Compare Lenders

Discover Popular Financial Services

Why do people in Halifax get personal loans?

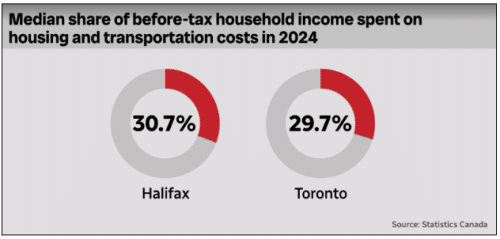

Despite the many advantages residents of Halifax enjoy, including lower-than-average consumer debt ($21,130 per consumer) and inflation that’s lower than the national average, there are still financial challenges to overcome. Rent and utilities are experiencing higher-than-average inflation, and research by Statistics Canada shows that half of Halifax households spend more on housing and transportation than their counterparts in that famously-expensive city, Toronto.Â

So it’s no surprise that many in the city turn to personal loans when times get tough; these flexible, accessible financial instruments can help with everything from buying groceries to healthcare costs. They can be quick and simple to get, and can provide a lifeline for both necessary and discretionary spending.

Where can I get a personal loan in Halifax?

Downtown Halifax is home to all of the major banks and several major credit unions, and these may seem like the obvious choice if you need a personal loan. There are alternatives though: many lenders have easy-to-use online platforms and apps that allow borrowers to research, compare and apply for loans without ever having to go downtown. Some of these lenders specialize in particular types of loans (e.g. bad credit loans, auto loans, or payday loans) but many more offer more traditional installment loans to a variety of borrowers at competitive rates. Some of these companies are listed in the table above.

What paperwork do I need to get a personal loan in Halifax?

The type of loan you apply for, and the lender you apply to, will at least partially dictate the exact paperwork you need when getting a personal loan. At a minimum, you should have ready:

- I.D.

- Bank statements

- Proof of residence

It’s possible that you might also need:

- Proof of income, such as pay stubs

- Details regarding existing debts

- Proof of assets (if pursuing a secured loan)

- Details of the item being purchased (e.g. if getting a vehicle loan)

- Tax records

What income do I need to get a personal loan in Halifax?

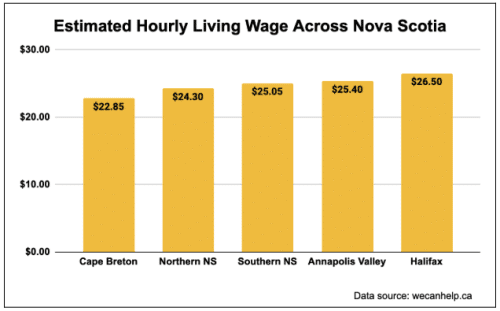

14.9% of Nova Scotians are considered low income, and the median hourly wage in the province is the second lowest in the country at $23.08. So it’s common for residents to be concerned that their income is not sufficient to qualify for a personal loan. Luckily though, there are no universal rules regarding income level among lenders. This doesn’t mean there are no income requirements – just that each lender has their own. For example, CIBC has a minimum income requirement of $17,000 a year. Other lenders may require more, or less.

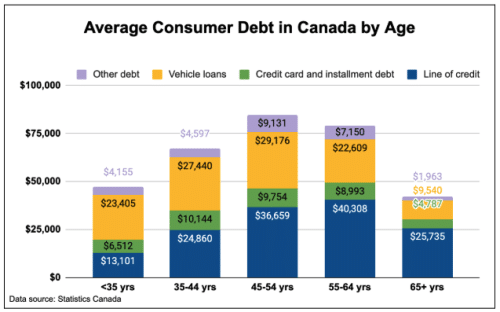

Your debt-to-income ratio is usually a more important factor when getting a loan than raw income level; crucially, lenders will want to see that you have enough income left over, even after all of your existing financial obligations are paid, to cover new debt repayments.

What credit score do I need to get a personal loan in Halifax?

The average credit score in Halifax is 664, just below the national average of 672. If you’re seeking a loan from your bank or credit union, you’ll probably need a score of at least 650. But other lenders have lower requirements than this; some even specialize in lending to bad credit borrowers. In addition, some loan types do not rely on credit at all. So your credit will not affect whether you can get a personal loan, but it will affect where you can get a personal loan. It’ll also affect the interest rate you are charged.

Can I use my home to secure a personal loan in Halifax?

One way to lower your personal loan interest rate is to offer collateral against the loan. This is so, in the event of you defaulting on the loan, your lender does not lose out entirely – they can seize the collateral in lieu of payment. This mitigates their risk and allows them to charge less in interest.Â

As the average property price in Halifax is a healthy $626,156, many consumers choose to secure their personal loan against their home, and this is a perfectly valid choice. Just be aware that it does put your home at risk if you default on the loan; the delinquency rate in Halifax is 1.36%, a 10% increase year on year.

Explore more

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice