Top Auto Insurance Companies and Brokers in Canada

Pricing varies by product, Discounts on Home + Auto Bundles

Ontario Only

What is Auto Insurance?

Auto insurance in Canada can cover all types of passenger cars, including sedans, hatchbacks, SUVs, pickups, sports cars, electric cars, and others. Insurance works by the car’s owner (the policy holder) paying a small monthly fee (a premium) to the insurance company (the insurer), in exchange for the insurer taking on the financial responsibility of repairing or replacing the car if something happens to it. This something depends on the type of insurance coverage you have, and can range from minor repairs to complete replacement of the car.

Types of Auto Insurance

Although auto insurance is a little different in each province, there are fundamentally three main types available:

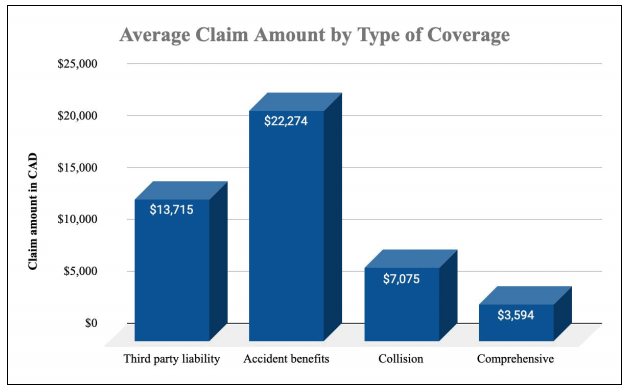

1. Third Party Liability Insurance

This is the most basic level of coverage, and it protects the insured person against financial liabilities when their vehicle causes damage to another person’s property (or person). So if you’re in an accident, you won’t be liable for the costs to repair the injured party’s vehicle or their medical bills. This type of insurance is mandatory across all of Canada, although the minimum required coverage varies by province.

Many third party liability policies come bundled with accident benefits insurance, uninsured party insurance, and no fault insurance. This is because these three additional forms of insurance are mandatory in all provinces but one, and so often come packaged with third party liability to make things simpler. Accident benefits pays for medical costs for anyone involved in an accident; uninsured party insurance covers the eventuality that the other vehicle in a collision with you is not insured; and no fault insurance is for circumstances where no one was technically at fault.

2. Collision Insurance

Collision insurance is the next rung up the coverage ladder; as well as third party liability coverage, it offers protection for accidents where you hit something other than another vehicle - for example street furniture, like guardrails or embankments.

3. Comprehensive Insurance

Lastly we have comprehensive insurance, and as you might expect this covers all manner of possibilities - not just accidents with other people, vehicle repairs and at-fault accidents, but theft and car damage from other causes, like weather events.

The cost of insurance depends on a number of factors, but generally it scales according to what level of coverage you choose. Comprehensive insurance is the most expensive.

The Cost of Auto Insurance

Factors that affect the cost of your insurance include:

- Driver age and gender

- Where you live

- Vehicle make, model, age and engine size

- Driving history

- Current driving habits

- Type of coverage

- Availability of discounts

Factors that don’t affect your rates:

- Employment status

- Financial standing

- Housing type

- Credit score (unless you live in Nova Scotia)

- Car colour

Discounts can be applied to your auto insurance premiums for many reasons, including:

