lenders

Quick Links

- Are Online Loans Safe?

- Online Personal Loans vs. Payday Loans

- Requirements for Loans Online in Canada

- The Application Process for Online Loans in Canada

- Potential Uses of Online Loans

- Tips for Choosing the Right Loans Online

- Is It Possible to Get Loans Online with No Credit Check?

- How Do I Calculate the Cost of an Online Loan?

- Factors to Consider When Applying for Loans Online

- How To Improve Your Chances of Approval for an Online Loan in Canada

- How Do I Get an Online Loan Quickly?

- Frequently Asked Questions About Personal Loans Online

Are Online Loans Safe?

Applying for an online loan is safe, so long as you choose the right lender.

If you choose a reputable online lender with responsible lending practices and robust security features, such as bank level encryption, you can be sure the entire process will be both hassle free and safe.

Many online loans are available in a very short amount of time - usually just one business day. Because of how fast they are, a financial company that offers online services is often a competitive alternative to a payday loan.

However, as is the case with payday loans - including online payday loans - you should pay attention to the terms in an online loan agreement. This is crucial to keeping yourself safe, as well as ensuring that you are able to make the terms regarding loan repayment work for you.

Online Personal Loans vs. Payday Loans

In many ways, personal loans that are available online are similar to payday loans. Both are:

- Widely available online, with application processes that take just minutes to complete

- Popular methods for borrowers to access money fast

- Short term loans

- Typically used to meet unexpected financial challenges

- Have a streamlined approval process - sometimes even relying on an automated system for approval

Despite these many similarities, there are some important differences between the two, which are important to understand if you are trying to choose between them.

Payday Loan or Online Payday Loan

Payday Loan

A payday loan - whether accessed online or in person - is a short-term loan, often called a "cash advance" or a "pay check loan". They typically have lower borrowing amounts and higher APRs than other types of loans. And they're called payday loans for a reason: they are meant to be used as bridging funds until the borrower gets their next pay check. As soon as the next pay check comes, the intent is that a payday loan is totally paid off.

Online Personal Loan

Online personal loans, on the other hand, have more variety and flexibility. You can get a small personal loan quickly, with a short term, or you can take out a larger personal loan to finance a larger purchase, like a new car. Both options are available online, and both are types of online personal loan.

Online personal loans can range from a few hundred to many thousands of dollars, and typically have terms of a few months to five years. But in the end, all online personal loans are relatively short term and meant for one individual.

An online loan provider will want to see your credit score, and possibly some other financial information, in order to determine the level of financial assistance they can provide you.

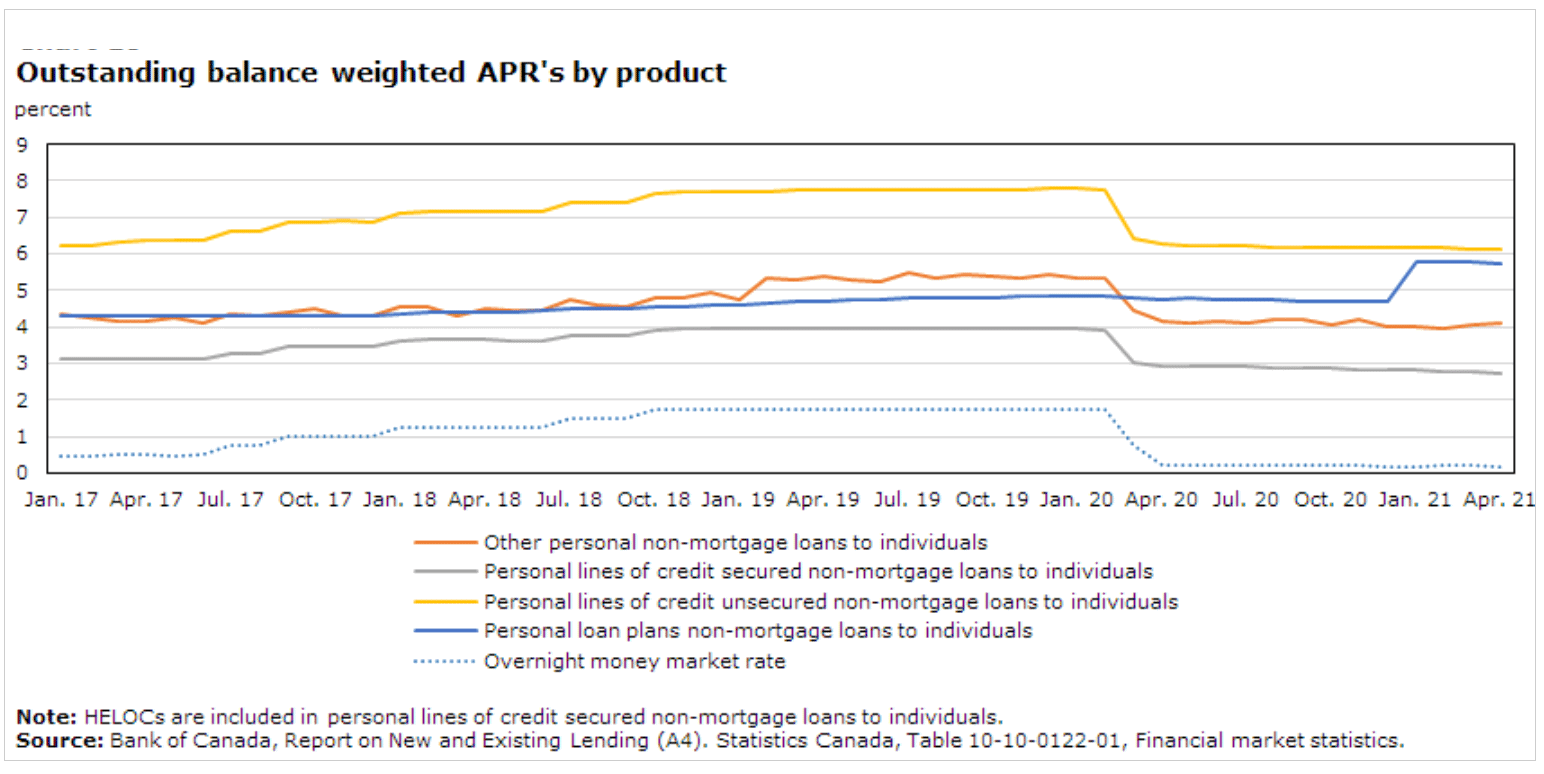

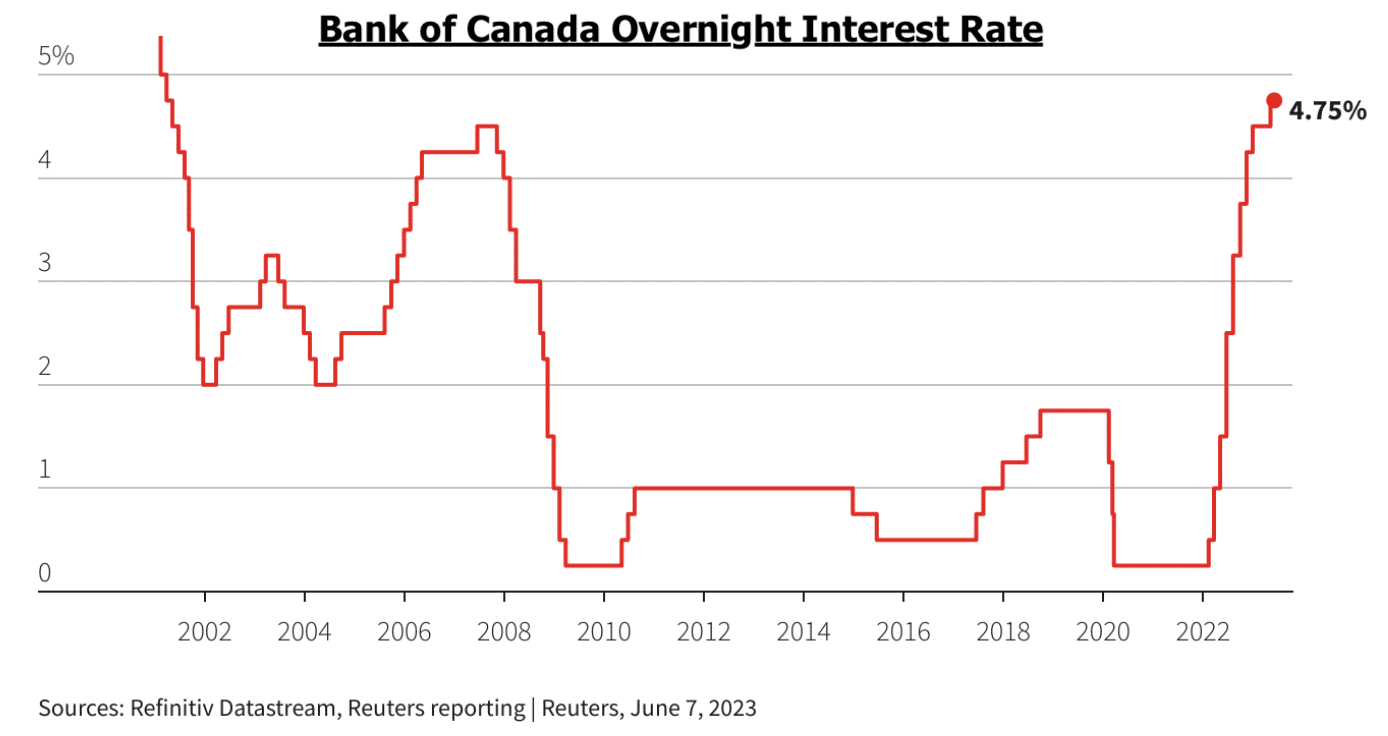

"With interest rates remaining at record lows throughout 2020, interest expenses on existing non-mortgage liabilities fell along with obligated payments of principal. Those borrowers with variable rate products or those able to refinance or consolidate the money they borrow at lower rates were able to reduce their interest costs and potentially direct a larger share of their overall debt servicing to reducing their outstanding principal." - StatsCanada

Requirements for Loans Online in Canada

Understanding the requirements and eligibility criteria for various types of loans in Canada is crucial for a successful online loan application. In this section, we will outline the common criteria that lenders consider when approving loans, including credit checks loans and easy online loans, and discuss how factors like repayment schedule and your cash flow impact eligibility.

Credit History

Most lenders will want to assess your credit history to determine your creditworthiness. Canadians with a good credit score are more likely to be approved for loans, and to qualify for lower interest rates and more favourable loan terms.

However, there are lenders offering loans to those with poor credit; just bear in mind that bad credit borrowers are usually subject to higher interest rates and stricter repayment terms.

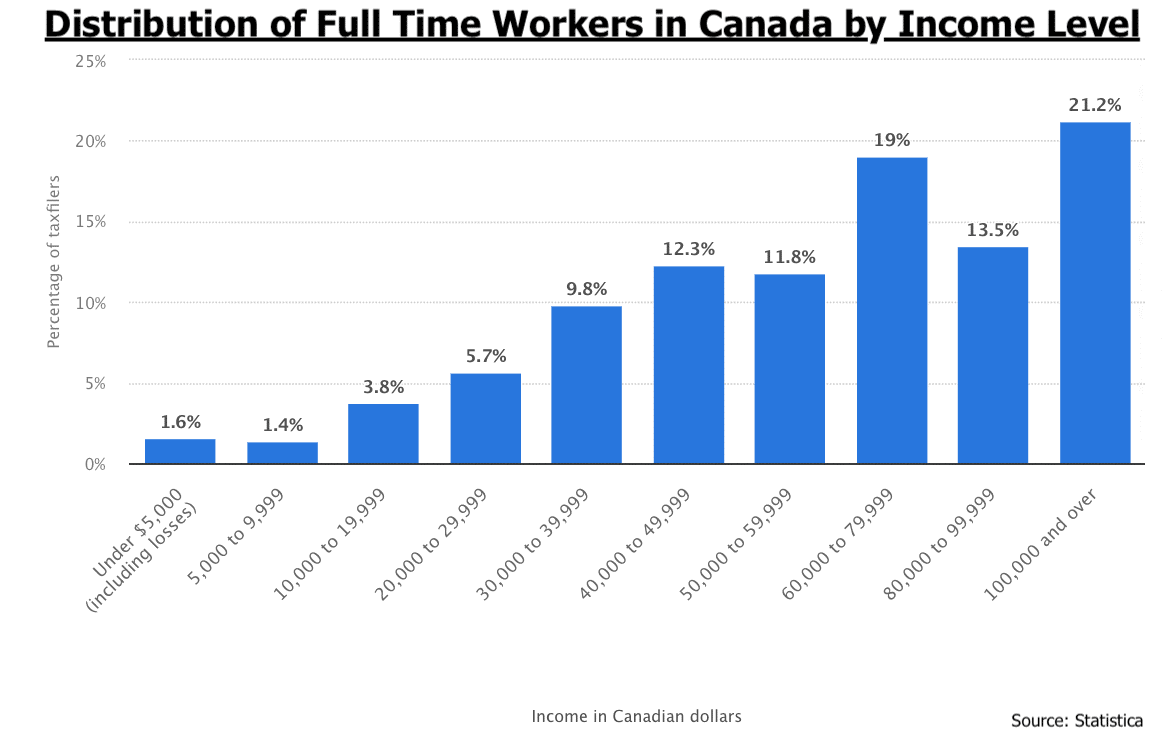

Income and Employment Status

Lenders will assess your income and employment status during the application process to ensure you have stable cash flow and the ability to repay the loan. A consistent income, preferably through direct deposit, is often a requirement for approval.

It's worth noting that income does not have to be employment income; those receiving regular payments via benefits, such as the child tax benefit, or from another source such as a private pension, are still considered as having income.

Debt-to-Income Ratio

Your debt-to-income ratio is another important factor that lenders consider. This ratio helps lenders determine your ability to manage your current debt payments and the unpaid balance of any new loan. A lower debt-to-income ratio increases your chances of being approved. In order to take on additional debt, a lender essentially has to be convinced you can afford to repay it.

Age and Residency

To be eligible for loans in Canada, you must be at least 18 years old and a resident of the country. Some provinces, like Nova Scotia, British Columbia, and Prince Edward Island, may have specific regulations and requirements for loans within their jurisdiction.

Bank Account and E-Transfer

Having an active bank account is essential for receiving funds from lenders, as many use e-transfer for quick and secure money transfers. Additionally, lenders may require that loan payments be automatically withdrawn from your account.

Required Documents

The documents required for a personal loan application vary depending on the lender and loan type. Common necessary documents include:

- Proof of identity

- Proof of address

- Proof of income

- Savings or checking account information (via bank statements)

Be prepared to provide these documents during the application process to ensure a smooth and efficient approval.

Repayment Ability

Your ability to repay the loan on time is critical for approval. Lenders may assess your cash flow and repayment schedule to determine if you can comfortably repay the loan by the next payday, or within the agreed-upon timeframe.

Preparation Makes a Big Difference

Before applying for any online loans in Canada, it's essential to carefully review the eligibility criteria of your chosen lender, and to gather all necessary documents. Comparing the loans and their terms will help you make an educated decision on the right loan for you, which best suits your financial needs.

Keep in mind that late payment fees can be costly, and may impact your credit score, so always ensure you can commit to the repayment terms before accepting any financial assistance. By understanding the requirements and eligibility criteria, you'll be better equipped to navigate the application process and secure the cash you need fast.

The Application Process for Online Loans in Canada

The online application process for loans in Canada is designed to be straightforward and efficient, allowing borrowers to access funds quickly in times of financial emergency. In this section, we will discuss the steps involved in applying for various types of loans, including installment loans and cash loans, and how factors like credit status, interest rates, and repayment schedules play a role in the process.

Step One: Choose Your Loan

When looking for online loans in Canada, it's essential to determine which personal loan best suits your needs. Installment loans are a popular choice, as they allow borrowers to repay the loan amount in small, scheduled payments over a longer period. Cash loans and online payday loans, on the other hand, are often smaller and designed to be repaid quickly, typically within just a few weeks.

Make sure that the personal loan you're considering provides the financial support you need, without adding to your long term financial challenges.

Step Two: Check Your Eligibility

Before applying for an online loan, make sure you meet the lender's eligibility criteria. Lenders may consider factors such as your credit score, income, employment status, and debt-to-income ratio. Many have requirements regarding the documentation you must provide during the application process, so be sure you have all the necessary paperwork or can source it.

Those with bad credit or other limiting factors may not have as much choice when it comes to available online loans, and may find they fall at the eligibility hurdle for some. However, there are still plenty of loan options, regardless of your situation. For example, bad credit loans are available all across Canada.

Step Three: Submit Your Loan Application

The online loan application process is typically quick, and can be done entirely online. Many online lenders have some of the industry's fastest tools, including streamlined systems that mean the application takes just minutes to complete, and is then approved or declined via an automated system. This can mean you get a decision on the same day.

Remember that you'll need to provide personal and financial information, such as your name, address, Social Insurance Number, employment details, and income information, when you apply. Some lenders may perform credit checks through credit bureaus to assess your creditworthiness and determine the loan amount and terms they can offer.

Step Four: Review the Loan Offer

Once your application has been reviewed, the lender will present a loan offer, which includes details on the approved loan amount, annual percentage rate (APR), interest rate, payment schedule, and any applicable fees. It's crucial to carefully review all the fees and terms to ensure you understand your repayment obligations and can afford the loan.

Step Five: Accept the Loan Offer and Receive Funds

If you agree to the loan offer, you'll need to sign a loan agreement, and the lender will deposit the money into your account. Many online lenders offer instant loan approval and can transfer funds within a few hours, or on the next business day.

Step Six: Repay the Loan

Make sure to follow the payment schedule outlined in your loan agreement, which may include pay frequency and repayment amounts. Late or missed payments can result in additional fees and negatively impact your credit score. Some lenders may offer flexible repayment schedules or the option to pay off the loan early without penalty.

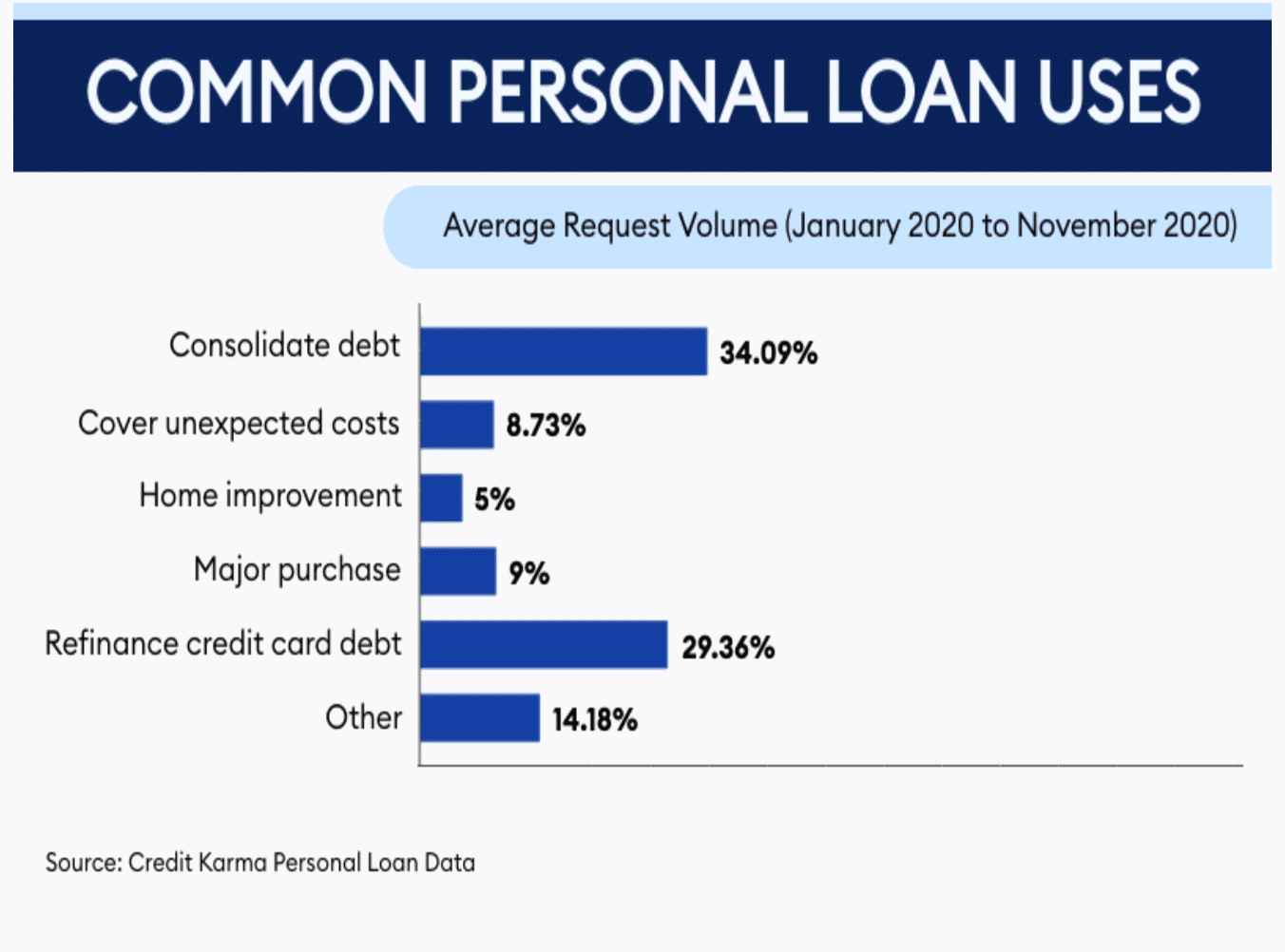

Potential Uses of Online Loans

As mentioned above, online loans can be a quick and efficient solution when you need financial assistance - for any reason. Most online loans (aside from those that are purpose-specific, like an auto loan) have no restrictions on what they can be used for. This makes them useful for:

- One-off unexpected expenses of any kind

- Medical expenses

- Car repairs

- Rent, utilities and other running expenses you are struggling to meet

- Debt consolidation

And so on. Even if you have bad credit, quick access to the cash you need is available across Canada.

Tips for Choosing the Right Loans Online

Selecting the right loan can be a daunting task, but by following these tips, you can make an informed decision that best suits your financial needs. Whether you're considering a personal loan in British Columbia, Nova Scotia, or anywhere else in Canada, these guidelines will help you find the best option:

