Best Home Insurance Companies in Ontario

Pricing varies by product, Discounts on Home + Auto Bundles

Ontario Only

Pricing varies by product

British Columbia, Alberta, Saskatchewan, Manitoba, and Ontario

Pricing varies by product

All of Canada excluding Quebec

Home Insurance Requirements in Ontario

Unlike auto insurance, home insurance is not legally mandatory in Ontario. However, you may still be required to have some form of home insurance, especially if you have a mortgage. There is usually a clause in mortgage agreements that states the mortgage holder must have enough property insurance to cover rebuild costs, in the event of total loss of the home, and most show proof of this insurance when applying for the mortgage.

Types of Home Insurance Available in Ontario

There are a couple of different types of property insurance available in Ontario; although all three are colloquially known as “home insuranceâ€, they are in fact distinct. They are:

- Homeowner’s insurance

- Condo insurance

- Tenant’s insurance

Homeowner’s Insurance

A standard homeowner’s insurance policy will cover the physical buildings that constitute the home (including detached structures), your personal belongings, and personal liability in the event that someone is injured on your property. These aspects of your home are covered against common events, known as “insured perilsâ€; however some (potentially common) issues are not covered by standard homeowner’s insurance policies.

Coverage for these unlikely but potentially expensive events (like flooding) is sometimes available as an add-on, or as part of more comprehensive policies. But depending on where you live in Ontario, specific coverages may be unavailable. For example, flooding insurance is not going to be an option if you live on a floodplain.

Condo Insurance

Condo insurance is like homeowner’s insurance, but it only covers the named unit within the condo building - not the larger building’s structure. A condo building will usually have its own insurance policy (known as condo building insurance) to cover the common areas and main structure of the property. Many condo boards have specific requirements for occupant’s condo insurance, and you should check these before purchasing a policy. It’s also wise to ask to see the condo building insurance policy, so you know how far this goes and any exclusions you need to be aware of. Over 23% of Canada’s condo population live in Toronto alone, so this is a popular form of insurance in the province.

Tenant’s Insurance

Tenant’s insurance is a little different in that it does not cover the property in question, but it does cover your personal belongings within the property, as well as personal liability. If you don’t have a lot of valuable possessions, this may feel like overkill, but the liability portion matters; imagine if you had a cooking fire in your kitchen, and it damaged the property itself. Without insurance, you’d be liable for the repairs. This level of protection is valuable and costs much less than homeowner’s insurance.

The Cost of Home Insurance in Ontario

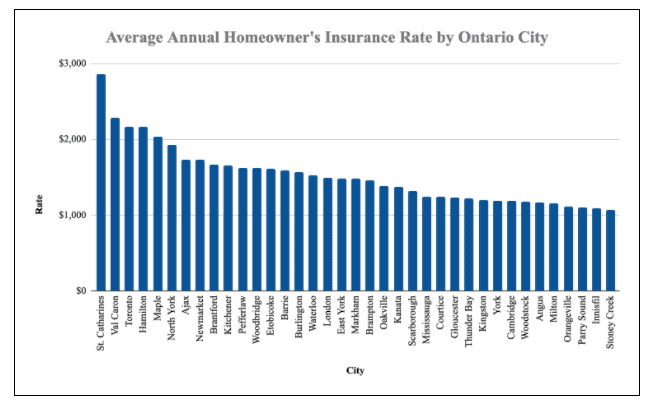

The average cost of homeowner’s and condo insurance in Ontario is just over $104 a month, but the range around this average is broad. Some people pay as little as $60 a month, and some as much as $170 a month. Those in Ottawa and Toronto pay the most on average because of higher property prices and higher risks in these urban areas. The average cost of tenant’s insurance in Ontario is much lower, at just $21 a month.

Understanding the Rising Cost of Home Insurance in Ontario

Insurance costs in Ontario have been on the rise for the past few years, for multiple reasons, including:

- Prevalence of insurance fraud

- More weather related claims because of climate change

- Higher risk due to an increase in crime

- Rising property prices

All of these reasons drive costs up, so it’s more important than ever to find ways to save.

How to Save on Ontario Home Insurance

Shopping around is still the number one way to save on your home insurance, but there are other methods, including:

- Bundling insurance policies across insurance types e.g. home and auto

- Bundling insurance policies across multiple properties

- Remaining claims free by covering minor issues yourself rather than filing a claim

- Installing a fire alarm

- Installing a security system

- Paying a higher deductible

- Paying for your policy annually rather than monthly

Frequently Asked Questions About Home Insurance in Ontario

Do I need extra home insurance if I rent my Ontario property out?

You can technically use standard homeowner’s insurance if you choose to rent your property out, but you need to be clear with your policy provider about who will be living in the home. Because homeowner’s coverage does not cover you for loss of income from the home, if something happens to it that prevents you from renting it out, many landlords choose rental property insurance instead.

Can I get home insurance for an Ontario vacation home?

Yes, absolutely, and protecting your vacation home is important. You can often add vacation property or cottage coverage to your main homeowner’s insurance policy to save money.

Are home insurance premiums tax deductible in Ontario?

No, unless you run a home business, in which case you will need business insurance coverage as well as your standard homeowner’s coverage. In this case, only the supplemental business insurance will be tax deductible.

Can an Ontario insurance company deny coverage?

Technically, yes, any individual insurance company can deny you coverage, but this is very rare. If you are denied, you can ask why and potentially solve the problem or find another provider.

Does performing renovations on my property affect my homeowner’s insurance?

Performing renovations on your home will not affect your insurance coverage, but you must inform your insurer of any changes you make to the home. Improvements may decrease or increase your insurance rates, but in the event of a claim the insurer has room to deny you if you’ve failed to give them accurate and up-to-date information on the home’s condition.

What kind of insurance do I need if I have an Ontario home business?

Those running an Ontario home-based business need to have a separate insurance policy to cover their business activities, as homeowner’s insurance does not cover business-related claims. Business insurance or home-based business supplements to your existing policy are both possible.

Written By Smarter Loans Staff

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada's highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the "GPS of Fintech Lending" by the Toronto Star.

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice