Compare Lenders

$7.5K to $200K (Refinance existing auto loan)

From 6.93% (lower your auto loan interest rate)

Up to 86 months

Discover Popular Financial Services

Quick Links

- How Does Car Financing Work in Ontario?

- How To Get Approved for a Car Loan in Ontario

- How To Get a Car Loan with Bad Credit in Ontario

- Current Auto Loan Rates in Ontario

- Important Considerations When Borrowing Money for a Car Purchase

- Useful Resources for Ontario Car Buyers

- Ontario Car Loans FAQs

How Does Car Financing Work in Ontario?

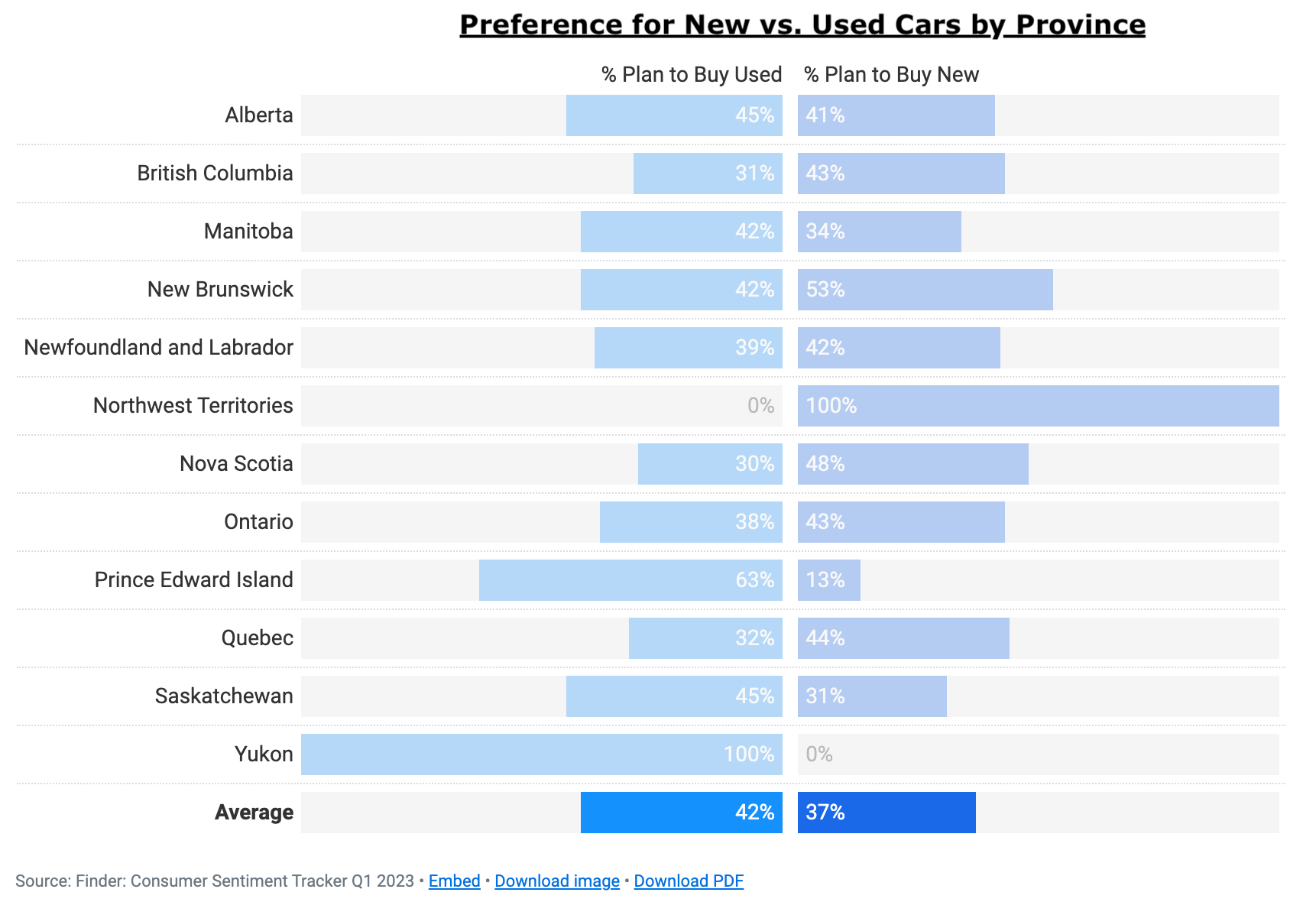

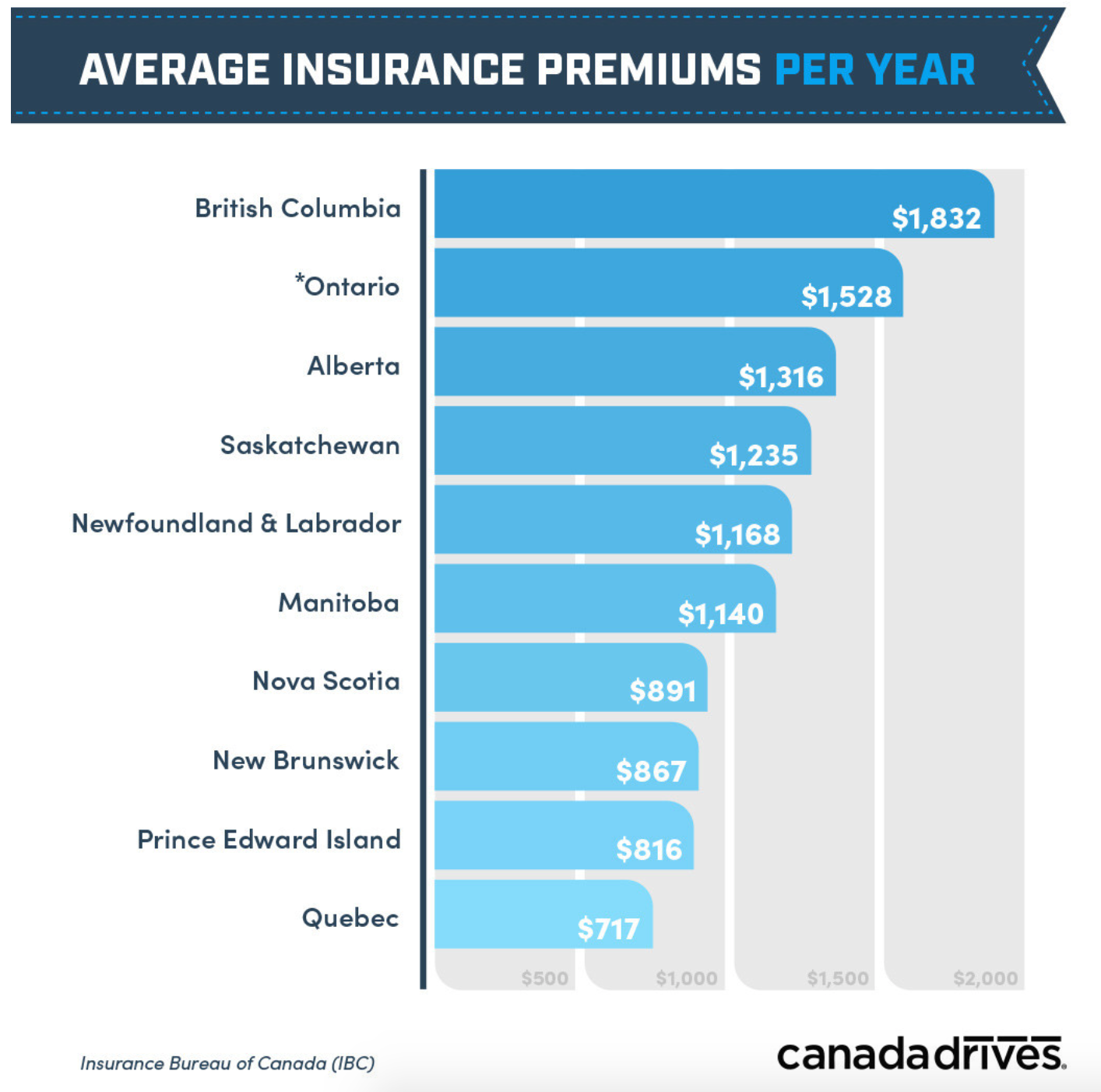

Four out of every 10 vehicles sold in Canada wear Ontario plates; as Canada’s busiest province, Ontario has no shortage of car loans, car dealerships, and used car options. But all this choice doesn’t mean buying a car in Ontario is easy; there are always challenges to overcome, some financial, some logistical. For example, did you know that Ontario has the most expensive car insurance in Canada?

Auto Finance from the Dealership

So buying a car means considering multiple factors, the first of which is financing. After your home, your car is likely the most expensive thing you will ever purchase, and very few have savings enough to completely cover the cost of a new vehicle. This is where financing options come in.

There are multiple different routes to obtain car loans; one very popular method is to finance a car through a loan arranged with the car dealer. The majority of car dealers will arrange a loan on your behalf. In fact, if buying a car directly from a manufacturer, the dealership will usually have its very own financing division that provides loans to its customers at preferential rates.

Auto Finance from a Bank or Credit Union

If the manufacturer or dealership can’t give you a loan, they can usually still help you get one from a credit union, bank or alternative lender. They may also work with other auto financing companies that offer specialized loans for the dealer’s clients.

Auto Finance from an Alternative Lender

And finally, you may choose to get a car loan by yourself – shopping around to find the best lender. This route means you can compare the full details of a variety of car loans, and use a car loan calculator to examine your potential costs. You may in the end get a loan from a new or used car dealership, your bank or credit union, or from an alternative lender, such as an online lender or specialty lender.

Most Car Loans Work in the Same Way, No Matter the Lender

Wherever you get your loan from, it will almost certainly work in the same way. An application form must be filled out, and assessed by the lender. If approved, the loan will be secured against the vehicle in question, so if there are ever any issues with your payments, the vehicle may be seized. An initial lump sum will be provided to cover the cost of the car (this is usually paid directly to the dealership if buying from one), and then regular repayments must be made, over the life of the loan, until you completely pay off your loan.

In this way, car loans allow Canadians to access and use vehicles, while paying for them over an extended period of time.

How To Get Approved for a Car Loan in Ontario

To get approved for a car loan in Ontario, you must submit a loan application to your chosen lender. You can do this yourself, or have your local dealership do it for you. Either way, you will need to prepare some paperwork, including:

- I.D. showing you are at least 18 years old

- Proof of address

- Proof of income

- Proof of car insurance

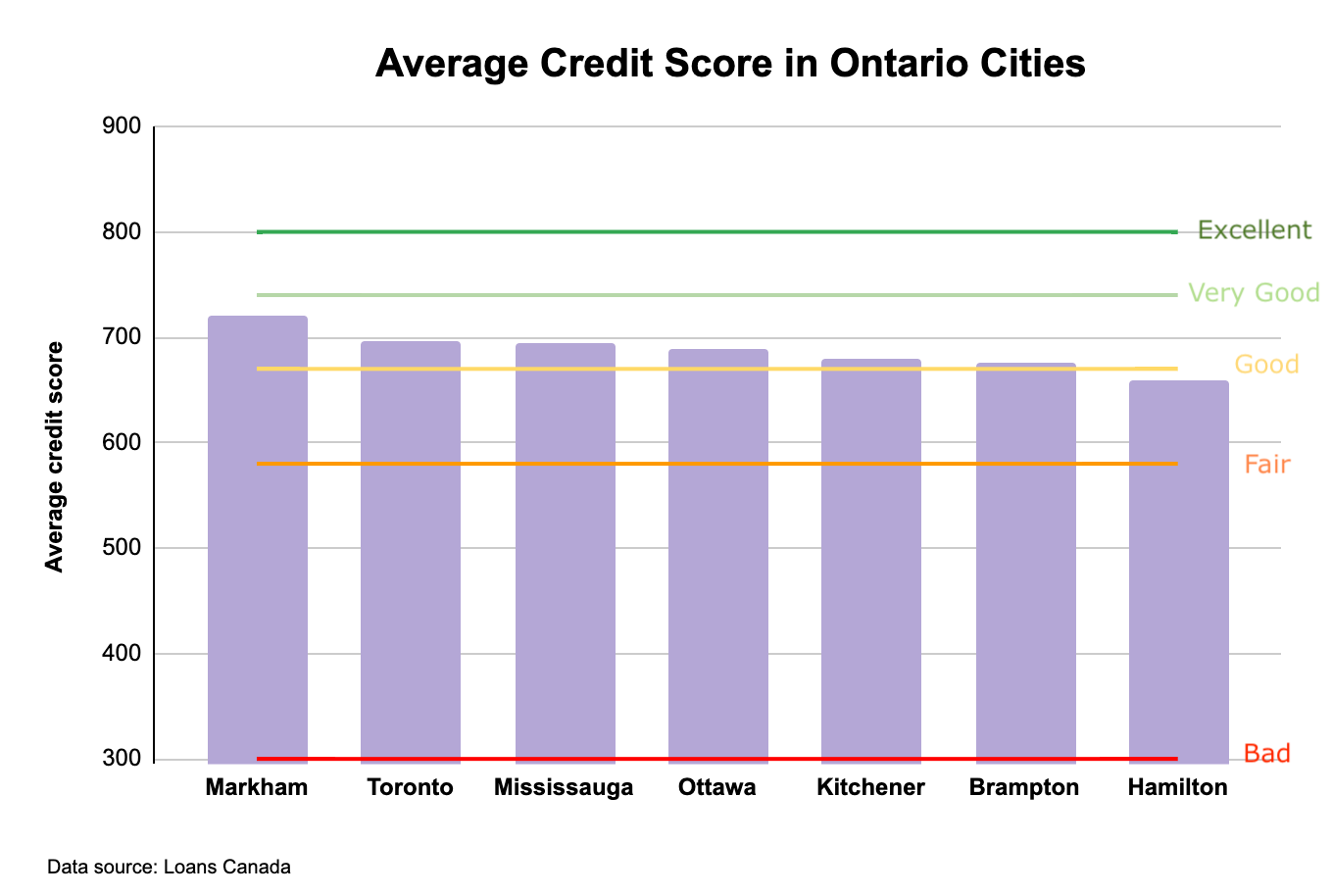

Most auto loan providers will also want to assess your credit score to determine if you qualify for an auto loan with them. Then they will determine the interest rate you pay using your credit score.

Car Loan Eligibility in Ontario

There are plenty of myths about car loans in Canada; many people believe that you can’t get a car loan if:

- You are self-employed

- You don’t have credit

- You have bad credit

But the facts are:

- If you’re self-employed, you just need to provide evidence of income

- A lack of credit history can disqualify you for some car loans, but not all; there are plenty of providers that rely on proof of income over credit score

- The Financial Consumer Agency of Canada reports that one quarter of all auto financing options are subprime, meaning that even those with bad credit have plenty of options

How To Get a Car Loan with Bad Credit in Ontario

Getting a car loan in Ontario isn’t necessarily hard, but if you have a low credit score, there are some dealers, banks and other lenders that may not be able to help you with financing. This is because vehicle financing works in the same way as many other types of loans – lenders use a person’s credit score to assess whether they want to do business with them, and some lenders (like banks) have stricter criteria than others.

So if your credit score is below the national average of 650, and veering into ‘fair’ or ‘bad’ credit territory, you’ll probably have to consider a loan from another source. Luckily, there are a multitude of lenders that cater to this demographic; even with absolutely no credit history at all, or a past bankruptcy, you will still be able to get a car loan. Just bear in mind that the most competitive interest rates are usually reserved for those with the highest credit scores.

You may also want to to consider other methods of making yourself a more attractive borrower, such as:

- Providing a trade-in to lower the loan amount

- Getting a co-signer for the loan

- Saving up a deposit to lower the loan amount

Current Auto Loan Rates in Ontario

The interest rate you pay on your car loan will depend on your credit score, the details of the car you’re buying, and other financial factors. You can typically expect to pay less interest if buying a new car. Rates can vary quite widely; the general range is between 3% and 10%, although some special offers from manufacturers boast 0% for an initial period, and some borrowers will end up paying as much as 30%.

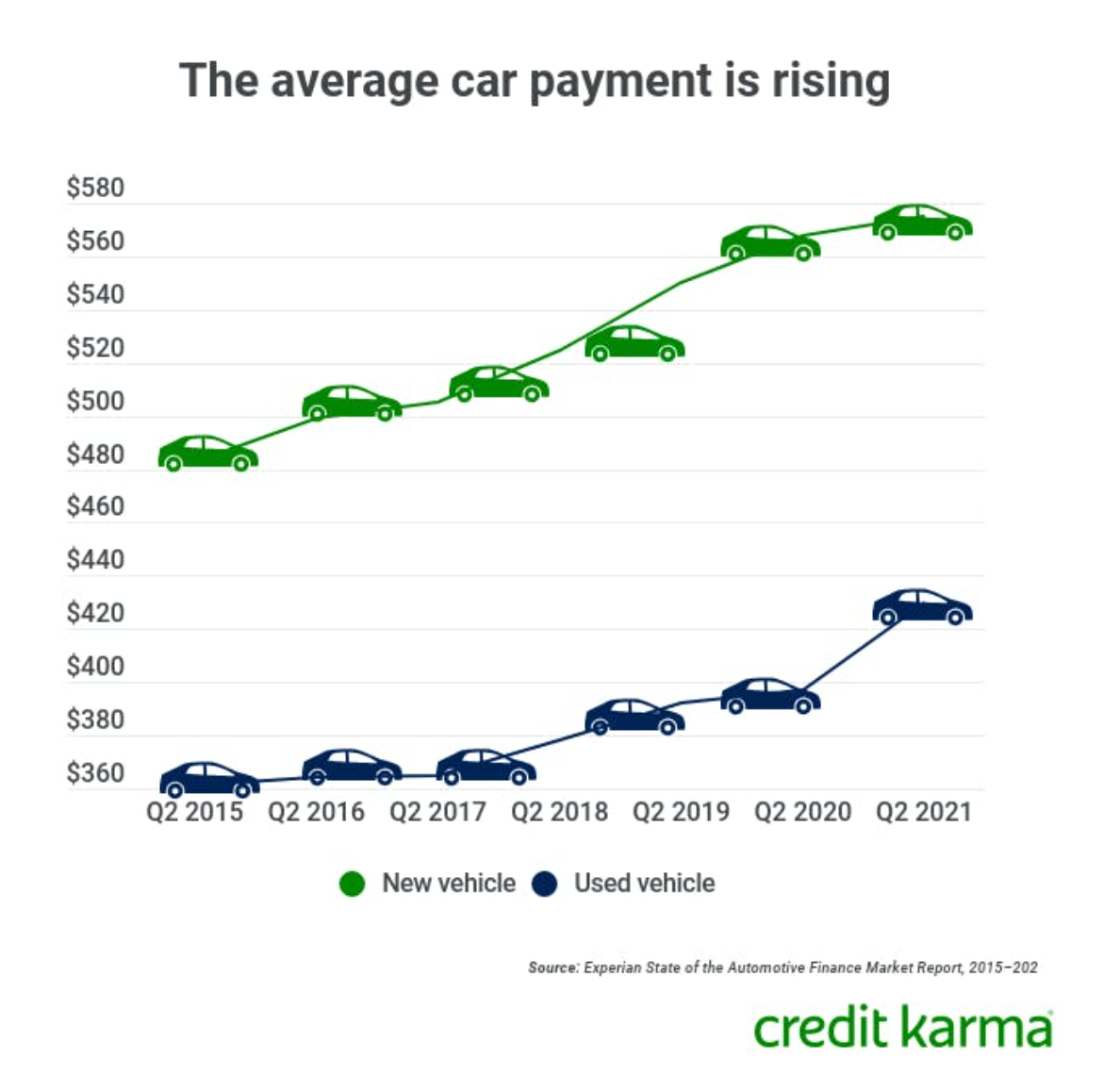

You won’t know what interest rate you’ll get until you start the loan application process, but to put things into some context: the average APR on new auto loans is now 8.19%, meaning the average brand-new car costs around $1,091 per month to finance over an eight-year term.