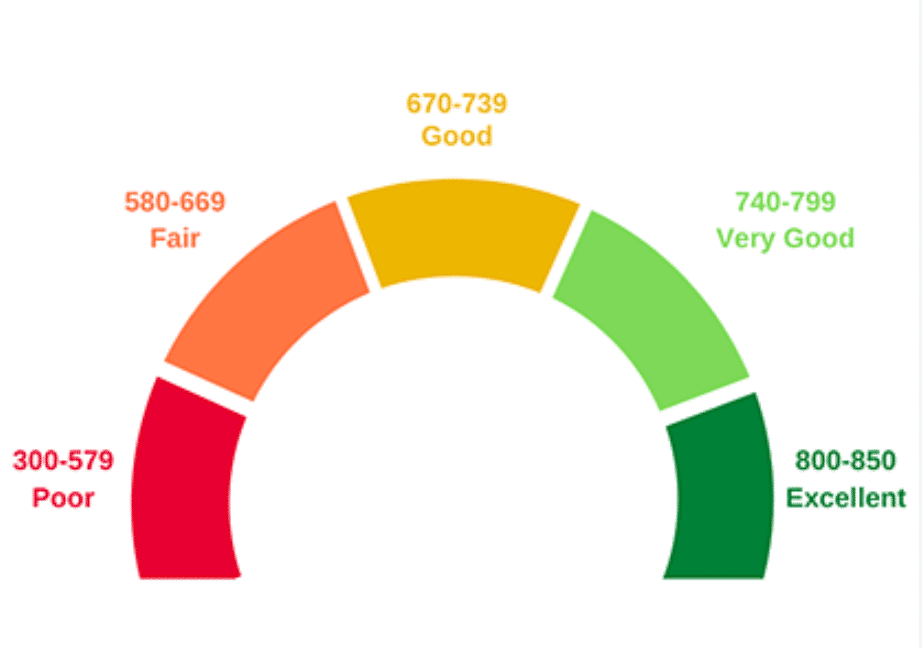

1. Check Your Credit Score

Your credit score is a crucial factor in determining your eligibility for a personal loan. Knowing your credit score before you begin will help you to understand the online loans you are likely to be approved for, and what interest rates you can expect. Some lenders cater to borrowers with good credit, while others offer bad credit loans to those with lower credit.

2. Assess Your Financial Needs

Before applying for any personal loan, evaluate your financial situation and determine the purpose of the loan. Consider the amount you need to borrow, the ideal repayment period, and the monthly payments you can comfortably manage. This will help you narrow down the types of loans suitable for your needs.

3. Compare Lenders

Once you know what types of online loans will suit your purpose, you need to take the time to research and compare lenders. Before applying for an online loan, search out reputable loan companies with positive customer reviews, transparent loan terms, and competitive interest rates. Comparing lenders will help you find the best loan option that aligns with your financial needs and goals. It will also ensure you avoid hidden fees and other issues that may derail your financial plans further down the line.

4. Understand the Loan Terms

Before you apply online, carefully review the personal loan terms and conditions, including interest rates, fees, repayment schedule, and penalties for late or missed payments. Ensure you understand the total cost of the loan and your responsibilities as a borrower. Same day funds may be attractive in an emergency, but unless you take the time to check the personal loan terms, you are at risk of endangering your financial health.

5. Check for Pre-Approval Options

Many lenders offer pre-approval options, allowing you to check your eligibility for a loan without impacting your credit score. Pre-approval can give you an idea of the loan amount, interest rate, and terms you may be offered, helping you make an informed decision before committing to a loan application. This is an especially useful option for those shopping for bad credit loans, as finding the best rates can feel antithetical to ensuring you are approved for a personal loan when you have bad credit.

6. Consider Flexible Repayment Options

Look for loans online that offer flexible repayment options, such as the ability to choose your payment schedule (e.g. to line it up with your income, you may want to make repayments semi-monthly), or the ability to make additional payments without penalties. This flexibility can help you manage your loan more effectively and potentially save on interest costs over time.

7. Read the Fine Print

Before signing any loan agreement, read the fine print to ensure you understand all the terms and conditions. Look for hidden fees or clauses that could impact your ability to repay the loan or result in additional costs. This may be particularly important for those who already have bad credit, as failure to meet the personal loan agreement will result in further damage to your credit score.

8. Seek Professional Advice

If you're unsure about which personal loan option is best for your financial situation, consider seeking professional advice from a financial advisor or credit counsellor. They can help you assess your financial needs, understand the personal loan options available, and guide you in making the right decision.

By following these tips, you can confidently choose the right personal loan that meets your financial needs and helps you to achieve your goals. Remember that responsible borrowing and timely repayment are crucial to maintaining good credit and ensuring future borrowing opportunities.

Is It Possible to Get Loans Online with No Credit Check?

Yes, some online lenders will give you a loan without checking your credit.

You can expect worse terms if you don't get your credit checked. If you're not sharing your credit history with a lender, it will be assumed that you have bad credit or a limited credit history. Neither of these situations will look attractive to either a payday lender or an online lender. So while no credit check personal loans do have fast application processes and may even offer same day funds, they're

How Do I Calculate the Cost of an Online Loan?

Several factors go into calculating the cost of a loan online. Your credit score will often play a large part in determining your total cost. But factors such as collateral, income level, debt level and so on may also play a part.

Online loans aren't always so simple to calculate yourself. This is why we created an online personal loan calculator. Check here to find out what the personal loans you are considering will cost you.

Factors to Consider When Applying for Loans Online

1. Your Credit Score Determines Your Options

Your credit score is the first thing that most lenders will look at. Your score will determine your interest rate, APR, and whether that particular lender will want to do business with you in the first place.

2. Extra Costs

Not all costs associated with personal loans are immediately visible. Make sure you account for administration fees, early repayment fees, and any other extra fees.

3. Pre-Qualification

A lender will typically pre-qualify you as a first step, before giving you a loan. This generally involves you filling out a form asking you for information on your:

- Credit score

- Occupation

- Income

- Current debt levels

A lender will perform a hard pull on your credit score to see your credit history. This, along with the information listed above, will determine how risky they perceive you as a potential borrower.

If you pass the lender's pre-qualification test, you will be invited to apply for a loan. They will ask for more information at this stage. Then, if approved, they will send you the loan's terms - which you must accept before any funds will be released to you.

How To Improve Your Chances of Approval for an Online Loan in Canada

Review Your Credit Report

Your credit score plays a significant role in the loan decision-making process. Before applying for a loan, check your credit report for inaccuracies or outdated information. Addressing any discrepancies can help improve your credit score and increase your chances of being approved.

This is actually something you can do anytime, so that you're not waiting for your report to be updated before you can apply for a loan. In some cases this may not make a difference, but if you need the loan for a medical emergency or something similar, you'll be glad you didn't wait to ensure your credit report was accurate.

Pay Down Existing Debts

Paying down your outstanding financial commitments can lower your borrowing-to-earning ratio, which lenders consider when reviewing your loan application. Paying down existing money that you owe will demonstrate your ability to manage and repay loans, making you a more attractive borrower and more likely to be approved.

Maintain Steady Employment

Stable employment and income are essential factors in getting approved for loans. A consistent employment history signals to lenders that you have a reliable source of income to repay the loan funds.

Save for a Down Payment or Collateral

While not all loans require collateral, providing it can improve your chances of being approved. For instance, when borrowing for a significant purchase, like a car or home, a down payment demonstrates your commitment to the loan, and reduces the lender's risk. It also means you'll need to borrow less money.

Apply for the Right Loan Type

Evaluate your financial needs and choose a loan type that best suits your situation. Whether it's a cash advance or a personal loan, selecting the appropriate instrument will help you avoid unnecessary inquiries and potential rejections.

Compare Loan Offers

Before you apply online, research various lenders in your area, such as those in Nova Scotia, British Columbia, and Prince Edward Island. Some lenders are available across Canada, while others are more local. Compare interest rates, loan terms, and fees to find the offer that aligns with your financial goals.

Prepare Documentation

Gather all necessary documents and information before starting your loan application. This includes proof of income, identification, and banking information. Having these documents ready will expedite the application process and minimize delays.

Limit Loan Applications

Submitting multiple loan applications in a short period can negatively impact your credit score. Limit the number of applications you submit, and only apply for loans you believe you have a high chance of being approved for.

Opt for a Co-signer

If you have a low credit score or limited credit history, consider asking a friend or family member with good credit to co-sign your loan. A co-signer can increase your chances of being approved by sharing the responsibility of repaying the loan.

By following these steps, you can improve your chances of obtaining personal loans with favourable terms, such as a low interest rate or flexible repayment schedule. Once approved, make sure to repay the loan on time to maintain a positive credit history.

In most cases, lenders can offer an instant decision and fund the loan via e-transfer or Interac e-transfer, allowing you to access funds quickly and efficiently.

How Do I Get an Online Loan Quickly?

Most online lenders are typically quite fast. They can replace payday lenders in many cases. Should you pre-qualify for a loan, you should be able to apply for one and receive it quickly.

The loan application process has become very streamlined and efficient. So, when you've found a reputable lender, all you have to do is apply. As always, the higher your credit score is, the more options you will have.

Frequently Asked Questions About Personal Loans Online

How do I apply for an online loan in Canada?

Getting a loan online is simple in Canada. Once you've chosen your lender, you just need to submit an online application. A loan application is typically very easy to complete and should only take a few minutes. You will usually need to provide:

- Your personal information

- Data about your income and employment

Do I need to upload any personal documents when applying for a loan online?

Yes, you will always need to provide at least a few personal documents. When applying for a loan online, you will need to provide government ID and proof of your income. This might include bank account statements or pay stubs. You may also have to give them permission for a credit pull or provide a credit report - though some online lenders can approve you for a loan without checking your credit.

Some online lenders will require more paperwork than this. If they do, they will make it clear when you click through to their online application. If you are worried about security, check the lender's systems to ensure they provide bank level encryption to protect those applying for their personal loans.

Do I need to be employed to get a loan in Canada?

Getting a loan is tougher if you're unemployed. Even newly hired employees represent more risk, that makes lenders think twice about whether to loan them money. The crucial thing to remember is that a lender is looking for proof that you will be able to pay them back.

Self-employed individuals, those with temporary incomes, or those on government subsidies can still apply for loans, but they must show evidence that they will be able to make their repayments.

How much money can I borrow online?

The amount of money you can borrow online is based on a lender's assessment of your finances. as well as the type of loan you are looking for. If you have a strong, stable income, you can qualify for a loan of up to $40,000. If you are looking for a business loan, it can be as high as $500,000.

If you have bad credit, you can still borrow money via bad credit loans. Just remember that lenders will usually loan you less money than if you had good credit, and the interest rates charged will be higher.

Can I use a personal loan for medical bills?

How you use the funds released via personal loans is not restricted, so if you need money to cover medical expenses, an online personal loan is absolutely suitable for this purpose. Just be sure that any funds you apply for - whether in the form of personal loans or other types of loan - you can repay.

Expert Review & Editorial Standards

This page was researched, written, and reviewed by financial professionals with expertise in Canadian lending regulations. All information is regularly updated to reflect current rates, terms, and regulatory changes.

About Smarter Loans

Canada's independent lending comparison platform since 2016. Trusted by over 2 million Canadians and recognized by the Toronto Star as "the GPS of FinTech Lending." Featured in the National Post and major Canadian publications.

Our Editorial Process

Every page undergoes research, expert writing, fact-checking, and review by our Financial Content Director. We verify all rates, terms, and regulatory information against official sources including FCAC guidelines and provincial lending regulations.

Last Updated: November 17, 2025 | Next Review: Ongoing monitoring

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice