Compare Lenders

What types of personal loans are available in Regina?

All of the many different types of personal loan found in Canada are available to residents across Regina, including:

- Traditional installment loans

- Online loans

- Short term loans

- Auto loans

- Lines of credit

- Home equity loans

- Bad credit loans

- Payday loans

- Emergency loans

- Medical loans

- Student loans

Saskatchewan residents have one of the highest consumer debt levels in the country (holding on average $23,167 in non-mortgage loans), and it is very common for those in the province’s capital to utilize multiple types of personal loans for their various financial needs.

Can I use a personal loan in Regina to pay my bills?

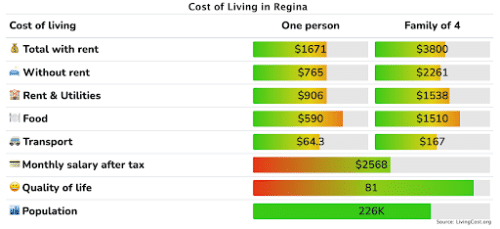

Regina is already the second most expensive city to live in in Saskatchewan (with the average cost of living for a single adult sitting at $1,671) and with prices rising across the board, it’s only getting more expensive. Thankfully, personal loan funds can be (and often are) used to help pay for everyday expenses like rent, food and travel. They can also be used for bigger one-off expenses, such as car repairs, medical costs and even discretionary purchases. There are really no restrictions on how loan funds can be used.

What credit score do I need to get a personal loan in Regina?

Some (though not all) personal loans in Regina have credit requirements, and these vary from lender to lender. The strictest in the market are the banks and credit unions, which typically demand a minimum credit score of 650. Online lenders generally have lower thresholds – 600 is a common one. And some lenders specifically accept borrowers with a low credit score (560 or below).

The average credit score in Regina is 659, quite a bit lower than the national average of 672, but still higher than in neighbouring Saskatoon. This means that the average borrower in the city should be able to meet the credit requirements of almost every lender.

What’s the best interest rate on a personal loan in Regina?

Interest rates on personal loans in Regina can vary a lot, depending on the borrower, the lender, and the loan type. They can be as low as 0%, to as high as 35%. This range can have a big impact on the affordability of different products, so it’s essential that borrowers shop around to get the best rate they can. Fully half of Saskatchewan residents are concerned about their debt repayments in light of recently high interest rates, with nearly a quarter (23%) only paying the minimum on their credit cards, and 16% having missed debt payments entirely.

To minimize your loan costs, look for anything that may reduce your interest rate; for example, offering security can significantly lower the interest rate you qualify for. As two thirds of Regina households are owner-occupied, and the average home price is $330,600, this is a viable option for many.

Can I use a personal loan in Regina for debt consolidation?

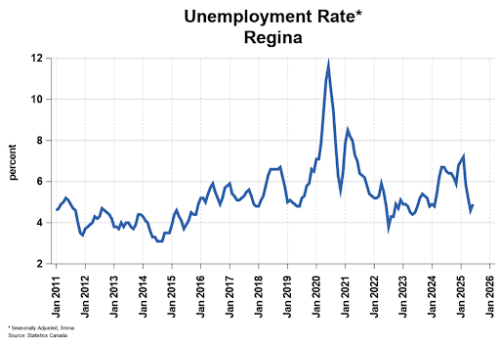

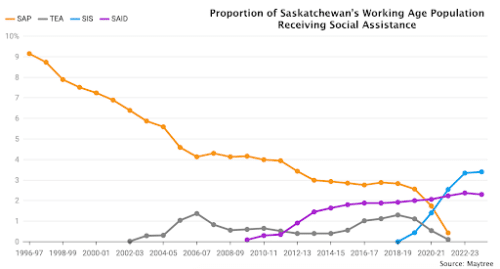

Many Regina residents are struggling financially. The average credit card debt per person in Regina is $4,200; the unemployment rate is higher than other cities in the province, at 5.2%; and while the average annual salary is a reasonable $56,700, minimum wage in Saskatchewan is the lowest in the country, at $14 per hour. Prices are rising, and locals are borrowing more to cover their costs.

All of this borrowing and all of these squeezed budgets has led to a rise in how much people are having to pay each month in debt repayments, and for some, the cost is untenable. Delinquency rates in the province have risen by over 15%. This is why debt consolidation is so important; high interest debt obligations can quickly exacerbate difficult circumstances, and moving your debt to lower interest instruments is a smart way to reduce your debt costs whilst meeting your financial obligations. A personal loan may be a viable debt consolidation tool – but it depends on the interest rate you qualify for, and the rates you are currently paying. It is only worth using a personal loan in this way if the cost differential makes sense. Remember to consider all costs, and seek expert advice if you are struggling to make sense of the numbers.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice