Compare Lenders

Discover Popular Financial Services

What can a personal loan in Kitchener be used for?

Personal loans can be used for almost any expense, including: medical bills, utility bills, day-to-day living expenses, travel, weddings, vacations, car repairs, car purchase, home repairs, emergency expenses, and one-off purchases. Unless you borrow via a use-specific personal loan (like an auto loan), then there are no restrictions on how you can use loan funds.

How much can I borrow with a personal loan in Kitchener?

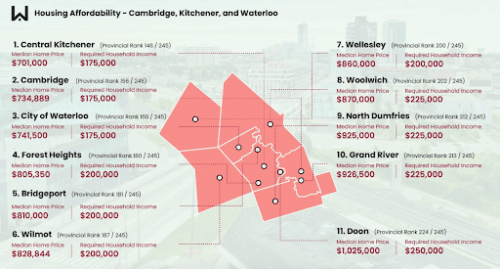

Personal loans are in theory available in amounts ranging from $300 to $35,000 (and sometimes more), but the amount you will qualify for depends on your financial circumstances, the lender you apply to, and the loan type you choose. The average Ontarian has $20,165 in student loans, $21,717 in car loans and $13,986 in personal loans. If you need to borrow a large amount, then you might want to consider a secured personal loan. Secured loans can be for larger amounts than unsecured loans; this is one reason home equity loans and lines of credit are so popular across Kitchener, where 60% of homes are owned and the average property value is $877,884. By leveraging a valuable asset, like your home, you are more likely to be able to borrow more.

What credit score do I need to get a personal loan in Kitchener?

The average credit score in Kitchener is 679, just slightly higher than the national average of 672. Most traditional lenders, like banks, have a minimum credit score requirement of 650. But many other lenders have differing credit requirements; some accept borrowers with credit scores of 600 and above, others specifically accept borrowers with bad credit (560 or below), and some don't require a credit check at all! As a starting point, you should know your credit score, so you can determine which lenders and loan types you are most likely to qualify for. If, like the average Kitchener resident, you have good credit, then you'll have lots of options. But if you have lower-than-average credit, you'll still have plenty of choice - you just may need to shop around a little more.

What employment income do I need to get a personal loan in Kitchener?

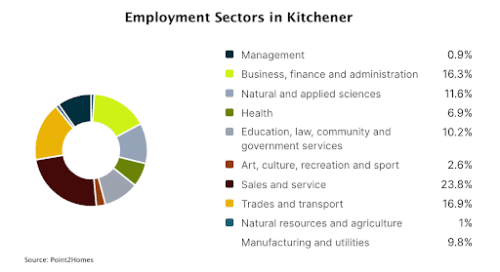

The median household income in Kitchener is a healthy $104,300, but you don't necessarily need to have that much in order to qualify for a personal loan. Each lender will have their own income requirements, and their own way of assessing loan affordability for each borrower, but the crucial factor is your debt-to-income ratio. Lenders will want to see that you have enough income coming in to make new loan payments, even after all of your other financial commitments have been met. If you are one of the 31.9% of Kitchener residents not engaged in the labour force - whether this is due to retirement, unemployment or any other reason - you can access personal loans too. Simply check to see which lenders accept borrowers with non-employment income.

What happens if I can't repay my personal loan in Kitchener?

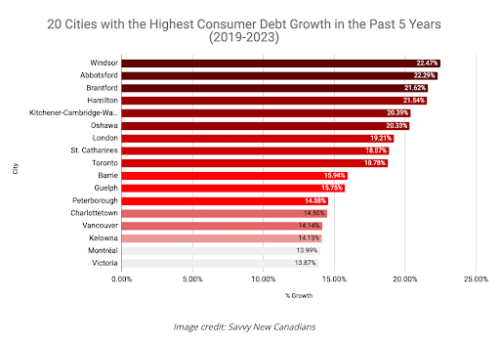

Before taking on any new debt, you need to be sure you can afford it. But sometimes life throws up unexpected challenges, and even the best prepared can fall on hard times. 6.4% of Kitchener residents are unemployed, and in general incomes in the area are falling compared to cost of living. Over the past few years, the amount of debt needed to push people in the area into insolvency has dropped, to an average of $48,437 (lower than the wider Ontario average of $52,634). And of those filing a bankruptcy or consumer proposal in the area, 6% owned their own home. So struggling with debt is not uncommon for KW residents, even those with steady incomes and valuable assets. But if you find yourself unable to make debt repayments, don't hang around. Contact your lender immediately to let them know your situation, and to see if workarounds can be found. Speak to a debt relief expert, or consider a debt consolidation loan if necessary. Help is available, but action is needed to prevent short-term difficulties from impacting your long-term financial health.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice