Listen, we get that investing can seem like not only a weird thing but also seem super intimidating too. For many, it seems like something Canadians do or that older (i.e. rich) people can afford to do. Truth is, that’s just not the case! There’s a reason why people are still investing in stocks, it has a long history that shows it’s one of the most profitable ways for one to build wealth for the years to come.

An increase in stock price and its dividends are two ways to profit from owning and investing in stocks. This means that as they accumulate over time, the right yearly investment with the correct company can yield a solid return. Sounds good right? Who wouldn’t want to help secure potential long-term wealth!? You need to pause those thoughts of what can I do with that extra money dreams and think for a minute.

It’s important before you start investing in stocks that you not only know how to invest in the stock market but understand the risks that come with it. Before you invest, educate yourself and look at your finances to determine what you can invest in the stock market. Make sure to keep reading and learn the basics of how to invest in stocks for beginners.

Topics:

Stocks 101

You might have heard of stocks, but do you know what a stock exactly is?

Stock is capital raised by a company or corporation through the issue and subscription of shares.

It is essentially legal ownership in said company or corporation. They are sold often to help raise money with two varieties:

Common stock entitles those with shares to dividends that vary in amount. These particular types of stock may even be missed, depending on the fortunes of the company. To break it down, common stock allows the stockholder a proportional share of the profits but also of its losses.

Preferred stock entitles the holder to a fixed dividend, whose payment takes priority over that of ordinary share dividends. To put it simply this option of stock investing comes with a predetermined dividend payment.

Now that you know what stocks are, it’s time to learn how to invest in the stock market!

What’s the Best Approach in Investing in Stocks?

This is where it can get a bit confusing. There are a few key ways to approach stock investing. First, you have to determine your investing approach. To get into stocks and how you invest you have to pick an option that represents and reflects how hands-on you’d like to be in your investment and what your risk tolerance is. You also want to consider how much time you want to spend researching different companies etc.

Think about who you are as a person. If you’re more of a DIY kind-of-person and want a more hands-on investor experience and choosing stocks for yourself sounds ideal, then you will just need a stockbroker. A stockbroker is a professional who executes buy and sell orders for stocks and other securities on behalf of clients.

If hands-on investing sounds a bit daunting and you’d like someone to manage the process for you, then consider a robo-advisor. Think of them as an investment advisor. Created in 2009, Robo-advisors is a service that offers low-cost investment management. A majority of brokerage firms offer this service. They’ll help you set specific goals and invest your money based on them. Robo-advisors tend to be the most common way for beginners to get into stocks.

In a report by Charles Schwab, 58% of Americans say they will use some sort of robo-advisors by 2025.

If Wealthsimple doesn’t sound quite right for you and your budget is small you might consider investing through your employer if this a viable option. The common investment people make when doing this is one percent of your salary into the retirement plan available to you. Work-based retirement plans deduct your contributions from your paycheck before taxes are calculated. Talk about an added bonus!

Once you have a preference in mind, you’re ready to shop for an investment account.

Opening an Investment Account

In order to invest in stocks, you’ll need an investment account. If you’re doing the hands-on approach this means a brokerage account. If you’re seeking help, this is when you’d open an account with a robo-advisor. Let’s break it down a bit more.

Brokerage Account

Brokerage accounts are operated through licensed brokerage firms. It is through these firms that investors (you) can deposit funds and buy investments. In order for you to make purchases and trades, you must have one of these accounts. Without it you can’t invest. There are plenty of brick-and-mortar brokerage account firms but many offer online services. This often is the least expensive path to buying stocks for beginners and is the quickest. When picking the right brokerage account make sure to ask yourself these questions:

- What are the commissions?

- Are there any account fees?

- What does their investment selection look like?

- Do they offer educational tools or access to investment research?

- Do I want a standard brokerage account or an IRA?

When asking yourself these questions also make sure to ask yourself the question of why. Why are you investing? If you’re investing for a rainy day and easy access to your account, then a standard brokerage account works for you. If you’re investing for retirement an IRA is great for tax-purposes, but it can be difficult to withdraw your money until you get older. This can be a pro and con depending on what you need.

Understanding the Difference Between Full-Service and Discount Brokers

There are full-service brokers that tailor recommendations for you, but a more bespoke service means higher fees and commissions.

A discount broker allows you once an account is set up at a minimal cost to yourself to buy through their website. They also often offer support online or by phone.

Let’s talk about money and just how much you’ll want to invest.

Determining Your Investment Budget

Determining a budget is essential for those looking to invest in stocks. Figuring out how much money you have to invest is crucial as it will impact not only how you’ll invest but the outcome too. Before we dive deeper, we want to talk about the money you shouldn’t invest in stocks.

Stocks can be risky. We don’t want to downplay that stock markets can have financial risks which is why you shouldn’t invest certain areas of your money. The fact is, the stock market is no place for money that you might need within the next few years. This means your:

- emergency fund

- down-payment money

- tuition money

- next year’s vacation

If you’re struggling to keep up with credit card payments and have little savings, maybe pause for a second. Take a step back and think again about investing. We know the lure of the gains in the stock market can be very appealing but it’s important to analyze your own financial situation first.

If you do have money to invest in stocks, then let’s talk about what to do with your investable money!

Asset Allocation

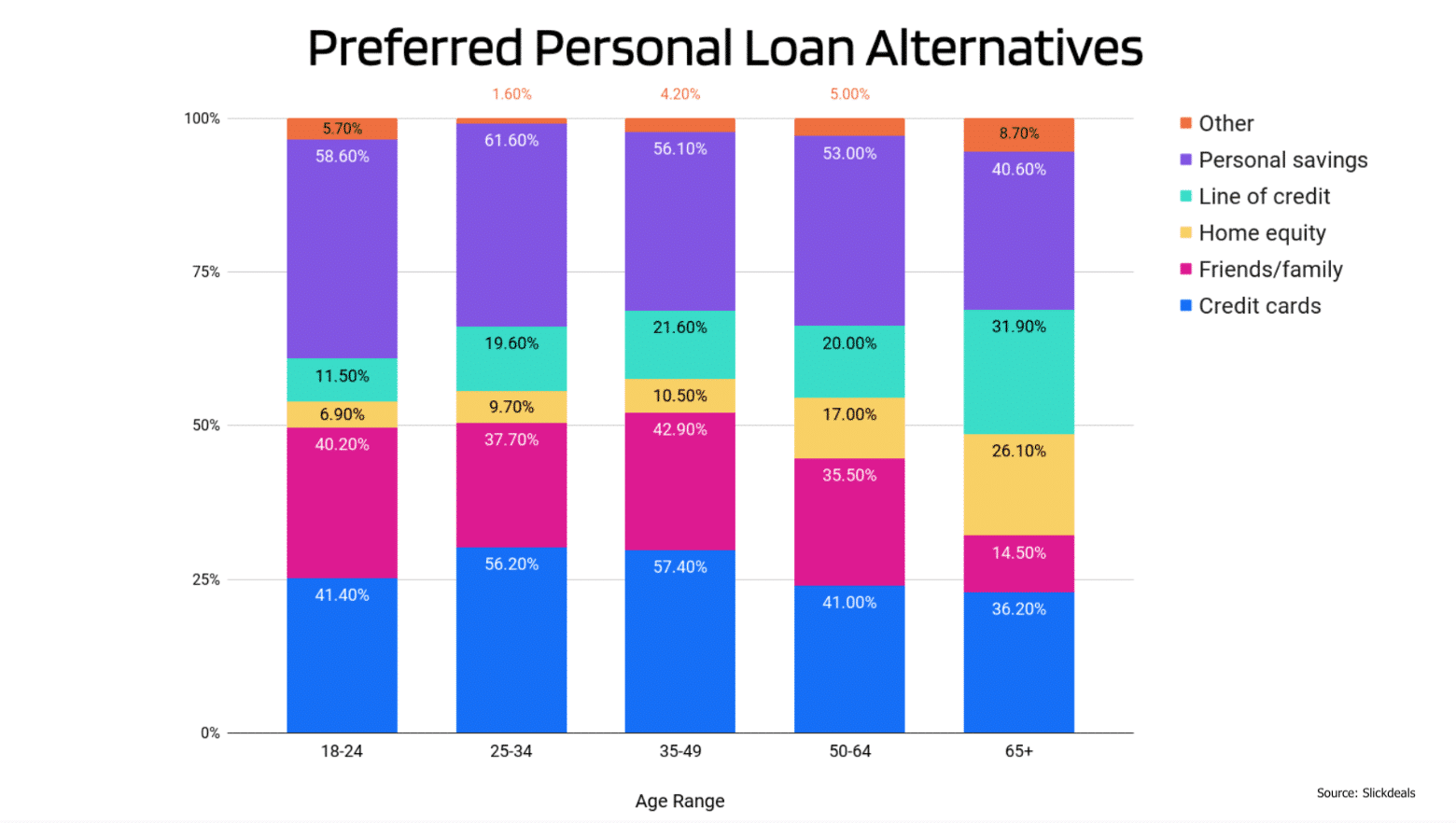

When we talk about investable money, we’re talking about the money you won’t likely need within the next few years. This is a concept known as asset allocation, and there are a few factors that come into play here. Age is a consideration, as is your investment objectives and particular risk tolerance.

Why is age a consideration when it comes to stocks? Generally, the thought is that as you get older, stocks gradually become a less desirable area to keep your money in. When you’re young, it’s presumed you have lifetime ahead of you to ride out the ups and downs of the stock market. This is why investing younger allows a greater chance for gains versus when you are investing at an older age.

This is the approximate percentage of your investable money that should be in stocks. To give you an example, if you are 28 years old this rule implies 82% of your investable money should be in stocks.

Finding the Perfect Stock

Now that you have figured out just how much you can invest it’s time to find the stock that speaks to you but also will make you some money (hopefully!). When beginning to invest in stocks it’s important to do the following:

But most importantly, make sure to diversify your stock portfolio!

Diversification

When you have a diversified stock portfolio it allows you to have a variety of companies in your portfolio. Diversification is designed to help reduce the volatility of your portfolio over time and is one way to balance risk and reward in your investment portfolio.

Value Investing

If you’d prefer to just invest in individual stocks make sure to educate yourself with some of the best ways to evaluate them. Once you have done that, you buy Value stocks. Value stocks tend to trade at a lower price relative to their fundamentals, such as dividends, earnings, and sales, making them appealing to investors with longer time horizons.

Time to Invest

It is now time to invest but how?

Warren Buffett has famously said, “a low-cost S&P 500 index fund is the best investment most Americans can make – and choosing individual stocks only if you believe in the company’s potential for long-term growth.”

For many investors they have had success in buying stocks solely with two types of orders; market and limit orders.

Market Orders

What is a market order? When purchasing a market order, you’re indicating that you’ll buy or sell the stock at the best available current market price. Since there are no price limits on the trade, your order will often be done immediately. With this type of order, don’t be too surprised if the price you pay – or receive when selling is not the exact price you were quoted just seconds before.

In this system bid and ask prices are fluctuating quickly and constantly throughout the day. This is why a market order is best used when buying stocks that don’t experience massive price swings but instead show steadiness.

TIP: Make sure to check your broker’s trade execution disclaimer. With some low-cost brokers, they will bundle all customer trade requests to execute all at once at the prevailing price, either at the end of the trading day or a specific time or day of the week.

Limit Orders

The second option you can do if market orders don’t sound appealing is a limit order. A limit order gives you more control over the price at which your trade is executed. Limit orders are a good tool for investors buying and selling smaller company stocks, which tend to experience wider spreads, depending on investor activity. Another positive is they are good for investing during periods of short-term stock market volatility.

Just make sure to make your conditions clear to your broker. While a limit order guarantees the price you’ll get if the order is executed, there’s no guarantee that the order will be filled fully or even if at all. Limit orders are placed on a first-come basis AND only aftermarket orders are filled AND only if the stock stays within your set parameters long enough for the broker to execute the trade.

Before you start buying stocks, it is important to understand one other thing first…

Learning to Read a Stock Chart

When you’re a beginner and investing in stocks it can seem intimidating at first to read stock charts. With all those lines, numbers and colors it can feel confusing but, here are some tips on how to read them and before you know it, you’ll be a pro! These are also known as IBD charts. When reading a chart, you will see why it’s important to analyze it as part of your regular stock investment routine.

Why Should You Use Stock Charts?

If you don’t use charts, then you are investing blindly. You can’t see or understand what is really happening with a stock, which means investing in it is just a silly and unnecessary risk. When reading a chart think of it as a story. You can almost see what others are thinking and planning when reading it. Ask yourself or your broker questions like is the stock being heavily bought by large investments and why? Or are they dumping shares as fast as they can?

It’s not uncommon to see share prices go up and down every day, but with the chart, you can put those in perspective and help see when you should sell, hold or buy.

What’s in a Stock Chart?

Price and Volume

The relative strength line (RS) compares a stock’s price performance to that of the S&P 500. This is where you can quickly see if your stock is a leading or in the back of the pack. Generally, a sharply rising RS line tells you the stock is outperforming the general market. If you see the RS line going down that shows the stock is lagging.

Relative Strength Line

The relative strength line (RS) compares a stock’s price performance to that of the S&P 500. This is where you can quickly see if your stock is a leading or in the back of the pack. Generally, a sharply rising RS line tells you the stock is outperforming the general market. If you see the RS line going down that shows the stock is lagging.

Daily vs. Weekly Charts

When you are a beginner you will wonder if you need to use daily or weekly charts. The short answer is you need to use both. When reading a daily chart, it gives you insight at the price and volume at a specific time. Reading the weekly chart helps give you a longer-term perspective on the stock and its trend. It also helps you not get overly swayed by the day-to-day volatility.

Invest Wisely

There you have it, 7 steps on how to invest in stocks. There is a plethora of information out there so make sure to read all that you can. This guide is just a starting point for beginners looking to not only invest in stocks but to understand stocks too. Stock market investing can be daunting but take things slowly and seek advice and guidance from professionals.

Keep in mind that there are different investing styles that are more or less suitable depending on each person. For example, your preference between active and passive investing style will dictate what type of platform to use to manage your investments.

There is no reason to rush into any investments. Learn how to invest wisely and who knows you might just be the next Warren Buffet!

Still, have a few questions? Check out a few FAQ’s we get when it comes to those just starting out in the stock market.

Stock Investing for Beginners – FAQs

To view the answer of each question, click the plus icon (+) beside it.

When looking to invest in stocks make sure you’re taking your money and investing it wisely. This is why we tell everyone to research before they invest. Read the stock charts and look for trends.

Yes! It is a common misconception you must be wealthy to invest but if you’re a beginner investor then you can invest in stocks too! It doesn’t take a lot of money to build a stock portfolio.

You can begin with as little as $500.

This is a great article from Stock Trader with 10 Great Ways To Learn Stock Tending in 2020.