The better your credit score, the more likely it is you’ll qualify for the lowest rates.

Important Considerations When Borrowing Money for a Car Purchase

When you apply for a car loan, keep the following factors in mind:

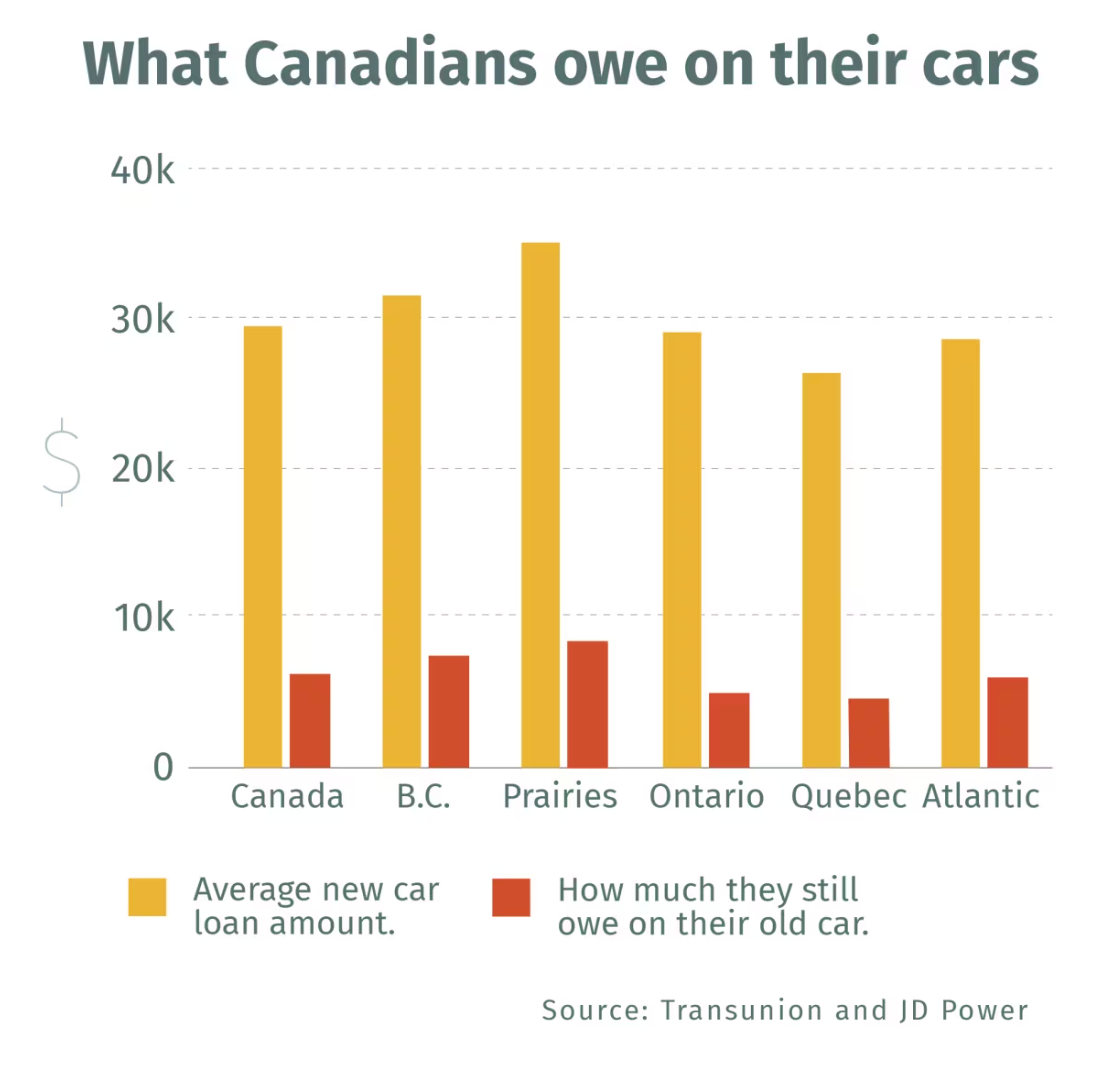

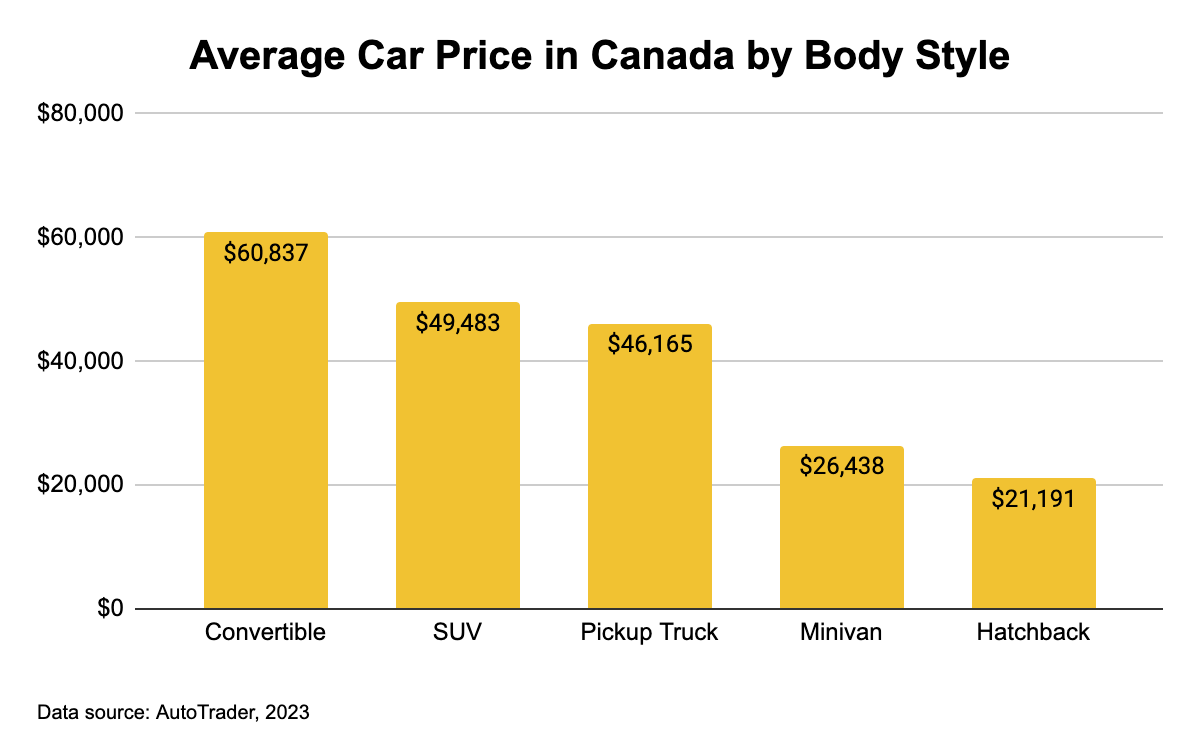

Interest Payments and Total Cost

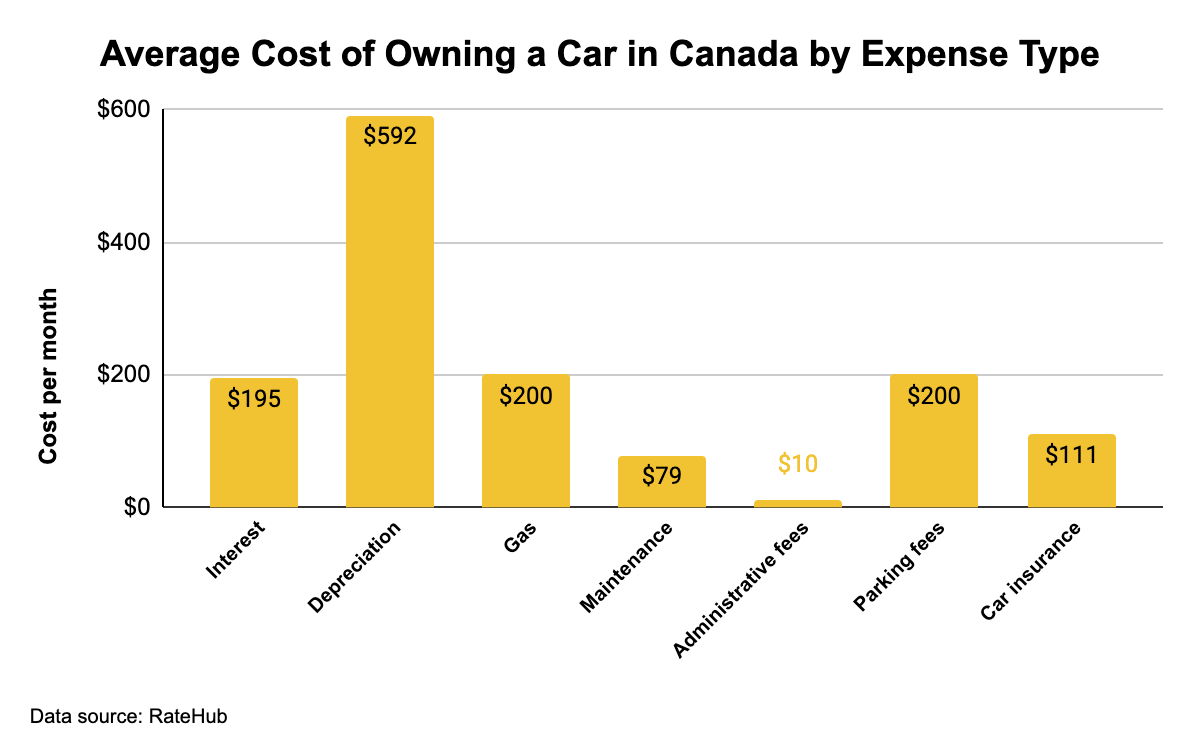

The APR on your car loan should be factored into the total cost of your car. This is especially true of older cars. While used vehicles are cheaper than new ones in terms of price (the average new vehicle price in Canada in June 2023 was $66,288, and the average for used cars was $39,645), loans on used vehicles have higher interest rates. So take into account the cost of your interest payments when considering the total cost of a car. And don’t forget that interest compounds; the longer the loan term is, the more you’ll pay in interest.

Day-To-Day Finances

Monthly payments for a car loan will affect your ability to make other regular payments, like rent and utility bills, and will stretch your daily finances. You must factor in this additional expense before you take out a car loan. Do whatever you can to lower the loan amount and save on monthly payments; consider a trade in, a down payment, or other mitigating factors to ensure you can pay off your loan.

Car Insurance

All motorists in Ontario are required to have insurance by law, and car insurance can be one of the most expensive aspects of owning a vehicle. Most people choose to pay for their insurance via monthly payments, to spread out the cost, but you must ensure that you factor this amount into your calculations when considering how much you can afford to pay monthly for the car you want.

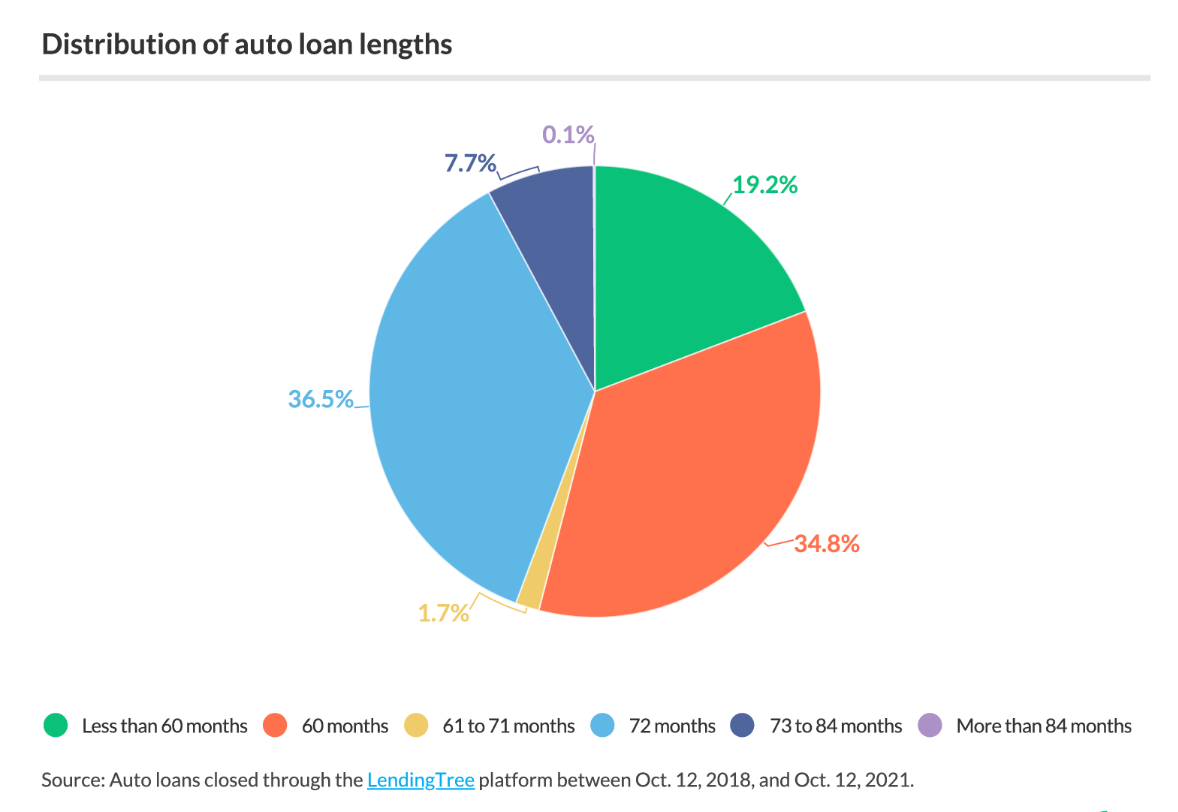

Loan Term

Nearly half of new car loans are taken for amortization periods exceeding 60 months. Long amortization helps fuel car sales in Canada, but as mentioned above, the longer your loan term, the more you will pay in interest over the life of the loan. You must balance the loan payments, total interest cost, and longevity of the vehicle when considering the loan term.

Leasing

If you want to lease a vehicle, you will likely have a more competitive rate than when purchasing. A dealership lease program only requires you to pay a small down payment for a portion of the vehicle’s value – or to trade in an existing vehicle as a down payment towards the new vehicle lease. The downside to a lease is that you won’t actually own the vehicle you lease, but you are still required to make a regular payment amount to the dealer.

Leasing can be a viable option for those unwilling to commit to a new purchase, those seeking fast approvals, those unsure of their needs, or those who only need a car for a short time. Just keep an eye on the lease term to ensure it aligns with your intended use of the car and your required car payments.

Your Rights As An Ontarian

Purchasing a vehicle from an OMVIC-registered dealer in Ontario means you are protected by the Motor Vehicle Dealers Act. A dealer is obliged to disclose the full history of the vehicle and its condition, including:

- Age

- Make

- Model

- Mileage

- The total cost of a vehicle

Should they fail to do so, you can resort to the Motor Vehicle Dealers Compensation Fund. You are entitled to a full refund within 90 days if the dealer withholds any of this information.

Useful Resources for Ontario Car Buyers

- Know your rights when buying a new or used vehicle in Ontario

- Don’t get scammed when buying a car in Ontario

- Understand the cost of borrowing in Canada and how it is regulated

- Understand how personal loans work and your options

Smarter Loans is your primary source for auto loan providers in Ontario; let us help you find financing for your next vehicle. Review our list of auto loan companies above to compare current car loan rates, or to try a car loan calculator.

Ontario Car Loans FAQs

How do auto loans work in Ontario?

Car financing starts with choosing between auto loans from financial institutions or vehicle financing through a dealership. Understanding the financing options available, including for electric cars or used vehicles, allows borrowers to select the best financing solutions for their needs.

To get behind the wheel of your next vehicle with favourable financing terms, you need to understand the payment amount, pre-approval processes, and how the loan affects your financial situation. The loan term and rates of interest are also key features of any car purchase and financing plan.

Financing options in Ontario cater to a range of needs, ensuring borrowers find solutions that match their budget and allow them to purchase their car.

What is a good interest rate on a car loan?

The interest rate on a car loan in Ontario depends on multiple factors, including the borrower’s financial situation, credit score, and income, and the car’s details. Rates as low as 2-3% are possible with good credit.

Seeking out financing options with the lowest interest rates can significantly reduce payments and the total cost of your vehicle. Whether through a dealership, financial institution or auto finance company, ensure that you can secure a payment plan that fits your budget.

Which lender is best for car loans?

The best lender for a car loan depends on your situation. Different financial institutions provide auto loans with different rates for different people, and varying product types. To complicate things further, many companies offer special financing rates at certain times of the year or for certain people.

Start by looking for a lender that offers a maximum loan amount suitable for your needs. Then check they have competitive rates and reasonable fees. Credit unions are often lauded for their customer-friendly terms and competitive rates, making them an attractive option for potential borrowers.

And remember that a car loan is not necessarily your only option; a personal loan can provide the money you need and may be a more flexible option for you.

Which bank or credit union has the best car loan rates in Ontario?

When searching for the best rates in Canada, it’s crucial to compare car loans from banks and credit unions, and from dealerships and online lenders – preferably by using a car loan calculator. Rates can vary significantly, so exploring a loan online is essential. Credit unions often provide competitive rates alongside flexible payment options, making them strong contenders.

For the best deal, consider the lender offering quick approvals and the most competitive rates with minimal fees. The finance terms, including the loan’s total cost, should align with your budget and monetary situation.

Can I get a loan for a used car in Ontario at a local dealership?

Yes, your dealer or local dealership can usually get you financing for a used car. However, used car financing will cost you more in interest; used car rates start at around 5%, but can climb as high as 30% in extreme cases.

Can I make a lump sum payment towards my car loan?

Yes. Lump sum payments are a great way to lower your monthly payment and pay off your car more quickly. Just remember to check whether the lender you are considering has any early payment fees that may impact you.

Many people choose to focus their ‘lump sum’ efforts at the start of their car purchase, usually via a trade in or large down payment. This minimizes the interest paid, but really any extra payment towards your debt will help you in the long term. A down payment can technically happen at any time!

Can I get a car loan online?

Yes. Car loans are readily available online; this is an especially good option if you are buying your first car and don’t know what to expect, as it allows you to do a lot of research before committing to anything. All of your financing options will be clearly detailed on each lender’s website, so you can make an informed financing decision.

What credit score do you need for a car loan in Ontario?

Securing a car loan requires understanding how your credit score impacts credit approval. While a good credit report and strong credit history are advantageous, as lenders perform credit checks to determine eligibility, bad credit doesn’t preclude you from financing. Plenty of options exist for those with bad credit, including pre-approval and pre-qualify options. Being pre-approved can provide leverage when car shopping, whether you’re looking at new vehicles or used cars.

Is it better to get a car loan from a bank or dealer in Ontario?

Deciding whether to get a car loan from a bank or a dealer in Canada involves weighing the benefits of each option. Banks and credit unions can offer competitive rates, but local dealerships can provide more variety, including promotional rates for select vehicles at participating dealerships.

The decision is inevitably a personal one; a dealership may have more flexibility in terms of repayment, allowing semi-monthly or bi-weekly payment options. This is especially true of a dealer that’s part of a nationwide network.

Explore more

Similar products

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice