Compare Lenders

What kind of personal loan can I get in Mississauga?

Mississaugans have access to many different types of loans, and aren’t afraid to use them. The average revolving debt (credit cards and lines of credit) held by a local is $12,234, and the average installment debt (personal loans, auto loans, etc.) is $17,288. There are other types of loans on offer too, including student loans, bad credit loans, payday loans, and much more. So knowing what you need cash for, and how much you need to borrow, is an important first step in choosing the right type of personal loan in Mississauga for you.

How much can I borrow with a personal loan in Mississauga?

Mississauga lenders can offer anything from $300 to $35,000 (or sometimes even more) with their personal loans, but the exact amount any single individual can borrow will be dictated by three things:

- Their financial circumstances (credit score, income level, debt levels, etc.)

- The lender they apply to

- The type of loan they choose

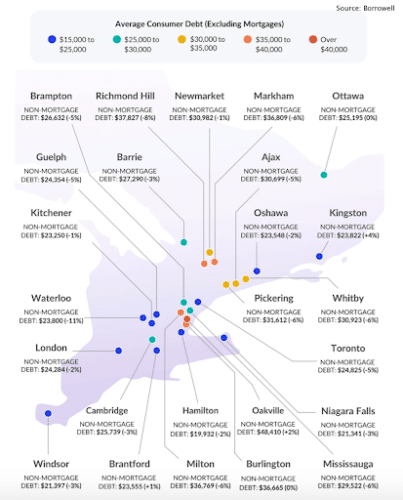

Unsecured personal loans have lower borrowing limits than secured loans, and those with good credit or high income are more likely to be able to borrow large amounts. Currently, the average consumer in Mississauga has $23,000 in unsecured consumer (i.e. non-mortgage) debt.

What credit score do I need to get a personal loan in Mississauga?

Your credit score can have a big impact on the types of loan you qualify for, the lenders that will approve you, and the cost of your borrowing. Most Mississaugans are in a great position when it comes to credit – the average credit score across the city is an impressive 695, which is higher than both the national and provincial averages, and only just shy of downtown Toronto’s average. This is easily enough to pass even the most stringent of credit thresholds for personal loans, set by banks at 650.

But if your credit score is lower than this, don’t despair. There are many lenders, including online and alternative lenders, that have lower credit thresholds. There are even some types of personal loan that do not require a credit check at all. So everyone has some options for borrowing in Mississauga, regardless of their credit score.

How much do I need to earn to get a personal loan in Mississauga?

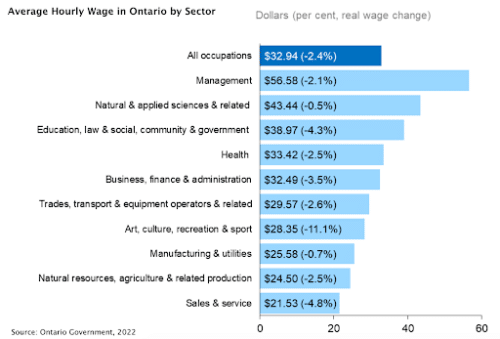

Mississauga enjoys a high level of pay, with the median household income sitting at $102,000. But a six-figure salary is not necessary when applying for a personal loan. What is necessary is that you can demonstrate your ability to make loan repayments; this relies more on your debt utilization ratio than it does on outright income.

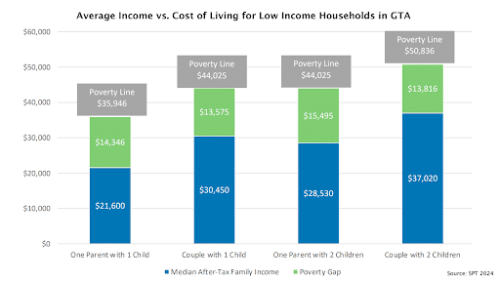

Here’s how it works: most lenders will ask to see proof of income, as well as information on your existing debts. They will then calculate how much they think you can afford in new loan repayments; if the loan you have applied for falls within this affordability window, you are likely to be approved. If it doesn’t, then you may need to consider either a smaller loan, different loan terms, or a different lender. But crucially, there is no set income threshold that everyone must meet in order to get a personal loan, so even those on low incomes have some options.

Can I get a personal loan in Mississauga if I already have a mortgage?

Already having one type of loan does not necessarily mean you can’t get another; many Canadians have mortgages, and personal loans, and credit cards, and lines of credit. And given that the average property price in Mississauga is just over $1.3 million, with over 70% of the population owning their own home, it’s unsurprising that the majority of locals have big mortgages. If you’re one of them, the existence of your mortgage will not affect your ability to get a personal loan – but the cost of it might. As mentioned above, lenders want to be sure borrowers can afford new loan repayments, so if your mortgage eats up all of your income every month, then they may deem you to have insufficient funds to afford a new personal loan on top.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice