Compare Lenders

Discover Popular Financial Services

Quick Links

- How Do Payday Loans Work?

- Who Can Get a Payday Loan in Ontario?

- What Counts As Income for a Payday Loan?

- How Much Do Payday Loans in Ontario Cost?

- What Do I Need To Get a Payday Loan in Ontario?

- Where Can I Get a Payday Loan in Ontario?

- How Fast Can I Get a Payday Loan in Ontario?

- What Do I Need To Know About Getting a Payday Loan Online?

- How Safe Are Online Payday Loans?

- Does My Credit Score Matter?

- How Can I Use a Payday Loan?

- How Do I Receive My Payday Loan?

- How Long Do I Have to Repay My Payday Loan?

- What Happens If I’m Denied a Payday Loan?

- Does My Employer Need To Know I’ve Taken Out a Payday Loan?

- How Do I Choose a Payday Lender Near Me?

- Legal Requirements in Ontario for Lenders

- Borrower Rights in Ontario

- Payday Loans Ontario Summary

How Do Payday Loans Work?

A payday loan is an unsecured loan available to retail consumers, and it works just like most other loans. You complete an application process, and if approved, you receive a sum of money. You may use this money as you wish.

You then have to repay the loan, plus interest and fees, according to the repayment plan in the payday loan agreement. Most of these loans must be repaid when the borrower receives his/her next payday.

Who Can Get a Payday Loan in Ontario?

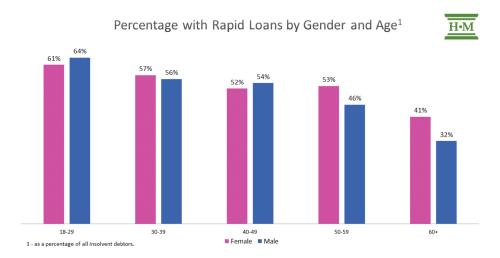

Chart showing breakdown of borrowers in Ontario by age and gender.

Getting instant payday loans in Ontario is simple, and minimal personal and financial information is required. Eligibility rules state that applicants must:

- Be at least 18 years old

- Have a bank account

- Have some form of steady income

And that’s it! No credit check is required; neither is any form of collateral. As long as you can show the above, you are likely to receive approval.

Their easy application process and minimal requirements are a big part of why these loans are so popular for dealing with unexpected expenses and emergencies.

What Counts As Income for a Payday Loan?

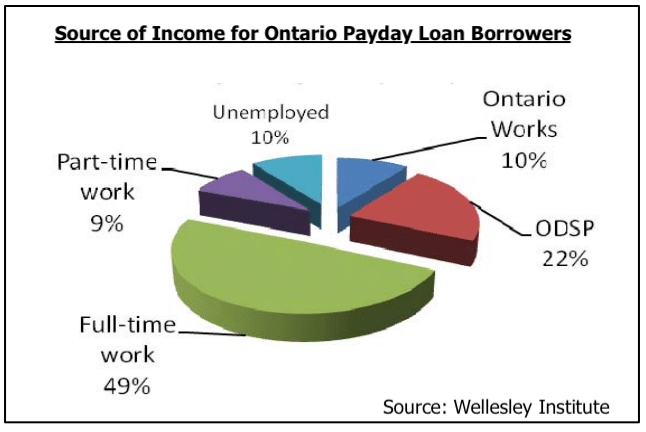

Chart showing income sources by % of Ontario borrowers.

Crucially, the income needed to qualify for an instant payday loan does not have to be employment income; any form of regular income counts. This includes:

- Government benefits

- Pension income

- Alimony/child support

- Tax rebates

- Royalties

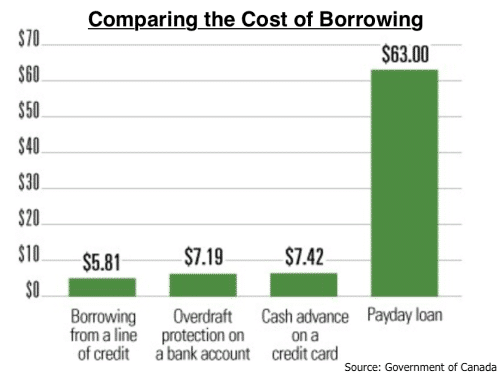

How Much Do Payday Loans in Ontario Cost?

Ontario residents enjoy some of Canada’s lowest payday loan rates. This is because the maximum allowable cost is not controlled by lenders, but by the provincial government via the Payday Loans Act.

This maximum cost is set to $15 per $100 borrowed. The cost is expressed in this way rather than as an interest rate because most payday loans are intended to be repaid in one lump sum from your next paycheque, so their cost is advertised as a ‘flat fee’.

However, you should know that this is the cost only if you pay back the cash on time, and does not account for other fees or interest that will increase if you fail to repay. The total cost may therefore be much higher.

It’s also worth noting that even with this cost cap, payday loans in Ontario are still significantly more expensive than other online loans and short term loans. Even if you have a poor credit score, there is financial support available that can provide quick access to urgent funds. Research by the Government of Canada found that 57% of people who get these loans were aware of their high costs versus their alternatives.

How Much Can I Borrow With a Payday Loan in Ontario?

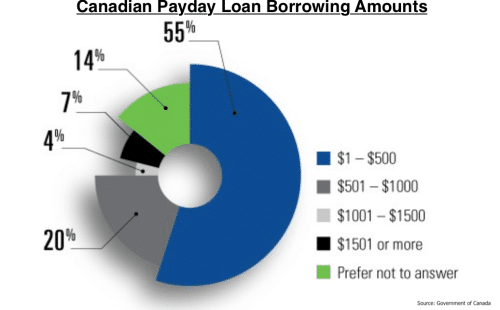

Chart showing distribution of borrowing amounts. Most people borrow under $500.

The amount Ontario residents can borrow with a payday loan is smaller than with other personal loans in Ontario. The maximum borrowing amount is set by the financial regulator, and is $1,500.

You cannot increase the loan amount. This is because there are rules that state customers can only take out one loan at a time from each lender. You must therefore repay all of the money you borrow before you can access extra funds.

What Do I Need To Get a Payday Loan in Ontario?

The application process for payday loans in Ontario is easy, and does not require much paperwork. You’ll just need to provide:

- I.D.

- Your most recent pay stub or other proof of income, such as employment details

- Proof of address (crucially, all that is required is proof of residence; you do not have to be a Canadian citizen)

- Bank account details

- An active cell phone number

If using an online loan application, you will need to have high quality images or scans of these items.

Where Can I Get a Payday Loan in Ontario?

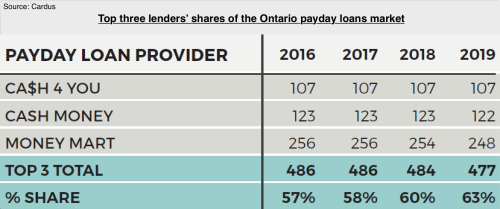

Table showing the share of the market covered by the top three lenders.

Payday loans are available at retail stores in convenient locations across Ontario, as well as online. This form of instant loan is provided by non-bank institutions that must be registered with the Financial Consumer Agency of Canada.

There is no need to go anywhere to get a quick cash loan in Ontario; online payday loans are readily available from a wide range of online lenders, under the same terms as store-bought payday loans.

How Fast Can I Get a Payday Loan in Ontario?

Very fast. Most lenders (whether you apply online or in person) will provide an almost instantaneous turnaround time. This means you can apply in just a few clicks, receive instant approval, and get your funds into your bank account in just moments. The entire process can take as little as a few minutes.

Their speed is one of the primary attractions of payday loans, as they allow those experiencing a financial emergency an almost immediate solution.

What Do I Need To Know About Getting a Payday Loan Online?

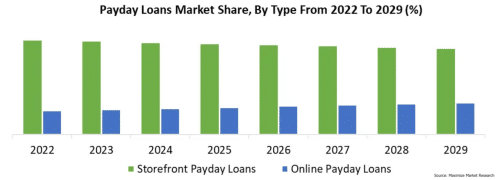

Chart showing distribution of instant cash loan market. Most people still choose to borrow money in person rather than get an online payday loan.

Online payday loans Ontario are essentially the same instruments as in-store payday loans. And because so many people want convenience, the majority of lenders now offer an online application form; once submitted, you can receive an almost instant decision on your online loan application, and if approved have funds deposited directly into your bank account or sent via Interac e-transfer.

So online payday loans are extremely accessible and those in the Ontario area can get funds fast, without having to go anywhere. But physical locations for most instant cash lenders are present throughout Ontario as well, with most open outside of regular business hours.

How Safe Are Online Payday Loans?

The security of your personal information online will depend more on your personal setup than the loan provider’s security; any reputable online lender in Canada will have robust security protocols. You should verify the trustworthiness of a lender before you apply for payday loans online. And if you’re at all worried about sharing personal information online, just visit a nearby payday loan store instead.

Does My Credit Score Matter?

Unlike with other loans, a credit check is not necessary when you apply for payday loans; the only really important factor is income. This means payday loans are a great option for those with a poor credit history, or who wish to avoid a credit check for any reason.

It’s important to realize though that payday loans are not suitable as a means to rebuild your credit. This is because most lenders do not report payments to credit bureaus, so positive payment will not be taken into account in your credit history.

How Can I Use a Payday Loan?

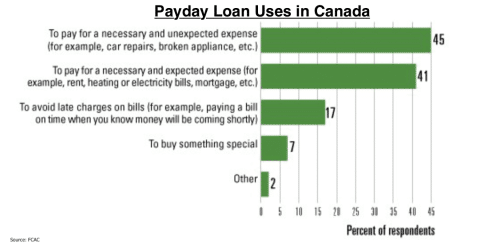

Chart showing typical loan uses. The majority of users want money to cover unexpected payments.

Due to their structure, instant payday loans are best suited to provide cash for financial support in times of emergency, or to cover unexpected expenses. Their size and interest rate makes them less suitable for long-term borrowing or large amounts of money.

This doesn’t mean those accessing them are restricted in how they can use their funds; on the contrary, payday loans in Ontario can be used for any purpose, including:

- Financial assistance for ongoing expenses, such as food or utility bills

- Unexpected expenses, such as a car repair

- Unexpected bills, such as medical bills

- Other unforeseen expenses

- Discretionary purchases

- Other financial needs

How Do I Receive My Payday Loan?

Once your loan application has been through the approval process and accepted, your entire loan amount will be automatically deposited into your bank account, or sent to you via Interac e-transfer.

This is one of the ways in which payday loans are so convenient: there is no long assessment period by a loan officer, and no credit check; instant approval is possible. And funds will be sent electronically, so via online banking you’ll be able to see them right away. Hassle free, quick cash is available via a very easy process.

How Long Do I Have to Repay My Payday Loan?

That depends on the loan agreement you signed. Most who borrow money via payday loans do so with the intention of paying the money back within a few weeks.

If you extend your borrowing beyond your next payday, you may end up paying much more money for your loan. Payday loans are high cost loans, so should be considered as short term loans only; if you need more time to repay, you may be better off considering other solutions for your immediate financial needs.

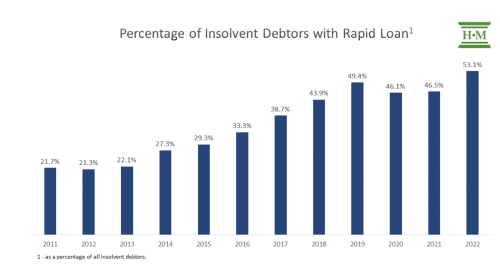

Graph showing percentage of insolvent debtors with rapid loans.

What Happens If I’m Denied a Payday Loan?

If you are an Ontario resident and your loan application is denied, it’s probably because you already owe money to that lender. Try applying through another lender.

Or, work on paying off your outstanding debts and building your credit with services such as credit counselling or a debt management program, so you can more easily access short term loans in the future.

Does My Employer Need To Know I’ve Taken Out a Payday Loan?

No. While you need to be able to prove your income when applying for instant loans, your employer does not need to know, and lenders should in no circumstances inform your employer.

It’s also worth noting that it is illegal for lenders to take payment in the form of automated paycheque deductions.

How Do I Choose a Payday Lender Near Me?

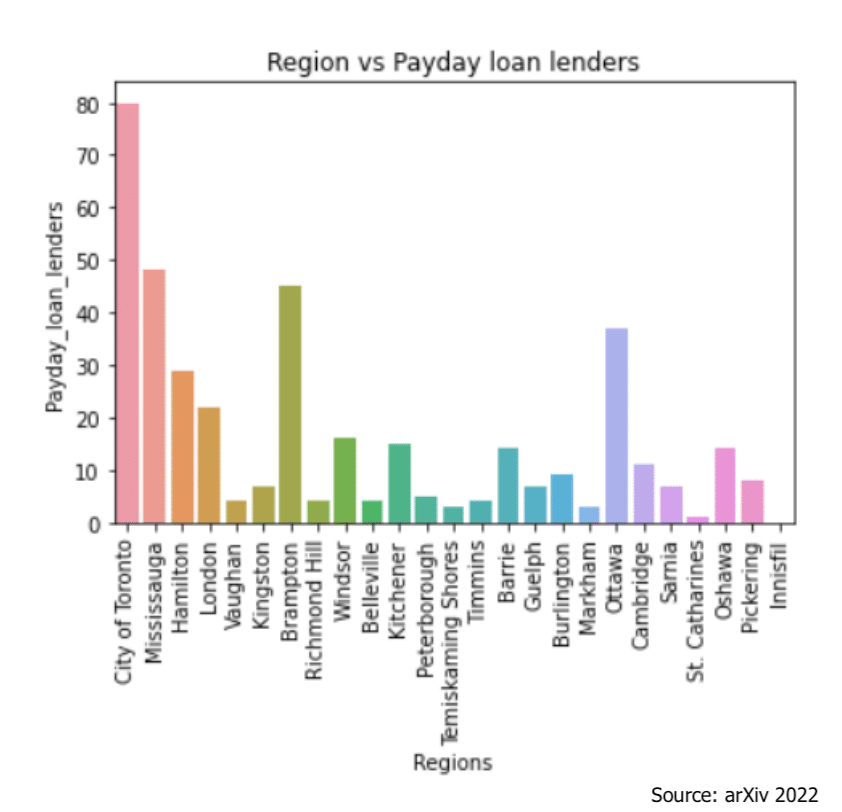

Graph showing number of lenders in different regions in Ontario. East Central Canada has the most options.

With so many options to choose from, picking the right lender can seem tough. This is especially true if you are looking at payday loans online.

To find an online option that works for you, first check whether a lender offers an online application. You should know that many lenders use the terms “cash advance” and “no credit check loan” to describe the same products.

Then check whether the lender is transparent about their fees. Do they encourage responsible borrowing? What do they charge for access to quick cash?

Then finally ask: what are their reviews like? What do other people getting their cash from this type of loan say? Do they have a customer support team to help explain the loan terms or discuss your financial needs?

Finding the right instant payday loans is not just about cost – you also need to take into account the reputability and practices of the lender.

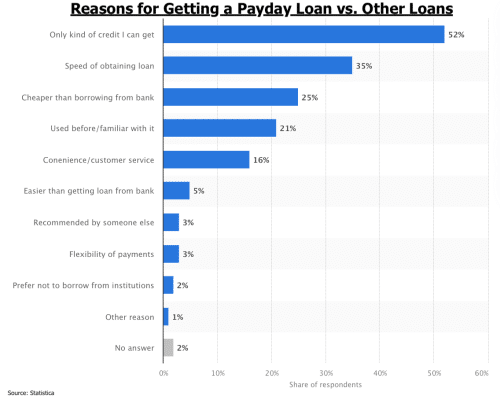

What Are the Alternatives To a Payday Loan?

Chart showing the cost of borrowing for different loan types.

A major reason many turn to payday loans in Ontario is that they are unable to access cash by any other means; 65% of these borrowers in Canada do not have access to a credit card. If you combine this issue with the prevalence of bad credit, it’s easy to see why payday loans are so popular.

But given their cost, it’s worthwhile considering if any of the other loans in Ontario that are available may better suit your needs; for example, bad credit borrowers can access other types of short term loan, and many of these lenders have an online application form. Or, if time is of the essence, other lenders have hassle free online application processes that allow borrowers to access cash fast – some even providing direct deposit or e-transfer of borrowed funds within a day.

As loans in Canada, of all types, have become more popular, and online lending has surged, pretty much any type of loan you can think of is available online, and lenders of all kinds – including banks, credit unions, credit card companies and alternative lenders – have multiple options that make getting a loan much easier than you might think.

Chart showing reasons people get a fast cash loan.

Here are some of the best alternatives to payday loans in Ontario, that can help you deal with unexpected costs, without suffering punitive interest rates:

Credit Card Cash Advance

This is structured as a line of credit, where the cash advance offered is dependent on the unused credit limit on the borrower’s credit card, rather than on income. This type of cash advance is provided directly by the credit card company (not the issuer), and receives the same type of treatment as any other ordinary purchase made with a credit card.

In some cases, credit card companies charge higher interest rates on cash advances than on ordinary credit purchases, so it is important for the borrower to understand the rate differential, and act accordingly.

Bad Credit Loans

It’s a myth that you need a high credit score to secure a personal loan. Those who can’t pass traditional lenders’ credit checks still still gain access to quick loans – most usually from bad credit lenders who specialize in products geared towards those with less-than-perfect credit. You may have to pay more in interest for a bad credit loan than you would for a traditional personal loan, but it still may be cheaper overall than Ontario payday loans online.

Secured Loans

Another option if you’re worried about credit checks is a secured loan. It is easier for those with bad credit to access secured loans than unsecured loans. By providing collateral against a short term loan, you can reduce the risk to the lender, and so access more money and better rates.

Short Term Personal Loans

If you have reasonable credit, short term personal loans in Ontario will have much better interest rates and more flexible terms than any other quick loans. Many lenders offer these instruments online, with fast application processes and funds available via deposit into your bank account or e-transfer. In this way these loans can be as convenient as payday loans in Ontario, while still allowing you to access cash fast.

Savings

Research has shown that even those with high income and savings turn to fast cash loans in Ontario to get extra cash in times of need. This is believed to be an education issue; people would rather keep savings accounts ring-fenced, and take on new debt, than dip into rainy day funds.

However the math on this does not add up, as a third loan costs more than using savings, and can potentially affect your credit rating and overall financial health too. The best advice states that it is better to use savings when encountering an unexpected expense, and then rebuild them slowly from your monthly pay, than it is to take on unnecessary debt.

Legal Requirements in Ontario for Lenders

Lenders in Canada are regulated and have to comply with specific requirements in order to operate. These requirements state that those who offer payday loans in Ontario – including those who offer online payday loans – must:

- Be licensed and registered, as well as fully compliant with the rules of the Payday Loans Act, 2008

- Be transparent about the terms in their contracts

- Be clear about their costs and display them prominently in store and online, with no hidden fees

- Limit each borrower to one loan at a time

- Refuse payment by automatic paycheque deduction

Borrower Rights in Ontario

There are also mandated borrower rights, including:

- Insurance is optional on a payday loan

- Borrowers cannot be charged more than 15% interest

- Lenders cannot sell any incremental and/or additional goods and services along with a payday loan

- Lenders cannot provide a loan of more than 50% of net pay

- Borrowers can cancel a payday loan contract within 2 business days of origination, without paying any penalty, fees, or providing a reason to the lender

- Payday loan debt cannot be rolled over into a new payday loan

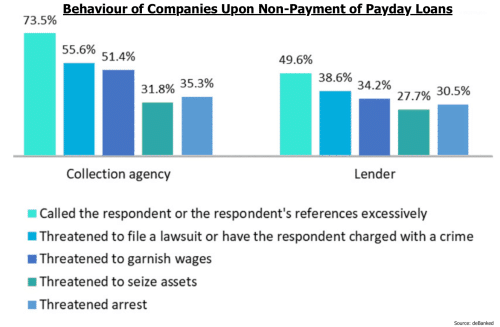

In addition, the Payday Loan Act puts restrictions on a lender’s behaviour if a customer fails to repay their borrowed funds. Lenders cannot:

- Contact the borrower more than 3 times a week (excluding regular mail) or on statutory holidays

- Contact people associated with the borrower, such as relatives, friends, neighbours or acquaintances

- Use excessive pressure or threatening language

- Process a post-dated cheque or pre-authorized debit more than once if it means that the financial institution will charge additional fees

Chart showing that some illegal behaviour still occurs.

Payday Loans Ontario Summary

Borrow up to $1,500 at a time

Repay from your next paycheque

Pay $15 per $100 borrowed in interest

Funds can be used for any reason

No credit check required

You must have some form of income to qualify

Fast cash is available within minutes

Explore more

Similar products

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice