Getting approved for a conventional mortgage isn’t always easy—especially if you have poor credit or lack confirmable income. Fortunately, private mortgage loans can fill the gap when you don’t meet the criteria of conventional lenders.

What is a private mortgage loan?

As opposed to a bank or credit union, a private mortgage is a loan you get from a privately-held institution.

Private mortgage loans are usually:

- Short-term. Six to 24 months is common

- Asset-backed. The property you own or want to purchase is used as collateral

- Interest-only. You’ll often just be responsible for making monthly interest payments, rather than paying down the loan principal

Private mortgages take many forms, but are generally used to purchase, refinance, or improve property.

What is a private mortgage lender?

Private mortgage lenders are individuals, groups, or independent organizations that invest funds to earn a profit.

Although they must follow guidelines for financial companies in Canada, private lenders aren’t directly regulated by the federal government. On the upside, that usually means it’s much easier to get a mortgage application approved.

The best way to connect with a reputable private mortgage lender is by working with a mortgage broker or by using an online comparison tool to research and reach out to lenders directly.

Private mortgage rates and fees

Unlike most conventional mortgages, private mortgages can be approved and funded relatively quickly (within a week, in many cases). Because they pose a greater risk to the lender, however, they usually come with higher interest rates and additional fees.

Here’s a comparison of conventional vs private mortgage loan costs in Canada.

Interest Rates:

- Conventional mortgage rates: Currently 2%-5%

- Private mortgage rates: Typically 5%-18%

Fees:

- Conventional bank mortgages: Usually involve appraisal, inspection, and legal fees (mortgage broker fees are generally paid by the lender)

- Private mortgage loans: Usually include all of the above plus brokerage, lender, and set-up fees ranging from 1%-10%

Private mortgage interest calculation example

While the actual calculation is a little more complex, here’s an example of what the interest charges on a 2-year, interest-only, $100,000 private mortgage loan at 9% would look like:

Private mortgage loans can be costly, but they can also be helpful in the right circumstances.

When should you consider a private mortgage loan?

People often turn to private mortgage loans when they don’t fit the qualifier criteria used by banks and other conventional lenders.

In Canada, for example, if you don’t have a decent credit score (usually 620-680), your bank might:

- Ask for a bigger down payment

- Require someone to co-sign your loan

- Refuse your mortgage application outright

Bad credit is just one reason why you might need, or even prefer a private mortgage however.

Here are some others:

You have no, low, or inconsistent income. To determine mortgage affordability, banks prioritize numbers like income, monthly housing costs, total debt load, and mortgage stress test results. Private lenders focus more on property value and equity.

You only need a short-term loan. Private mortgages are meant to be temporary. Not only do they come in various shapes and sizes (including construction and renovation mortgages), they usually offer more flexible repayment options.

You want to purchase an unconventional property. Many prime mortgage lenders aren’t open to financing vacant land, commercial, or distressed properties. Private lenders are far more flexible.

You need financing quickly. With their fast approval process, private mortgage loans can be used to finance property investment opportunities or bridge income gaps.

What to expect when you work with a private mortgage lender

Private mortgage lenders have the freedom to consider individual loan requests without having to focus on credit history or verifiable income.

For example, because they aren’t required to conduct a mortgage stress test, a private lender can often approve a second mortgage in the form of a home equity loan—even if you have no income.

While the income, credit, and other approval criteria varies from lender to lender, as a minimum you’ll need to provide:

- Confirmation of your property’s appraised value

- Information about your existing mortgage if you have one

- Legally reviewed and witnessed loan documents once your application’s been approved

Plus, because private lenders mainly deal with high-risk, uninsured mortgages, you may need to demonstrate a property loan-to-value ratio (LTV) of 80% or less (if your property is worth $500,000, for example, and your equity or down payment is $100,000, your LTV is 80%).

Bottom Line

Private mortgage loans are generally costlier and riskier than big bank loans. But that hasn’t kept the value of mortgages extended by Canadian non-bank lenders from reaching new highs ($350 billion in 2021). So long as you thoroughly research potential lenders, and understand their borrowing terms, you can avoid running into problems with your private mortgage loan.

Frequently asked questions about private mortgage loans

What’s the main difference between a bank and a private mortgage lender?

Private lenders have greater flexibility when it comes to approving unconventional mortgages and customizing loan terms and rates. To offset the additional risks involved, they charge higher interest rates than most banks or conventional lenders.

Can I get a private mortgage loan if I have a collateral mortgage?

If you have a collateral (or re-advanceable) mortgage—one that allows you to borrow additional funds as the value of your property increases—you’ve effectively “maxed out” your equity already. A private lender is unlikely to approve an additional mortgage loan.

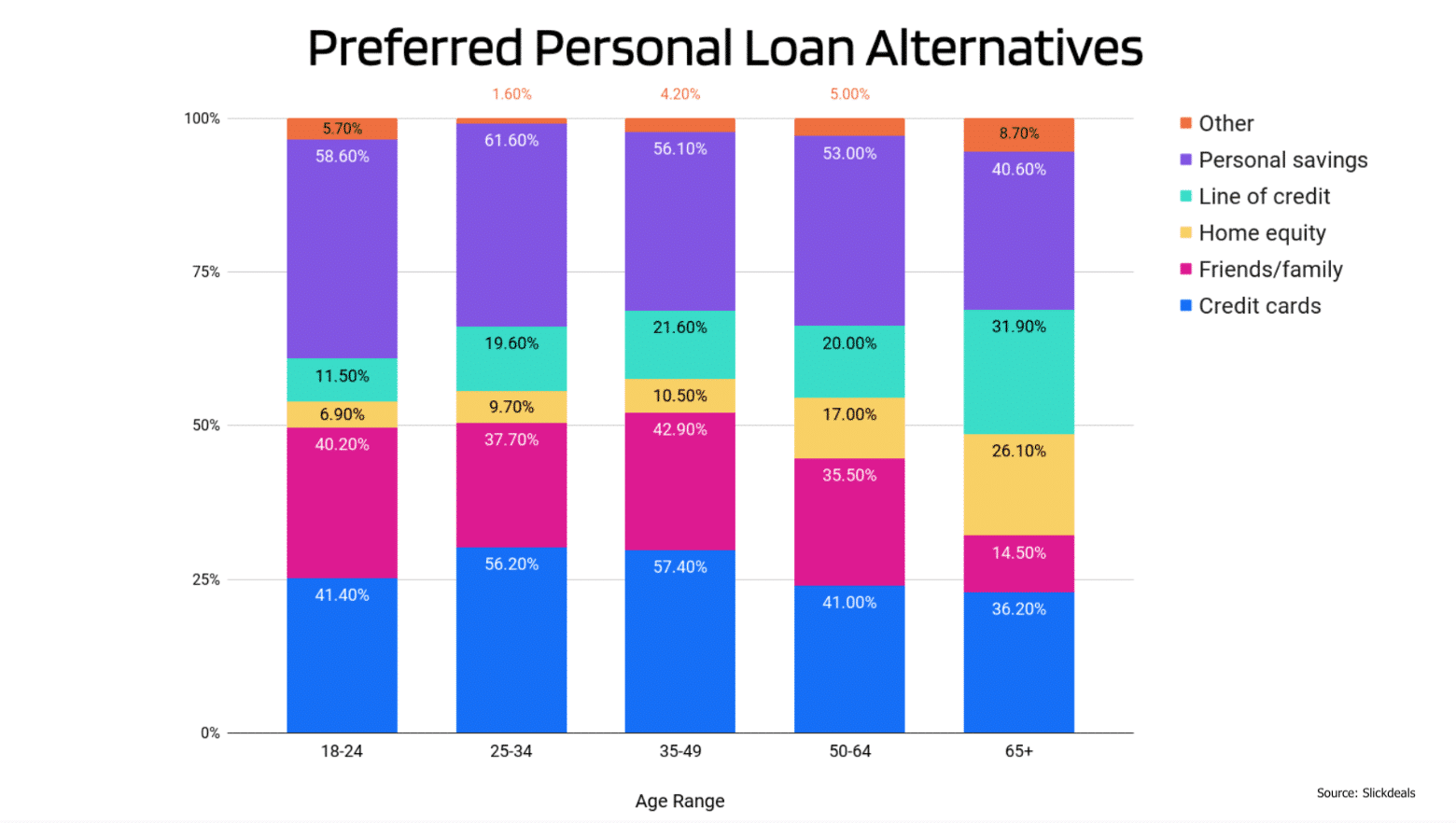

Can I get a private mortgage loan if I have no credit history?

It’s true that new Canadians and young adults—along with anyone who’s avoided credit cards, lines of credit, or consumer loans—might not have much of a credit history. But with less emphasis on credit scores, and more on property values, private mortgages are easier to qualify for than most bank loans.