Frequently Asked Questions About Prime Mortgage Lenders and Private Lenders

Is it better to get a mortgage from a prime mortgage lender or private mortgage lender?

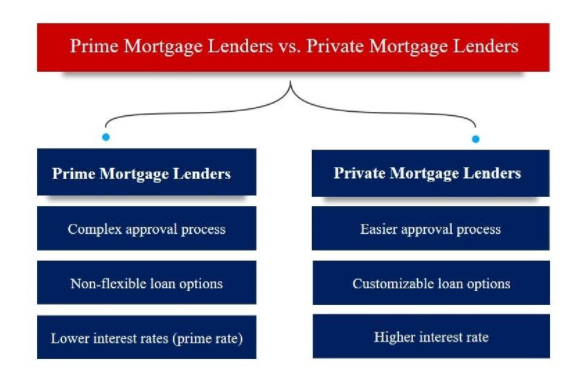

Prime mortgage lenders are generally less expensive, but it is difficult to get a loan approved if you do not have sufficient credit history or your credit score is below 620. It is easier to qualify for a private mortgage loan, but it charges a higher interest than a prime mortgage lender.

Are private mortgage lenders safe?

Private mortgage lenders are generally safe, and they can help you get a mortgage loan quickly and at better terms. However, due to the high risk of default, private lenders charge a higher interest than banks, and if the borrowers fall behind in making mortgage payments, the lender can foreclose on the home pledged as collateral.

How can I get a private mortgage loan?

If you are looking for a private mortgage lender, you should build a strong network of potential mortgage lenders comprising wealthy friends, family members, private investors, real estate agents, etc. You should prepare a strong proposal for your project, and show them the wow factor on how the proposal benefits them.