Compare Lenders

How can I get a personal loan in Edmonton?

There are many ways to get a personal loan if you live in Edmonton. Probably the easiest is to go online; there are a wide variety of loans and lenders available, so you can research your options, compare prices and complete a loan application, all from the comfort of your own home. But to make sure you’re getting the right personal loan, here are some tips:

- Shop around; different lenders often charge different rates for seemingly identical products, so it’s always worth seeing what deals are available.

- Consider how you’ll use your personal loan; if it’s for a specific purpose (e.g. purchasing a car), then a targeted loan (e.g. an auto loan) might be your best option.

- For the most competitive rates, consider a secured personal loan. By using an asset (such as your home) as collateral against your borrowing, you can access lower interest rates.

What credit score do I need to get a personal loan in Edmonton?

Credit can be an important factor when getting a personal loan. In general, mainstream lenders such as banks and credit unions require a minimum credit score of 650; the national average is 672, but the Edmonton average is lower, at 645. This means that the average Edmontonian will not qualify for a personal loan from their bank.

Fortunately, many other lenders, including online and alternative lenders, have more flexible credit requirements, and some loan types (e.g. payday loans) do not rely on a credit check at all. So if you have bad credit in Alberta but need to get a personal loan, just make sure you focus on loans and lenders with more accessible eligibility requirements.

How can I get the best interest rate on a personal loan in Edmonton?

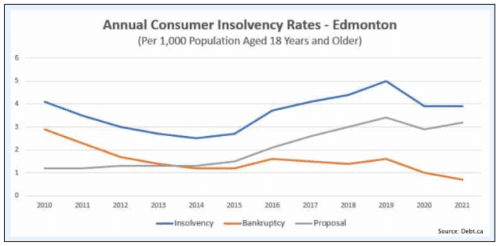

Getting the best interest rate on your loan is paramount; 51% of Albertans are concerned that rising interest rates could move them towards bankruptcy. So examine all of the ways that you might be able to lower the rates you qualify for, for example by:

- Shopping around

- Considering different loan types

- Borrowing a smaller amount of money

- Paying off other debts before taking on a new loan

- Securing your loan against an asset (e.g. your home – house prices in Edmonton were on average £410,193 last year)

- Delaying borrowing until you’ve improved your credit

- Finding a guarantor for your loan

How can I use a personal loan in Edmonton?

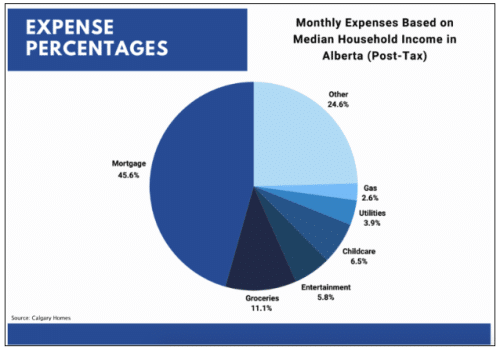

There are almost no limitations on how personal loan funds can be used; residents of Edmonton commonly use personal loans for a wide range of expenses, including general cost-of-living expenses. This is because although the median income in the province is relatively high ($90,000), the local economy is more volatile than in other areas, due to the impact of fluctuating oil prices. So the cost of basics such as utilities and transport are sometimes much higher than expected, and Edmontonians frequently use personal loans to manage. Funds can be used for other purposes too though, such as healthcare costs, vacations, car repairs, tuition fees, home repairs, debt consolidation, and so on.

How much can I borrow with a personal loan in Edmonton?

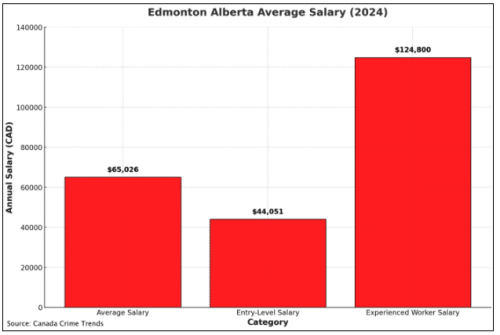

The amount you can borrow with a personal loan can depend on a few factors, including your income, employment type, and credit score. The average Edmonton salary is $65,026 – significantly higher than the Alberta provincial average of $39,000; but the unemployment rate is also quite high at 6.9%. Where you sit in the wider financial landscape will dictate how much any given lender will be willing to lend to you. In theory, amounts from just $300 to over $35,000 are readily available on an unsecured basis.

What happens if I don’t make my personal loan repayments in Edmonton?

Edmonton’s loan delinquency rate is 1.97%, an almost 20% increase since 2023. And the average Edmonton household has consumer debts of $23,732. Clearly, Edmontonians are struggling with their finances, and it’s vital that you don’t take on any new debt unless you can afford to repay it.Â

Defaulting on a loan, or failing to make your loan repayments on time, can seriously affect your credit, which in turn will negatively impact your ability to access financial products in the future. It can also put you at risk of legal action or collection agencies, and if you used an asset to secure your loan, you risk having that asset seized. So if you are struggling with debt, speak to one of Alberta’s independent debt relief agencies for help, or consider a debt consolidation loan.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice