2M7 Financial Solutions, a Canadian merchant cash advance company, occupies the bourgeoning alternative funding space, but is far from the new kid on the block. 2M7 was founded in Toronto in 2008 — in the throes of the worst financial crisis since the Great Depression and a time when there was scant customer knowledge of alternative financing methods. Its initial business strategy was to offer cash advances to small businesses within its pre-existing network. Since 2016, 2M7 has widened its doors and broadened its footprint to create a countrywide network of thousands of customers (and counting).

Compared to Canada’s traditional and often conservative lenders with high credit standards like the major banks, 2M7 has a more open philosophy and liberal funding approach, proudly approving 97% of all applications submitted through its website.

“Our goal from the beginning has been to fund every deal possible. A lot of what sets us apart is that philosophy and our attitude to help small, main street-type businesses. We want to approve every entrepreneur that is looking for financing,” said Avi Bernstein, chief executive and co-founder of 2M7. “We believe a merchant’s intention is generally good. Everyone wants to grow their business and they need access to capital to do that. We have dynamic underwriting that takes into account a lot of factors that other funders would reject.”

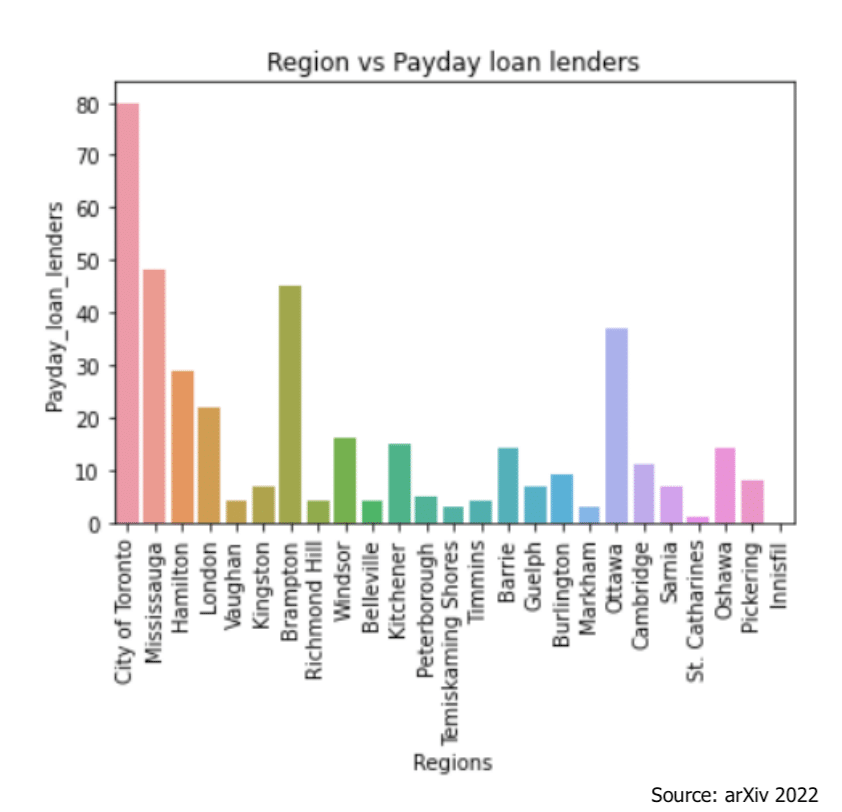

Bernstein attributed 2M7’s expansive growth post-2016 to rising consumer demand correlated with a lack of viable options to accommodate that need.

“We noticed there were very few funders in Canada that were able to handle that demand. At the time, there were only two or three players. Merchants were also starting to understand that there are other options than big banks. Demand started increasing quite significantly and we rode that wave,” Bernstein said.

“COVID has been the biggest challenge the Canadian business community has faced since I can remember — a way bigger struggle than 2008 was. Businesses froze up. The entire business community came to a standstill with the initial lockdowns,” Bernstein said.

2M7 pivoted quickly, offering reduced and deferred payments to clients to ensure their existing merchant base could withstand the systemic shock to their businesses and livelihoods. “Our staff reached out to clients one-on-one to understand how we could help — whether by deferring payments or addressing additional capital requirements or advising merchants on government programs that were available,” he described the first few months, specifically the “survival mode” that was March to May.

But since then, “the community has come back strong,” Bernstein said. The high number of defaults the 2M7 team was expecting did not materialize.

“It speaks to the resiliency of Canadian entrepreneurs. After the initial shock [of COVID-19] wore off, they have learned to work with and manage this new paradigm. Overall, people are focused on moving their business forward in a safe and healthy way for themselves, their staff, and their customers as much as possible,” he said.

While most of 2M7’s loan applicants are small businesses (“their bread and butter,” according to Bernstein), many medium-sized entities have applied since the onset of COVID-19, looking for capital injections due to cash crunches or having had banks pull their line of credit, he said.

Even with more significant headwinds facing companies as a result of spiking case counts and rolling lockdowns, Bernstein is confident about the financial future of Canadian businesses post-COVID-19. He predicts a renewed need for capital, with alternative funding companies like 2M7 positioned to serve merchants as the economy gains steam.

The demand for capital has already escalated in the past couple of months, with businesses accruing additional expenses to get back up and running, including restaurants purchasing heaters for outdoor patios or retailers installing hand sanitizer stations and new ventilation systems.

“I’m optimistic because I’m seeing how resilient, resourceful, and creative Canadian businesses are. It’s going to be a struggle and we’re going to see more pain on main street, but Canadian small business is going to come out a lot stronger than originally predicted,” Bernstein forecast.