Frequently Asked Questions About Low Interest Personal Loans

What’s the best interest rate I can get on a loan in Canada?

Interest rates in Canada can range from just a few percent to over 50%, depending on the type of loan you get, where you get it from, and your personal financial circumstances. The lowest interest rates tend to be reserved for the most qualified borrowers, who may be able to get a personal loan for as little as 4% interest. The eligibility criteria for these very low rate loans are strict though.

How do I qualify for a low interest loan in Canada?

Qualifying for a low interest loan means meeting the requirements of your chosen lender. Every lender is slightly different, but to get the best rate most will want to see:

- ID

- Proof of residency

- Proof of employment and income level

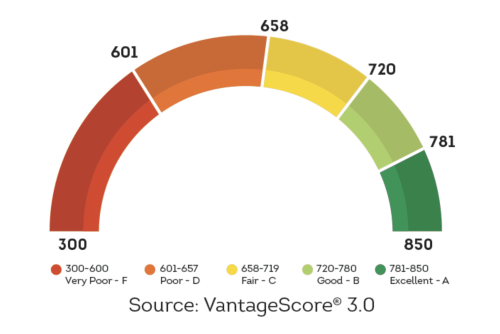

- A credit score of over 600

- Your existing debt profile

If you meet these criteria, you will be able to access the cheapest possible loans. However, you’ll still have options even if you don’t have a great credit score or high income - it’ll just cost you more.

How much can I borrow with a low interest loan in Canada?

Loan amounts from just a few hundred dollars to $50,000 (or sometimes more) are available throughout Canada, but how much you can borrow will depend on the type of loan you choose, the lender you get it from, and your personal details (including credit score, income, and so on). Those with excellent credit and high income not only qualify for the best rates, they also qualify for the most borrowing room too, while those with less ideal circumstances may be limited by what a lender feels comfortable with.

What credit score do I need to get a low interest loan in Canada?

Credit score can be a deciding factor in many loan approvals, but the exact score you need (and even whether a credit check is performed) depends on the lender you go to. Banks and credit unions require a minimum score of 600 to proceed with a loan. Other lenders, including many alternative and online lenders, have more flexible criteria, and may be willing to accept a credit score of less than 600 if you have extenuating factors (like no other debts, collateral, or high income). But be aware though, the lowest loan rates are reserved for those with the best credit score.

Where’s the best place to get a low interest loan from?

The best place to go for your low interest loan will depend on your exact needs. Is interest rate the most important factor for your loan, or does the borrowing amount available come into play? Do you need the loan as quickly as possible, or can you afford to wait a few weeks? Do you want to be able to apply online, or can you go into a branch? All of these elements will dictate which lender (and loan type) is best suited to your needs. You need to find a lender who can offer what you need, for a price you can afford, and whose eligibility criteria you meet.