Imagine a shopping mall scenario where a customer named Bart is on the hunt for a new mattress. As Bart looks at the various options available to him, he has shortlisted his selections down to the final four. The only thing left to do is select the best one and pay. Bart finally selects the one mattress that he can already envision getting a great night’s sleep in. But as he flips over the price tag, his heart sinks. The price is out of his budget range, and he now has to select one that is more affordable.Â

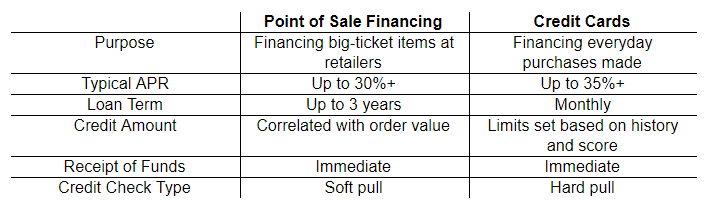

While this may be a little theatrical, it is a situation faced by hundreds of shoppers every day. However, that doesn’t have to be the case in today’s shopping environment. The advent of technology has given rise to several consumer finance companies offering innovative solutions to finance purchases made by everyday consumers at retail stores. In Bart’s case, one applicable solution would be point of sale financing - a relatively new innovation that has only been proliferated on a mass scale over the past year or so.