- Bundling insurance across products or household members

- Being an alumnus of named professional bodies or schools

- Enrollment in named further educational institutions

- Membership of named professional organizations or affiliation groupsÂ

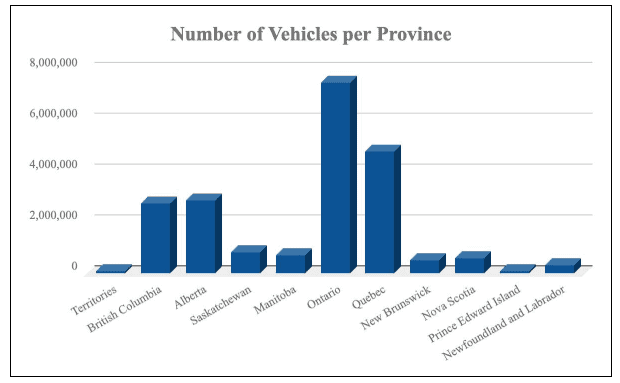

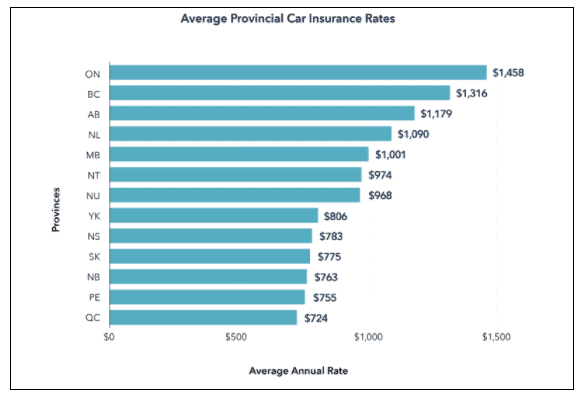

Provincial Differences

As mentioned above, the legal requirements for auto insurance vary across the country; all provinces require at least third party liability coverage, but what this actually means changes from one place to another. In addition, the penalties for failing to have the correct insurance vary by region. In Ontario, for example, you can be fined anywhere between $5000 and $50,000 for driving without the proper insurance, and may have your license suspended or your car impounded.

To make matters more complicated, each province has either private or public insurance - or a mix of both. So if you live in B.C., Manitoba or Saskatchewan, you must get your basic auto insurance from the government, and can then supplement the required minimum with private insurance if you wish. In Ontario, Alberta, New Brunswick, Newfoundland and Labrador, P.E.I. and Nova Scotia, you are compelled to purchase all of your insurance from a private company. And Quebecois require a mix of the two!

| Province | Private or Public Insurance | Insurance Required by Law | Minimum Third Party Coverage | ||||||

|---|---|---|---|---|---|---|---|---|---|

| No Fault | Third Party Liability | Accident Benefits | Direct Compensation Property Damage |

Uninsured Motorist |

Collision Insurance | Comprehensive Insurance | |||

| Alberta | Private | x | x | x | $200,000 | ||||

| B.C. | Public | x | x | x | x | $200,000 | |||

| Manitoba | Public | x | x | x | x | x | x | $200,000 | |

| N.L. | Private | x | x | x | x | $200,000 | |||

| New Brunswick | Private | x | x | x | x | x | $200,000 | ||

| Nova Scotia | Private | x | x | x | x | x | $500,000 | ||

| Nunavut | Private | x | x | x | x | $200,000 | |||

| NWT | Private | x | x | x | x | $200,000 | |||

| Ontario | Private | x | x | x | x | x | $200,000 | ||

| P.E.I. | Private | x | x | x | x | x | $200,000 | ||

| Quebec | Public | x | x | x | x | x | $50,000 | ||

| Saskatchewan | Public | x | x | x | x | x | $200,000 | ||

| Yukon | Private | x | x | x | x | $200,000 | |||

Commercial vs. Personal Auto Insurance

It’s important to be aware of the difference between commercial and personal auto insurance. Personal insurance is for those using their vehicle for personal reasons only; this does include driving to and from work. However, commercial auto insurance is required for any vehicles used for work purposes - i.e. to carry out work-related tasks or duties. You must make sure you get the right kind of coverage, as if you are involved in an accident while using your personal car for business purposes, your personal auto insurance will not cover you. This is of particular importance for the growing number of delivery and ride-share drivers who use their own car.

Frequently Asked Questions About Auto Insurance?

How much does auto insurance cost?

The cost of auto insurance varies according to which province you’re in (Ontario is traditionally the most expensive, Quebec the cheapest), your exact location (rural or urban), your age and gender, your driving history, your car (type, make, model, age and engine), and your typical use of your car. All of these factors influence how much you’ll pay in premiums. The average across the whole country is about $110 per month.

Do I have to get auto insurance?

Yes, some level of auto insurance is always mandatory, but exactly what this level is depends on which province you live in. All provinces require at least third party liability insurance, but you may need more. Check the table above to see what’s required by your local government.

Can I get auto insurance if I don’t have a full G license?

Yes - and you are still required to be insured if you are working your way through the graduated licensing system. However, most learners are not driving their own car, so you can probably get yourself added to your household’s car insurance for a small extra fee, rather than having to take out a whole new policy yourself.

Can I get auto insurance for an old car?

Yes. There is no age limit when it comes to insuring your car, but older cars tend to be worth less, and so will (in general) be cheaper to insure. As long as your car is roadworthy, the age should not affect its insurability.

Can I get auto insurance for a motorcycle?

You can either get a separate motorcycle insurance policy for your motorcycle, or (if you already have an auto insurance policy), you may have the option to add your motorcycle as a second vehicle on your existing auto policy. Call your insurance provider or research which companies insure both types of vehicle, to check you’re making the most of your bundling opportunities.

What happens to my insurance when I move?

You must inform your insurance company when you move, as your new location may affect your insurance rates. If you move between provinces, you will need to make sure you are adhering to your new home’s local rules. This may mean you have to cancel your old policy and get a new one, depending on how different the two provinces’ rules are.

Written By Smarter Loans Staff

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice