Tangerine is an online bank that has been serving Canadians since 1997, first as ING Direct and then switching to Tangerine in 2013. As with any Canadian bank, they offer a wide range of different financial services, the only difference being that they operate completely online and do not have any brick and mortar stores.

This online bank was created to fill a gap in the Canadian banking marketplace which was previously overrun by big banking institutions. Tangerine was able to create an online bank that allowed Canadians the opportunity to fulfill their financial requirements, from the comfort of their own home and they were also able to offer them better rates since there were fewer overhead costs associated with their virtual operation.

Tangerine also has a strong community presence and, with their #Bright way forward initiative, they are helping to build up Canadians by participating in local activities that empower and inspire individuals to take positive action in their lives.

Features

Tangerine is an innovative banking solution that offers so many benefits to its clients, including;

- A wide range of services – Tangerine offers all of the same services and products that a traditional brick and mortar bank or financial institution offers.

- Ability to bank from home – Tangerine offers their customers the ability to bank from anywhere at any time without having to rearrange their schedules to the often inconvenient hours that traditional banks offer.

- Low interest rates and fees – Due to the fact that Tangerine has fewer overhead costs than a traditional bank, they are able to offer their clients better interest rates and fewer fees and service charges than at a regular bank.

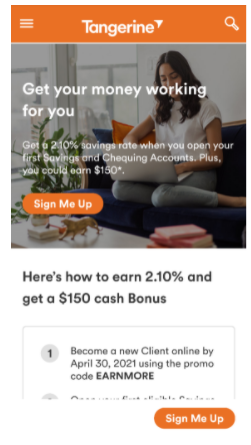

- New client incentives – If you are a new client to Tangerine, there are a wide variety of different incentives that they offer. For example, when you open your first savings account with them, you can earn up to a 2.10% interest rate for the first five months and if you choose to have your pay cheques directly deposited into the account for three consecutive months, you could earn an extra $150 bonus.

Services

As with any traditional bank, Tangerine offers a broad range of different services to meet each one of their customer’s individual financial goals. For more information on Tangerine’s services, visit https://smarterloans/company/tangerine/

Some of the most popular products and services that they offer include:

Savings Accounts

Tangerine offers both traditional and tax-free savings accounts with zero fees, minimum balances or service charges and 0.01% interest rate.

Chequing Accounts

No fee chequing accounts with free access to thousands of ABM’s is one of the perks of opening a Tangerine Chequing account.

Business Accounts

If you are a Canadian business owner, Tangerine has all of the business account options that you need to see your money grow. Their business savings accounts offer a 0.5% interest rate and their business GIC investment offers a 1.10% interest rate. They also offer US dollar savings options at great rates as well.

Mortgages

Purchasing a home is one of the largest investments most Canadians will ever make in their lifetime. Tangerine offers some of the best rates on the market combined with flexible repayment plan options to make your mortgage acquiring experience as simple and stress-free as possible.

Line of Credits

Applying for a line of credit is quick and easy and can be done online at any time of the day. Tangerine offers lines of credit with low variable interest rates and no annual fees.

Investment Funds

If you are looking for a way to invest your money and plan for the future, Tangerine offers their clients a wide variety of different investment accounts.

Home Equity Line of Credits

A home equity line of credit is an excellent way to borrow against the equity that you have invested in your home. HELOC’s can give you the money that you need for renovations, to purchase other properties or finance anything else that you need. Tangerine offers low interest rates on all of their line of credits.

RIF

Tangerine’s retirement investment funds are the perfect way to save for your future and plan for retirement. Depending on the type of investment that you choose you can benefit from interest rates that range between 0.15% and 1.10%

Credit Cards

Tangerine Credit Card offers all of the benefits of a traditional credit card but without the annual fees. Plus you can earn cash-back rewards on your daily purchases.

GIC’s

Tangerine offers GIC’s with no monthly fees and a guaranteed investment rate of 1.10%.

Frequently Asked Questions About Tangerine

What is the Tangerine Cafe?

The Tangerine Cafe is a physical Tangerine location for anyone wishing to speak to a Tangerine representative in person.

Where can I do my Tangerine Banking?

When you sign up for a Tangerine account, you can bank online, on the Tangerine app or visit a Tangerine Cafe.

How do I know my information is safe?

When banking with Tangerine, you can rest assured that all of your information is kept safe and secure. Tangerine strictly follows all Canadian privacy standards and offers their clients a security guarantee that consists of the use of multiple security questions in the event that you need to reset your PIN and use an embedded microchip in all of their debit and credit cards which protects against fraud and theft. Tangerine also offers Zero Liability Interact and Visa policies which protect you against unauthorized purchases and transactions.