Dividend reinvesting, automatic rebalancing, and tax-loss harvesting used to be services only the very rich could access. At Wealthsimple, they believe that everyone should have access to the same strategies for investing in their financial future.

Use our retirement calculator to estimate future income and check if your savings plan is on track.

Wealthsimple provides customers with intelligent, easy ways to invest, without charging high fees or requiring account minimums like most investment management companies do. Cutting edge technologies and diversified portfolios facilitate the best possible returns on investment. Everything about Wealthsimple is clear and straightforward; a core value of the business is gaining trust through transparency.

Everyone should be able to access the tools required to make good financial decisions. By making affordable financial products available to everyone, Wealthsimple is helping its customers gain financial freedom.

Features

- Easy to use and monitor – Manage your accounts from anywhere with Wealthsimple’s award winning website and mobile app.

- Expert Advisors – Wealthsimple has a team of investment experts always ready to help you reach your financial goals.

- Backed by research – Research has consistently proven that passive investing is the most dependable way to grow money over time.

- Free Account Transfers – When you transfer an existing account with a balance of more than $5,000, Wealthsimple will pay the transfer fees.

Products and Pricing

Wealthsimple Invest

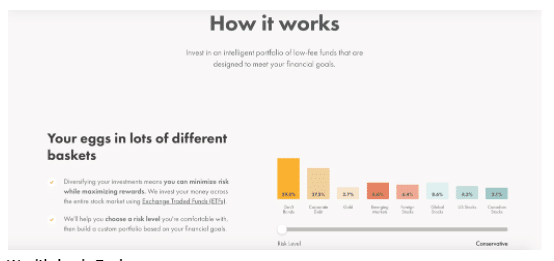

An intelligent portfolio with low-fee funds, designed to meet your financial goals. Diversifying your investment ensures that you minimize your risks while maximizing your rewards. The experts at Wealthsimple will help you choose the level of risk you are comfortable with and design you your own custom portfolio. With this option, you put your money completely on autopilot. Auto-deposits ensure that you never miss a contribution, and Wealthsimple automatically reinvests any earned dividends back to earn you even more.

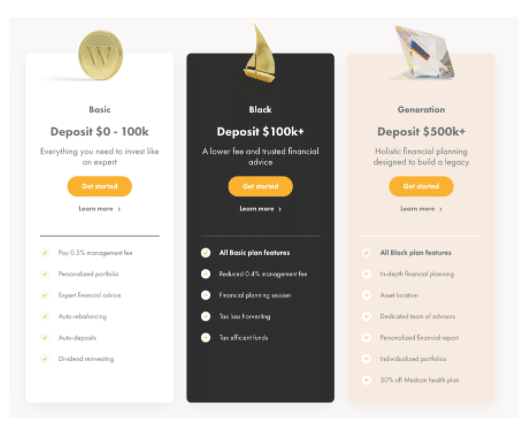

Fees:

- .5% management fee for accounts under $100,000

- .4% management for accounts over $100,000

Wealthsimple Trade

Buy and sell thousands of different stocks and ETFs on the major Canadian and US markets. With no account minimum, you can start trading with as little as one dollar, and there are never any commissions. Whether you use the website or the app, trading is easy and paperwork free.

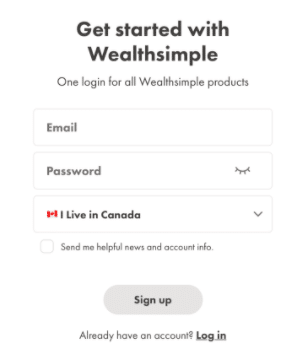

Start trading in five minutes. Sign up for an account, connect your bank account to deposit funds, and then start trading. It’s that simple.

Fees:

- No commissions on any trades

Wealthsimple Crypto

The world of cryptocurrency can seem overwhelming and complicated. Wealthsimple makes it easy. With simple and transparent pricing, no account minimums and no penalties on withdrawals, you don’t need to be an expert to start trading in crypto.

Fees:

- There are no fees associated with day-to-day transactions.

Tax Filing

Wealthsimple offers a tax filing service. Customers can auto-file their return with the CRA and see your refund amount instantly. Wealthsimple guarantees that they will help you receive the best refund possible, and the program is offered as a “pay what you can” service.

Portfolio Review

A portfolio review is a snapshot of your whole financial picture. From how diversified your investments are and what your risk level is, to your debt and savings amounts. Wealthsimple’s portfolio review can help you set realistic goals and create a plan that works.

Account Types

A personal account is the right choice for you if you are looking for an account with easy access to your money. Personal accounts are taxable accounts that you do not need to register with the government, unlike RRSPs and TFSAs.

The RRSP contributions you make help to lower your tax bill today, and you generally pay a lower rate on your withdrawals once you have reached your retirement. Let Wealthsimple keep track of the rules for your contributions, so you don’t have to worry. Optimize your returns for a fraction of what it would cost at a bank.

An RRIF is a lot like an RRSP, but instead of saving money for retirement, this account allows you to earn money during your retirement. An RRSP must be converted to either an RRIF or an annuity when you turn 71.

There is also a minimum amount that you must withdraw from your RRIF the year you turn 71. That amount is determined by your age and it increases every year. You are required to pay taxes on your withdrawals.

With a TFSA, you don’t pay any capital gains or taxes. You can withdraw your money at any time without penalty. Wealthsimple’s free tracker will help you to navigate what you are able to invest at any time, without needing to understand the CRA rules, and the fees are very low compared to what most of the big banks charge.

Frequently Asked Questions About Wealthsimple

Is Wealthsimple safe?

Yes. Wealthsimple is Canada’s largest robo-advisor and has been recognized as one of the top Global Financial Technology companies. They use state of the art encryption when handling any financial information, and they are a registered portfolio manager in Canada.

Is there a minimum investment required at Wealthsimple?

There are no minimum investments or account balances required to use Wealthsimple’s services.

What if I don’t know anything about investing?

Even if you are completely new to the world of investing, Wealthsimple is here to help. They offer many services on their website, designed to help even the most novice investor to take control of their financial future.